First, a review of last week’s events:

- EUR/USD. The upcoming elections to the European Parliament, as well as multi-episode confusion with Brexit continue to put pressure on the European currency. Even the escalation of tensions in the US-China trade war does not help the euro: despite the fighting mood of the PRC leadership, the markets are betting on the US victory. And the failure of China will automatically exacerbate the problems of the closely related Eurozone.

Recall that, giving a monthly forecast, 70% of experts have expressed an opinion that the pair will continue to move along the medium-term downward channel and will again test the low of the end of April 1.1110. The past week was a confirmation that this forecast was correct: the pair lost about 80 points in five days and finished not far from the set goal, at around 1.1155; - GBP/USD. Nothing new has happened here, and the movements of this pair still depend on just one short word, Brexit. Last week, we expressed the opinion that Prime Minister May would not be able to solve this problem at all. And now the media is full of headlines about her inevitable resignation. The impossibility (or inability) of the government to negotiate with the opposition brings the pound down. As a result, the pair easily broke through the April lows and, starting the week from 1.3000, completed it at 1.2715, losing 285 points;

- USD/JPY. The result of the last week for this pair is almost zero, the difference in quotes between midnight on Friday, May 10 and midnight on May 17 did not exceed 10 points, and the pair ended the week at 110.00;

- Cryptocurrencies. Few people had expected this: in six days, Bitcoin quotes soared by 30%, reaching $8,335 on Thursday May 16 and exceeding the most optimistic forecast of experts by almost $1,000. The increase since the beginning of the year has made 120%, which, according to Tom Lee, co-founder of Fundstrat Global Advisors, means the arrival of the next season after the crypto winter, "crypto spring".

The reason for such a “spring” mood was the closure of short positions by major players and the opening of long ones at the level of $5,500-6,000, after which numerous small investors joined them. Some experts also believe that a sharp aggravation in the trade war between the United States and China played a role, after which Chinese investors decided to protect their capital by investing in Bitcoin.

However, the main cryptocurrency has failed to firmly fix at the heights taken. Part of the players began to fix profits, and by Friday evening, May 17, the BTC/USD pair slipped to the level of $7,000, losing more than half of the gains won from the bears and leaving those who had opened long positions above this zone, counting possible losses.

As for the main altcoins, as usual, they followed their “elder brother”, repeating its rise and its fall. As a result, Litecoin (LTC/USD) increased by 11% over the past week, Ripple (XRP/USD) by 25%, and Ethereum (ETH/USD), showing the best result, by 30%.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. The greatest interest this week is focused on the American Fed. The head of this organization, Jerome Powell, will speak at the annual conference on financial markets on Tuesday, May 21, with a report on the risks of the US financial system. And the next day, the minutes of the Fed's Open Market Committee meeting of May 1 will be released. Investors are looking forward to what will be said in the report and in the protocol on the future monetary policy of the Fed, as well as what forecasts will be made there on the US economy.

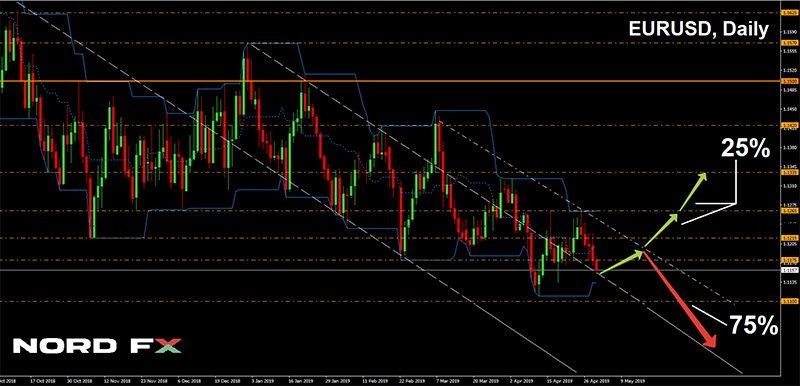

At the moment, the situation looks quite optimistic, and 75% of experts, supported by the overwhelming majority of oscillators and 100% of trend indicators on H4 and D1, expect the US currency to strengthen further. In their opinion, the pair will definitely try to break through support in the zone of the April lows and will drop below the level of 1.1100.

At the same time, 15% of oscillators warn of the pair being oversold. A correction to the north is also expected by 25% of analysts and graphical analysis on D 1, which draws the rise of the pair to the resistance of 1.1265, and possibly even higher, to a height of 1.1335. However, as already mentioned, the events listed above on May 21 and 22 may have a strong influence on the behavior of the pair;

- GBP/USD. It seems that the market does not know what other surprises can be expected in the next Brexit episodes. When will the resignation of May take place and which of the British parties will win the elections to the European Parliament? What will the next, fourth in a row, vote of the bill on the withdrawal of Great Britain from the EU bring? There are more questions than answers, and in such a situation, the majority (60%) of the experts simply shrug. The rest of the experts are equally divided, giving 20% of votes to the bulls and the same to the bears.

As for the readings of the indicators, they are exactly the same as for EUR/USD. Similarly, 15% of oscillators are in the oversold zone, and graphical analysis on D1 insists on upward corrections. The support levels are 1.2665, 1.2614, 1.2475 and 1.2400. The resistance levels are 1.2865, 1.3000 and 1.3165.

It should be noted that in the transition to the forecast for the coming months, the number of supporters of bulls, waiting for the rise of the pair above 1.3200, increases to 65%. The increase of the consumer price index (CPI), which will be published on Wednesday May 22, and is projected to grow from 1.9% to 2.1%, may help the pound sterling this week; - USD/JPY. Data on Japan's GDP growth will be released on Monday, May 20, and analysts expect it to be zero. Such a result could be a bad signal for the yen, and it will continue its retreat against the dollar. 50% of analysts expect the pair to rise to the height of 111.00. A third of experts believe that the pair will move in the range of 109.00-110.00. As for the remaining 20%, in their opinion, the Japanese currency will strengthen to the values around 108 yen per $1.

At the same time, almost all experts agree that the main trends for this pair will be determined not in Tokyo, but in the USA, and depend on the Fed's forecasts on Tuesday and Wednesday, as well as the course of battles on the fields of the US-China trade war. - Cryptocurrencies. Despite the bad news last Friday, crypto bulls along with crypto hamsters, who obtained their bitcoins back in the autumn of 2017, hope that the fall of the BTC/USD pair to the $7,000 mark is just a correction, and Bitcoin will soon continue to grow. About 50% of experts agree with them. The target for the coming months is the height of $10,000. And in the opinion of the Canaccord Genuity analysts, the BTC rate will reach $20,000 over two years. “We have found a coincidence between the periods of 2011-2015 and 2015-2019 and have realized that the first cryptocurrency operates within the framework of four-year cycles. This is confirmed by the fact that the decrease in the miner’s reward occurs every four years,” their statement says.

A quarter of experts suggest that the pair will find it difficult to consolidate above the resistance level of $8,500 (it was there that its growth stopped last July) and for some time it will move closer to this horizon, then moving away from it.

And finally, the remaining 25% of analysts predict Bitcoin to decline to support $6,000, based on which the pair moved from February to November 2018.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited. Trading in financial markets is risky and can lead to a complete loss of deposited funds.

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்