Markets don’t move in a vacuum. Every surge, dip, or sideways shuffle in price is often tied to one thing: information. And in trading, few types of information are as influential as economic news. Whether you're trading currencies, stocks, crypto, or commodities, understanding how macroeconomic indicators shape market behavior is essential. In this guide, we’ll walk you through which news matters, how it impacts different assets, and how you can fine-tune your strategy—not by chasing headlines, but by interpreting them wisely.

Why Economic News Moves the Markets

Economic news acts as fuel for price action. It offers clues about a country’s economic health, central bank direction, and overall investor sentiment. Markets tend to react swiftly to new data—especially when it diverges from expectations.

For traders, this volatility can be both a risk and an opportunity. A well-timed position ahead of a key release can lead to rapid profits. But trading blindly into news can also trigger unnecessary losses. That’s why it's important not only to watch the news—but to understand what’s behind the numbers.

The Most Important Economic Indicators to Watch

Here are some of the major types of economic data that can have a significant impact across various markets:

● Interest Rate Decisions

When central banks like the Federal Reserve or ECB adjust rates, the ripple effect hits almost every asset. Higher interest rates tend to strengthen a currency and weigh on stock and crypto markets, while lowering demand for commodities like gold.

● Inflation Reports (CPI, PPI)

Inflation data is closely watched because it influences future rate decisions. A surprise jump in CPI may spark expectations of tighter monetary policy, pushing bond yields and currencies higher.

● Employment Data (Non-Farm Payrolls, Unemployment Rate)

Strong job growth usually signals a healthy economy, which can boost stock markets and strengthen a country’s currency. Weak numbers can have the opposite effect.

● GDP (Gross Domestic Product)

GDP growth signals economic expansion. If the number beats expectations, it can lift equities and boost the local currency. But if it's weak, markets may brace for a slowdown.

● Consumer Confidence & Retail Sales

These are forward-looking indicators. High consumer confidence and strong retail sales suggest economic momentum, often leading to bullish market sentiment.

● Trade Balance & Current Account Data

Large trade deficits may pressure currencies, while surpluses can boost them. Commodities and export-sensitive sectors are also influenced by this data.

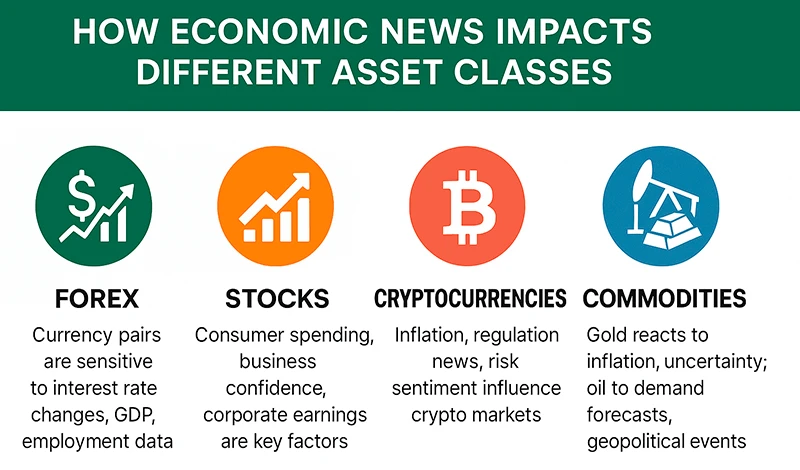

How Economic News Impacts Different Asset Classes

Not all markets react the same way to the same news. Each asset class has its own sensitivities and behavioral patterns. Here's how economic data impacts the major markets:

Forex

Currency pairs are especially reactive to economic indicators that suggest changes in interest rates or monetary policy.

● A surprise rate hike in the U.S. typically strengthens the USD, particularly against lower-yielding currencies like the JPY or CHF.

● On the other hand, weak job numbers or dovish statements from central banks can lead to sharp selloffs in the local currency.

● Emerging market currencies may also be sensitive to inflation, capital flows, and debt data—especially when compared to the U.S. dollar.

Stocks

Equities respond to a wide range of news that affects corporate profitability, investor sentiment, and macroeconomic trends. But reactions vary by sector:

● Strong employment data can boost consumer discretionary and retail stocks, as more jobs usually mean more spending.

The same data might hurt tech and growth stocks if it raises the odds of interest rate hikes.

● Energy and materials stocks often rise with inflation, while consumer staples may struggle due to higher input costs.

A positive GDP print or fiscal stimulus may lift cyclical sectors like industrials, financials, and housing, while defensive sectors remain more stable in times of uncertainty.

Cryptocurrencies

Crypto markets operate outside traditional finance, but they’re increasingly sensitive to macroeconomic trends.

● Rising inflation often fuels demand for Bitcoin, which some traders view as “digital gold.”

● However, tightening monetary policy and rising interest rates can hurt sentiment in crypto markets, as investors seek lower-risk returns.

● News of regulatory action, such as tax enforcement or exchange restrictions, can cause sudden volatility.

● During broader market downturns, traders may either flee to crypto as a hedge—or liquidate crypto positions for liquidity.

Commodities (Gold, Oil, and Others)

Commodities are directly affected by economic data tied to supply, demand, and inflation.

● Gold often rallies when inflation is high, central banks turn dovish, or geopolitical uncertainty rises. It's seen as a safe haven.

● Oil prices are closely linked to global growth expectations. Strong manufacturing or GDP data supports oil, while weak data from large consumers like China can push prices lower.

● Industrial metals like copper react to construction and production levels, often serving as early indicators of economic health.

● Agricultural commodities (wheat, corn, soybeans) are impacted by trade policies, subsidies, and climate-related economic disruptions.

It’s Not Just the Numbers—It’s the Surprise

Markets don’t react to the numbers themselves—they react to whether those numbers are better or worse than expected.

For example:

● If the forecast for U.S. GDP is 2.0% and the actual print is 2.1%, that’s bullish—even if it’s only a minor beat.

● But if the forecast was 3.0% and the result is 2.1%, markets may see it as a disappointment.

This is why understanding the context—previous numbers, analyst forecasts, and market sentiment—is as important as the headline itself.

Also, be aware of the classic trading maxim: “Buy the rumor, sell the fact.” Often, markets move ahead of the news in anticipation, only to reverse once the data confirms expectations.

Timing Your Trades Around News

News releases are often scheduled down to the minute. You’ll find these on economic calendars provided by most brokers or platforms.

There are three main strategies traders use around news:

● Pre-News Positioning

Taking a position based on expectations. Risky but can offer large rewards if you anticipate the outcome correctly.

● Fade the Reaction

Waiting for an initial spike, then trading the reversal. This is useful when the market overreacts or quickly corrects itself.

● Wait-and-See Approach

Let the dust settle, assess direction, then trade with confirmation. This suits swing traders and those who prefer more measured entries.

Adjusting Your Strategy Based on the News

● Economic news doesn’t just influence short-term trades—it shapes trends.

● Scalping and day trading benefit from the fast, sharp movements around announcements. If you enjoy volatility and speed, trading news releases directly can be part of your edge.

● Swing traders can use economic reports to validate setups or confirm trend reversals. A strong employment report, for instance, may support a bullish breakout in indices.

● Long-term investors and position traders use macroeconomic cycles to build broader narratives. A multi-month uptrend in inflation may justify holding commodities or defensive stocks.

No matter your style, the goal is to align your strategy with the bigger picture—without getting whipsawed by noise.

Useful Tools to Stay Informed

To stay ahead, you don’t need to sit glued to financial TV. A few smart tools can go a long way:

● Economic Calendars

Websites like Investing.com or platforms like MT4/MT5 offer real-time updates on upcoming releases, impact levels, and forecasts.

● News Alerts and RSS Feeds

Get customized alerts for the indicators that matter most to your trades. Many trading platforms and mobile apps offer this feature.

Practice trading news events without risking real money. This helps you understand volatility, test strategies, and build confidence.

Conclusion: Trade Smart, Not Fast

Economic news isn’t something to fear—it’s something to learn from. It offers structure, timing, and insight that technical charts alone can’t always provide. The key is to approach it with a calm, informed mindset. Don’t chase headlines. Instead, build your strategy around the patterns that emerge from consistent macro signals.

After all, successful trading is not just about reacting—it’s about anticipating. And that starts with understanding the forces that move the markets.

Go Back Go Back