Market Overview: What to Expect This Week

Financial markets closed last week with a mixed performance across major asset classes. The euro weakened slightly against the US dollar, gold surged to record highs, and bitcoin continued to trade within a bullish channel despite increased volatility. Traders are closely monitoring inflation data, central bank commentary, and global economic indicators. The outlook for the coming week suggests ongoing volatility, with key technical levels likely to play a crucial role in shaping the direction of forex, gold, and crypto markets.

EUR/USD Forecast: Is a Rebound or Further Decline Ahead?

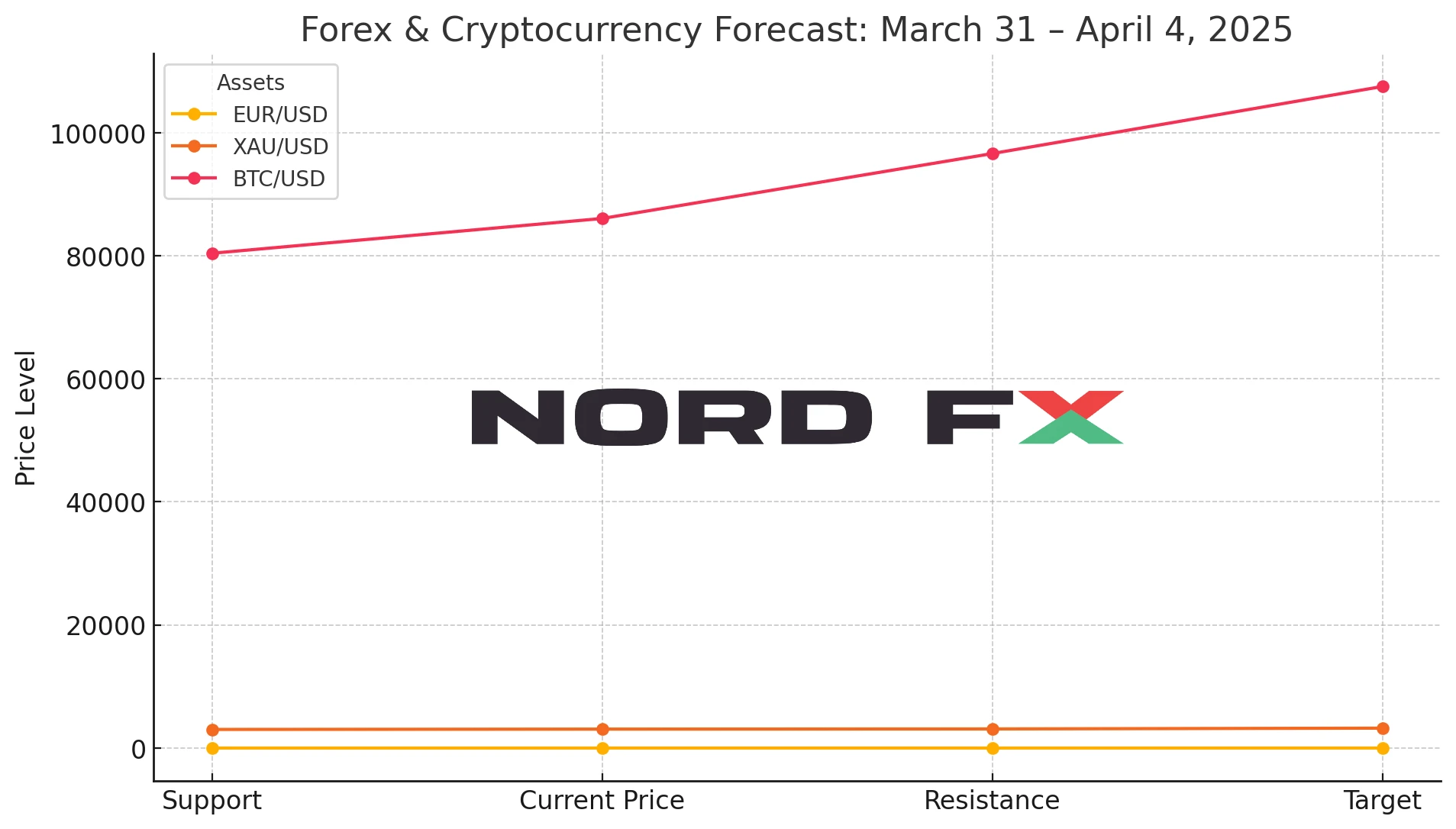

The EUR/USD currency pair ended the week near 1.0786, posting a moderate decline. Technical indicators point to a prevailing bearish trend, although the price has climbed above the moving average zone, suggesting short-term buyer interest. The latest EUR/USD forecast for the week of March 31 to April 4 anticipates a possible upward correction towards the resistance level of 1.0925. However, if this level holds, a reversal and renewed downward movement towards 1.0525 may follow.

Additional bearish signals include a test of the resistance line on the RSI and a potential rejection at the top of the descending channel. Should the euro break above 1.1105, this would signal a bullish breakout with a possible extension of gains toward 1.1365. On the other hand, confirmation of a bearish continuation would come with a break below the 1.0645 support zone.

Gold Technical Analysis: Will XAU/USD Extend Gains Above $3200?

Gold (XAU/USD) finished last week with aggressive gains, closing near $3079 and remaining firmly within a bullish channel. The outlook for gold prices this week remains positive, although a short-term correction is likely. The current gold technical analysis suggests that a pullback towards the $3025 support level may occur before renewed buying interest pushes prices above the $3235 mark.

Key bullish signals include a rebound from the RSI trend line and support along the lower boundary of the ascending channel. A confirmed breakout above $3105 would reinforce the bullish scenario. However, a decline below $2935 would break key support and indicate a shift toward a bearish trend, targeting $2815 as the next major support level.

Bitcoin Price Prediction: Will BTC/USD Break Through $100K?

Bitcoin (BTC/USD) closed last week at $86,056 and continues to consolidate within a bullish channel. The current bitcoin price prediction suggests that the market may first test support near $80,405 before resuming upward momentum. If this level holds, the next target lies above $107,505, which would represent a continuation of the broader uptrend in the crypto market.

Positive signals include a bounce from the lower boundary of the bullish channel and support on the RSI. However, if BTC/USD breaks below $72,065, this would invalidate the bullish outlook and suggest a deeper correction toward the $64,565 support zone. A confirmed breakout above $96,605 would indicate a resumption of upward momentum and a potential challenge of the psychological $100,000 barrier.

Conclusion: Key Trends to Watch in Forex, Gold, and Crypto Markets

As the new trading week begins, traders should prepare for possible short-term corrections within prevailing trends. The euro remains under pressure despite signs of a temporary rebound. Gold maintains strong bullish momentum, supported by macroeconomic uncertainty. Bitcoin continues to offer both risk and opportunity as it consolidates near key support and resistance levels. Whether you’re trading forex, commodities, or cryptocurrencies, staying alert to market signals and technical patterns will be crucial this week.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.