Meta Platforms, previously known as Facebook Inc., is a global technology leader widely recognized for pioneering the social media landscape. Originally established as a platform connecting users through online social networks, Meta has evolved significantly over recent years. The company has transitioned from its core social media roots into a visionary innovator in artificial intelligence (AI), virtual reality (VR), and notably, the Metaverse—a comprehensive digital environment that merges virtual and augmented realities.

This strategic shift has positioned Meta as a central player in shaping the future of digital interaction, commerce, and entertainment. Given this transformative evolution, analyzing Meta's long-term stock price potential becomes essential for investors seeking to understand the future trajectory of one of the most influential technology companies in the world.

Meta Stock Performance: Historical Perspective

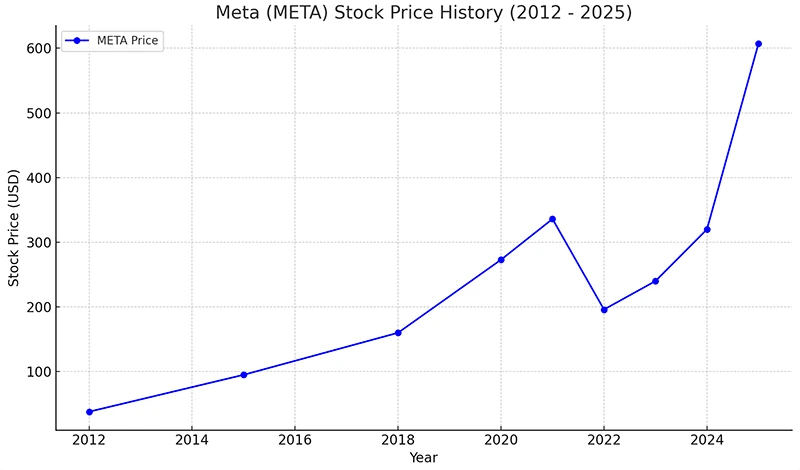

Meta Platforms' stock performance has seen significant growth and volatility since its IPO in 2012. Early fluctuations gave way to strong long-term gains, driven by strategic acquisitions and consistent advertising revenue growth. Challenges, including privacy controversies, regulatory scrutiny, and public criticism, have periodically impacted investor sentiment. However, Meta’s strategic shift towards AI and the Metaverse has set a promising foundation for future stock performance, making it a key company to watch through 2030.

IPO and Early Stock Performance

Meta Platforms, originally Facebook, launched its IPO on May 18, 2012, facing initial market volatility but quickly gaining momentum as user numbers and advertising revenues soared. Early instability gave way to significant stock appreciation as the platform solidified its dominant global market presence.

Strategic Acquisitions and Expansion

Meta significantly expanded through strategic acquisitions, most notably Instagram in 2012 and WhatsApp in 2014, reinforcing its market dominance and driving steady stock growth in subsequent years.

Challenges: Privacy and Regulation

Since 2018, privacy scandals, regulatory challenges, and public backlash have intermittently disrupted Meta’s stock trajectory. Issues such as the Cambridge Analytica scandal led to increased governmental scrutiny and substantial investor caution.

Transition to the Metaverse and AI

The 2021 rebranding as Meta Platforms signaled a strategic pivot toward artificial intelligence, virtual reality, and the Metaverse. Although met initially with skepticism, by 2024 these investments began showing potential, reviving investor confidence and stabilizing the stock price, positioning Meta favorably for continued growth towards 2030.

Key Factors Influencing Meta's Stock Price by 2030

Several crucial factors are likely to influence Meta's stock performance through 2030, shaping investor expectations and determining long-term market valuation.

Expansion and Acceptance of the Metaverse

Meta’s commitment to the Metaverse represents a significant growth opportunity. The widespread adoption and user acceptance of immersive digital worlds, virtual experiences, and associated products will be central to driving revenue and stock valuation. Successful market penetration and commercialization of the Metaverse could substantially boost investor confidence and increase long-term shareholder value.

Advances in Artificial Intelligence (AI) and Virtual Reality (VR)

Meta’s investments in AI and VR technologies will strongly influence future performance. Continued innovation, advancements in AI-driven services, and further improvements in virtual reality technologies can open new revenue streams, attract more users, and enhance existing platforms, positively impacting the company's stock price.

Advertising Revenue Trends and Monetization Strategies

Advertising remains a primary source of revenue for Meta. Future stock valuation depends significantly on the company's ability to maintain or expand advertising market share amidst intensifying competition. Successful implementation of targeted, privacy-respectful monetization strategies, particularly within the Metaverse and across Meta’s various digital platforms, will be pivotal to sustaining growth.

Regulatory Environment and Data Privacy

Ongoing regulatory scrutiny, particularly concerning data privacy and antitrust laws, could significantly influence investor sentiment and stock volatility. Meta’s ability to navigate and adapt to evolving regulatory landscapes and privacy concerns will directly affect investor confidence and the stock’s long-term trajectory.

Technological Competition and Market Positioning

Meta’s competitive environment, characterized by rivals in AI, VR, and social media sectors, including companies like Apple, Google, Nvidia, and TikTok, will impact market positioning and stock performance. Maintaining technological leadership and successfully managing competitive pressures will be essential for sustained stock growth into 2030.

Meta Stock Price Forecast: 2025–2030

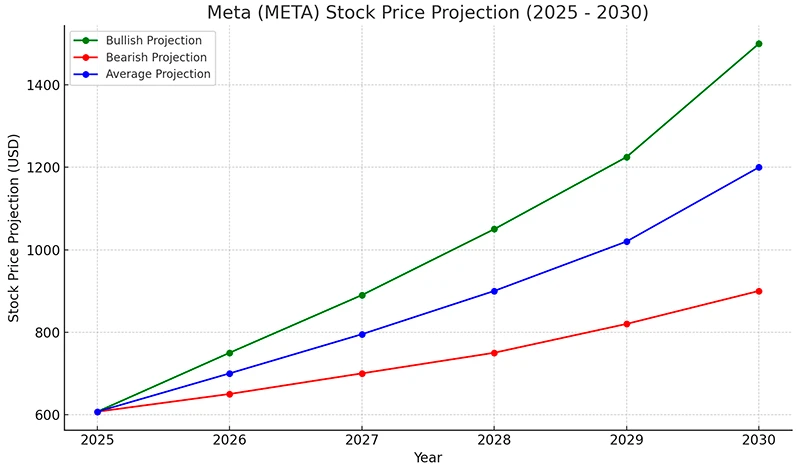

Bullish Scenario: Expert Forecasts

Analysts present optimistic projections for Meta Platforms' stock price in the coming years. CoinCodex forecasts that META's stock price could reach between $1,139.19 and $1,543.58 by 2030. Similarly, WalletInvestor predicts a long-term increase, suggesting that a five-year investment could yield a revenue increase of approximately 198.66%, potentially reaching $1,806.61 by 2030. Additionally, Exla Resources estimates that Meta's stock price could reach $2,215.59 by 2030, indicating a 325.82% increase from its current stock price.

These bullish forecasts are underpinned by several factors:

- Metaverse Expansion: Meta's strategic pivot towards the Metaverse is expected to unlock new revenue streams, particularly in virtual reality (VR) and augmented reality (AR) markets.

- Artificial Intelligence Integration: The company's advancements in AI technologies are anticipated to enhance user experiences and drive advertising efficiency, thereby boosting revenue.

- Advertising Dominance: Meta's stronghold in the digital advertising sector continues to be a significant revenue driver, with innovations like AI-powered chatbots on platforms such as WhatsApp expected to further monetize user engagement.

Bearish Scenario: Risks and Limitations

Despite optimistic projections, several risks could impede Meta's stock growth:

- Regulatory Challenges: Ongoing scrutiny over data privacy practices and potential antitrust actions could result in operational restrictions or financial penalties, adversely affecting profitability.

- Market Competition: Intensifying competition from other tech giants in the Metaverse, AI, and digital advertising spaces could erode Meta's market share and pressure profit margins.

- User Base Saturation: With a substantial portion of the global population already engaged on Meta's platforms, achieving further user growth may be challenging, potentially limiting future revenue expansion.

Balanced Scenario: Realistic Forecast Range

Considering both optimistic and pessimistic factors, a balanced projection for Meta's stock price by 2030 would be:

- Moderate Growth: Assuming steady advancements in the Metaverse and AI integration, coupled with effective navigation of regulatory landscapes, Meta's stock could experience moderate growth.

- Price Range: Based on current analyses, a realistic forecast range for Meta's stock price by 2030 would be between $1,000 and $1,500. This range accounts for potential market fluctuations, competitive dynamics, and the company's ability to innovate and adapt to evolving industry trends.

Investors are advised to monitor Meta's strategic developments, regulatory environments, and competitive actions to make informed decisions regarding long-term investments in the company.

Investing in Meta Stock: Pros and Cons

When considering Meta Platforms as a long-term investment, investors should weigh both its significant strengths and notable risks. Here’s a balanced overview to help inform investment decisions.

Advantages of Investing in Meta

Leadership in the Metaverse and VR

Meta has positioned itself as a leader in developing immersive virtual worlds and experiences. Its substantial investments in VR hardware (such as the Meta Quest devices), combined with its extensive efforts to build a comprehensive Metaverse, could unlock substantial revenue growth by 2030.

Strong Revenue Growth Potential

Meta maintains robust profitability, fueled by substantial advertising income, AI-driven ad targeting, and new monetization channels. Continued expansion into emerging technologies and new market segments, including augmented reality (AR) and virtual commerce, offers additional avenues for sustained earnings growth.

Diversified Digital Ecosystem

Meta benefits from a diversified ecosystem encompassing platforms such as Facebook, Instagram, WhatsApp, Messenger, and Oculus VR products. This diverse digital portfolio mitigates risk by spreading revenues across multiple segments and user demographics, providing resilience against market fluctuations or downturns in any single product line.

Risks: Competition and Regulatory Pressures

Intensifying Competition

Meta faces increasing competition across multiple fronts. Rivals such as Apple, Alphabet (Google), Nvidia, TikTok, and other emerging platforms continually challenge its dominance. Intensified competition could pressure user growth, engagement, and advertising revenues.

Regulatory Scrutiny and Privacy Issues

Meta remains under continuous scrutiny by regulators in both the United States and Europe, especially regarding data privacy, antitrust concerns, and content moderation policies. Regulatory challenges may result in significant fines, operational constraints, or forced strategic changes, potentially negatively impacting profitability and stock valuation.

Dependence on Advertising Revenue

Advertising continues to represent the largest portion of Meta’s revenue. Economic downturns, shifts in advertising strategies by major corporations, or tighter privacy policies—such as restrictions on user tracking—could significantly reduce ad revenues, undermining overall profitability and growth.

Potential Slow Adoption of the Metaverse

While Meta’s strategic pivot to the Metaverse promises substantial long-term gains, consumer adoption rates remain uncertain. Slower-than-expected acceptance, technological barriers, or limited user interest could stall growth, making investments in this area less rewarding than anticipated.

Evaluation of Meta’s Long-term Investment Potential

Despite the risks outlined above, Meta remains an attractive long-term investment candidate due to its solid financial foundations, extensive global user base, and leading role in emerging technologies. The company’s potential to innovate and capitalize on opportunities presented by AI, VR, and the Metaverse creates a compelling case for sustained stock appreciation through 2030. However, investors should approach with caution, closely monitoring competition dynamics, regulatory developments, and user engagement trends, to fully evaluate Meta’s ongoing performance and long-term investment viability.

Conclusion

Meta Platforms stands at a pivotal point, shaped significantly by its ambitious evolution from a social media powerhouse into a leading innovator in artificial intelligence and the Metaverse. Historically, the company’s stock has weathered substantial volatility, navigating challenges related to privacy scandals, regulatory scrutiny, and competitive pressures. Yet, strategic investments in advanced technologies like AI and virtual reality, alongside continued strength in digital advertising, create promising prospects for sustained growth.

Expert forecasts generally reflect optimism for Meta’s stock, projecting prices in the range of $1,000–$1,500 by 2030, driven largely by anticipated successes in Metaverse adoption and monetization strategies. However, risks related to regulatory actions, intensified competition, advertising dependency, and uncertain Metaverse acceptance remain prominent considerations.

For investors with a long-term horizon, Meta represents an appealing yet cautious opportunity. Its financial strength, innovation leadership, and extensive user base provide a robust foundation for potential growth. Nonetheless, careful monitoring of evolving market conditions and strategic performance through 2030 is essential for making informed investment decisions.

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

العودة العودة