First, a review of last week’s forecast:

- EUR/USD. The past week was filled with events, which at another time could initiate quite strong movements in the market. But not now, not at the height of the holiday season. We did not expect any surprises either from the data on the Eurozone GDP or from the values of the consumer price index. There was a little hope for the US Federal Reserve's decision on the interest rate and on the publication of data on the US labor market, but there were no special volatility outbursts there either. Even the drop in the NFP by 36.7% (from 248K to 157K) did not impress the market.

As a result, the situation was as had been expected by many experts: taking into account the standard backlash, the pair stayed within the two-week zone 1.1575-1.1750, reaching a maximum of 1.1745, then groping for the local bottom at 1.1560 and finally ending the five-day session at the mark 1.1567; - GBP/USD. The future of the British pound was not encouraging, even despite the Bank of England's possible increase in the interest rate - 65% of experts considered that the GBP/USD would continue its decline to the zone of 1.3000.

This prediction turned out to be absolutely correct. On the eve of raising the rate, the pound grew slightly. Then, as expected, on Thursday, August 2, the regulator lifted it from 0.50% to 0.75%. But then the accompanying commentary made it clear that one should not expect another increase in the foreseeable future - they say, the economy is not all right, and there are problems with the Brexit. As a result, the pair turned around and quickly fell to the horizon 1.2975. And it met the end of the week's session exactly where the experts expected, at 1.3000; - USD/JPY. The report on the monetary policy of the Bank of Japan, collapsed the yen, instead of strengthening it. The main theses from its head Haruhiko Kuroda speech were interpreted by the market as the intention to preserve ultra-soft policy and to stimulate the weakening of the Japanese currency by increasing the yield of 10-year government bonds.

As a result, the USD/JPY quotes jumped to 112.15. However, the pair did not manage to consolidate at this height and, having gone down about 90 points, it finished the week at the level of 111.25; - Cryptocurrencies. This market was controlled by the bears for the whole week. The fact that bitcoin and major altcoins were recently overbought sided with the bears. The absence of positive news from regulators and market makers did not help the growth either.

As a result, the BTCUSD fell by $1,000, losing about 12% during the week, and reached the mid-July value around $7,280 per coin.

The Ethereum lost even more, about 14%, breaking at some point the support at $400. Litecoin lost 11%, but the ripple was more stable: having fallen by 7%, it then turned and gained back 2.5%;

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. No significant events that could seriously affect the mood of the market are expected next week. Many indicators indicate a virtually total lack of activity. MACD on D 1 almost horizontally moves slightly below the zero mark for the fourth week running. Approximately 85% of all oscillators are painted red, but the remaining 15% are already signaling the pair is oversold.

As for the experts, 70%, supported by graphical analysis, still believe that the pair still should reach the lower boundary of the medium-term side channel 1.1505-1.1850, and only then go up. The remaining 30% have voted for the move in the narrower three-week corridor 1.1575-1.1750; - the scenario for the future of the British pound is also negative. Most analysts (70%) are waiting for the pair GBP/USD to fall to the low of the summer of 2017 in the zone of 1.2800. This development is supported by all oscillators (except one) and graphical analysis on H4 and D1. The nearest support is 1.2955, the next one is 100 points lower.

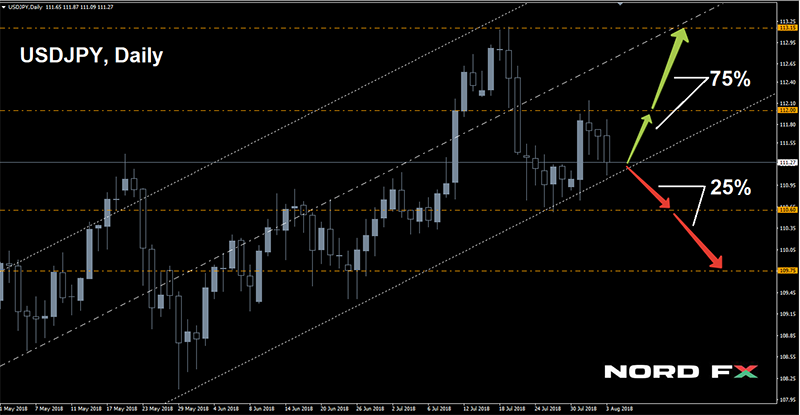

An alternative point of view is represented by 30% of experts who believe that the pair has moved to a lateral movement in channel 1.2955-1.3210. The nearest resistance is in the area of 1.3100; - USD/JPY. here most of the experts (75%) support the strengthening of the dollar .Despite the fall of the pair at the end of last week, it stayed within the medium-term rising channel, which began at the end of this March, and is now at the line of its support .The immediate goal for the pair will be the height of 112,000, the ultimate goal - 113.15.

If the the supporters of the bears win, the pair is expected to march to the south. In this case, the support is at levels 110.60, 110.30 and 109.75. It should be noted that, when moving from a weekly forecast to a forecast until the end of the summer, the number of supporters of such a scenario is growing among analysts from 25% to 45%.

The compromise version is offered by graphical analysis: first a decline to the level of 110.60, and then rise to the level of 112.00;

- Cryptocurrencies. Supporters of the Elliot wave theory can see the end of the 5th rising wave of the BTC/USD in the July 25 maximum. Thus, the subsequent fall is an impulse wave A, after which the market expects a corrective wave B and a rise to the zone of 7,800-8,000. The most optimistic goal for the first half of August is to take the height of $10,000.

However, the main indicators - both trend and volume indicators, as well as oscillators - do not yet give explicit signals for the trend change on timeframes D1 and W1. Therefore, in case the height $7,300 is broken down, it is possible to decline to the horizon $6,700. The strongest support is in the $6,000-6,100 zone - this is the level when mining becomes almost unprofitable.

According to one of the theories, one of the main reasons for the fall in quotes in 2018 in many respects are the miners. Their increased number resulted in a significant complication of the mining algorithm. And, as the price of bitcoins declined, and the profitability of mining was reduced, the owners of crypto farms began to get rid of the stocks of the coins they had mined, thus rendering themselves a truly bad service.

Roman Butko, NordFX

Повернутися Повернутися