EUR/USD: Old News from the Fed And the ECB

- The past week was the week of the Central Banks. The US Federal Reserve met on Wednesday, December 15, for the last time this year, the ECB and the Bank of England on December 16, and the Bank of Japan at the end of the working week, on Friday, December 17.

There is a trading model, FIFO: short for “first in, first out”. So, we will follow it, and we will begin to consider the results of the meetings in order in which they took place.

The first, as already mentioned, was the meeting of the FOMC (Federal Open Market Committee) of the US Federal Reserve. Some investors expected any radical decisions from it, and the rhetoric of representatives of the Federal Reserve on Wednesday was more hawkish than expected. This pushed the EUR/USD pair towards the lower limit of the three-week side channel. However, having reached the level of 1.1220, it turned around and the dollar began to lose ground.

The market realized that, in fact, almost all parameters of the monetary policy remained unchanged. Only the quantitative easing (QE) program was revised: the rate of reduction in asset purchases increased from $15 billion to $30 billion per month. The program can be completely closed in March-April 2022.

The outlook for the labor market was slightly improved but was accompanied by concerns about the possible emergence of "new virus variants". Core inflation in 2022 may also be slightly higher: not 2.3%, as previously expected, but 2.7%. Inflation for 2023 is projected to grow by only 0.1%, and it will remain unchanged in 2024.

According to the Financial Times, despite aggressive statements, the Fed still considers inflation a temporary phenomenon, and expects to return it to the target range within two years, gradually raising federal funds rates.

The key interest rate was left unchanged at 0.25% at the last meeting. As for the regulator's plans for next year, if it was about two or three rate hikes earlier, the Fed's dot chart showed that there should be three of them now. But this is just a declaration of intentions that can be realized if the macroeconomic situation develops as expected by the regulator.

In general, all statements of the American central bank were devoid of any specifics this time. Markets learned what they already knew before. Therefore, their reaction was appropriate: the EUR/USD pair turned around and went north. Having passed 140 points on Thursday, December 16, it was already at the upper border of the side channel, at the level of 1.1360.

(Of course, this was not without the help of the pound, which, thanks to the decision of the Bank of England, put a lot of pressure on the dollar. We will talk about this in more detail below).

The results of the meeting of the European Central Bank did not surprise investors either. Like the Fed, the European regulator also raised its inflation forecast for next year. And it also considers it a temporary phenomenon. It declares this openly though and does not consider it necessary to fight it now. It was announced Once again that the refinancing rate will remain at the current level until inflation reaches the target level of 2.0%, at which it will remain for a long time. As a result, the “main” result of the meeting was the statement of the head of the bank, Christine Lagarde, that “it is very unlikely that we will raise rates in 2022”. And this was already known to everyone.

The dovish position of the ECB did not allow the EUR/USD pair to rise above the borders of the side channel, and anxiety about the Omicron strain pushed it sharply down, and it ended week trading session at the level of 1.1238.

As for the coming week, it is pre-Christmas. And seven days after Christmas, it's New Year's Eve. In the absence of large players, the market these days is quite thin, liquidity is low, which can be fraught with all sorts of surprises. This is increased volatility, gaps with serious gaps in quotations, and what traders call the “Santa Claus Rally”. Although, of course, the opposite option is also possible: with "lazy" movement of pairs in a narrow range.

As for the experts, 50% expect further strengthening of the US currency and the fall of the EUR/USD pair, 30% are betting on the growth of the euro. The remaining 20% have taken a neutral position. Among the oscillators on D1, 80% point to the south (although 15% of them are in the oversold zone), 10% point north, and 10% point east. 100% of the trend indicators side with the bears.

Resistance levels are in the zones and at the levels 1.1265, 1.1300, 1.1355, 1.1380, 1.1435-1.1465 and 1525. The nearest support level is 1.1225, then 1.1185 and 1.1075-1.1100

The economic agenda of the year is practically exhausted, and no extra-important news is expected in the coming week. As for the reasons for breaking the trend or increased volatility, we can note the publication of annual data on US GDP on Wednesday December 22, and data on orders on capital goods and durable goods published by the U.S. Census Bureau the next day, December 23.

GBP/USD: The Bank of England's First Step

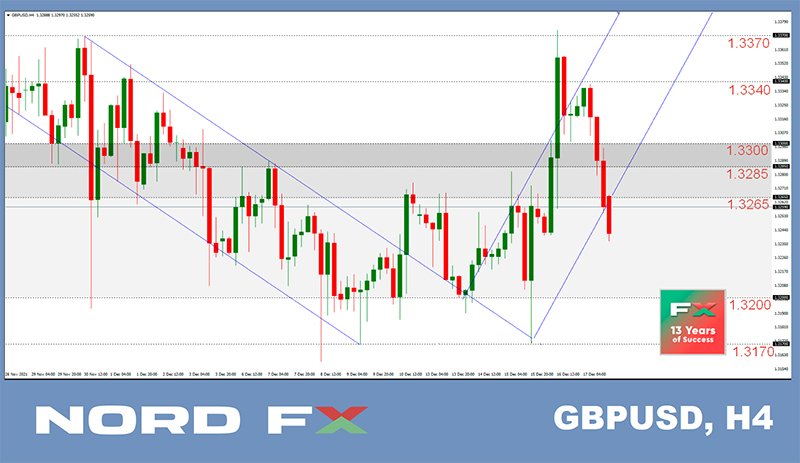

- We noted in the previous review that the No.1 task for the GBP/USD bulls is to overcome the key resistance in the 1.3285-1.3300 zone. And we predicted that if the Bank of England did raise the interest rate on December 16, it would not be a problem. This is exactly what happened.

While the Fed and the ECB are only swinging, the Bank of England has moved to attack rising prices. After inflation in the UK rose to 5.1%, reaching a 10-year peak, the regulator raised the rate for the first time in three years from 0.1% to 0.25%. The decision was made despite the worsening epidemiological situation due to the new Omicron coronavirus strain. However, according to the head of the Bank of England Andrew Bailey, it is more important to curb the price pressure on the economy and society.

Of course, the rate hike by 15 basis points cannot be called significant, but, most importantly, the first step has already been taken, and the market expects the second rate hike in February.

It is difficult to say why many financial publications write that the current decision of the Bank of England came as a complete surprise. If you look at our previous forecast, 40% of experts predicted a rate hike and, as a result, the subsequent strengthening of the pound.

But the British currency failed to consolidate the victory. Having risen on Thursday December 16 to the high of 1.3373, the GBP/USD pair turned sharply and went down. Investors began to sell off the pound due to growing concerns about Omicron. Risk aversion contributed to the strengthening of the safer dollar and, accordingly, dealt a blow to the stock indices and quotes of the euro and the British pound, which ended the five-day period at 1.3235.

The experts' forecast for the coming week looks rather pre-holiday, that is, uncertain. 35% of them side with the bulls, the same number side with the bears, and the remaining 30% prefer not to take sides. Among the oscillators on D1, the situation is similar: 30% of them indicate buying, 45% are selling, and the remaining 25% advise to take a break and do nothing for now. The trend indicators have a fundamentally different mood: 100% are colored red.

The supports are located at 1.3210-1.3220, then 1.3170-1.3190, 1.3135, 1.3075. In case of a breakout of the latter, the pair may fall down to the horizon of 1.2960. Zones and resistance levels - 1.3285-1.3300, 1.3340, 1.3370, 1.3410, 1.3475, 1.3515, 1.3570, 1.3610, 1.3735, 1.3835.

There will also be little macro-statistics important for the pound next week. Of particular interest are the UK GDP data for the Q3, which will be released on Wednesday, December 22. But the markets will focus on the situation with the spread of the new COVID-19 wave.

USD/JPY: The Sideways Trend Continues

- The one that is not afraid of risk aversion is the yen. On the contrary, it is only happy with this. Giving the previous forecast, the overwhelming majority of experts (80%) expected that with the help of the US Federal Reserve, the USD/JPY pair would go up and, perhaps, break the upper boundary of the 113.40-114.40 channel. This is exactly what happened: the dollar began to advance, and the pair was noted at the height of 114.25 on December 15. Then, due to the panic of investors, it managed to win back losses and found a local bottom, dropping to 113.13, and the final chord sounded in the center of the weekly trading range: at the level of 113.70.

It is difficult to predict what will happen with Omicron and how the situation will affect the panic in the markets. So far, the US currency is leading with a slight margin in the struggle between the yen and the dollar: 55% of analysts have voted for the growth of the USD/JPY pair, 45% for its fall.

The readings of technical indicators just confirm the sideways movement of the pair along the horizon 113.50 for almost 10 last weeks. Among the oscillators, 30% look south on D1, 35% remain neutral, and the remaining 35% look north. Among trend indicators, green has a slight advantage, 60% to 40%.

Support levels are 113.20, 112.70, 112.00, 111.60 and 111.20. Resistance levels are 114.00, 114.25, 115.00 and 115.50.

And now the promised information about the meeting of the Bank of Japan, which, it seems, is not at all interested in strengthening its currency. And although the regulator reduced the volume of emergency financing related to the pandemic on Friday, December 17, it, as expected, left the interest rate unchanged, at the previous negative level, minus 0.1%.

The bank retained its ultra-soft policies and measures to support small businesses, and its head Haruhiko Kuroda said at the press conference that a weak yen would rather support the Japanese economy than harm it. According to the official, if the yen falls, it will support exports and corporate profits. So we can confidently say that the monetary policy of this regulator will remain one of the most dovish in the foreseeable future.

CRYPTOCURRENCIES: Everything Is Complicated: It will be Either Winter, Or Spring Straight Away

- Things are ambiguous in the crypto market. The total capitalization has remained almost unchanged over the past 7 days and amounts to $2.270 trillion ($2.215 trillion a week ago). The Crypto Fear & Greed Index made only a small step up from 24 points and shifted from the Extreme Fear zone to the Fear zone, up to 29 points.

In this situation, some experts hope for the recovery of the upward trend of major coins, while others, on the contrary, predict a further fall. And then the end of 2017 comes to mind. Then, having conquered the $19,270 high in December, bitcoin collapsed instead of breaking above the iconic $20,000. It was already at $5,900 at the beginning of February 2018, losing 70% of its value and plunging investors and crypto enthusiasts into a state of deepest depression. And then long months of expectations and hopes followed, dubbed "crypto winter". The first hints of warming appeared only in March 2019, and the real crypto spring came a year later, in March 2020.

It isprecisely the possible onset of a new "ice age" that pessimists are talking about. We have already quoted renowned investor and economist Louis Navellier. According to him, a large bubble has been inflated in the stock market, which could lead to a strong correction of risky assets, as a result of which bitcoin could fall to $10,000. Navellier, as well as another specialist, legendary trader and techno-analyst Peter Brandt, warned investors that a dangerous “double top” pattern is observed on the chart of the first cryptocurrency. “A fall below $46,000 (200-day moving average) will be a bearish signal,” he writes. “Bitcoin must fall to $28,500 to complete the double top figure, and such a decline may indicate a fall below $10,000.”

According to Nikita Soshnikov, director of Alfacash crypto service, the market will face a long period of depressed sentiment if the double top pattern is confirmed. However, “there is no question of bitcoin for $5,000 or even $15,000,” the expert reassures. “You can simply forget about such cryptocurrency prices. But it may well fall below $40,000 and stay at this level for several weeks. I even admit a decline in the rate to $35,000 but going below this mark is unlikely”.

According to Michael van de Poppe, creator of the Material Indicators analytical resource, bearish sentiment still prevails among whales. "They haven't bought a single drawdown since early October," he says, "and have only been selling lately." And if you look at the chart of the past two weeks, you can clearly see how the bears are trying to push the BTC/USD pair below the $46,000 zone, where the 200-day moving average passes.

At the time of writing, the struggle continues. It seems that the initiative returned to the bears at the end of the working week. The markets were hit by another wave of panic caused by the Omicron coronavirus strain, and the sale of risky assets, including cryptocurrencies, began. The pair dipped to $45,525 late on Friday, December 17 but then rallied back to $46,500. According to IntoTheBlock specialists, BTC has a lot of chances to fall to the $43,000 zone in such a situation. It is only at this level that the coin will be able to find the local bottom. About 344,000 wallets purchased 395,000 coins at prices in the area of this support. It is these investors who must prevent further pullback so as not to go into the red.

A slightly different support zone is emerging based on the analysis of the order book of the Bitfinex exchange. Its data indicate that a significant amount of orders to buy bitcoin was placed in the range of $44,500-$46,000.

Christmas and New Year are still kind and happy holidays. Therefore, on their eve, we would like to complete the forecast on a more or less positive note. The appearance of a “double top” pattern on the chart, according to a number of experts, does not at all mean that it will eventually be fully formed and that the market will go into a deeper correction.

The analytical department of Bestchange believes that despite the high risks of continuing the local fall, the main cryptocurrency is able to go up powerfully in the medium term. “The situation is extremely ambiguous today, but mid-term forecasts until mid-2022 are still positive. Bitcoin needs to lose at least half of its capitalization and securely gain a foothold at levels below $28,000-30,000 in order to abandon most positive scenarios. Until this happens, the hope for $100,000 continues to be relevant,” Bestchange believes.

Weiss Crypto rating agency also points to this magic figure. Despite the protracted correction, it still adheres to the optimistic scenario. Agency analysts support the forecast of colleagues from Bloomberg, who previously announced a high probability of a coin breakthrough to $100,000 in 2022.

The chances of reaching this psychological mark exceed the risks of a further fall, according to the Weiss Crypto review. Against the backdrop of the confrontation with China, the United States will accelerate the legalization of the crypto sphere, which will positively affect the value of digital currencies.

The authors of the study emphasize that cryptocurrency will be the main beneficiary of the fall of the stock market in the context of tightening the monetary policy by the Fed. Investors can abandon stocks in favor of digital currency as a hedging tool. In addition, the decline in the yield on US Treasury bonds may also have a positive effect on the quotes of BTC and ETH.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back