First, a review of last week’s events:

- EUR/USD. As said in the previous forecast, the euro has returned to the boundaries of the four-month downward channel. And 70% of the experts, supported by graphical analysis, considered that in such a situation, the European currency would continue to lose ground, dropping into the zone of the 2019 lows, 1.1175-1.1185. Expectations of strong economic statistics from the US were pushing the euro down for the whole week, confirming the validity of such a forecast. The pair even exceeded the “plan”, dropping to the level of 1.1110 by the middle of Friday, April 26.

The Released macroeconomic data did turn out to be quite positive. Orders for capital products rose from 0.1% to 1.3%, while the GDP increased by one percent compared to the previous quarter (3.2% compared to 2.2%). However, the market considered that the goals set had already been achieved. Positions were closed before the weekend, and after a slight correction, the pair set a final point at the level of 1.1147; - GBP/USD. The forecast for this pair was also quite accurate. Recall that the overwhelming majority of experts (75%) had voted that the pair would be able to overcome the medium-term level of support in the area of 1.2975, after which it would rush to the zone of 1.2770-1.2830.

That is exactly what happened: on Tuesday, April 23, the pair broke through this support and abruptly went down. The week low was fixed at 1.2865, and the pair completed the five-day period at the level of 1.2915; - USD/JPY. Analysts' opinions on the behavior of this pair last week were almost equally divided: a third voted for its growth, a third were for a fall, and a third for a continuation of the lateral movement. As sometimes happens, it was such a “blurred” forecast that turned out to be the most correct. At first, the pair moved in a very narrow side channel only 15 points wide. Then, the volatility gradually started to grow, and the pair rose to the level of 112.40, and then, probably due to the fall in the pair with the yuan (USD/CNY), the dollar slipped to the Japanese yen as well, touching a local bottom at 111.35. After that, the pair returned to the horizon 111.60, having lost about 30 points in a week;

- Cryptocurrencies. As has been said many times, the cryptocurrency movement is largely motivated by the news background. At the same time, 65% of experts believed that even with positive news, the BTC/USD would fail to break through the resistance of $5,500 in the near future. In case the news background gets worse, the bears would try to press the pair to support $4,600.

In general, this forecast can be considered correct. It was in the middle of the week that several attempts were made to consolidate above the upper boundary of this echelon, and the pair stayed around $5,650 for some time. However, after it became known on Thursday, April 25, that the State of New York Attorney's office accused the Bitfinex cryptocurrency exchange of hiding the disappearance of $850 million of corporate and client funds, the Bitcoin quotes flew down. On some exchanges, the BTC price dropped to $4,600, and at Bitfinex itself, the collapse was stopped at $5,065.

The exchange management completely denies any losses, stating that these funds have not been lost, but confiscated. And the exchange makes every effort to return them and intends to defend its good name in court. The final of this criminal story has yet to be learned. In the meantime, the pair quotes have returned to the level of the beginning of the week, to the $5,370 zone.

As for the major altcoins, after the collapse, unlike Bitcoin, they were not able to fully restore the lost positions. Ethereum (ETH/USD) lost about 9.5% during the week, Litecoin (LTC/USD) fell by 11.0%, and Ripple (XRP/USD) lost about the same amount (10.4%).

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. The relatively good performance of the US economy and growing concerns about the Eurozone economy and, in particular, Germany, are forcing investors to look at the dollar as a protection against global economic and political risks. Thus, on April 28, extraordinary parliamentary elections will be held in Spain, and in a month, elections to the European Parliament will take place, fueled by the Brexit problem. The ambiguity of the outcome of these events pressures the euro.

As for the United States, here the market will look at the rhetoric of the Fed, the next meeting of which will take place on May 1. The focus there will be the issue of a possible interest rate reduction. Among other events of the coming week, it is necessary to note the publication of the report on inflation in the United States on Monday April 29; the data on the Eurozone GDP and the Consumer Price Index (HICP) of Germany on Tuesday; and the data on the Eurozone consumer market and on the US labor market (including NFP) on Friday, May 3.

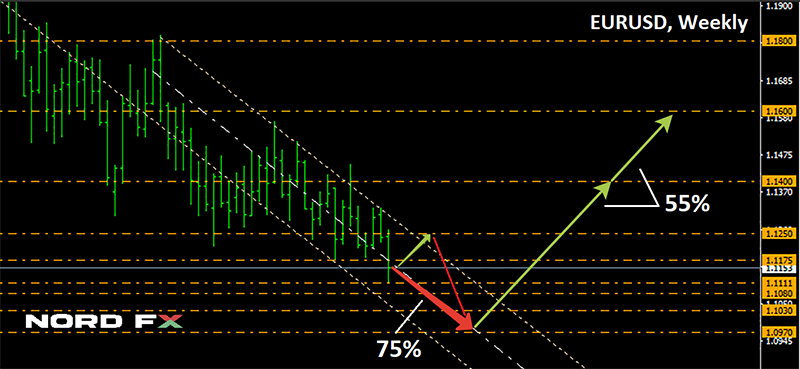

Last week, the EUR/USD pair dropped to the level of 1.1110, which is not only the 2019 low, but also the lowest value since mid-2017. And 75% of analysts, supported by 90% of indicators on D1, believe that the fall will not stop here, and the pair may first reach the lower boundary of the downward channel in the 1.1080 area, and then go even lower, to the zone 1.0970-1.1030.

The remaining 25% of analysts are inclined to believe that the pair may linger in the range of 1.1110-1.1250 with Pivot Point in the area of 1.1175 for some time. Graphical analysis on H4 and 10% of oscillators on D1, which signal that the pair is oversold, adhere to the same point of view.

It should be noted that in the transition to the medium-term forecast, the number of Euro-bulls, who believe that the pair will return to the zone 1.1400-1.1600, is almost 55%;

- GBP/USD. The pair has broken through the medium-term support level at 1.2975, and the overwhelming majority of experts (90%), supported by 100% of the oscillators and trend indicators on D1, believe that it will definitely retest the low of April 25 at 1.2865 and, if successful, sink to 1.2770-1.2830. The opposite point of view is expressed by 10% of analysts and graphical analysis on D1 , indicating the zone 1.2985-1.3015 as the closest target. The next resistance is 1.3065.

As before, 60% of experts still hope in the medium term for the Bank of England to raise interest rates and, as a result, strengthen the British currency. The next meeting of the regulator will be held on Thursday 02 May. However, the likelihood of a rate hike is close to zero already this week; - USD/JPY. There is still no clarity about the movement of this pair, and the opinions of the experts are almost equally divided. A small advantage (55%) is with the bulls, expecting it to return to the level of 112.00, and, possibly, to the April 24 high at the height of 112.40.

45% of analysts and graphical analysis on H4 strongly disagree with such a forecast, they believe that the dollar will continue to fall, first to the level of 111.35, and then to the level of 110.85; - Cryptocurrencies. In a situation of uncertainty, experts are divided into three equal camps: the bears (their target for Bitcoin is $4,800), the bulls (target $5,700) and the side trend supporters (Pivot Point $5,300). At the same time, 70% of respondents believe that the BTC/USD will rise above the level of $6,000 within May.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

Повернутися Повернутися