Short answer

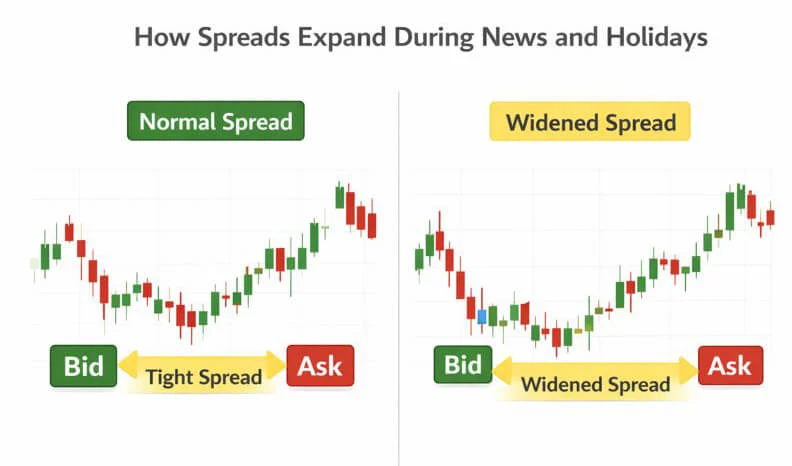

Spreads widen when market liquidity drops or risk rises. During news releases and holidays, liquidity providers protect themselves by increasing spreads to manage volatility and price uncertainty.

What the spread really represents

The spread is the difference between:

- Bid price (sell price)

- Ask price (buy price)

It reflects:

- market liquidity

- execution risk

- price availability

Tighter spreads = stable, liquid markets

Wider spreads = risky or thin markets

Why spreads widen during major news

Volatility increases instantly

When economic news is released:

- prices move very fast

- direction becomes uncertain

- large orders hit the market

Liquidity providers face higher risk of sudden losses.

To compensate, they:

👉 widen spreads temporarily

Fewer stable prices exist

During news:

- price levels disappear quickly

- orders jump between levels

- smooth execution becomes impossible

Wider spreads protect against execution at unstable prices.

Why spreads increase during holidays and off-hours

During holidays or low-activity sessions:

- fewer traders participate

- liquidity drops sharply

- price availability becomes thin

With less liquidity:

👉 spreads expand naturally

This happens even without major price movement.

The role of liquidity providers

Liquidity providers are institutions that supply buy and sell prices.

They adjust spreads based on:

- market risk

- volatility

- available liquidity

When conditions worsen:

✔ spreads widen

When conditions stabilize:

✔ spreads tighten again

This is automated and happens in real time.

The illustration shows how market risk causes spreads to expand.

Why this is normal market behavior

This is not:

❌ broker manipulation

❌ price error

❌ platform malfunction

This is:

✅ global liquidity risk management

✅ standard market pricing

✅ how all professional markets operate

Stocks, futures, forex, and crypto all behave the same way.

Why this matters for traders

Understanding spread widening helps traders:

- avoid trading during risky moments

- place realistic stop losses

- manage costs

- prevent surprise executions

Most sudden stop loss triggers during news are caused by spread expansion.

Why was my order rejected or not accepted?

Voltar Voltar