General Outlook

Last week was marked by heightened geopolitical risk after Israel’s strike on Iran, driving strong safe-haven flows and sudden price spikes in commodities. Gold rallied to a two-month high, oil surged over 7%, and risk currencies like the euro faced headwinds from a stronger US dollar but later regained some ground. bitcoin saw a midweek jump toward 110,000 but settled lower by Friday. In the coming days, the market is likely to remain sensitive to fresh headlines, with potential for short-term corrections before any decisive moves resume.

EUR/USD

EUR/USD ended the week around 1.155 after rebounding from lows near 1.149. Technical signals remain broadly bullish, supported by upward-sloping moving averages, though dollar demand driven by risk-off sentiment continues to limit upside momentum. The pair may attempt to break higher and test resistance near 1.1620–1.1625. Should it fail to hold above that zone, a pullback toward 1.1480 or even 1.1450 is likely. A decisive rally beyond 1.1825 would strengthen the bullish case towards 1.2245, while a close below 1.1335 would increase the likelihood of a deeper slide toward 1.1125.

XAU/USD

Gold closed the week at approximately 3,432 per ounce, lifted by robust safe-haven demand. The technical pattern remains constructive, with prices moving within an ascending triangle and above key moving averages. A modest correction towards the 3,380–3,395 area is likely in the early part of the week, but if support holds, another attempt to reach 3,500–3,525 is anticipated. A break below 3,335 could undermine the current bullish structure and push prices down to 3,275 or lower if geopolitical tension eases.

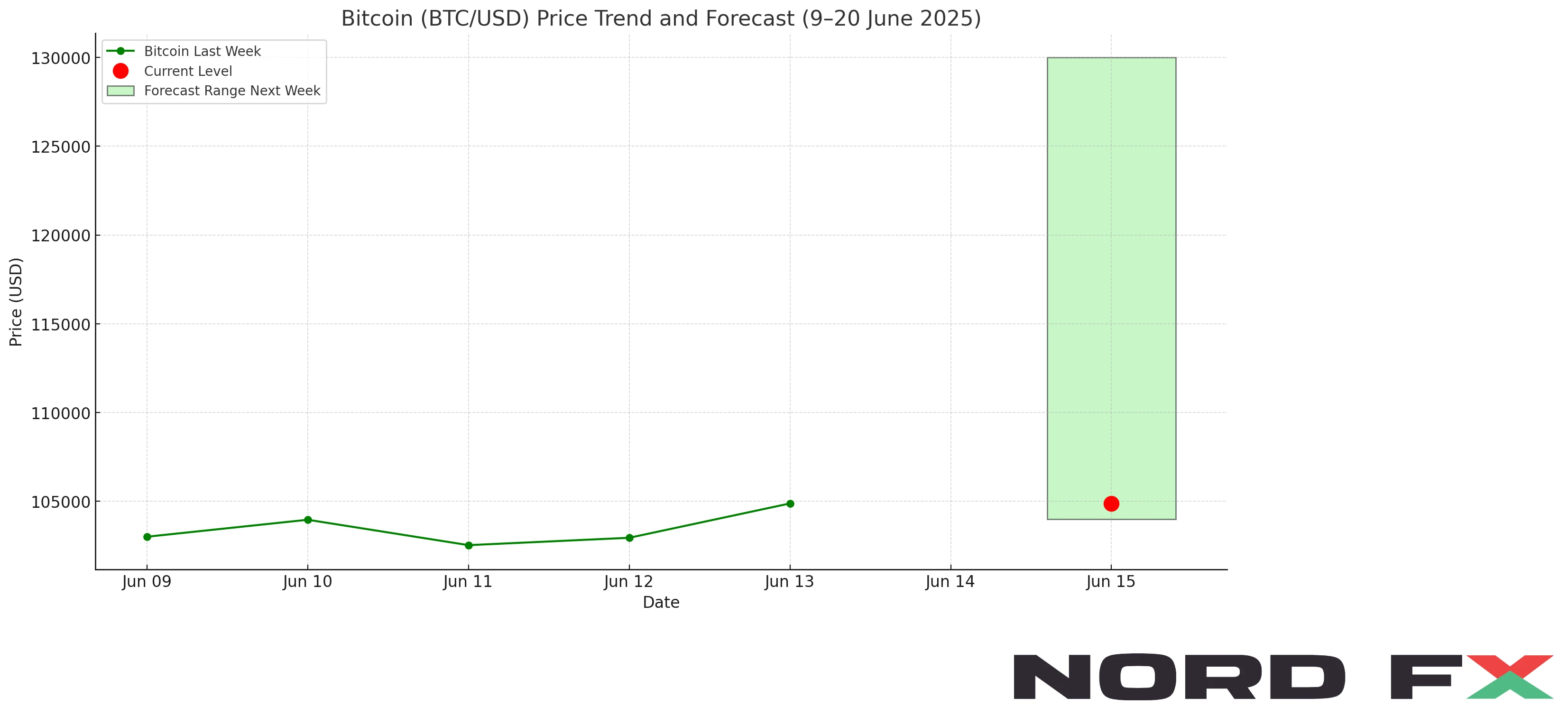

BTC/USD

Bitcoin finished the week close to 105,000 after failing to maintain its midweek gains near 110,000. The structure suggests ongoing consolidation just below resistance, with the market watching the key support zone between 105,000 and 104,000. If buyers defend this area, a rebound toward 115,000 and potentially 130,000 remains possible. However, sustained weakness below 100,000 would dampen sentiment and open the way for a deeper retreat toward 95,000.

Conclusion

The outlook for 16–20 June calls for cautious trading amid lingering geopolitical risks. EUR/USD may probe higher but remains vulnerable to sudden dollar strength. Gold is well supported as long as it holds above key levels and may attract fresh buyers if global tensions persist. bitcoin must protect its support zone near 105,000 to avoid deeper losses; a break higher would restore bullish momentum. Traders should remain alert to geopolitical developments and central bank signals, as these will shape risk appetite in the days ahead.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.