First, a review of last week’s events:

- EUR/USD. Starting on Monday from the level of 1.1110, the pair went up, as expected by most experts. The market did not react to the initiated impeachment of the US President Trump, and the S&P500 Index once again updated the historical maximum. However, the end of the year is the end of the year and the associated fall in volatility. Therefore, the pair failed to reach the target, the height of 1.1200, and recorded the maximum of the week at 1.1175.

Then everything happened again according to the scenario described by us in the previous forecast: the pair turned around and went south, braking at 1.1110. This was followed by several unsuccessful attempts to break through this support, then on Thursday 19 December there was a rebound up on the background of the weak economic statistics from the US, and then again, a return to the 1.1110 zone.

It should be noted that, in addition to the horizontal support, this level coincided with the lower limit of the uptrend, which began on November 29, which is why the bulls stood up for it so fiercely. But their strength was exhausted at the very end of the week, and the support was broken. According to experts, this was facilitated by the decline in quotations for a number of cross-pairs, the release of positive statistics on the US consumer market, as well as the narrowing of the yield spread on US and German government bonds. In addition, at the time of the breakdown, many stop orders placed on long positions worked, which allowed the pair to fall to the level of 1.1065. This was followed by a slight rebound, and it ended the week at 1.1075; - GBP/USD. Last week was not the most successful for the British currency. The negative dynamics in the debt market, where the yield of UK securities fell in comparison with the bonds of the US and Germany, weighed on the pound. Statistics on the consumer market also disappointed investors: retail sales fell in November at the highest pace for the whole year, by 0.6%. Whatever Prime Minister Boris Johnson and his supporters say, British consumers fear Brexit and therefore limit themselves in spending. The Bank of England contributed to the overall gloomy picture as well by lowering its economic growth forecast.

As a result, the pound moved according to the scenario developed for it by experts for the whole week. Recall that the majority of analysts (65%), supported by 90% of indicators on D1, expected that the GBP/USD pair will once again rush to storm the height of 1.3500, and that this storm will end in collapse. Indeed, on Monday, December 16, the pound went up, but was able to overcome only 85 points, then turned around and continued the fall, which had begun on Friday, December 13.

75% of analysts, supported by graphical analysis, voted for this development. According to their forecast, the pair should have reached the 1.3100-1.3200 zone very quickly, which happened on Tuesday. But the fall did not end there, and it was only on Friday 20 December, thanks to positive GDP data for the third quarter (growth of 0.4% instead of the forecast 0.3%), that the pound was able to find support at the level of 1.2990.

This was followed by a rebound up to 1.3080, supported by the adoption of the Brexit Act by the UK Parliament, and again a drop of 100 points. The final chord sounded at the level of 1.3000; - USD/JPY. The news background on the yen is quite diverse. There is a strong rise in the US Treasury yields, with which the Japanese currency is strongly correlated, and the continuation of the oil uptrend, and hopes for the imminent completion of a comprehensive deal between Washington and Beijing. It is necessary to pay attention to the inflation figures in Japan. At the end of November, it was at the level of 0.5%, that is, it grew by 0.3%, which is, though not powerful, but still a favorable signal for the Bank of Japan and the economy as a whole. The yen reacts as the weathervane to the multidirectional statistics on the state of the American economy as well.

As a result, the most accurate forecast was the one supported by a quarter of analysts, according to which the pair will remain in the side channel 108.40-109.70 until the end of the year. In reality, the channel was even narrower: 109.15-109.70, and the pair ended the trading session in its central zone, at the level of 109.45; - cryptocurrencies. On Saturday, December 14, the benchmark cryptocurrency went south. More precisely, it did not just go, but flew headlong, updating the six-month low by Wednesday and "losing weight" by more than 11%. According to the main version, voiced by Bloomberg analysts, the fall was caused by the sale by crypto-pyramid PlusToken of bitcoins worth about $2 billion, followed by other coins. The total capitalization of the crypto market decreased by 9% in just 5 days, and some analysts rushed to put a "death cross" on Bitcoin, giving such a name to the intersection by the 50-day moving average from top to bottom of the 200-day MA).

However, rumors about the death of Bitcoin, as it has repeatedly happened, were greatly exaggerated. On Wednesday evening, it became known that the Bakkt platform demonstrates record volumes of trading in BTC futures. And having found support at the level of $6,470, Bitcoin quickly began to make up for losses, just in a few hours getting $1000 (+15%). After that, the BTC/USD pair returned to where it all started, to the values of December 14.

As for such top altcoins as Ripple (XRP/USD), Ethereum (ETH/USD) and Litecoin (LTC/USD), in general, they followed in the wake of the reference cryptocurrency. It is just that the results of the seven-day trip were unprofitable for them. If Bitcoin fully recovered its losses, Ripple lost 12.5% of its value, Ethereum lost 11.5%, and Litecoin lost 10%. This result suggests that investors are getting rid of altcoins, redirecting financial flows towards the first cryptocurrency.

As for the forecast for the coming 10 days, perhaps we will not make a discovery, saying that Christmas and New Year holidays are ahead. In this regard:

- December 24 - Forex trading closes at 17: 00 CET

- December 25 - trading is closed

- December 26 - trading opens at 00: 00 CET

- December 31- trading closes at 17: 00 CET

- 01 January - trading is closed

- 02 January - trading opens at 00: 00 CET

- EUR/USD, GBP/USD, USD/JPY. With a high probability we expect quite sluggish trading in a narrow range throughout this time. Although, due to the subtlety of the market, emissions in one direction or another are not excluded. Gaps can be expected at the opening of markets after the New Year holidays.

If we talk about the forecasts of experts for the upcoming ten-day period, it is impossible to give preference to either bulls or bears, because the opinions of experts are divided:

- either in half: 50% for the growth and 50% for the fall,

- or equally in three parts: a third for the growth, a third for the decline and a third for a sideways trend.

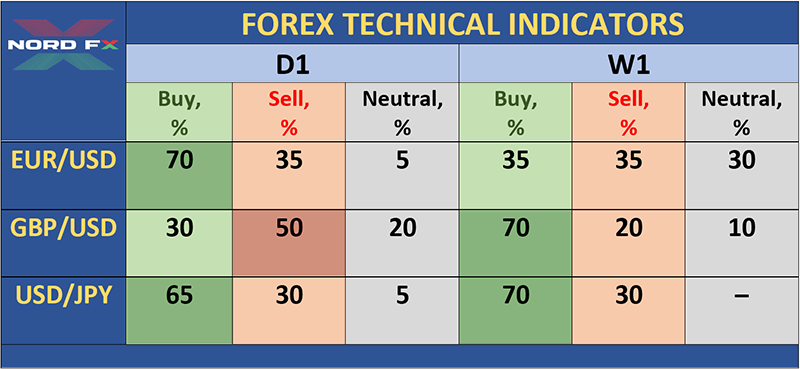

The forecasts of analytical departments of global banks for the entire year 2020 are much more interesting, we will publish them exactly one week later. Naturally, they are based on fundamental factors. And as for the fans of technical analysis, we have gathered together in one table the indicator readings on the daily (D1) and weekly (W1) timeframes, which, we hope, will help you form an opinion about the main trends and market sentiment.

- cryptocurrencies. Unlike Forex, the crypto market never sleeps. And even if crypto traders celebrate holidays, they do not take their eyes off the trading terminal.

In general, the news background is positive:

- Banking giant Bank of America Merrill Lynch has named the best and the worst assets by investment performance over the past ten years. According to the bank's calculations, $1 invested in the first cryptocurrency in 2010 has now turned into $90,026.

Sweden's Central Bank Riksbank is exploring the possibility of creating a digital Swedish Krona.

The success of Bakkt was mentioned above. And this is a very positive signal for the crypto market, as it suggests that institutional investors (at least some of them), consider the current situation a good one to buy.

- Analysts have given their forecasts of the Bitcoin price for the beginning of 2020. Executives of South Korean cryptocurrency exchanges Bithumb, Korbit and Hanbitco argue that 2020 will be the best year for the crypto market due to demand for cryptocurrencies from institutional investors and people of generation Y (Millennials).

Amsterdam stock exchange analyst Michael van de Poppe is confident that the coin will rise to $8000 in early 2020, and a month after that it will rise to $9500. Alistair Milne, Investment Director of the Altana DS Fund, is also confident in the growth of the Bitcoin value. In his opinion, the coin will become more expensive in the run-up to the halving. In parallel, the sale of altcoins in favor of the main cryptocurrency will continue.

Another point of view is held by the founder of Signal Profits Jacob Kenfield, who predicts a decline in the rate of Bitcoin to $5500. But the worst news for today is that more than 20 thousand BTC tokens remain on the accounts of the PlusToken cryptopyramid. And if it continues to sell, according to Bloomberg forecasts, there is a risk of a fall in the price of Bitcoin down to $4000. However, this is not the limit. Calculations for ASIC miners have shown that Bitmain's S17 is a device in which mining will become unprofitable only if the price of Bitcoin falls below $3600. This means that it is at this level that the main support is situated.

For now, the Crypto Fear & Greed Index is still in its lower third, at 29, which corresponds to the moderate fear of investors.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back