First, a review of last week’s events:

- EUR/USD. In general, the week has not brought any surprises. No one had expected a rate increase at this FOMC meeting, but investors had been worried about the comments of the Fed management on plans for 2019. And here their forebodings about the “pigeon” comments were fully justified. Instead of specific promises, the regulator spoke about the fact that the decision to further rate increase should take into account global economic factors and be extremely balanced. Thus, the uncertainty caused a sharp sell-off of the dollar, as a result of which the pair soared to the upper border of the medium-term lateral channel 1.1300-1.1500. However, then the situation calmed down, and the pair turned to the south.

Another expected event was the publication of the US labor market data on Friday, February 01. The statistics really turned out to be extremely positive. Thus, NFP grew by 37% compared with the previous month (from 222K to 304K), and the ISM business activity index rose from 54.3 to 56.6. But this did not come as a surprise either thanks to Trump's economic adviser Larry Kudlow, who, as we wrote in the previous review, “leaked” this information long before the official publication. As a result, the market reaction was limited to insignificant fluctuations within 40 points, after which the pair completed the week at the level of 1.1455; - GBP/USD. The next meeting of the UK Parliament on Brexit has not added any clarity to the process of divorce from the European Union. As a result, the pound lost about 160 points in the first half of the week, and then moved into a sideways trend, making fluctuations in the range of 1.3050-1.3150, and finished the week at the level of 1.3075;

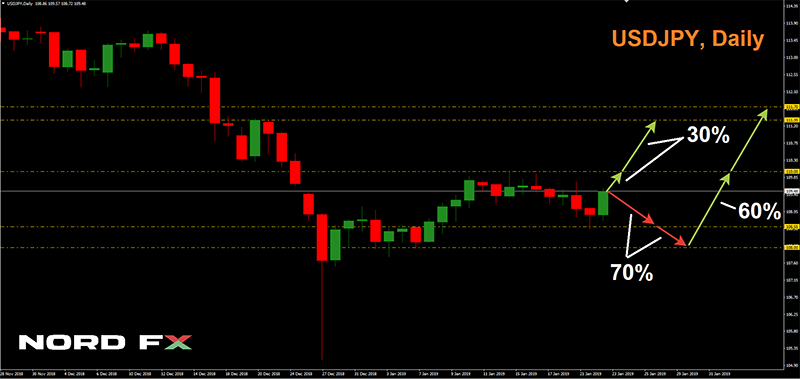

- USD/JPY. Like the rest of the dollar pairs, the USD/JPY responded to the Fed's comment with the US currency dropping to 108.50. However, then, taking advantage of the positive dynamics in the US labor market, the dollar won back the losses, and the pair returned by the end of the week to where it had begun, to 109.50;

- Cryptocurrencies. It was noted In the previous forecast that the major coins are in a side trend, constantly experiencing pressure from bears. 70% of experts had supported the scenario according to which Bitcoin was supposed to yield to such pressure and gradually decrease to 2018 lows. The past week confirmed the validity of such expectations. On Tuesday, February 29, the benchmark cryptocurrency fixed a local minimum at $3,425, after which the rebound followed, and the pair saw February in the $3,500 zone. As for the capitalization of the crypto market as a whole, it “dried out” by 5.5% over the week, dropping to $113.6 billion.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. There appears a hope for a trade deal with China, siding with the dollar. On January 31, another round of negotiations on this topic ended in Washington. And as analysts say, progress in the negotiation process cost both sides a lot of effort. The American negotiators showed an obvious desire to succeed, because President Trump is now in dire need of something positive. However, the industrial espionage accusations made by the Americans against Huawei Technologies Co. somewhat overshadowed the optimistic picture drawn by the parties. The next round of talks is to be held in Beijing in mid-February.

The counterbalance to the successful negotiations, as already mentioned above, was made by the US Federal Reserve, who doubted the need for another increase in the interest rate. And if in the medium term, 60% of analysts are still waiting for the dollar to strengthen, this week the majority (70%) sided with the euro. In their opinion, which is supported by approximately 80% of the oscillators and trend indicators on D1, the EUR/USD will once again try to break through the upper limit of the medium-term side channel 1.1300-1.1500 and gain a foothold in the area of 1.1500-1.1570. The next target is the height of 1.1625.

The alternative scenario has been supported by 30% of experts, graphical analysis on H4 and about 20% of oscillators, giving signals that the pair is overbought. In this case, the pair, having failed to break through the key level of 1.1500, will be located in the side corridor 1.1400-1.1500 for some time. And if there is positive news for the dollar, it will make an attempt to reach support on the horizon of 1.1300; - GBP/USD. Thursday, February 7 will see a decision of the Bank of England on the interest rate, which is likely to remain unchanged, at the level of 0.75%. Investors are Much more concerned about the situation with Brexit, but there is no clarity here. Moreover, the likelihood of a British exit from the EU without a deal has begun to grow again. That is why 65% of analysts predict a decline of the pair first to the level of 1.2930, and then another 100 points lower.

As for the indicators, about 40% of them are colored red on H4, 40% are green and 20% are neutral gray. Although, on D1 the green color dominates: 60% versus 30% red and 10% gray. The nearest resistance is 1.3215, then 1.3250 and 1.3300; - USD/JPY. Certain surprises can be expected from this pair in the near future, and the reason is oriental New Year. Traditionally this time is not only for summarizing financial results, but also for active actions by the Bank of Japan, which for several years in a row begins to buy and sell large amounts of currency at this moment. Such interventions can cause a jump of several hundred points, and at the moment most analysts (70%), supported by graphical analysis on D1, expect the pair to first fall to 108.00-108.55, and then return to the horizon 110.00. At the same time, about 60% of experts believe that the pair will not stop at what has been achieved and can reach resistance at the level of 111.70 within a month;

- Cryptocurrencies. Experts and investors can now be divided into two groups. The first group believes that the current lull is the lull before the storm. The second one thinks is that it is a lull before ... even more calm. Andy Bromberg, the head of CoinList crypto exchange, has sided with the latter. , having said in his interview to Yahoo Finance that the situation in the market will be calm as all the necessary instruments have been created already and the companies will focus not on speculations but on innovations and product development.

This scenario is also supported by the report of Circle Research, according to which, despite the fact that direct investment in digital currencies decreased 8.5 times over the year, investments in blockchain companies, on the contrary, increased 3 times and exceeded $5 billion.

As for the forecast for the next few weeks, 70% of experts still believe that Bitcoin should decline to the 2018 lows in the zone of $3,200-3,250, and then rush to support at $ 2,400. The remaining 30% of analysts do not exclude a short-term growth of the BTC/USD pair to $3,700-3,850, and possibly even higher, to the height of 4.215.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited. Trading in financial markets is risky and can lead to a complete loss of deposited funds.

Voltar Voltar