First, a review of last week’s events:

- EUR/USD. As expected, both the Fed and the ECB have left their interest rates unchanged. Accordingly, the reaction of the markets to their decisions was almost zero. President Donald Trump and the new head of the ECB Christine Lagarde were on the side of the dollar last week.

The US President told his followers that "we (i.e. the US) are close to concluding a major deal with China. They want it, just like we do! » That is, if earlier President Trump said that the trade treaty is needed only by Beijing, now it turned out that Washington is also interested in signing it.

Later, Bloomberg reported that Trump, in order to prevent a tariff increase on December 15, has already signed an interim agreement, which, in addition to the rejection of new duties, provides for a reduction in existing tariff rates on many types of Chinese imports as well.

The second driver for the dollar was Christine Lagarde, who reported that the ECB, although it made some adjustments to the forecasts for GDP and inflation for 2020, has in general left in force the current parameters of its monetary policy.

Thanks to these two leaders, the results of the week could be very disastrous for the European currency, if not for the results of the parliamentary elections in the UK. The victory of the Conservative party pushed the pound sharply up, and in turn, it pulled the Euro up. As a result, at the maximum, the EUR/USD pair rose to the level of a strong medium-term support-resistance zone at around 1.1200. However, then the balance of powers was almost restored, and the pair finished at 1.1116; - GBP/USD. Naturally, following the results of the elections, the gap was demonstrated by not only the Euro, but also, first of all, by the pound. The conservative party led by the current British Prime Minister Boris Johnson won a steady majority of seats in Parliament, which gave hope that the years of confusion with Brexit will finally end, and on January 31, 2020, the process of Britain's exit from the EU will start.

Such an outcome of the election, in general, had been taken into account by the market. Therefore, after the GBP/USD pair soared by almost 500 points and rose above the level of 1.3500, many players began to close long positions, which was facilitated by the above-mentioned steps of President Trump. As a result, by the end of the trading session, the British currency lost almost 180 points, stopping the fall at 1.3340; - USD/JPY. While the European and British currencies rose against the dollar, the yen, on the contrary, lost ground. Recall that the majority of experts last week voted for the growth of the pair to the height of 109.75, and this forecast was 100% accurate.

The US and China are almost close to signing a trade agreement, and the US stock market on Thursday 12 December updated the historical high. Investors' interest has once again turned to such risky assets as, for example, stock index futures, causing a sell-off of the Japanese currency, which was losing about 130 points at the maximum. The final chord of the week was made at the level of 109.35; - cryptocurrencies. By the end of last week, the Crypto Fear & Greed Index was still in its lower third, at 29, which corresponded to the moderate fear of investors. That's how the market behaved: moderate purchases with more active sales. The BTC/USD pair moved in the range of $7,100-7,700 all week with some superiority of bears, which gradually pressed it to the lower border of this channel. In seven days, Bitcoin lost about 4.5%. Similar dynamics were demonstrated by top altcoins, such as Ripple (XRP/USD), Ethereum (ETH/USD) and Litecoin (LTC/USD), which generally repeated the movements of the reference cryptocurrency.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

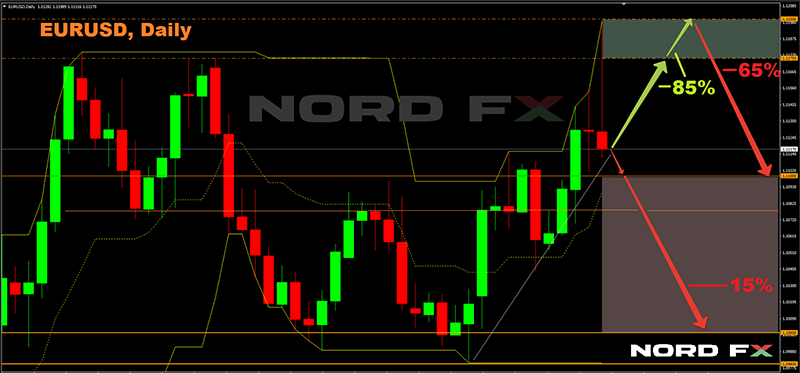

- EUR/USD. At first glance, there are a lot of important events ahead of us in the coming week. This is the publication of the PMI Markit of Germany and the EU on Monday 16 December, and the speech by ECB President Christine Lagarde on Wednesday, and the publication of the annual data on U.S. GDP on Friday 20 December. However, it is hardly worth waiting for a repeat of the rate hikes, such as those that were caused by the last week's elections in the UK. Some of the experts believe that the pair will be pressured by the success in the US-China trade talks. Others, on the contrary, expect that the pair will continue to move upward for some time by inertia.

It should be noted that 85% of oscillators and trend indicators on D1 are still painted green. 85% of experts are also waiting for the pair to continue growing in the near future. However, this growth, in their opinion, will be insignificant. The pair will try to break through the resistance of 1.1200 again and, taking into account the backlash, it may rise to the zone of 1.1225-1.1235. The next resistance is 1.1255. However, then it will face a trend reversal and return to the 1.1000-1.1100 zone. The implementation of this scenario can take one to three weeks, and 65% of analysts and graphical analysis on D1 fully agree with this;

- GBP/USD. Over the next five days, the UK's macroeconomic statistics will pour down on us like a cornucopia. On Monday, it is Markit Services PMI, on Tuesday it is ILO unemployment rate, on Wednesday - the consumer prices index, on Thursday - the Bank of England interest rate decision and the monetary policy report, on Friday it is the GDP data for the third quarter. That is, there isn't a day without news. But most importantly, the market will wait with bated breath for what Prime Minister Boris Johnson will say and do regarding the launch of the Brexit process. Recall that he still has until January 31, 2020 to ratify the agreement with the European Union in Parliament.

In the meantime, the experts' forecast for the pound looks about the same as for the Euro. Most of them (65%), supported by 90% of indicators on D1, believe that the pair will once again rush to storm the height of 1.3500, which it reached on the night of Thursday 12 December to Friday the 13th. However, it is only 25% believe in the success of such a storm. The remaining 75% of analysts, supported by graphical analysis, believe that we will soon see the GBP/USD pair in the 1.3100-1.3200 zone once again. And, in fact, why not? What good is awaiting the UK after leaving the EU? That's the question; - USD/JPY. 75% of analysts believe that the progress in the US-China trade talks will continue to push the pair up. Additional support will be provided by the growth of the yield spread of 10-year US and Japanese government bonds on the debt market. 85% of oscillators, 95% of trend indicators and graphical analysis on D1 agree with this forecast. The nearest resistance is 109.70, the goal is to consolidate in the zone 110.00-111.00.

The remaining 25% of experts believe that the pair will not be able to go beyond the side corridor 108.40-109.70, where it will continue to move at least until the end of the year. A possible reversal of the trend and the return of the pair to the support of 108.40 is also indicated by 15% of oscillators that give clear signals about the pair being overbought. The next support is 108.25; - cryptocurrencies. The Crypto Fear & Greed Index is still in its lower third and is even down a quarter from the previous week, dropping to the 22 mark. In general, the current situation can be called stagnation. But the crypto market is famous for the fact that after a long lull, a sharp rise follows. Or a fall. After all, most traders come here to earn on the super-volatility of cryptocurrencies.

It does not matter for speculators whether the market is bullish or bearish at the moment. Thus, despite the price decline, the Bitcoin network has continued to expand recently and has now reached a record 28.4 million addresses. This is evidenced by the CoinMetrics data service. A similar dynamic was observed at the end of last year, when Bitcoin was trading at $3,200. At that time, many investors, taking advantage of the fall of the crypto currency, began to actively buy it.

According to the service glassnode, the number of wallets with a thousand or more bitcoins soared to a new high, their owners hope to make a profit, primarily as a result of the halving, which is scheduled for May 2020.

According to Morgan Creek Digital co-founder Anthony Pompliano, this event can multiply the price of Bitcoin, but its growth will be gradual. "I do not think that the price will soar the day after the halving, but I believe that, starting from the current values, it will rise to $100,000 by December 2021," the entrepreneur predicted.

Recall that as a result of the halving, the size of the reward in the bitcoin network will decrease twice, from 12.5 to 6.25 coins per block. But all this will happen in five months. If we talk about the forecast for the near future, 65% of experts expect the BTC/USD pair to decline to the $6,500-6,800 zone. According to the remaining 35% of experts, the pair will attempt to rise above the level of $8,000.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்