Short answer

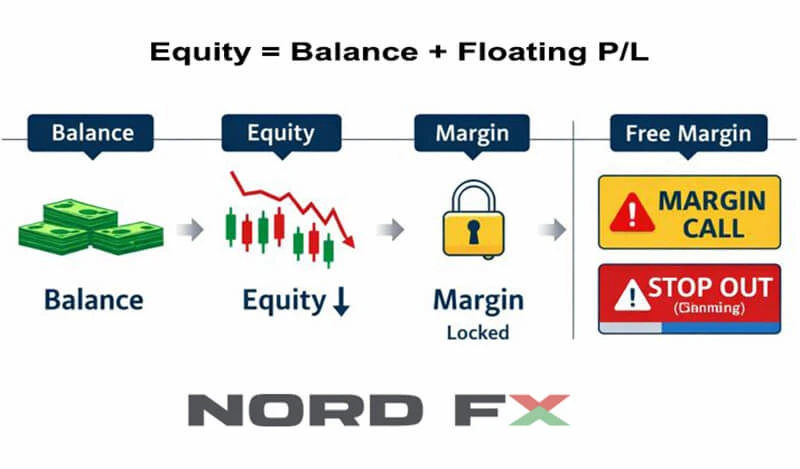

Balance is the money in your account without open trades. Equity is your balance plus floating profit or loss. Margin is the amount locked to keep trades open, and free margin is the remaining funds available for new trades or losses.

This video explains the differences between balance, equity, margin, and free margin, and how these values interact to determine your margin level and risk.

Balance explained

Balance is the amount of money in your trading account after all closed trades.

Important points:

- balance does not include open trades,

- balance changes only when a trade is closed,

- deposits, withdrawals, profits, and losses affect balance.

If you have no open positions, balance = equity.

Equity explained

Equity shows the real-time value of your account.

Formula:

Equity = Balance + Floating Profit / Loss

This means:

- equity changes with market price movements,

- even if balance stays the same,

- equity is the key value used for margin control.

Margin calls and stop outs are based on equity, not balance.

Margin explained

Margin is the portion of your funds that is reserved to keep open positions active.

Key points:

- margin is not a fee,

- it is temporarily locked,

- margin depends on trade size and leverage.

Higher leverage means lower required margin, but higher risk.

Free margin explained

Free margin is the amount of money available to:

- open new trades,

- absorb floating losses.

Formula:

Free Margin = Equity − Margin

When free margin reaches zero, you can no longer open new trades.

Margin level and why it matters

Margin level is a key risk indicator.

Formula:

Margin Level = (Equity / Margin) × 100%

This value determines:

- margin call levels,

- stop out activation.

As equity decreases and margin stays the same, margin level falls.

What is a margin call?

A margin call occurs when margin level falls below a predefined threshold.

This means:

- losses are reducing your equity,

- risk is increasing,

- you may need to add funds or reduce exposure.

A margin call is a warning, not a liquidation.

What is a stop out?

A stop out happens when margin level reaches a critical minimum.

At this point:

- the platform automatically closes positions,

- starting with the most unprofitable,

- to prevent further losses.

Stop out protects both the trader and the broker.

Why traders get margin calls even with balance left

This happens because:

- margin control is based on equity, not balance,

- floating losses reduce equity,

- balance alone does not reflect real risk.

This is one of the most common beginner misunderstandings.

Why this matters for traders

Understanding these concepts helps traders:

- manage risk properly,

- avoid unexpected margin calls,

- choose appropriate leverage,

- control position size realistically.

Most margin-related issues come from confusing balance with equity.

What’s next

Now that margin mechanics are clear, the next important topic is:

This connects margin logic with execution and pricing behavior.

Повернутися Повернутися