First, a review of last week’s events:

- EUR/USD. The US Federal Reserve meeting on Wednesday June 16 was the key event of the week. No particularly significant decisions were made there: the interest rate remained unchanged at 0.25%. The Federal Reserve will also continue to print money and buy back assets in the previous volume of $120 billion. But, as expected, following the meeting, the regulator's roadmap was unveiled, as a result of which the dollar bulls got what they had been waiting for.

Fed Chairman Jerome Powell and his colleagues raised the forecast for US GDP for 2021 to 7%, and also recognized the need to discuss the process of curtailing fiscal stimulus programs (QE). The Fed has no intention of turning a blind eye to accelerating inflation to the highest marks since the 1990s. However, according to Powell, the US labor market is still far from the pre-crisis level, and therefore it is advisable to maintain soft financial conditions for now. At each subsequent meeting, the regulator will consider reducing QE volumes. And he will set out the level of employment after which incentives can be reduced, at the next meeting on July 28.

Investors also received a signal of intent to raise interest rates earlier than expected. An averaged forecast by Fed executives showed that the rate could be gradually raised to 0.5-0.6 percent by the end of 2023. At the same time, Jerome Powell noted that vaccination has a positive effect on the labor market, and we will soon see strong employment reports. Inflation may also be stronger and more stable than central bank officials had expected. And it will require a quicker response to what is happening.

Such "hawkish" forecasts of the Federal Reserve System instantly revived the market's appetite for the dollar. Investors continued to buy USD despite weak macro statistics, thinking that the indicators will improve as the US economy recovers.

One of the major currencies that suffered last week was the euro. Europe's economy has not kept pace with America's in any way. And according to Philip Laine, the ECB's chief economist, it will be too early even in September for the regulator to begin discussing the programme of winding down QE in the Eurozone.

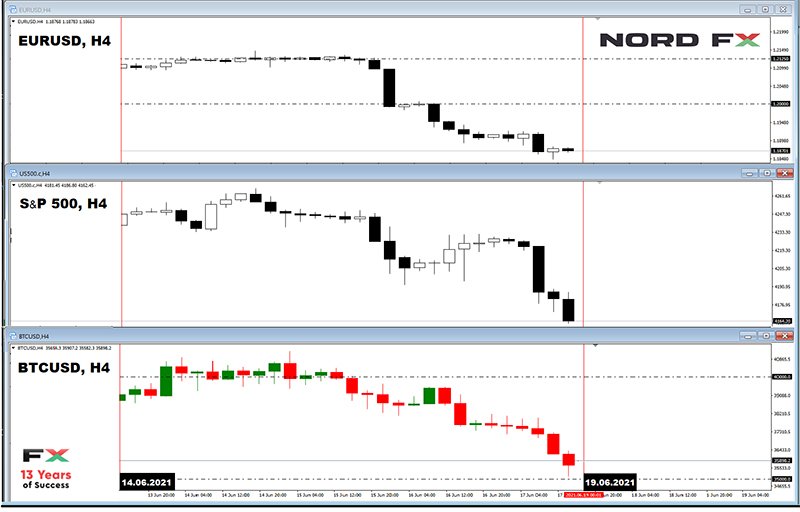

As a result, starting from a height of 1.2125 on June 16 and flying 280 points, EUR/USD reached the local bottom at 1.1845 on Friday June 18. The finish took place at 1.1865, in the zone where the pair returned after a 10-week absence; - GBP/USD. If the euro fell against the dollar by 280 points, the pound ceded as much as 340 to the US currency. Positive sentiment about the UK currency is melting like fog over London after the country's prime minister, Boris Johnson, delayed the full opening of the country's businesses by a month. This is due to an increase in cases of the Delta coronavirus strain, first discovered in India, which doubles the risk of hospitalization. And this despite the fact that about 80% of the country's adult population has already been vaccinated with one dose of the vaccine, and 30% have been vaccinated with two doses.

The pound is also under pressure from the increasingly unstable relations between London and Brussels after Brexit. This is particularly true of trade between Northern Ireland and the rest of the UK.

Against this unjoyful backdrop, another “blow” is being struck on 16 June by the U.S. Federal Reserve management. The result is a fall of the pound to the level of 1.3790, not far from which it ends the trading session; - USD/JPY. Making a forecast for the past five days, the majority of experts (60%) voted for the strengthening of the dollar and the growth of the pair to the zone of 110.00-110.30. And, looking at the results of the week, they were right: starting at 109.70, the pair finished at 110.20.

It is clear that the statements of Jerome Powell and other executives of the US Federal Reserve could not but affect the behavior of the USD/JPY pair: it reached 110.80 at the high. In addition to the dollar's strengthening, weak macroeconomic statisticians from Japan have added pressure on the yen. Thus, the growth of orders for engineering products in April slowed down from + 3.7% to + 0.6%, against the forecast of 2.7%. Of course, the rate grew by 6.5% in annual terms, but still turned out to be lower than the expected 8%.

Despite this, amid the subsidence of the remaining major currencies, the Japanese currency has shown maximum resilience against the dollar. At the time when the euro, pound and other currencies continued their decline, it was, on the contrary, able to win back about 60% of the losses. The reason for this, according to a number of analysts, lies in the lower risk appetite of the market and increased investor appetite for safer assets; - cryptocurrencies. It has long been clear that news has a fairly strong impact on cryptocurrency rates. However, much more powerful fluctuations in this market are caused by large investments. There were none of those last week. On the contrary, the total cryptocurrency market capitalization even decreased slightly, from $1.585 trillion to $1.560 trillion. So there remains news, whose source is influencers and regulators.

In terms of the former, Elon Musk was once again there with his tweets. This time, the owner of Tesla said that the company will resume selling electric cars for BTC when at least half of the miners switch to renewable energy. Bitcoin is up 12% amid this tweet, according to CoinGecko.

It is worth noting that the tweet was a response to criticism from the head of the financial company Sygnia Magda Wierzycki. She said in the podcast The Money Show the Tesla founder was manipulating the price of the first cryptocurrency. In her view, the billionaire raised the price of digital gold deliberately and eliminated much of his position at highs. Sygnia's CEO emphasized that if Musk's tweets were about any public company, he would have already been targeted by the US Securities and Exchange Commission (SEC).

Now about the regulators, news from which comes from all over the planet. Thus, Tunisian Finance Minister Ali Kuli announced the need to change the country's legislation to “decriminalize” ownership of the first cryptocurrency. The government of India has also changed its anger to the mercy for bitcoin. Now, as in Tunisia, it intends not to ban but regulate the crypto sphere. Banks in Texas (USA) have been authorized to accept and store customers' bitcoins, as well as handle their cryptocurrency transactions. It should be noted that of all American states, Texas was one of the first, as early as 2019, to move on the path to legislate this market.

Similar events are taking place in El Salvador. The president of this country, Nayib Bukele, has proposed a "bitcoin law" for parliamentary consideration. Under the bill, cryptocurrency is recognized as legal tender and companies are required to accept BTC as payment. In addition, bitcoin trading is exempt from capital gains taxes.

Some important European officials, however, have fallen out of favor with digital assets. Thus, Peter Hasekamp, director of the Bureau of Economic Analysis of the Dutch Ministry of Economy, said that a complete ban on mining and bitcoin transactions should be immediately imposed. In his opinion, digital gold has no intrinsic value, it is used in a criminal environment, and the collapse of the crypto market is inevitable.

But, judging by the emerging trend, Mr. Hasekamp will remain in the minority. Most regulators will try to take control of digital assets. As the great German chancellor Otto von Bismarck liked to repeat back in the 19th century, "If you cannot defeat the enemy, lead it."

Spurred on by the news and the bulls' desire to take revenge, the BTC/USD pair rallied earlier in the week, reaching $41,260 on Tuesday June 15. However, the sharp strengthening of the dollar after the US Federal Reserve meeting reversed the uptrend, bringing the pair back below the $36,000 level at the end of the working week.

The Bitcoin dominance index added slightly, rising from 44.03% to 45.33%. The same thing happened with Crypto Fear & Greed Index, which went up from 21 to 25 points. Note that since the BTC/USD pair went sideways at the end of May, its values have never gone beyond the 20-40-point range.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Does the EUR/USD fall mean a trend reversal? Or will everything be back to normal soon and the dollar will continue to retreat? (Recall that at the turn of 2016-17, these two currencies almost reached parity. Then 1 euro was only $1.034, and after only a year the European currency was worth $1.2565).

In the wake of the Fed's comments, some banks began to abandon their bullish forecasts for the euro. Others took a break. Still others, such as Societe Generale, expect the pair to return to 1.2000. Opinions among experts are almost equally divided: 55% of them vote for a further fall, and 45%, supported by graphical analysis on H4, support its growth. According to the latter, it is too early to talk about a trend reversal, additional confirmation is needed, and the collapse that occurred is the result of speculation on the Fed's statements, which led to panic closing of long positions.

Technical analysis readings look like this: 100% of trend indicators and 100% of oscillators on H4 and D1 are colored red. But at the same time, 35% of oscillators on both time frames are already in the oversold zone, which may indicate an approaching correction to the north.

The pair ended the previous week in a strong support-resistance zone, which it has been storming from time to time since 2017. The nearest target of the bears is the low of March 31, 2021, 1.1700, the next one - April 04, 2020 low, 1.1600. Bulls will try to regain their lost positions. The first serious resistance is in the 1.1985-1.2000 zone, the next one is 100 pips higher. The goal is to refresh the May high of 1.2265. However, it will obviously take more than one week to reach it. And here it should be noted that in the transition to the medium-term forecast, the advantage goes to the bulls, the number of which increases from 45% to 60%.

From the strategically important events of the coming week, it is worth highlighting the speeches of the head of the ECB Christine Lagarde on Monday June 21 and Wednesday June 23, the meetings of the European Council on June 24-25, as well as the speech of the head of the Fed Jerome Powell in Congress on June 22. In addition, Germany's Markit business activity will be released on June 23, followed by capital and durable orders and annual US GDP data the following day; - GBP/USD. On Thursday, June 24, a meeting of the Bank of England is due. In the run-up to this event, experts continue to analyze incoming economic data in an attempt to forecast possible moves by the regulator.

As mentioned in the first part of the review, the negative factors include the risk of labor shortages arising from Brexit, the controversy in Northern Ireland and the problems associated with the new strain of coronavirus.

Against the backdrop of generally encouraging macro statistics, retail sales in the UK have unexpectedly dropped, especially food. This makes one think that the growth of the country's GDP in May and in the II quarter of 2021. will not be as strong as predicted.

The report released last Wednesday showed that overall inflation in the country is rising, and the CPI's annual rate rose by 2.1%, surpassing the 2% target for the first time in two years.

Adding to this the positive UK labour market data released on June 15, the Bank of England can be expected to start discussing moves to wind down programmes quantitative easing (QE) in the foreseeable future. As for the regulator's specific momentary steps, it is very likely that, like its counterparts in Europe and the United States, it will not move sharply and leave the parameters of its credit - monetary policy without change. Although, again, the Bank of England's management does not rule out hawkish statements similar to those of US Federal Reserve management. And they might, just as well, push the British currency back up.

55% of analysts expect the pound to rise, supported by graphical analysis on D1. Moreover, with the transition to forecasts for July-August, their number increases to 70%. The readings of the technical indicators are very similar to their readings for the EUR/USD pair: all 100% on both time frames are facing south. True, there are 25% oscillators in the oversold area here, not 35%. The nearest strong support is located in the 1.3670-1.3700 zone, followed by 1.3600. Resistances - 1.3920, 1.4000, 1.4150 and 1.4250; - USD/JPY. Making a forecast for the near future, the majority of experts (65%) vote for further strengthening of the dollar and the growth of the pair above the 111.00 horizon. They are supported by 85% of oscillators and 95% of trend indicators on D1. Graphical analysis on H4 is also in agreement with this forecast, however, it does not exclude that the pair will make a spurt to the north, relying on support at 109.70-109.80.

The remaining 35% of analysts, together with the graphical analysis on D1, believe that this support will not become a serious obstacle to the strengthening of the yen, and the pair USD/JPY will be able to fall to the area of 108.00-108.55; - cryptocurrencies. The Crypto Fear & Greed Index has not gone out of the fear zone for almost a month. Frightened by the collapse of quotes in April-May, many, especially retail, investors and traders take profits at the slightest sign of danger, which prevents the BTC/USD pair from gaining a foothold above the psychologically important level of $40,000.

And there's also the US Fed, fueling interest in the dollar and reversing stock indices. Suffice to compare the S&P500 and BTC charts to see their correlation, which, according to a number of experts, will now only grow stronger.

In the event of an active sale of shares, most likely, bitcoin will not feel good either, which is an even more risky asset for institutional investors. (Not to mention altcoins).

Yes, hedge funds understand not only the risks, but also the benefits of investing in digital assets. And, according to the Financial Times, they intend to "substantially" increase their shares in cryptocurrencies by 2026. But, first of all, 2026 will not come soon. And secondly, this "substantially" is not so "substantial". According to a survey of 100 hedge funds conducted by Intertrust, on average, they intend to allocate up to 7.2% of their investment portfolios to cryptocurrencies, which will amount to about $312 billion, that is, about 20% of the current volume of the crypto market. Agree that this kind of growth over 5-6 years looks modest enough.

Earlier, Tudor Investment hedge fund founder Paul Tudor Jones said in an interview with CNBC that hereserves 5% of his capital each for gold, bitcoin, exchange contracts and cash. The billionaire was going to determine the scenario for placing the remaining 80% funds after analyzing the outcome of the June 16 meeting of the US Fed. The investor hinted that he could increase the share of "inflationary" instruments if the monetary authorities ignore the recent "very significant" jump in consumer prices. The meeting has passed and, perhaps, we will soon know the final content of the Tudor Investment portfolio.

The above leads to the conclusion that, despite caution in approaches, institutional investors continue to believe in the prospects of the crypto market. As another billionaire, Avenue Capital Management founder Mark Lasry, observed, the cryptocurrency market has already formed and is not threatened by anything. “If a market is created, it does not disappear anywhere,” the financier believes.

It is also encouraging that hodlers holding bitcoins for more than six months have, for the first time since October 2020, started buying more than selling. And whales (wallets from 100 BTC to 10,000 BTC) have purchased about 90,000 coins in the last month for about $3.4 billion.

Such optimists include venture investor and billionaire Tim Draper. Back in 2018, he predicted the growth of the first cryptocurrency to $250,000 by 2022. And he has confirmed his forecast now, albeit with some timing prolongation. Bitcoin will hit the $250,000 mark by the end of 2022 or early 2023, according to his latest statement, despite the sharp price fluctuations. The reasons for the growth, which the billionaire named, are still the same: the limited emission of coins and the growing demand for digital gold as protection from inflation.

And at the end of the review, our traditional heading of crypto life hacks. This time, the President of Salvador Nayyib Bukele is its hero, who has recently come up with another initiative. He instructed the head of state-owned electricity company LaGeo to develop a plan to mine bitcoin with "very cheap, 100% clean, 100% renewable, zero emissions" energy... of more than 20 volcanoes in the country. So, if you happen to have an active volcano in your possession, you may well follow the example of the head of El Salvador. Elon Musk will be pleased.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்