What Are Cryptocurrencies?

Cryptocurrencies are digital assets designed to function as a medium of exchange, a store of value, or a programmable financial instrument within decentralised ...

Read More

Cryptocurrencies are digital assets designed to function as a medium of exchange, a store of value, or a programmable financial instrument within decentralised ...

Read More

Moving averages are among the most widely used tools in technical analysis, and their popularity is easy to explain. They help traders reduce visual noise, iden ...

Read More

Price rarely moves in a straight line. Even the strongest trends pause, breathe, and “go quiet” before the next meaningful move begins. That quiet phase is ofte ...

Read More

A forex trade is the act of buying one currency while simultaneously selling another in order to profit from changes in exchange rates. Forex, short for foreign ...

Read More

The forex market is the largest and most liquid financial market in the world, with trillions of dollars traded every day across currencies, time zones and trad ...

Read More

Financial markets are not driven by numbers alone. Prices move because millions of participants interpret information, react emotionally, and act under pressure ...

Read More

The cryptocurrency market is built not only on price movements and trading strategies, but also on technical standards that determine how digital assets are cre ...

Read More

Backtesting is one of the most important tools available to forex traders who want to approach the market in a structured and disciplined way. Instead of relyin ...

Read More

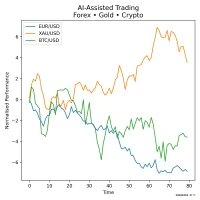

Artificial intelligence (AI) and machine learning are increasingly influencing how traders analyse markets, detect patterns and develop systematic trading strat ...

Read More

Why News and Macro Matter So Much Prices move because expectations change. Economic data, central bank meetings, political decisions and unexpected crises conti ...

Read More