Short answer

The Bid price is the price at which you can sell an asset, and the Ask price is the price at which you can buy it. The difference between them is called the spread and represents the cost of entering a trade.

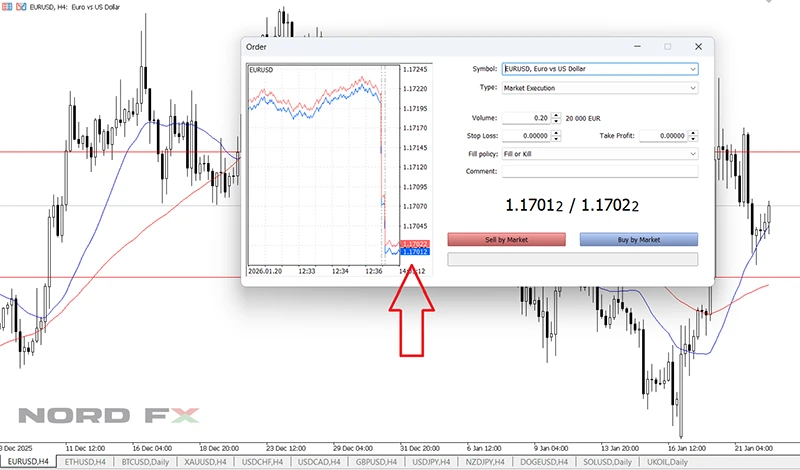

This video explains the difference between Bid and Ask prices, why charts usually show only the Bid price, and how the spread affects trade execution and stop loss behavior.

Bid and Ask explained in simple terms

What is the Bid price?

The Bid price is the price at which the market is willing to buy an asset from you.

- If you open a Sell trade, it is executed at the Bid price.

- If you close a Buy trade, it is closed at the Bid price.

On most trading charts, only the Bid price is displayed.

What is the Ask price?

The Ask price is the price at which the market is willing to sell an asset to you.

- If you open a Buy trade, it is executed at the Ask price.

- If you close a Sell trade, it is closed at the Ask price.

The Ask price is usually slightly higher than the Bid price.

Why Bid and Ask prices are different

The difference between Bid and Ask prices is called the spread.

This difference exists because:

- liquidity providers quote two prices (buy and sell),

- the spread covers trading costs and market risk,

- prices change constantly based on supply and demand.

There is no single “true” market price — there is always a Bid and an Ask.

How Bid and Ask affect trade execution

Opening a trade

- Buy trade → opens at the Ask price

- Sell trade → opens at the Bid price

This is why a newly opened trade may start with a small floating loss — the spread is applied immediately.

Closing a trade

- Buy trade → closes at the Bid price

- Sell trade → closes at the Ask price

This explains why Stop Loss and Take Profit levels may behave differently depending on trade direction.

The illustration shows that charts display only the Bid price, while Buy and Sell trades are executed using different prices.

Why this matters for traders

Understanding Bid and Ask prices helps traders:

- correctly place Stop Loss and Take Profit levels,

- understand why trades open or close “earlier” than expected,

- avoid confusion when price seems not to touch a level on the chart,

- interpret spread widening during volatility or low liquidity.

Most beginner execution issues start with misunderstanding Bid and Ask.

What’s next

Now that Bid and Ask prices are clear, the next essential topic is:

This concept explains trading costs, execution differences, and many common beginner questions.

Go Back Go Back