Smart contracts are often described as the “invisible engines” powering today’s blockchain economy. They run silently in the background, moving billions of dollars daily — from settling trades in seconds to unlocking digital loans without a bank in sight. For many traders and investors, smart contracts are no longer just a buzzword; they are the infrastructure that makes decentralized finance (DeFi), tokenized assets, and automated marketplaces possible.

Understanding how a smart contract works isn’t just for developers — it’s becoming essential knowledge for anyone who wants to navigate modern markets confidently. Whether you’re curious about how automated crypto swaps happen, how blockchain-based insurance pays out instantly, or why certain trades carry hidden risks, smart contracts are at the core. In this article, we’ll break down what a smart contract is, explore its key components, highlight practical use cases, and examine the risks and best practices you should know before interacting with them.

What Is a Smart Contract?

A smart contract is a self-executing agreement stored and run on a blockchain. Instead of relying on a third party, the contract’s terms are written directly into code and automatically carried out when specific conditions are met.

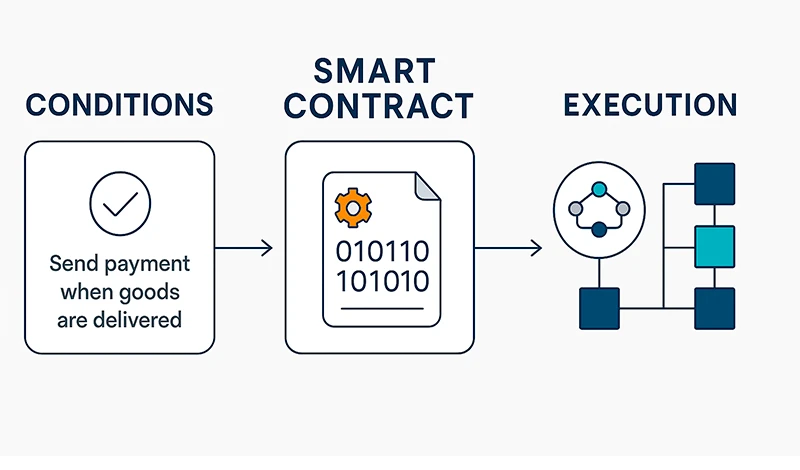

The basic flow looks like this:

- Conditions are set (e.g., “Send payment when goods are delivered”).

- Data triggers the contract (from the blockchain or an external source).

- The blockchain verifies and executes the outcome without manual approval.

Smart contracts are immutable once deployed, meaning they cannot be altered unless built with upgrade mechanisms. This makes them reliable but also requires careful design before launch.

How Smart Contracts Work: The Core Components

Smart contracts operate through a combination of blockchain execution, digital signatures, and external data feeds. Key elements include:

Blockchain Execution (EVM and Beyond)

Most smart contracts run on the Ethereum Virtual Machine (EVM), a decentralized environment that executes contract code on every node in the network. Other blockchains, like BNB Chain, Avalanche, and Polygon, are also EVM-compatible, while Solana and Cardano use their own architectures.

Gas and Fees

Each contract execution consumes network resources, measured in “gas.” Users pay fees in the blockchain’s native token to process these operations. Gas fees can fluctuate depending on network demand, affecting the cost and speed of transactions.

Wallets and Digital Signatures

To interact with a smart contract, users need a blockchain wallet. Transactions are authorized with a private key signature, ensuring that only the rightful owner can trigger actions from their address.

Oracles

Smart contracts can only read data on their own blockchain. Oracles are services that feed external data — like market prices, weather conditions, or shipment tracking — into the blockchain so contracts can respond to real-world events.

Composability

One of the most powerful features of smart contracts is that they can interact with other contracts. This “money Lego” effect allows developers to combine multiple protocols, enabling complex DeFi strategies, automated trading systems, or multi-step transactions.

Popular Smart Contract Ecosystems

While Ethereum pioneered the concept, today’s smart contract landscape spans multiple platforms:

- Ethereum: The largest ecosystem with the most DeFi protocols and developer tools.

- Layer 2 Solutions: Networks like Arbitrum, Optimism, and Base reduce costs and speed up transactions while settling on Ethereum.

- BNB Chain: Popular for low fees and wide adoption in retail-focused apps.

- Avalanche & Polygon: Known for high throughput and compatibility with Ethereum tools.

- Non-EVM Chains: Solana, Cardano, and Tezos offer alternative architectures with unique benefits.

Practical Use Cases for Smart Contracts

Smart contracts are versatile and already power many real-world applications:

- Decentralized Finance (DeFi): Lending, borrowing, liquidity pools, and yield farming without intermediaries.

- Payments and Escrow: Automatic release of funds upon meeting delivery or performance conditions.

- Tokenization of Assets: Representing real-world assets like property, bonds, or commodities as blockchain tokens.

- Gaming: Managing in-game assets, rewards, and marketplaces.

- Supply Chain Tracking: Recording product journeys from origin to destination for transparency.

- Insurance: Triggering payouts automatically when specific conditions (e.g., flight delays) are verified.

Risks and Limitations

Despite their potential, smart contracts carry significant risks:

- Bugs and Vulnerabilities: Coding errors can lead to exploits, as seen in numerous DeFi hacks.

- Reentrancy Attacks: Malicious contracts repeatedly trigger functions to drain funds.

- MEV and Frontrunning: Network participants manipulate transaction order for profit.

- Upgradeability Risks: Contracts with admin keys can be altered, sometimes maliciously.

- Key Management: Losing a private key can mean losing all access.

- Oracle Manipulation: Feeding false data can trigger unintended actions.

- Cross-Chain Risks: Bridges between blockchains can be exploited.

- Fees and Scalability: High gas costs can make smaller transactions unfeasible.

- Legal Uncertainty: Different jurisdictions may not recognize smart contracts as legally binding.

Balanced Outlook: The Future of Smart Contracts

While smart contracts have already transformed the way value is exchanged and agreements are enforced, the technology is still evolving. Several key developments are on the horizon, each aiming to address the limitations that have held back wider adoption.

Layer 2 rollups are one of the most promising solutions to scalability and cost issues. By processing transactions off the main blockchain and only submitting summaries back to it, rollups can dramatically reduce gas fees and increase throughput. This makes complex smart contract operations more affordable and accessible, even during peak network demand.

Account abstraction is set to make blockchain wallets more user-friendly. Today, interacting with smart contracts requires careful handling of private keys — a process that can be intimidating for newcomers. Account abstraction allows for features like social recovery, spending limits, and custom authentication methods, which could make smart contracts easier and safer for mainstream users.

Real-world assets (RWA) on the blockchain open the door to tokenizing tangible items like real estate, bonds, or commodities. Smart contracts can manage these tokenized assets, enabling fractional ownership, faster settlement, and a more global investor base. For traders, this could mean exposure to entirely new asset classes without the friction of traditional intermediaries.

Interoperability protocols aim to break down the barriers between blockchains. Right now, most smart contracts are confined to a single network, but cross-chain protocols allow them to interact and share data securely. This could lead to seamless trading, lending, and settlement across multiple ecosystems, expanding the opportunities for both developers and investors.

Although challenges such as security vulnerabilities, legal uncertainty, and network congestion remain, smart contracts are steadily becoming a critical part of global market infrastructure. Their ability to automate complex processes, reduce counterparty risk, and create entirely new business models suggests that their influence will only grow in the years ahead.

Key Takeaways

- A smart contract is a blockchain-based program that executes automatically when conditions are met.

- They eliminate the need for intermediaries but require careful coding to avoid vulnerabilities.

- Core elements include blockchain execution, gas fees, wallets, oracles, and composability.

- Use cases span finance, payments, gaming, supply chain, and insurance.

- Risks include coding bugs, attacks, high fees, and legal uncertainty.

- Best practices like audits, testnets, and multisig setups help mitigate risks.

Glossary

● Smart Contract: A self-executing program stored on a blockchain.

● EVM (Ethereum Virtual Machine): The computing engine for running Ethereum-based contracts.

● Gas Fee: The cost of executing a transaction or contract operation on a blockchain.

● Oracle: A service that delivers external data to a smart contract.

● Composability: The ability of contracts to interact and build on one another.

● Layer 2 (L2): Scaling solutions built on top of a main blockchain to improve speed and reduce costs.

● MEV (Maximal Extractable Value): Profit from transaction ordering in a block.

● Multisig: A wallet setup requiring multiple approvals for a transaction.

Go Back Go Back