Short answer

The spread is the difference between the Bid and Ask price. It represents the cost of entering a trade and directly affects when trades open, close, and become profitable.

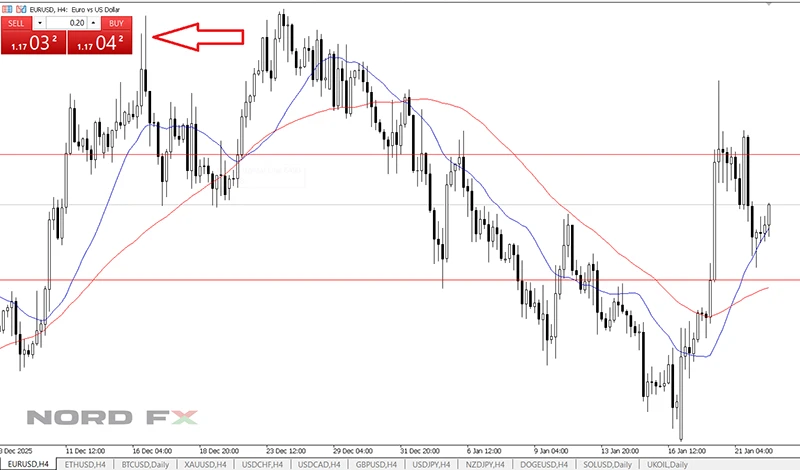

This video explains what spread is in trading, how it is formed from Bid and Ask prices, and why it directly affects trade execution and final results.

What is spread in simple terms

In trading, there are always two prices:

- Bid price — the price to sell,

- Ask price — the price to buy.

The spread is the difference between these two prices.

For example:

- Bid: 1.1000

- Ask: 1.1002

- Spread: 2 points (or 0.0002)

This difference is applied automatically when a trade is opened.

Why spread exists

Spread exists because:

- liquidity providers quote separate buy and sell prices,

- it compensates for market risk and execution costs,

- prices constantly change based on supply and demand.

There is no single market price — spread is a natural part of how markets work.

How spread affects trade opening

When you open a trade:

- a Buy trade opens at the Ask price,

- a Sell trade opens at the Bid price.

This means:

- the trade starts with a small floating loss equal to the spread,

- price must move in your favor by at least the spread to reach breakeven.

This is normal and not a trading error.

How spread affects trade closing

When closing a trade:

- Buy trades close at the Bid price,

- Sell trades close at the Ask price.

Because of this:

- Stop Loss and Take Profit are triggered by different prices,

- trades may close earlier or later than expected if spread changes.

Why spreads can increase

Spreads are not always fixed. They can widen during:

- low liquidity periods,

- market open or rollover,

- major news releases,

- holidays or abnormal market conditions.

When spread increases, trade execution and Stop Loss behavior may change.

The illustration shows that charts usually display only the Bid price, while the spread exists between Bid and Ask.

Why this matters for traders

Understanding spread helps traders:

- avoid confusion when trades start in loss,

- correctly place Stop Loss and Take Profit,

- understand why results differ from expectations,

- trade more realistically during volatile periods.

Many “unexpected” trade outcomes are explained by spread behavior.

What’s next

Now that spread is clear, the next important topic is:

This explains slippage and execution differences.

العودة العودة