Short answer

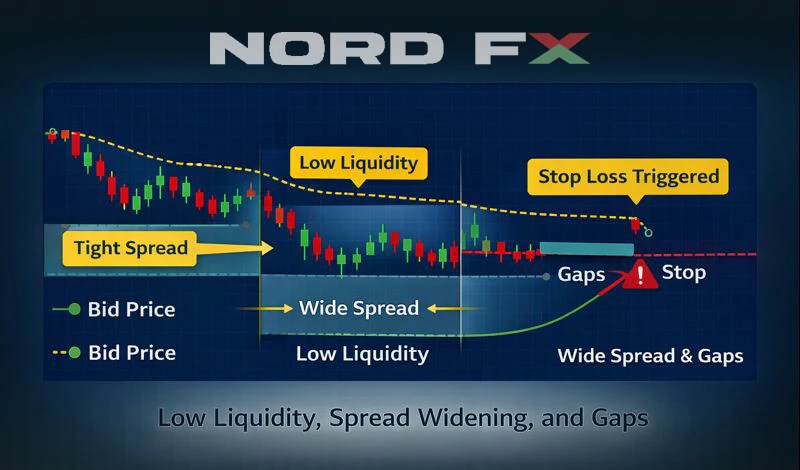

During low liquidity and market open, spreads often widen and prices can jump between levels. This can cause stop losses to trigger earlier than expected — even without smooth price movement on the chart.

This video explains why stop losses can trigger during market open or periods of low liquidity. It shows how wider spreads and price gaps affect execution, even when the chart does not move smoothly.

What is low liquidity in trading?

Liquidity refers to how many buyers and sellers are active in the market.

When liquidity is high:

- orders are filled smoothly

- spreads stay tight

- prices move gradually

When liquidity is low:

- fewer orders are available

- spreads widen

- prices can jump quickly

Low liquidity commonly occurs:

- at market open

- during rollover

- on holidays

- between trading sessions

Why spreads widen during low liquidity

When fewer market participants are active:

- liquidity providers increase spreads to manage risk

- price availability becomes thinner

- execution becomes less precise

This is normal market behavior.

Wider spreads mean:

- Ask price moves further from Bid

- stop losses can be hit faster

- execution looks “early” on the chart

What happens at market open

At market open (especially after weekends):

- new orders enter the market suddenly

- price may jump from one level to another

- there may be no trading at intermediate prices

This creates price gaps.

If a stop loss sits inside a gap zone, it is triggered at the next available price.

What is rollover and why it affects stop losses

Rollover is the daily transition between trading days.

During rollover:

- liquidity temporarily drops

- spreads often increase

- execution can become less stable

This short period frequently causes unexpected stop loss activation.

Why price seems to “jump” past your stop loss

This happens because:

- the market does not move tick by tick

- prices update based on available liquidity

- when no orders exist at certain levels, price skips them

Your stop loss is filled at the first available market price, not necessarily the exact level you set.

The illustration shows how low liquidity causes spread expansion and price gaps that trigger stop losses earlier.

Why this is normal market behavior

This is not:

❌ platform malfunction

❌ broker interference

❌ incorrect trading

This is:

✅ how real markets handle risk

✅ how liquidity affects pricing

✅ standard global trading mechanics

All financial markets behave this way.

Why this matters for traders

Understanding low liquidity helps traders:

- avoid trading during risky periods

- place wider stop losses when necessary

- expect spread changes

- manage risk more realistically

Many stop loss “surprises” are simply liquidity effects.

What’s next

Now that execution, spread, and liquidity are clear, the next key topic is:

Why was my profit smaller than expected even when the trade was correct?

This explains spread costs, commissions, swaps, and partial closures.

Geri dön Geri dön