First, a review of last week’s events:

- EUR/USD. The worse the things are for Trump, the better they are for the dollar. Such a conclusion can be made by looking at the quotes’ charts. Now, due to a conversation with the President of Ukraine, the US President is facing impeachment, and the dollar index has already risen to the highs around 99.00. The euro retreated another 100 points, as a result of which the EUR/USD pair updated its lows, dropping to the level of April 2017, and ended the week at 1.0940;

- GBP/USD. The dollar is growing not only due to the economic downturn in the Old World, but also to the growing concern about Brexit. The British Parliament has no way to deal with Prime Minister Boris Johnson, and he, in turn, is in confrontation with both Parliament and Brussels, which does not want to make concessions. In such a situation, Michael Saunders, a member of the Bank of England 's Monetary Policy Committee, said the Bank might be forced to lower interest rates, even if a no-deal Brexit is avoided.

Such a statement from one of the financial "hawks" pushed the pound even further down. As a result, as most experts predicted (60%), the British currency is weakened by more than 200 points, and at the end of the week session it cost 1.229 US dollars per pound; - USD/JPY. Recall that most experts (65%) supported the bears by voting for the fall of the dollar and the return of the pair to the area of 105.75-106.75. Indeed, starting from the moment the trading session opened, the pair went down, reaching the local bottom at 106.95 by Tuesday evening. After this, a U-turn followed, and the pair returned to where it had already been seven days ago, completing the five-day period at 107.95;

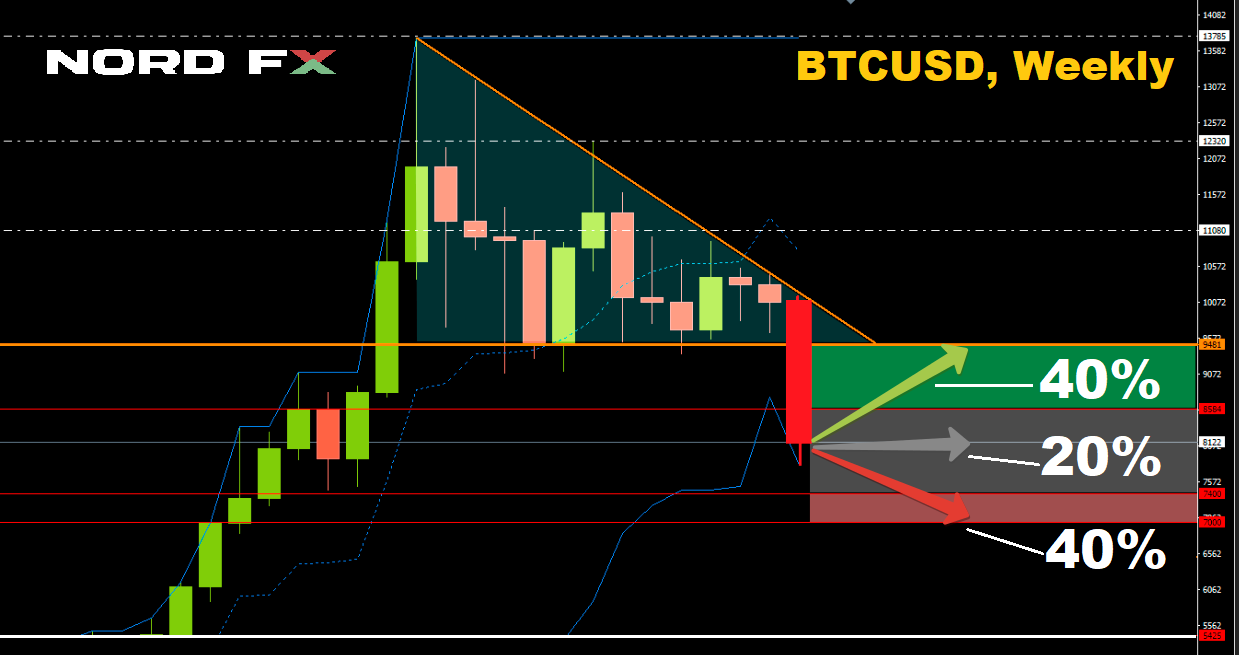

- Cryptocurrencies. What the bulls were so afraid of did happen. Everyone understood that the three-month localization Bitcoin prices in the $10,000 area should, finally finish with a breakthrough. But just in which direction? The scenario we announced for the pair to fall to around $8,000 was supported by 35% of experts, who, as a result, turned out to be right. On September 24, the day already nicknamed Black Tuesday, the basic cryptocurrency flew down, losing almost 17% and reaching $8.115. (During the “minute flow” on the Binance crypto exchange, someone managed to buy bitcoin for only some $1,800). The bulls' attempt to win back the losses failed. Only on one BitMEX cryptocurrency exchange, mainly due to the triggering of stop orders, “long” positions of $650 million were closed. On Thursday, the decline continued, and the BTC/USD was able to find the local bottom only reaching the horizon of $7,700.

According to one version, the market crash is associated with the complete disappointment with trading volumes on the Bakkt platform, intended for trading cryptocurrency futures. Recall that it began working on Monday, September 23, and on the first day only 71 contracts were sold, each with a volume of 1 BTC. Futures trading was supposed to help the crypto industry. But the opposite happened, and the day after the start of Bakkt there came a "Black Tuesday."

Naturally, falling into the abyss, Bitcoin pulled altcoins along with it. So, the week low for Ethereum (ETH/USD) was fixed at $154.3 (minus 30%), for Litecoin (LTC/USD) - at $50.5 (minus 34%), for Ripple (XRP/USD) - $ 0.213 (minus 28%). The total capitalization of the cryptocurrency market decreased by more than 20% in seven days, from $ 277 billion to $ 218 billion.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. The dollar continues to be in demand amid confusion with Brexit and weak economic statistics coming from the EU. It is also supported by the strong results of the auction on US Treasury bonds and some optimism regarding the outcome of the US-Chinese trade war. Thus, last week, the Minister of Commerce of China expressed hope that, a position suiting both sides would be found in negotiations with the United States.

But besides this shiny side, the medal has another, reverse side. It lies in the discontent of Trump and his administration with the growth of the dollar, which negatively affects the competitiveness of American industry. In this regard, it can be expected that, under pressure from the US President, the Fed will take certain steps towards quantitative easing (QE), which will lead, if not to the dollar weakening, then at least to slowing down of the further strengthening of the US currency.

This week we will see a lot of economic news from both Europe and the United States. The preliminary values of the German Consumer Price Index (September 30) and the EU (October 01) will be published. Also, on Tuesday, October 1 and Wednesday October 2, ISM Business Activity Indices in the US manufacturing and services sectors will be released. And on the first Friday of the month, statistics on the US labor market, including NFP, will traditionally be released. The business week will be completed by a speech by Fed Chairman J. Powell.

Regarding the opinion of experts, 55% of them expect a correction of the EUR/USD pair up to the zone 1.1000-1.1100. 15% of the oscillators on D1 and W1 also support this scenario, giving signals that the pair is being oversold. The remaining 45% of analysts, along with the overwhelming number of indicators, have sided with the bears, expecting the dollar to further strengthen and the pair to decline to the 1.0800 horizon. The nearest support is 1.0885. A compromise option is drawn by graphical analysis on D1: first, a decline to the level of 1.0800, then movement in the channel 1.0800-1.0885 and a subsequent return to the height of 1.1000; - GBP/USD. On Monday, the last day of September, the data on the UK GDP for the 2nd quarter will be released. The indicator is expected to show an increase of 0.7% (from -0.2% to + 0.5%). However, this is unlikely to have a long-term impact on the pound, whose exchange rate is still determined by the confusion around Brexit, the date of which, October 31, is inexorably approaching.

In this situation, 45% of the experts, supported by graphical analysis on D1 and most indicators, expect the pair to try to update the September 3 low, 1.1960. Immediate support is at the levels of 1.2210, 1.2080, 1.2015.

25% of analysts have voted for the lateral movement of the pair along the Pivot Point 1.2300. And another 30% of experts expect its growth to the height of 1.2500. Such a forecast is supported by 15% of the oscillators on H4 and D1, signaling overselling of the pair. The nearest resistance is in the zone of 1.2385-1.2415 ; - USD/JPY. As for the yen, investors will wait for the developments in the US-Chinese trade war and the results of the meeting of the Bank of Japan in late October, which may give a regulatory impetus to the country's economy. Pushing the yen up may decrease the yield on US bonds.

In the meantime, the voices of experts are divided as follows. 40% of analysts and graphical analysis on D 1 have voted for the pair to decline. The goal is a breakthrough of support in the zone 107.00 and the transition to the zone 105.75-106.70. The next target is 105.00. 60% of the experts, 100% of trend indicators on Н4 and 90% on D1 have voted for the pair to reach the zone of 109.00. The nearest resistance is 108.50; - Cryptocurrencies. It seems that the climatic chaos on the planet is reflected in the crypto market as well. And instead of the crypto spring promised by the famous investor Thomas Lee, another crypto winter is setting in. At least, the rise of Bitcoin to 50, 100 or 200 thousand dollars predicted by many gurus has not yet happened. And the fact that the current rebound from $7,700 has not received any serious development indicates the lack of consumer appetite among investors.

The cryptocurrency “Fear & Greed Index” on Thursday reached the “12” mark, which corresponds to the “extreme fear”. According to the developers of the index, this is a good moment to open “long” positions, however, as already mentioned, there are no active purchases. And it is possible that they will begin only when the price approaches the zone of $7,000-7,400.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

戻る 戻る