Short answer

Price charts usually show only the Bid price, but stop loss orders for sell trades are triggered by the Ask price. Because Ask includes the spread, your stop loss can be hit even if the chart never reaches that level.

This video explains why a trade can close even though the visible chart price never touched your stop loss, by showing how Bid and Ask prices and the spread affect stop loss execution.

The two prices in every market: Bid and Ask

Every instrument has:

- Bid price — the price you sell at

- Ask price — the price you buy at

The difference between them is the spread.

Charts in most trading platforms display only the Bid price by default.

This is the key reason for the confusion.

How stop loss works for buy and sell trades

For Buy trades:

- Stop loss is triggered by the Bid price

For Sell trades:

- Stop loss is triggered by the Ask price

This means:

If you are in a sell trade, your stop loss reacts to a price you usually do not see on the chart.

Why it looks like price never touched your stop loss

Example situation:

- Chart shows Bid price falling close to stop loss

- Spread widens slightly

- Ask price reaches the stop loss level

- Trade closes — even though Bid never touched it

Visually, it feels like a mistake.

Technically, it is correct execution.

The role of spread in early stop loss activation

When spread increases:

- Ask price moves higher

- Bid price stays where it is

- stop loss on sell trades gets hit sooner

Spread often widens during:

- low liquidity

- market open

- news releases

- rollovers

This makes stop losses appear to trigger “too early”.

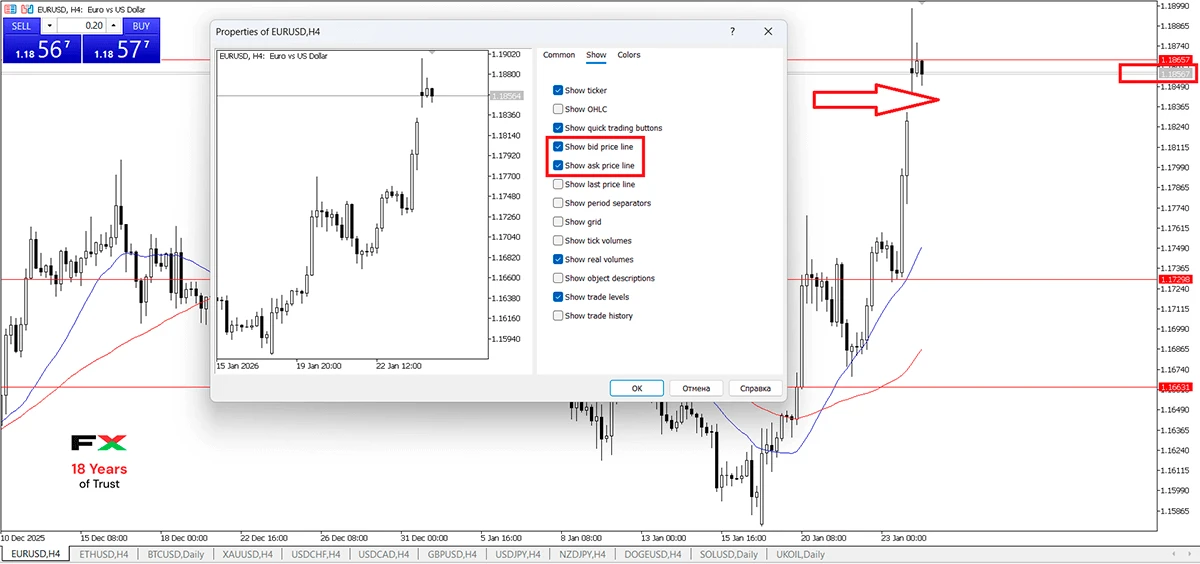

The illustration shows how you can turn on Ask price on the chart of MetaTrader if you want to see it too.

Why this is normal market behavior

This is not:

❌ broker manipulation

❌ wrong execution

❌ platform error

This is simply:

✅ how pricing works in real markets

✅ how spread is applied

✅ how stop loss logic functions

All professional markets operate this way.

Why this matters for traders

Understanding Bid and Ask helps you:

- place stop losses more accurately

- avoid surprise trade closures

- account for spread in risk management

- trade confidently during volatility

Most stop loss “mysteries” are explained by spread mechanics.

What’s next

Now that Bid, Ask, and spread behavior is clear, the next topic is:

Why does my stop loss get triggered during low liquidity or market open?

This explains gaps, spread spikes, and rollover effects.

ফিরে যান ফিরে যান