First, a review of last week’s events:

- EUR/USD. The main theme last week was undoubtedly Brexit. New Prime Minister Boris Johnson managed to reach a compromise with Brussels, and on Thursday October 17, the European Union Summit approved an agreement on the terms of Britain's exit from the EU and its date, November 01. This event, as well as the reduction of political and trade risks in Europe, Asia and America, "seasoned" with weak statistics from the US, opened the way to the north for the bulls.

The overwhelming majority of experts (70%) pointed to 1.1160 as the main target, and this forecast turned out to be absolutely correct: on Friday evening the pair managed to rise to this height, where it ended the week-long session; - GBP/USD. Since October 08, the British currency has gained almost 800 points, or about 6%. And all this thanks to the hope for a coming successful completion of the" show " called Brexit, which has lasted for 3.5 years and od each all are quite tired. At the peak of optimism on Thursday, October 17, the pound was noted at 1.2990, followed by a correction and a finish at 1.2940;

- USD/JPY. Recall that the opinions of the experts concerning the yen were spread equally last week: a third voted for the pair's growth, a third for its fall and a third for a sideways trend. And they were all right. At first, the pair fell slightly to the level of 108.02. Then it rose a little, to the level of 108.90, then moved sideways and finished almost where it was a week ago, in the Pivot Point zone 108.40-108.45;

- cryptocurrencies. Twitter users have estimated that the price of the main cryptocurrency has increased by 838.078.685% over the past ten years. But it seems that such space takeoffs are no longer worth waiting for. Not so long ago, Bitcoin was pushed up by the news of the launch of major projects such as Libra by Facebook and TON by Telegram. (Though it's not really clear why. After all, if both of these coins appeared, they would constitute a powerful competition to Bitcoin). But many governments and regulators have turned on the Facebook project, and Telegram has postponed the launch of TON altogether amid problems with American legislation. Thus, both of these drivers, if not completely disappeared, are at least greatly weakened. And this could not but affect the crypto market. Over the past ten days, its capitalization has fallen from $236 billion to $224 billion, and the price of Bitcoin, as most of our experts had expected, has fallen to the lower limit of the side corridor of $7,795-8,700.

Ethereum (ETH/USD) and Litecoin (LTC/USD) dutifully followed to the south in the wake of the main cryptocurrency. But as for the Ripple (XRP/USD), it shows a stubborn character for the last four weeks. During this time, the price of the coin rose by 40%, returning to a strong medium-term support/resistance level in the 0.30 zone. Most likely, this rise is caused by a number of positive news related directly to the company itself.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- GBP/USD. We put this pair before the Euro/Dollar because everything that will happen to the pound in the coming week will have a powerful impact on the quotes of the other leading currencies.

In fact, the new Brexit agreement is basically the same text that the previous Prime Minister Theresa May failed for three times to "push" through the British Parliament. And now on Saturday 19 October, Prime Minister Boris Johnson will try to do it. And without Parliamentary approval, the deal with the EU will not take place.

The main difference of Johnson's version is the absence of the so-called "Irish backstop", because of which the UK risked remaining in the European customs Union. But Johnson failed to completely close this border gap, and Northern Ireland will still have to obey EU trade rules. And in this, many see a threat of the collapse of the United Kingdom. The Democratic unionist party of Northern Ireland is unhappy as well. "We do not intend to vote for this project," said the DUP leader Arlene Foster. "It's not the end yet. It's not even the beginning of the end! »

So, for the first time since the 1982 Falklands war, MPs will cancel their weekend plans and meet for an emergency meeting. When this forecast is written, we do not yet know how "super Saturday" ends. But a simple count shows that Johnson may be a few votes short and the vote will fail and bring back the old uncertainty about the outcome of Brexit.

In any case, there is a lot of chance that on Monday, October 21, the markets will open with a big gap. Almost 20% of oscillators already indicate the British currency is overbought. And in case of Johnson's defeat, we will see a powerful counterattack of the bears and the return of the pair to the lows of the first decade of October in the area of 1.2200. (Supports 1.2515, 1.2380 and 1.2280). If the Agreement is approved, the pound has a lot of chances to exceed this year's maximum at 1.3380.

If we move from the weekly forecast to the medium-term, it becomes clear that even in the case of a regulated Brexit, the pound will still be under pressure. Accustomed to working within the EU, the UK economy, left alone, will surely begin to experience serious difficulties, which will force the Bank of England to cut interest rates and take a number of serious steps to ease monetary policy. In such a situation, the pound has a lot of chances to roll back from the highs and return to the 1.3100 zone; - EUR/USD. In the coming week, the interest rate decisions of the People's Bank of China on Monday 21 October and the ECB on Thursday 24 October will be known. And if the rate on the Euro is likely to remain unchanged, Beijing may present markets with a small surprise. The data on business activity in Germany, which will also be released next Thursday, are also of interest. But, as already mentioned, the main trend of the pair will be set by the pound, which will either pull the Euro up, or overturn it by a hundred or two points. The bears ' targets are September-October lows of 1.0850-1.0925, the bulls' targets are 1.1250-1.1350.

At the moment, the majority of experts (80%) expect that Boris Johnson will be able to get a majority of votes in Parliament, and only 20% predict the fall of the pair. It is interesting that in the transition to the medium-term forecast, the balance of forces is mirrored, and here 80% are waiting for the decline of the pair to the zone 1.0800-1.0900 by the end of the year; - USD/JPY. The targets for the yen remained unchanged. Support zones – 107.00, 106.65 and 105.70, resistance - 109.00 and 109.85. It is only the mood of the experts that has changed. If 60% of them vote for the growth of the pair the next week, and 40% are for the fall, then in the medium – term interval everything is vice versa: 40% are for the growth and 60% are for the fall.

There is no unity among the indicators either. If on H4 80% of oscillators are colored red and 20% signal the pair is oversold, then on D1 80% have changed the color to green, and 20% believe that the pair is oversold.

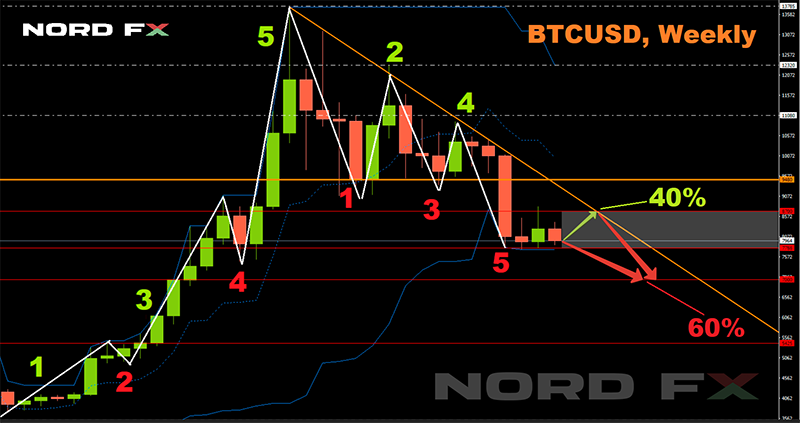

The result of the discord is summed up by the graphical analysis on D1, which draws first a fall to the level of 107.50, and then a rise to the height of 109.00; - cryptocurrencies. The BTC/USD pair has been moving along the $7,795-8,700 corridor with a Pivot Point of $8,300 for almost a month, starting from September 25. The same thing happened from mid-May to mid-June. But then, if you follow the Elliott wave theory, it was a respite (or corrective wave #4) between the impulse waves #3 and # 5 of the uptrend (which is clearly visible on the W1 timeframe). Now the picture is reversed and, following the same Elliott, we see the end of wave #5 already on a downtrend. In theory, we should expect an upward correction of the pair, especially since the MFI indicator on H4, D1 and W1 is in the lower, critical zone, and the MACD on H4 and D1 indicates divergence. But it has long been noticed that when it comes to cryptocurrencies, graphic and technical analysis often slip. Much more important here are the news background and manipulations of large speculators. The fact remains that over the past four months, the price of Bitcoin has decreased by more than 40%, and the crypto-currency "Fear & Greed Index" is still in the "Fear" zone.

Pessimistic sentiment is supported by 60% of experts who expect a breakthrough of the lower border of the corridor and the fall of the BTC/USD pair to the $7,000-7,400 zone. The remaining 40% of analysts do not expect Bitcoin to take off either. In their opinion, in the coming week, the reference cryptocurrency will be traded in the range of $8,300-8,700 per 1 coin.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Voltar Voltar