The past week saw contrasting movements in key markets. The euro continued to lose ground against the US dollar, with bearish sentiment dominating the EUR/USD pair. Meanwhile, bitcoin remained strong despite minor pullbacks, holding its place in a bullish trend channel. Gold prices, too, extended their rise, reflecting continued market demand for safe-haven assets amid global uncertainties. As we look ahead to the upcoming week, market trends suggest potential shifts in key assets depending on support and resistance levels.

EUR/USD Outlook

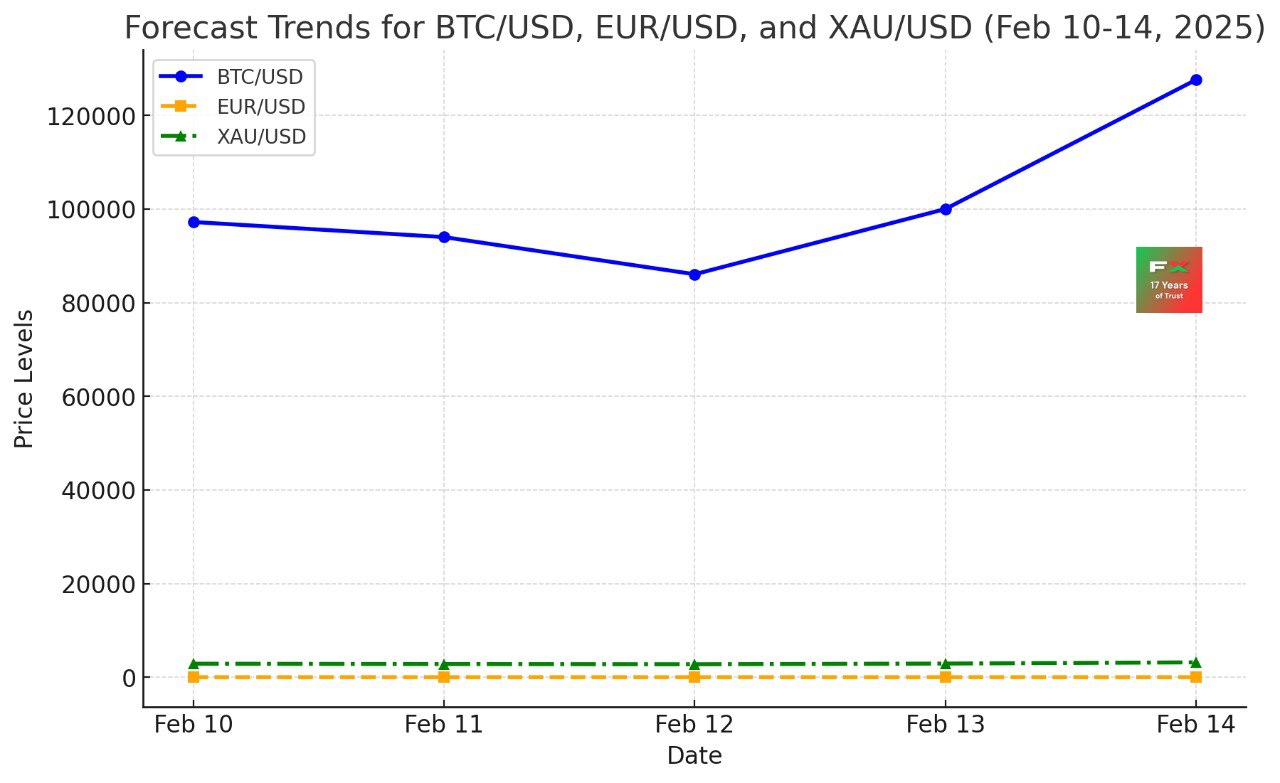

The EUR/USD currency pair concluded last week near 1.0393, marking another decline as bearish momentum persisted. A reversal pattern, identified as the "Head and Shoulders," remains in play, indicating continued pressure on the euro. Moving averages confirm the bearish trend, and the pair broke below key signal lines, reinforcing expectations for further downside movement.

In the coming week, the pair may test the support level near 1.0290. If this level holds, a rebound is anticipated, potentially propelling the euro toward a target of 1.0735. Technical indicators, including a test of the support line on the relative strength index (RSI), point towards this recovery scenario. However, should the pair breach 0.9985, the bearish outlook would be reaffirmed, setting the stage for a decline towards the 0.9675 region.

Ultimately, the focus for EUR/USD traders remains on whether the pair can sustain its current support levels or whether further bearish action will drive it to new lows.

Gold (XAU/USD) Outlook

Gold ended the week trading near 2870, maintaining its position within a strong bullish channel. Moving averages indicate that the upward momentum remains intact, with prices breaking higher across key signal areas. This suggests that market sentiment remains favourable for continued gold price growth in the near term.

Despite the bullish sentiment, a short-term correction could lead to a test of the 2755 support level. If prices find stability there, a rebound toward the 3165 target is likely. A key signal supporting this scenario is a potential bounce off the lower border of the bullish channel, complemented by RSI trends pointing to continued upward momentum. Conversely, if gold prices breach the 2635 level, a deeper correction toward 2555 could unfold.

Given its safe-haven status, gold’s trajectory this week will likely reflect both technical dynamics and broader risk sentiment in the markets.

Bitcoin (BTC/USD) Outlook

Bitcoin remains resilient, closing last week at 97,224. The asset has stayed within an established bullish channel, with moving averages suggesting a continuation of the uptrend. The break above key signal lines has underscored renewed buying interest, even though short-term corrections are still part of the market dynamic.

In the coming week, bitcoin may test support near 86,065. Should buyers regain control at this level, a subsequent rally could push prices beyond 127,605. Technical signals, including a rebound from both the lower channel boundary and the RSI support line, indicate that bitcoin remains on course for further growth. However, a failure to hold the 86,065 level might lead to a steeper decline, targeting the 75,205 mark.

Bitcoin’s price path will largely depend on whether bullish momentum can overcome any short-term corrective pressures, as traders monitor both fundamental and technical indicators.

Conclusion

The upcoming week presents key inflection points for EUR/USD, gold, and bitcoin. The euro faces potential further losses unless it can hold crucial support levels, while gold appears set for continued gains if its bullish channel remains intact. Bitcoin, on the other hand, retains its long-term upward trajectory but must first withstand near-term corrections. Traders will closely watch support and resistance levels across these markets to assess potential reversals and confirm trend continuation.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.