Short answer

Margin level drops when your equity decreases due to floating losses, even if no new trades are opened. Since margin level is calculated using equity, market price movements alone can reduce it.

What margin level actually measures

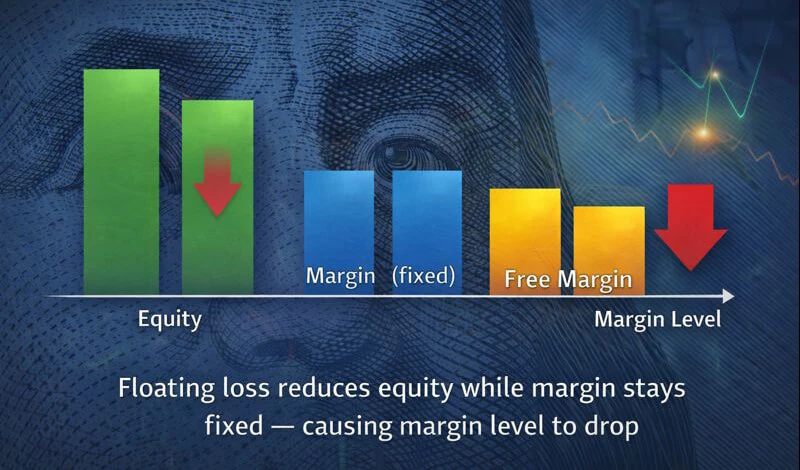

Margin level shows how much equity you have compared to the margin locked in open trades.

Formula:

Margin Level = (Equity / Margin) × 100%

This means:

- equity changes constantly with price movement

- margin usually stays fixed while positions are open

So, margin level can fall even without opening anything new.

The role of floating loss

Floating loss is the unrealized loss on open trades.

When price moves against your position:

- floating loss increases

- equity decreases

- margin remains the same

Result: margin level drops automatically

This is the most common reason traders see margin level falling.

Why leverage makes margin level change faster

Leverage allows you to open larger positions with smaller margin.

This means:

- small price movements create larger profit or loss

- equity changes faster

- margin level becomes more sensitive

Higher leverage = faster margin level fluctuations.

Example in simple terms

You open a trade using $1,000 margin.

If market moves against you:

- floating loss reduces equity

- margin stays at $1,000

- margin level drops

No new trades are required for this to happen.

The illustration shows how price movement alone can lower margin level.

Why this is normal market behavior

This is not:

❌ system error

❌ hidden broker action

❌ incorrect calculation

This is simply:

✅ real-time risk control

✅ how leveraged trading works

✅ standard margin mechanics

All trading platforms operate this way.

Why this matters for traders

Understanding margin level helps traders:

- monitor risk in real time

- avoid unexpected margin calls

- choose appropriate leverage

- manage position size properly

Most margin problems come from ignoring floating loss impact.

What’s next

Now that margin level behavior is clear, the next topic is:

Why can’t I close my trade at the exact price I see on the chart?

This explains market execution and slippage in real conditions.

Kembali Kembali