First, a review of last week’s events:

- EUR/USD. Last week was marked by two events. The first is progress on the next stage of trade negotiations between the US and China, the beginning of which was called by president Trump "very, very good." The second is a breakthrough in the Brexit negotiations. Increased hopes for a regulated UK exit pushed the pound up, followed by a pull to the North by the European currency as well. It was facilitated by the minutes of the ECB meeting published on Thursday, October 10, which confirmed that the Bank is coming to the end of the easing policy (QE). As a result, the pair was able to rise to 1.1062;

- GBP/USD. Only 35% of experts believed in the new Prime Minister Boris Johnson and counted on a miracle. And now the miracle did happen, and even exceeded all expectations. Analysts were waiting for the pair to rise to the height of 1.2525, in reality, the pound soared by more than 500 points, reaching the height of 1.2708. The reason was a breakthrough in the negotiations on the Irish border, following which Irish Prime Minister Leo Varadkar said that they were "very positive and promising." It is possible that Johnson is ready to introduce special terms for Northern Ireland and allow it to remain in the European Customs Union for four years after Brexit.

According to experts, the GBP/USD pair was so oversold that any positive news was able to cause the pound to rise. And in this case, the positive turn in the negotiations worked like a trigger, allowing the British currency to become heavier by 4% in just a couple of days; - USD/JPY. But for the yen, unlike the pound, it seems that hard days have come: thanks to the growth of risk sentiment, the Japanese currency has undergone a massive sell-off, resulting in its quotes’ fall by almost 200 points, to the level of 108.62 yen per dollar. Among the reasons are several. These are hopes for a favorable outcome of the US-China trade war, progress in Brexit negotiations, the latest minutes of the ECB meeting and a sharp rise in the US bond yields;

- Cryptocurrencies. The capitalization of the crypto market ($234 billion) is still small compared to traditional markets (the gold market is estimated at $9 trillion, the stock market – at $66 trillion, the bond market – at $86 trillion) and does not exceed two tenths of a percent of their total assets. But, despite this, the topic of cryptocurrencies constantly arises on the crest of the world politics.

So, the famous American billionaire Daniel Steven Peña said that cryptocurrencies can be the result of a conspiracy of Russia against the United States, and President Vladimir Putin himself is behind the creation of Bitcoin. This statement was echoed by the appeal of members of the House of Representatives of the US Congress to the Head of the Fed with a proposal to issue a crypto-dollar. With this step, the authors of the appeal want to protect American finances from the influence of someone else's hostile cryptocurrency.

A similar initiative was made by German Vice-Chancellor and Finance Minister Olaf Scholz, who called for the release of the digital Euro. "We should not leave this space to China, Russia, the United States or any of the private suppliers," he said.

Crypto-dollar and crypto-Euro are things of the distant future, but already now governments and Central banks are beginning to actively fight against potential independent competitors. Zuckerberg's (Facebook) release of his own Libra coin came under intense pressure. The next in line is TON-coin, the launch of which Telegram is rapidly approaching.

For now, the main cryptocurrency on which the entire market is based, of course, remains Bitcoin. The forecast for the past week, which was supported by the majority of experts (75%), assumed a lateral movement of the BTC/USD pair with some dominance of bears, able to lower the pair to $7,500-7,700. However, on Monday, bitcoin found a local bottom at $7,795, and then turned around and went up. The change in trend may have been due to the launch of the p2p platform from Binance, where Bitcoin and Ethereum will be traded for Chinese yuan.

On Wednesday, October 09, the pair managed to overcome a two-week resistance in the $8,350 zone and on Friday reached a high of $8,815. After that, it returned to the $8,350 horizon, which may now become a new strong support area for it.

Altcoins obediently repeated the movements of the reference cryptocurrency for the whole week. However, while the swing of Ethereum (ETH/USD) and ripple (XRP/USD) was about 17%, Litecoin (LTC/USD) behaved somewhat calmer, demonstrating volatility at the level of 13%.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Regarding the final outcome of the US-China trade negotiations, markets are showing reasonable restraint, expecting endless disputes to continue, and maybe even their complete collapse and the introduction of new duties. In the coming week, we also expect some important news that can have a strong impact on the rates of the currencies in question. Among them are statistics from China on Monday October 14 and Friday October 18, as well as the UK and Eurozone inflation reports on Tuesday October 15 and Wednesday October 17. On Thursday, increased volatility may be caused by the report on industrial production in the United States. A significant decrease in this indicator is predicted: from 0.6% to 0.1%. And if the actual value coincides with the forecast, one can expect a decline in the dollar.

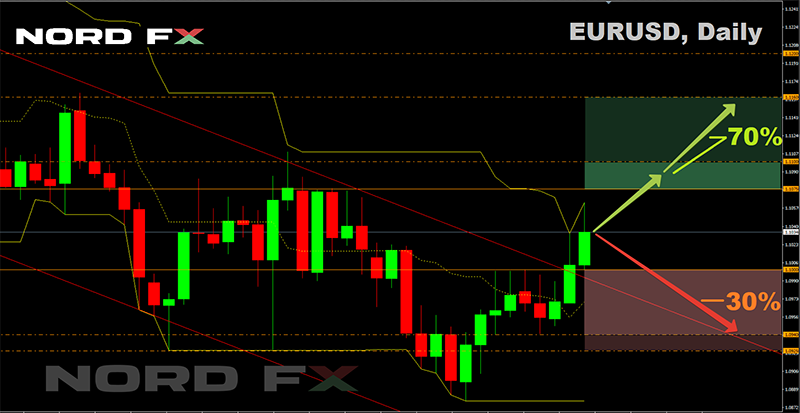

The fall of the dollar and the rise of the pair are expected by 70% of experts, whose forecast is supported by the readings of 75% of oscillators and graphical analysis on H4 and D1. The support zone in case of growth of the pair is 1.1000. Targets are 1.1075, 1.1100 and 1.1160.

The opposite point of view is held by 30% of analysts and 20% of oscillators, giving signals about the pair being overbought. The targets are 1.1000, 1.0940, 1.0925 and the low of 01 October 1.0880;

- GBP/USD. In fact, it is too early to exult over the successful conclusion of Brexit. Johnson still needs the terms of the deal with the EU be approved by Parliament. And this, we recall, the previous Prime Minister of Great Britain Theresa May failed to do, four times. The negotiations with Ireland have also not yet concluded. In addition, the European Council summit on Brexit will be held on the coming Thursday and Friday. Each of these steps can slow down the process of concluding a deal or even become an insurmountable obstacle in its path. In the latter case, the EU is ready to provide a new extension until the summer of 2020 to still ensure an orderly exit of the UK from the EU.

These difficulties, as well as too rapid growth of the pound last week, led to the fact that now 75% of experts expect a reversal of the trend and the fall of the British currency to the 1.2200 zone. This scenario is supported by graphical analysis on D1 and 15% of oscillators on H4 and D1, signaling the pound is overbought.

The vast majority of oscillators and trend indicators, as well as 25% of experts waiting for the strengthening of the pound and the rise of the pair to the height of 1.2800, still believe in the luck of Boris Johnson. Naturally, the emergence of serious positive news regarding Brexit, not to mention the signing of the Agreement, can lead to another jerk of the pound to cosmic heights; - USD/JPY. On H4, 100% of trend indicators look up, on D1, a little less – 90%. 75% of oscillators are colored green on both H4 and D1, the remaining 15% give signals about the pair being overbought. The graphical analysis on D1 indicates a decline of the pair to the horizon of 106.65, and then a return to the height of 108.40.

As for the experts, their opinions are equally divided: a third are for the pair's growth, a third are for the fall and a third vote for the sideways trend. The support zones are 107.00, 106.65 and 105.70, the zones of resistance are109.00 and 109.85; - Cryptocurrencies. As mentioned above, breaking through the two-week resistance at $8,350, Bitcoin may now turn this zone into a strong enough support. Moreover, the cryptocurrency Fear & Greed Index, rising from the red zone of "extreme fear", has almost passed the orange zone of "Ordibary Fear" and is approaching its neutral position. If this happens, the next target for the BTC/USD pair will be to consolidate in the $9,000 area. However, this forecast is supported by only 35% of analysts. Most of them (65%) have sided with the bears, expecting the pair to decline first to the horizon of $8,000, and then to $400 below.

Another "cosmic" forecast, which we regularly talk about, was the statement of the creator of the famous antivirus John McAfee that in 2020 the price of Bitcoin will reach $1 million. The main impetus for reaching the bullish dynamics, according to him, will be the limited number if coins as well as the reduction in the number of altcoins, which will make the main coin the only reliable and stable asset.

Analysts of the TIE also predict a gloomy future for altcoins. According to their observations, interest in altcoins is rapidly falling, approaching zero in some cases. So, it is possible that out of thousands of coins only a few of the largest, such as Ethereum or Libra will remain afloat in a few months.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்