The past week saw a continuation of significant trends in Forex and cryptocurrency markets. The EUR/USD pair maintained its position within a bearish channel, reflecting ongoing pressure on the Euro. Gold demonstrated strength, nearing resistance levels while forming a bullish technical pattern. Meanwhile, Bitcoin held within a bullish channel, exhibiting volatility but with an overall upward trajectory. The upcoming week will likely feature further movement in line with these patterns, influenced by technical levels and market sentiment.

EUR/USD

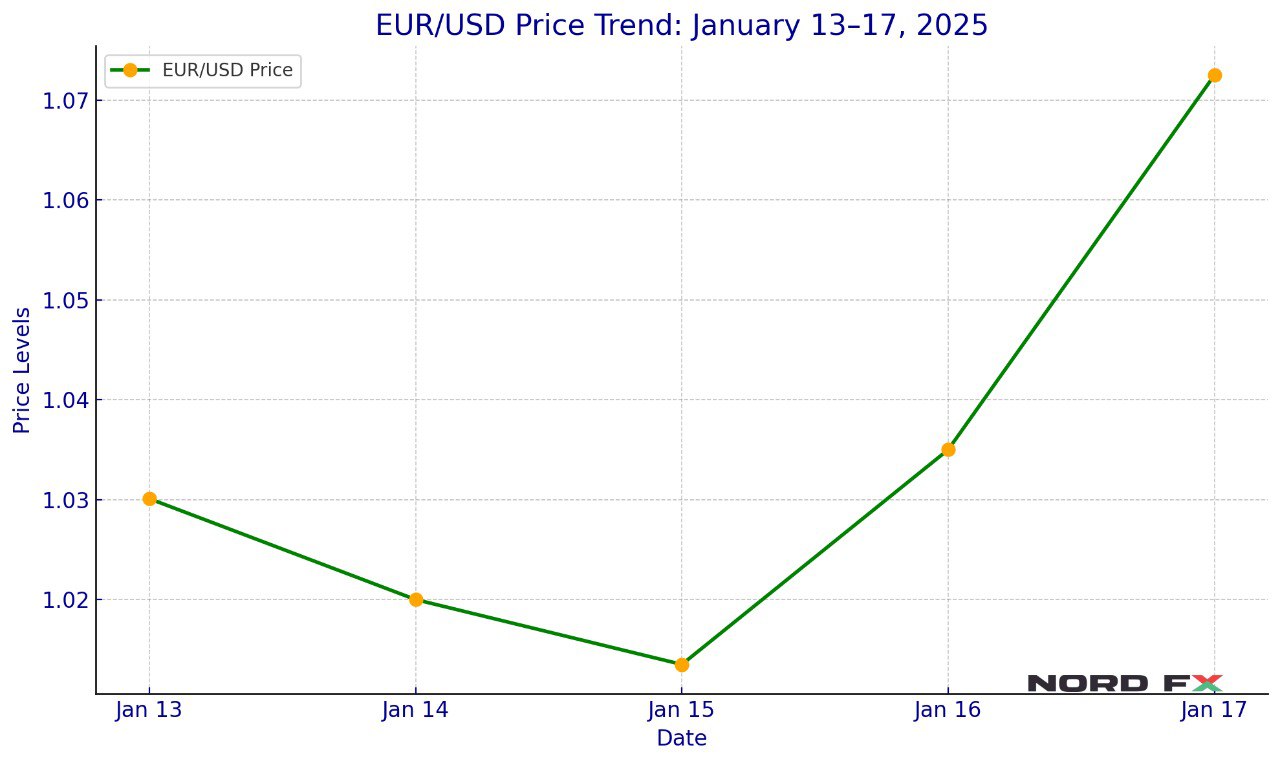

The EUR/USD currency pair closed last week near 1.0301, continuing its descent within a well-defined bearish channel. Moving averages confirmed this downtrend, with prices breaking below the signal lines, signaling continued seller dominance. In the coming week, a further decline toward the support level of 1.0135 is anticipated. However, this area may serve as a pivot for a rebound, potentially propelling the pair to targets around 1.0725.

Key technical indicators reinforce the possibility of a rebound. A test of the support line on the Relative Strength Index (RSI) would strengthen the bullish scenario. However, any breach of the 0.9905 level would invalidate this outlook, pointing instead to a continuation of the bearish trend with a potential target near 0.9645.

The forecast for January 13–17 suggests an initial bearish move to test 1.0135, followed by a possible upward correction. Market participants should monitor the RSI and price action at key levels for confirmation of either a reversal or further decline.

XAU/USD (Gold)

Gold ended the week on a strong note, trading near 2677 as it continued its climb within a bullish structure and the formation of a "Triangle" pattern. The moving averages indicate a robust upward trend, supported by repeated tests of key levels. Despite the upward momentum, a short-term dip to test the 2645 support level is likely, before an eventual rebound pushes prices toward the 3025 target.

Additional confirmation of this bullish scenario includes rebounds from the trend line on the RSI and the lower boundary of the "Triangle" pattern. However, a break below 2505 would negate the upward trend, suggesting further declines to 2435. A decisive close above 2735 would confirm the continuation of the bullish breakout, aligning with the broader trend.

For the week ahead, Gold is expected to test 2645 before resuming its upward trajectory, with key resistance at 3025 and support at 2505 serving as pivotal levels.

BTC/USD (Bitcoin)

Bitcoin concluded the week at 94,812, sustaining its position within a bullish channel. The cryptocurrency displayed upward momentum, with prices breaking through key resistance levels. However, in the near term, a pullback to the 85,205 support level is likely, offering a potential launching point for further growth toward the 130,675 level.

Technical signals, such as rebounds from the channel’s lower boundary and the RSI support line, bolster the case for continued upside. Conversely, a drop below 80,505 would invalidate the bullish outlook, potentially driving prices lower to 70,205. A breakout above 99,605 would confirm a resumption of the bullish trend, reinforcing the case for further gains.

For the week of January 13–17, Bitcoin is expected to test lower support levels before resuming its upward momentum, targeting significant resistance at 130,675.

The coming week promises continued volatility and opportunities across the Forex and cryptocurrency markets. EUR/USD may attempt to rebound from near-term lows, Gold looks poised to build on its bullish momentum after a brief dip, and Bitcoin is likely to challenge resistance levels following a potential correction. Traders should keep a close watch on key support and resistance levels, as well as technical indicators, to navigate the evolving market dynamics effectively.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.