Short answer

Most modern trading platforms use market execution, meaning your trade opens at the best available price when it reaches the market — not the exact price shown when you clicked.

What happens when you click Buy or Sell

When you click:

- your order is sent to the market

- liquidity providers offer real prices

- the system matches your order to the best available quote

This process happens in milliseconds — but prices can still change.

Market execution explained simply

Market execution means:

execute immediately at the current available market price

There is:

- no price guarantee

- no re-quotes

- only real liquidity matching

This is how professional markets operate.

How this differs from instant execution

Instant execution (older model)

- platform offers a fixed quote

- if price changes, you get a re-quote

- you must accept again

Market execution (modern model)

- no re-quotes

- fills at real price

- reflects true market conditions

Most brokers now use market execution.

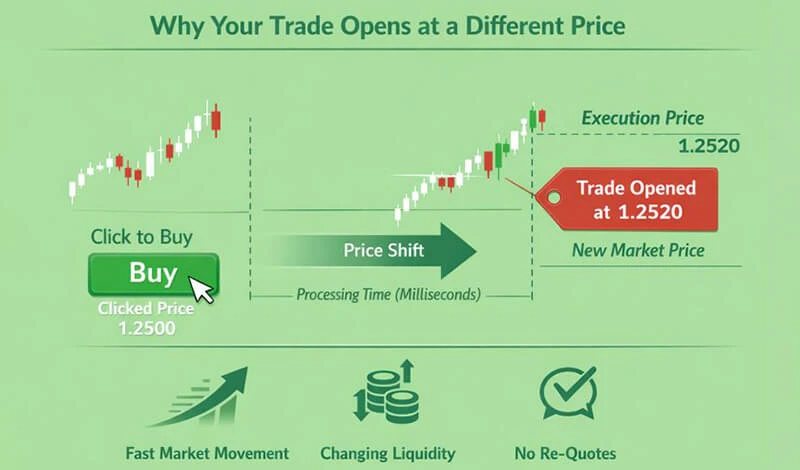

Why the opening price can change

Common reasons:

- fast market movement

- spread fluctuations

- changing liquidity

- order processing time (milliseconds matter)

This is normal behavior in live markets.

The illustration shows how price changes slightly between clicking and execution.

Why this is normal market behavior

This is not:

❌ system delay

❌ broker manipulation

❌ execution error

This is:

✅ real-time price discovery

✅ liquidity matching

✅ global trading mechanics

All professional trading systems operate this way.

Why this matters for traders

Understanding execution helps traders:

- avoid confusion about fills

- trade confidently during volatility

- choose appropriate strategies

- understand real market behavior

Most “wrong price” complaints are simply execution mechanics.

What’s next

Next logical topic:

Why did my account get a margin call even though I still had balance?

This ties execution mechanics back into risk control.

Go Back Go Back