General Outlook

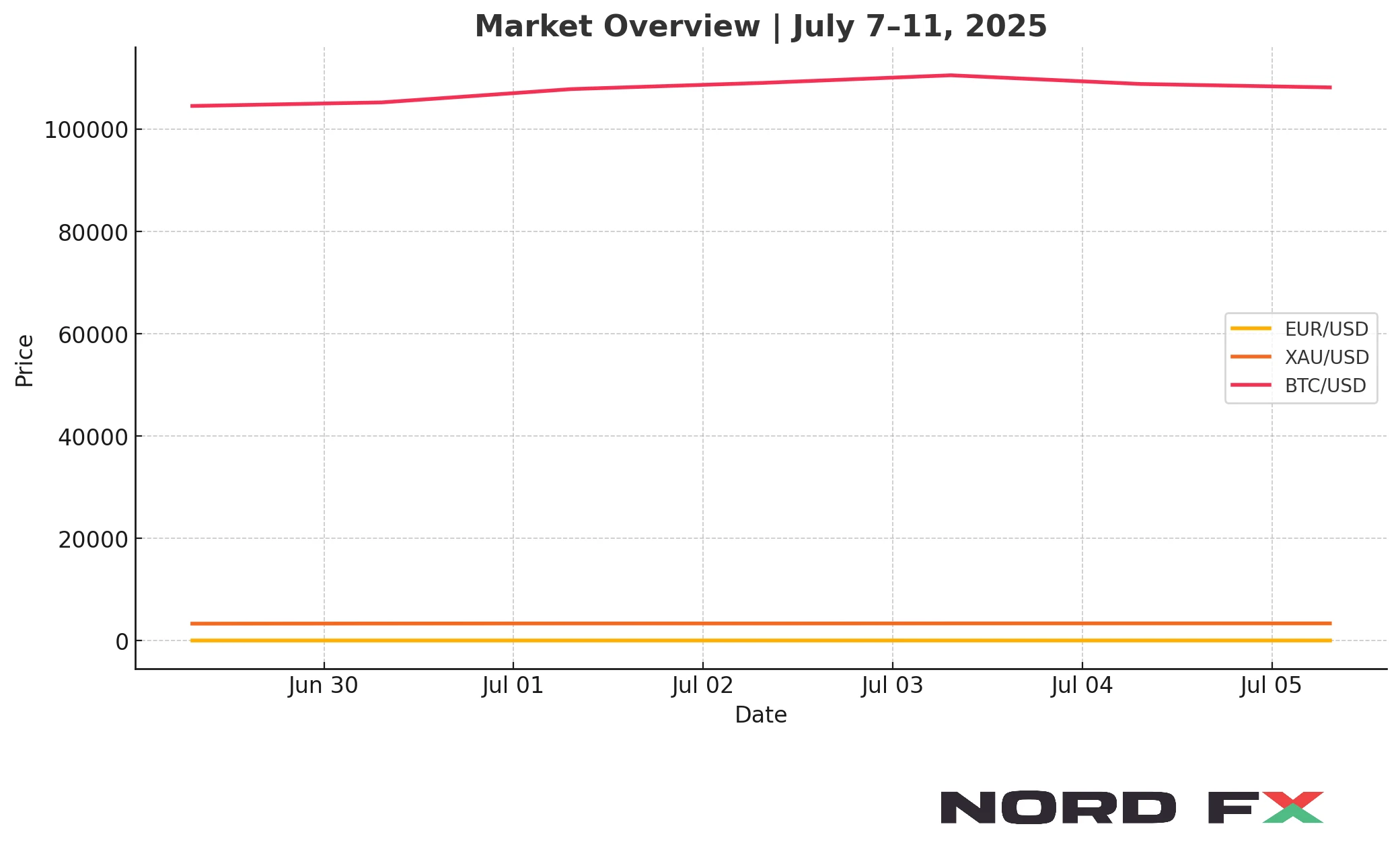

Last week ended with mixed movements: EUR/USD closed around 1.1779, reflecting modest euro strength. Gold eased slightly to approximately $3,330.44 per ounce, and bitcoin dipped just below $110,000, settling around $108,125. Markets now await fresh catalysts, with technical corrections likely in play before any sustained momentum emerges.

EUR/USD

EUR/USD closed the week at roughly 1.1779, consistent with the ECB reference rate. Bullish indicators remain present, yet momentum appears to be slowing. In the coming week, we may see a move toward resistance near 1.1895. If that level proves firm, a reversal toward support around 1.1750 is possible. Only a clear breakout above 1.1985 would negate the bearish lean and open a path toward ~1.2275. Conversely, a drop below ~1.1475 would indicate a deeper downtrend.

XAU/USD (Gold)

Gold closed Friday at approximately $3,330.44, down modestly from recent peaks. Price action continues within a bullish triangle on the charts. Expect an initial pullback toward the $3,295–3,260 range next week. A rebound from there could resume the bullish drive toward $3,745. However, dropping below $3,145 would invalidate the bullish pattern, pushing prices potentially toward $2,965. A clean breakout above $3,505 would confirm renewed upside momentum.

BTC/USD

Bitcoin ended last Friday near $108,125, having slipped from just under $110,500. It remains confined within a bullish channel. A likely next move is a correction toward $102,265–105,000. If that support holds, a fresh rally may drive prices toward $127,505. A drop below $92,205 would challenge the bullish structure, opening a path toward $82,605. Meanwhile, a rally above $115,605 would reinforce bullish expectations.

Conclusion

From July 7–11, EUR/USD may test resistance near 1.1895 before correcting toward 1.1750–1.1475. Gold looks poised for a dip to $3,260–3,295 before another upward push toward $3,745, barring a break below $3,145. Bitcoin still aims higher, but a correction to $102k–105k is likely; holding that zone could set it up for a move toward $127,505. These forecasts reflect current technical setups and preserved bullish trends, albeit with expected near-term consolidations.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.