First, a review of last week’s events:

- EUR/USD. As expected, the last week had a lot of trouble for both the euro and the US dollar. The pair visited both the upper and lower boundaries of the medium-term side corridor 1.1525-1.1830 during the last five days. In the end, the victory was with the dollar. The reason for this were the Fed meeting results, along with the growth of US GDP and inflation in the Eurozone, as well as problems in Italy, whose government published the budget for 2019. with a deficit of 2.4% (instead of the expected 2%). As a result, having shown volatility of 245 points, the pair completed the weekly session at 1.1602;

- GBP/USD. Recall that last week 55% of experts voted for the growth of this pair, 30% gave their votes for its fall, and the remaining 15% were for a sideways trend. And this discrepancy turned out to be the most accurate forecast. The pair was rising for the first half of the week, reaching 1.3225 at the maximum, and was going down during the second half, feeling for a local bottom near the level of 1.3000. As a result, it went down by only 45 points during the five working days, finishing at 1.3030;

- USD/JPY. The scenario, for which 40% of analysts, graphical analysis on D1 and 100% of trend indicators had voted, provided for the pair to grow to the area of 113.20-113.75. And the pair did grow indeed, reaching the high at 113.70.

The reason for the fall of the yen were the statements of the head of the Bank of Japan Haruhiko Kuroda and the head of the US Federal Reserve, Jerome Powell. The first of them said that the Japanese regulator did not plan to curtail the mitigation policy. Moreover, the interest rate, which is now minus 0.1%, can be lowered further. As for Powell, he confirmed at a press conference that, in addition to the increase on Wednesday, September 26, the Fed was planning another increase in interest rates in 2018 and three more increases in 2019.

In this situation, the reaction of the markets was predictable: the dollar continued its active growth and met the end of the week at 113.68; - Cryptocurrencies. There was no special news that could seriously move the crypto market in one direction or another last week. The cryptocurrencies included in the TOP-10 behaved accordingly. During the first half of the week, the bitcoin showed a 7.5% drop, followed by a 7.25% increase. As a result, the pair BTC/USD did not leave the range between $6,000 and $7,000, keeping in an even narrower channel, $6,325-6,835. The litecoin (LTH / USD) and the ripple (XRP/USD) are closing the week almost at the same place where they started it. It was only the ethereum (ETH/USD) that showed a drop of 8% during the seven days, dropping to $225.0 per coin, and is now at the level of September 6-7.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

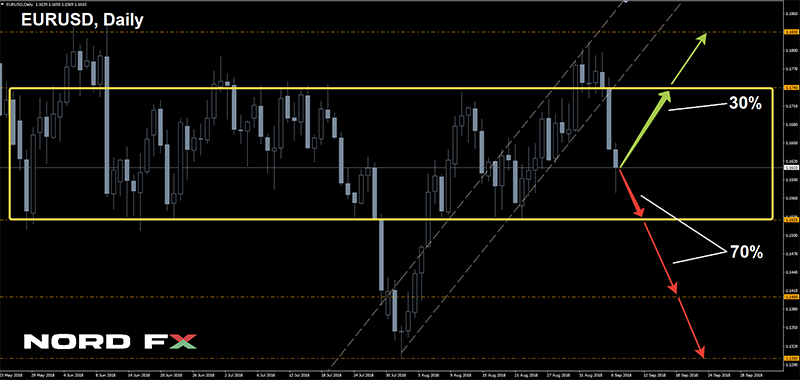

- EUR/USD. The overwhelming majority of experts (70%), supported by 95% of the trend indicators, are voting for further strengthening of the dollar and decline of the pair first to support 1.1525, and to the August low at 1.1300 during the month of October.

An alternative scenario has been supported by 30% of analysts and 20% of oscillators giving signals the pair is oversold. If we supplement their forecast with graphical analysis indications on H4 and D1, we can say that the growth of the pair will be limited by the upper boundary of the medium-term horizontal channel 1.1525-1.1830. The nearest target for bulls is the level of 1.1740.

As for the release of macroeconomic data, we should pay attention to the statistics on the US labor market on Friday, October 5, including the data on wages, unemployment and NFP. The consensus of American analysts predicts that the number of new jobs created outside the agricultural sector will be 8% less than the August values, which may lead to a slight weakening of the dollar;

- GBP/USD. 55% of experts vote for the fall of this pair to the level of 1.2900, 25% are for its growth to the area of 1.3100-1.3145, and the remaining 20% have taken a neutral position. The reasons for such a preponderance of votes given for the further weakening of the pound are still the same: deterioration in the UK's economic performance and the uncertainty with Brexit.

The indicators' reading. If most of the oscillators and trend indicators are colored red on H4, about 30% are already green on D1. At the same time, about 20% of the oscillators on both timeframes indicate the pair is oversold. There is no unity in the readings of graphical analysis either: on D1, it clearly demonstrates the movement of the pair down to zone 1.2800-1.2845, and on H4 it draws a side channel 1.2980-1.3175 for the pair; - USD/JPY. Here the voices are split exactly in half. 50% of experts, supported by graphical analysis on D1 and 100% of trend indicators, believe that the upward momentum is not yet exhausted, and the pair must necessarily reach a height of 114.50.

The second half of the experts expect a serious correction and the fall of the pair to support 112.00. 15% of the oscillators are also signaling that the pair is overbought, which is in favor of such a scenario; - Cryptocurrencies. The capitalization of the crypto market as a whole has not crossed the mark of $ 250 billion, but the growth of major cryptocurrencies rates is on good volumes, indicating that the bulls are gradually gaining strength. The ripple (XRP) and the bitcoin cash (BCH) are those two altcoins that inspire investors at the moment, giving them hopes for a better future. The ripple has risen more than twice over the past three weeks, and the bitcoin cache has gone up by 30%.

Instant transfers based on protocols from Ripple are more and more likely to take away a "piece of pie" from the SWIFT system which is now reigning in the banking sector. There is an opinion that such blockchain technologies are financed by corporations wishing to hide their funds in the depths of "digital offshore companies " instantly, deeply and reliably. On the contrary, an alternative point of view ascribes the authorship to US special services, whose goal is the total control over all the world money flows. It is not known which of these theories is true, but, in any case, such virtual currencies as ripples have a weighty basis for growth.

Whether the crypto market capitalization comes close to the $300 billion mark in the near future, whether the bitcoin exceeds the $7,000 mark, dragging the altcoins up with it, depends now solely on the news background. If there are no positive news, the movement in the range of $6,000-7,000 (or in a narrower channel - $6,325-6,835) is the most likely scenario.

Roman Butko, NordFX

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்