Higher-Yielding Currencies: Opportunities and Risks for Traders

When traders talk about higher-yielding currencies, they usually mean those backed by central banks with interest rates above the global average. These currenci ...

Read More

When traders talk about higher-yielding currencies, they usually mean those backed by central banks with interest rates above the global average. These currenci ...

Read More

Few events capture the attention of global traders quite like the release of the U.S. Non-Farm Payrolls (NFP) report. In just a few lines of data, markets can s ...

Read More

Smart contracts are often described as the “invisible engines” powering today’s blockchain economy. They run silently in the background, moving billions of doll ...

Read More

Scalping is a fast-paced trading strategy designed to extract small profits from tiny price movements. Unlike swing or position trading, where trades last from ...

Read More

In the world of finance, few concepts are as essential as equity. Whether you're a trader, a long-term investor, or simply someone trying to understand how the ...

Read More

Markets don’t move in a vacuum. Every surge, dip, or sideways shuffle in price is often tied to one thing: information. And in trading, few types of information ...

Read More

In the world of technical analysis, few reversal patterns hold as much strategic weight as the double bottom. While often covered in beginner materials, experie ...

Read More

In just over a decade, crypto trading has gone from a fringe concept understood by a handful of tech-savvy idealists to a global phenomenon reshaping the financ ...

Read More

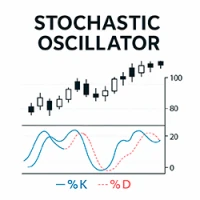

The Stochastic Oscillator has long been a favorite among technical traders for identifying momentum shifts and potential reversals. Originally developed by Geor ...

Read More

When you place a trade, you expect it to be executed at a certain price. But sometimes, what you get is something entirely different—better or worse. That tiny ...

Read More