Bitcoin remains the world’s leading cryptocurrency and one of the most traded digital assets globally. If you’re looking to gain exposure to Bitcoin’s price movements, this guide explains exactly how to buy Bitcoin on NordFX, step by step.

This article is designed for beginners and covers account setup, funding, placing a Bitcoin trade, leverage, risks, and frequently asked questions.

Important: On NordFX, Bitcoin is typically traded as a BTCUSD instrument (price-based trading), not necessarily as on-chain Bitcoin that you can transfer to a private wallet. Always check your account type and available withdrawal options.

What Is Bitcoin?

Bitcoin (BTC) is a decentralized digital currency launched in 2009. It operates on blockchain technology, which records transactions on a distributed public ledger. Unlike traditional currencies issued by central banks, Bitcoin is not controlled by any government or financial institution.

Key features of Bitcoin:

- Limited supply: Maximum of 21 million coins

- Decentralized network secured by cryptography

- Tradable 24/7 in global markets

- Highly volatile, offering both opportunity and risk

Bitcoin can be used as a speculative trading asset, a long-term investment, or a hedge depending on your strategy.

Can You Buy Real Bitcoin on NordFX?

When trading Bitcoin on NordFX, you typically trade the BTCUSD pair. This means:

- You trade Bitcoin’s price against the US dollar.

- You open buy (long) or sell (short) positions.

- You may use margin, depending on your account type.

This is often referred to as margin or CFD-style trading. You are gaining exposure to price movements rather than necessarily owning transferable on-chain BTC.

If you want to withdraw Bitcoin to an external crypto wallet, check whether your account supports crypto withdrawals.

How to Buy Bitcoin on NordFX: Step-by-Step

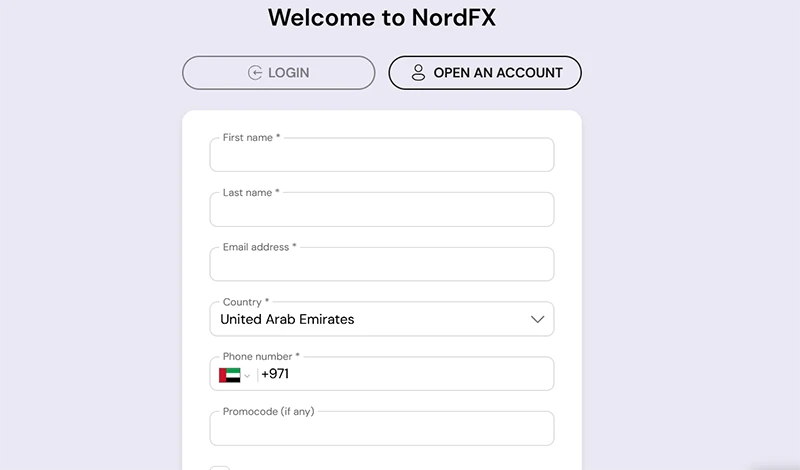

Step 1: Open a Trading Account

To start trading Bitcoin:

- Visit the official NordFX website.

- Click “Open Account.”

- Fill in your name, email, phone number, and country.

Once your account is approved, you can log in to your trading cabinet.

Step 2: Deposit Funds

Before you can buy Bitcoin, you need to fund your account.

- Log in to your client area.

- Go to the “Deposit” section.

- Select a payment method (bank card, bank transfer, e-wallet, or cryptocurrency, depending on availability).

- Enter the deposit amount.

- Confirm the transaction.

Minimum deposit requirements depend on the account type you choose.

Tip: Always check deposit fees, processing time, and minimum funding thresholds before transferring money.

Step 3: Install and Log In to MT4 or MT5

Bitcoin trading on NordFX is done via trading platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

- Download MT4 or MT5 from the broker’s website.

- Install the platform on your device.

- Log in using your trading account number and password.

- Open the “Market Watch” window.

- Locate the BTCUSD trading pair.

If you don’t see BTCUSD, right-click inside Market Watch and select “Show All.”

Step 4: Open a Bitcoin Trade (BTCUSD)

To buy Bitcoin:

- Click on BTCUSD.

- Select “New Order” (or press F9).

- Choose your trade volume (lot size).

- Optionally set Stop Loss and Take Profit levels.

- Click “Buy” to open a long position.

If you believe Bitcoin’s price will rise, you open a Buy position.

If you believe Bitcoin’s price will fall, you open a Sell position.

Your open trade will appear in the “Trade” tab of the terminal.

Example:

If BTCUSD is trading at 65,000 and you open a small position size, your profit or loss will depend on how much the price moves and your selected volume.

What Is Bitcoin Margin Trading?

Margin trading allows you to control a larger position with a smaller deposit by using leverage.

For example:

- With 1:10 leverage, $100 can control a $1,000 position.

- With 1:100 leverage, $100 can control a $10,000 position.

Higher leverage increases both potential profits and potential losses.

NordFX may offer leverage on BTCUSD depending on:

- Account type

- Client category

- Regional regulations

Always check the instrument specifications inside MT4/MT5 for current leverage limits.

Costs of Trading Bitcoin

When trading BTCUSD, you may encounter:

- Spread (difference between buy and sell price)

- Commission (depending on account type)

- Swap/overnight financing if holding positions long-term

Before opening a trade, review contract specifications and trading conditions inside your platform.

Risk Management Tips for Bitcoin Trading

Bitcoin is known for volatility. To manage risk:

- Use Stop Loss orders.

- Avoid risking a large percentage of your account on one trade.

- Start with smaller position sizes.

- Avoid excessive leverage.

- Follow a defined trading plan.

Never trade with money you cannot afford to lose.

Frequently Asked Questions

Is NordFX safe for Bitcoin trading?

NordFX is an established brokerage offering access to currencies, cryptocurrencies, stocks, and other markets. As with any broker, you should review its regulations, client agreements, and trading conditions before opening an account.

Do I need to buy a whole Bitcoin?

No. You can trade fractional exposure by adjusting your position size (volume). You do not need to purchase 1 full BTC.

Can I withdraw Bitcoin to a private wallet?

This depends on whether your account provides crypto wallet functionality or only BTC price trading. Check your withdrawal options in the client area.

What is the minimum deposit to trade Bitcoin?

The minimum deposit depends on your chosen account type. Check the account comparison section on the broker’s website for current requirements.

Is trading Bitcoin the same as buying on a crypto exchange?

Not exactly. On a crypto exchange, you usually buy on-chain BTC that can be transferred to external wallets. On a broker platform, you typically trade Bitcoin’s price as a financial instrument, often with leverage.

Key Takeaways

- Bitcoin can be traded on NordFX via the BTCUSD pair.

- You need to open and verify a trading account before depositing funds.

- Trading is done through MT4 or MT5 platforms.

- You can go long or short on Bitcoin.

- Leverage is available but increases risk.

- Always understand fees, spreads, and margin requirements before trading.

If you’re new to cryptocurrency trading, start with small positions, focus on risk management, and build experience gradually.