First, a review of last week’s events:

- EUR/USD. The range 1.1025-1.106 can be called the Pivot Point zone of the last month and a half. It was there that the pair returned to by the end of the week trading session, which indicates the uncertainty prevailing in the market.

It is known that the situation now is most affected by the Trump trade wars and the US Federal Reserve policy. The information that Washington and Beijing could resume negotiations in early October had a positive impact on the stock market: the S&P500 index went up and approached the mark of 3000 again, while the growth rate of 10-year US Treasury bonds yields turned out to be the highest over the past three years. At the same time, the dollar began to strengthen, reaching its maximum since May 2017 against the euro. As a result, on Tuesday 03 September, the EUR/USD pair once again updated the low, reaching the level of 1.0925.

However, upon further reflection it turned out that in general there are no special reasons for optimism. You should not count on serious concessions from China, the problems of the American economy have not gone away and, in the event of continued trade wars, the likelihood of a deep recession will only increase. And this inevitably should entail a fall in rates and a serious easing of the Fed's monetary policy.

Investors expected to get some guidance at the end of the week based on the labor market data. However, the performance of such an important indicator as Non-Farm Payrolls (NFP) showed... nothing because its decline was very, very small (from 159K to 130K). As a result, the dollar lost only some 40 points against the European currency. After that, the market tried to find the answers in the speech of Fed Chairman Jerome Powell in the evening on Friday, September 6. But to no avail either. As a result, the point was set at 1.10 25; - GBP/USD. The British currency rate was first determined by optimism No. 1 - regarding the continuation of the US-Chinese negotiations, and then by optimism No. 2 - regarding negotiations with the EU on Brexit. Recall that most experts have expected that the pair would test again the 12 August 2019 low, 1.2015. Graphical analysis on D1 indicates a possible fall of the pair even further, to the low of October 2016, 1.1945. And this forecast was implemented at the beginning of the week: thanks to optimism No. 1, the pair fell to 1.1958. And then it turned around and, thanks to optimism No. 2, the pound was able to win back almost 400 points from the dollar by the middle of Thursday. As for the final chord, it sounded at the height of 1.2290;

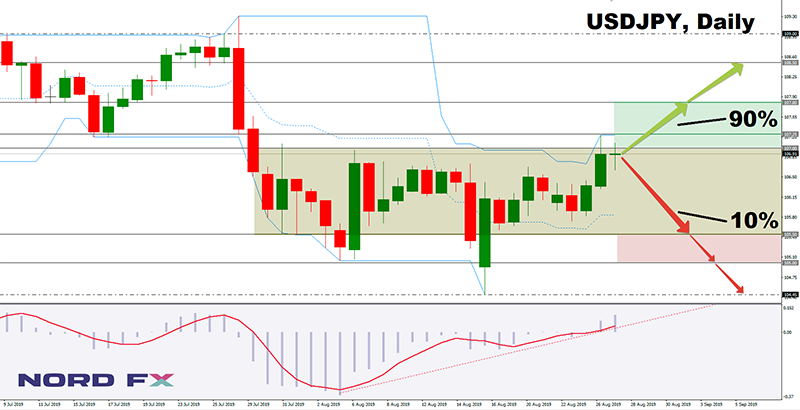

- USD/JPY. Unlike the British pound, with its growing volatility, the yen is behaving quite calmly, moving in the lateral corridor 105.50-107.00 from the beginning of August. And the rare emissions outside this range are caused mainly by the news about the US-Chinese trade war developments, which Trump publishes on his Twitter.

As experts expected, interest in the yen, as a safe haven currency, has recently subsided, and as a result, the dollar managed to rise on Thursday to 107.23. After which a small rebound followed, and the pair finished the five-day period at the level of 106.9 2; - Cryptocurrencies. According to the online publication Block Journal, bitcoin has surpassed even the most successful investments in IT companies that have gone through public IPO in terms of profitability. In March 2010, the first cryptocurrency used to cost about $0.003. Thus, at the current exchange rate above $10,000, its growth amounted to about 350,000,000%. (For comparison, the same indicator of the online advertising giant The Trade Desk is “only” 1.317%).

Over the past seven days, the BTC/USD pair grew as well. A forecast chart published a week ago shows that 70% of analysts expected the pair to rise to the $11,000 zone, which happened in reality: by mid-Friday September 6, Bitcoin gained $1,250 and reached the level of $10,925.

Along with the forecast for the BTC/USD pair, we published another forecast, for altcoins. According to experts, their prospects, regardless of where Bitcoin goes, look rather gloomy. If Bitcoin is to fall, investor interest in the cryptocurrency market as a whole will also fall. And if Bitcoin begins to grow, then we can expect an active exchange of altcoins for the reference cryptocurrency. And last week, alas, showed the validity of such a scenario. With the growth of the BTC/USD pair by 13%, Ethereum (ETH/USD) grew by only 4%, Litecoin (LTC/USD) - by 3%, and the growth of Ripple (XRP/USD) was 0.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Despite the fact that both the oscillators and the trend indicators on D1 are colored red, the analysts' forecast is neutral gray. The reason for this is the expectation of an event that can greatly affect investor sentiment. On Thursday, September 12, the ECB is due to announce its decision on the base interest rate. Currently, it is at a zero level, and one part of experts expects a decrease of 0.25 percentage points to -0.75%, the other does not exclude the possibility of an even more drastic decrease, to -0.4%, and the third believes that instead of specific measures to stimulate the economy of the Eurozone, the ECB may get off with general vague phrases this time as well.

In connection with the above, on September 12, we can expect increased volatility of the pair, the development of a bearish trend and a decrease in the euro quotes by 100 or more points. The nearest support is 1.0925, the next one is 1.0830. Resistance is in zones 1.1125 and 1.1250.

Among other events of the week, though not so significant, one can note the release of statistics on the US consumer market, which will be released on Thursday September 12 and Friday the 13th; - GBP/USD. On Tuesday, September 10, we are expecting the publication of data on the UK labor market. But much more important than any economic statistics is Brexit related news. The first portion will arrive from the Parliament of this country on Monday. On the whole, the tension regarding the deal with the EU has significantly decreased, hopes for a second referendum are in the air, and 80% of experts expect the pound to strengthen and the pair to rise to the zone of 1.2400-1.2525.

An alternative point of view is represented by only 20% of analysts, graphical analysis and 15% of the oscillators on D1, which give signals the pair is overbought. The main goal in the case of this scenario is to re-test the August-September lows in the 1.1960-1.2060 area; - USD/JPY. One can't say that nothing is happening in Japan. The Bank of Japan, trying to stop the decline in yield, is reducing the purchase of government bonds by 20 billion yen. On Monday, September 9, there will be statistics on the growth rate of Japanese GDP, which accelerated to 2.1% in the second quarter of 2019. But it seems that the yen quotes depend solely on the United States. Well, on China as well. And hopes for a trade agreement between these countries are pushing the Japanese currency down, and the pair up. As many as 90% of analysts (which is extremely rare), supported by 90% of oscillators and graphical analysis on D1, have sided with the bulls and voted for the pair to rise to the level of 107.25 and higher, to the resistances 107.80 and 108.50.

The fall of the pair to the level of 105.50 is expected, respectively, by 10% of experts and 10% of the oscillators, signaling the pair is overbought. Further support is located in zones 105.00 and 104. 45;

- Cryptocurrencies. Despite the stable growth throughout the past week, late on Friday, September 6, the main cryptocurrency unexpectedly went down, having fallen by almost $600 in literally 20 minutes. This confirms once again the thesis that with such super-volatility it is too early to talk about using bitcoin as a reliable asset for hedging risks in traditional financial markets - commodity, currency, and stock.

At the same time, Bitcoin adherents do not stop trying to warm up the crypto market with their appetizing forecasts. Thus, TV presenter and expert Max Kaiser said the other day that a stock market crisis, which is gaining momentum again, could lead the main cryptocurrency to a value of $25,000. However, there is a diametrically opposite point of view. For example, the analyst and trader John Bollinger, who created the well-known technical indicator Bollinger Bands, built into the MetaTrader terminals, has announced a possible complete reversal of the Bitcoin exchange rate. According to the expert, "the crypto winter, which was completed only in the second quarter this year, may return at a most unexpected moment."

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்