First, a review of last week’s events:

- EUR/USD. Stop-loss orders on long positions for this pair are triggered one after another for the second week in a row. The bulls retreat, successively surrendering all their lines of defense. The pair has not just updated the lows of this and last years, it has reached the lowest values since May 2017. And the most interesting thing is that there is no one serious reason for such a collapse of the European currency. You can explain the collapse of the USD/CHF pair on "Black Thursday" in January 2015 or the fall of the pound following the referendum on the UK's exit from the EU. And here it seems that nothing extraordinary has happened.

Experts call a variety of possible reasons that in total could lead to the fact that the dollar has pushed the euro by 270 points over the past two weeks, and, practically, without corrections. Among them are the difference in the positions of the ECB and the Fed regarding the policy of easing (QE) and the value of interest rates, as well as concerns about a prolonged recession in the euro zone, caused by the gloomy macroeconomic indicators of the German and EU economies. Coronavirus did not have the last word, because, unlike the US, the European economy is more vulnerable to Chinese risks. Traditionally, the dollar has been supported by a series of government bond offerings by the US Treasury.

It is difficult to say which of these factors the experts surveyed had been guided by, but the forecast given by most of them was absolutely accurate. Recall that 60% of experts supported by graphical analysis on H4, 100% of trend indicators and 85% of oscillators were confident that the pair would continue to fall. The goal was to test the November-October 2019 lows around 1.0880. The test was successful, and the pair ended the five-day session at 1.0835; - GBP/USD. The British currency seemed to set out to prove to the British that their country's exit from the EU was absolutely correct. While the former European "counterpart" of the pound, the euro, was continuously falling, the British, on the contrary, was growing all the past week, adding almost 200 points and reaching at maximum the height of 1.3070.

Initially, after the unexpected resignation of Chancellor Sajid Javid, who disagreed with the personnel policy of Prime Minister Boris Johnson, the pound went down, but very quickly it turned around after Rishi Sunak became the new Head of the UK Finance Ministry - an experienced financier and, concurrently, the son-in-law of a billionaire. Tax cuts and increased budget spending, of which Sunak is an apologist, can seriously fuel interest in the British currency.

The forecast given last week believed that in the event of an upward trend reversal, the pound would overcome the resistance of 1.2975 and possibly break through the upper limit of the 1.2800-1.3000 channel. This is what happened: the pair set the final chord at 1.3045; - USD/JPY. It seems that the bulls can't take the 110.00 level. Not yet. The pair tried to gain a foothold above it in mid-January and tried again to do so in February. But again, to no avail. Even the strengthening of the dollar as a safe-haven currency did not help. Having barely reached the 110.13 mark in the middle of the week, the pair turned around and eventually finished at 109.77;

- cryptocurrencies. What is the best refuge from the economic turmoil caused by the coronavirus? Dollar? Yes, indeed, it shows convincing growth against the euro and a number of other currencies. But Bitcoin shows even more convincing growth against the dollar itself. Last week, 80% of analysts thought that the BTC/USD pair would reach $10.450. And this forecast was 99.99% correct: on Thursday, February 13, its quotes reached a height of $10.490. Thus, since the beginning of January, the cost of the main cryptocurrency has increased by more than 45%.

So, is Bitcoin the super safe haven?

However, as it turned out, there are even more attractive assets. The demand for Bitcoin has also pushed the demand for such top altcoins as Ethereum (ETH/USD), Litecoin (LTC/USD), Ripple (XRP/USD), and others. And if before they followed in the wake of the reference cryptocurrency, now some of them have gone far ahead. For example, Ethereum has increased in price by 120% since the beginning of the year, but it has increased by 35% only in the last week.

This activity of alternative coins could not but affect the share of Bitcoin in the total capitalization of the crypto market: if in early January it was 70%, today it has dropped to 62.4%. So the discussion about the best asset-haven is not over yet.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of various methods of technical and graphical analysis, we can say the following:

- EUR/USD. The calendar for the upcoming week is filled with information for fundamental analysis specialists. Although, as for the Eurozone, the forecasts do not promise anything good in advance. It is expected that the indicators of the indices that characterize the state of the business environment in Germany and the eurozone – ZEW on Tuesday, February 18 and Markit on February 21 – will be lower than the previous ones. The report on the ECB meeting on February 20 may add to the pessimism. All this can lead to further losses of the euro against the US dollar. Positive news from the front of the fight against coronavirus will be able to turn the trend up, but it is still difficult to predict anything here.

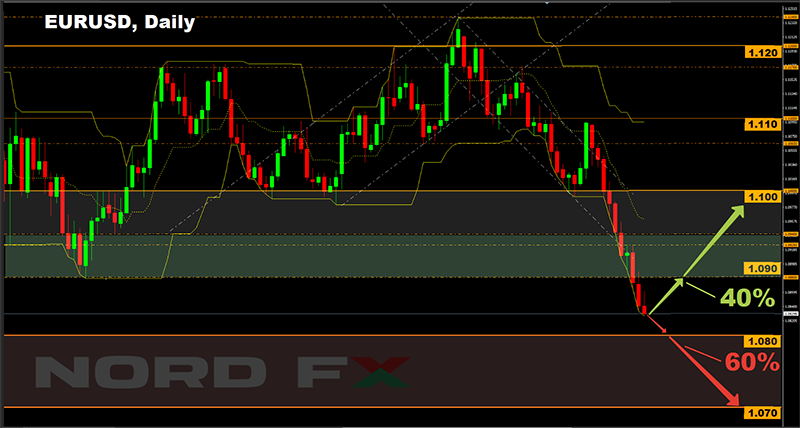

100% of the trend indicators on H4 and D1 are colored red. 65% of oscillators look down as well. The targets are 1.0700 and 1.0525; However, the remaining 35% of the oscillators are already in the oversold zone, which is a very strong signal for a possible upward trend reversal. Or, at least, for a serious correction, which, according to the indications of the graphical analysis on H4, can return the pair to the 1.0900 zone, and, perhaps, bring it closer to the 1.1000 mark.

At the moment, only 40% of experts vote for the pair's growth, however, when switching to the monthly forecast, their number increases to 65%;

- GBP/USD. It is possible that in addition to the resignation of Chancellor Sajid Javid, the UK is able to present other surprises in these difficult times. As they say about Brexit, the farther into the forest, the thicker the trees. For now, the picture looks like this. Trend indicators on H4 indicate: up 95%, down 5%, on D1 up 75%, down 25%. Oscillators: on H4, 90% is green, 10% is overbought, and on D1, it is a complete mess. Analysts do not have any clear point of view, although, when moving to the medium-term forecast, most of them (65%) side with the bulls. The nearest bullish target is 1.3200, the resistance levels are 1.3070, 1.3115 and 1.3160. Supports: 1.3000, 1.2970, 1.2940 and 1.2880;

- USD/JPY. After the week-long sideways trend of this pair, there is complete discord among the indicators. As for experts, 70% of them, supported by graphical analysis on H4 and D1, look to the north. According to their scenario, the pair should eventually overcome the resistance of 110.00 and rise another 80-100 points higher. The remaining 30% of analysts remain pessimistic. In their opinion, the decline in the stock market and the yield of government bonds may lead to a fall in the pair to the zone of 109.10-109.30, following supports are 108.30 and 107.65.

- cryptocurrencies. The forecasts of the crypto market gurus are, as usual, overflowing with enthusiasm. The Bitcoin exchange rate will rise to $40,000 within the year, said co-founder of Fundstrat Global Advisors Tom Lee in an interview with CNBC. He attributed the halving, the coronavirus outbreak, the geopolitical instability, and overcoming the 200-day moving average to the reasons for the cryptocurrency's rise in price. According to Lee, the White House deliberately interfered with the rally of the first cryptocurrency last year. But now the US government is distracted by the election of the new President and will not be able to organize a campaign against Bitcoin.

Anthony Pompliano, partner of Morgan Creek Digital investment company, predicts further growth of the main cryptocurrency as well. He is confident that the explosive growth of the Bitcoin exchange rate will occur due to the growing demand for the asset and its limited issue, resulting in it reaching $100,000 by the end of 2021.

In general, 60% of analysts expect that the BTC/USD pair will break the $11,000 mark in February-March. However, while last week it was only 20% of experts who exclaimed: "Beware of a trend reversal!", now their number has doubled, reaching 40%. Some crypto traders believe that the growth in the value of Bitcoin and other cryptocurrencies, which began in January, is caused by "ghost money". As they say, on certain trading platforms, large orders appear periodically, which are not intended to buy or sell cryptocurrency, but to create the illusion of a demand for the asset. Someone provokes investors to purchase the coin with their help, thereby inflating its price. "You can only push the price so high with the help of "ghost money". At some point, people will want to cash out their crazy earnings, but will not be able to find someone to sell the asset to. This is going to be a show!"- one of the crypto sceptics wrote on Twitter.

And in this situation, the brokerage company NordFX offers probably the best option for trading cryptocurrencies – a kind of contract for the difference in price, without the actual delivery of coins. In this case, when opening long or short positions, you can be sure that even if the price of Bitcoin soars to the skies or, conversely, collapses to zero, you will get your due profit.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Повернутися Повернутися