First, a review of last week’s events:

- EUR/USD. COVID-19 continues its second attack on the United States. A new spike in incidence is observed in at least seven states. And in the three most populous states, the number of infected people continues to grow at a record pace, with a spike in deaths due in about two weeks. Authorities in Houston (Texas) announced that intensive care units in hospitals are nearly overcrowded. It is clear that this new outbreak is related to the lifting of the quarantine at the end of May. And no matter how much the White House and the governors would not like to return to strict quarantine again, it is possible that they still have to do this.

Against this background, risk sentiment began to weaken, the stock market and government bond yields went down, and the dollar, now entrenched in the status of the main protective currency, on the contrary, went up. Investors believe in the dollar largely thanks to the policy of President Trump, who, for the sake of supporting his own economy, is again starting to increase pressure on other countries, threatening them with another portion of trade tariffs. Not only China, but also the EU, Great Britain and Canada have already come under attack.

And if at the beginning of the week the dollar slightly lost to the European currency, it managed to win back a significant part of the losses since Tuesday June 23. As a result of this counterattack, theEUR / USD pair returned to the strong support / resistance zone 1.1240, around which it fluctuated as early as March 2019, and completed the five-day period at 1.1225; - GBP/USD. If the distance, which passed in the second half of the week EUR/USD pair was about 160 points, the flight down of the British pound was more rapid: 230 points. Even the 60% growth in the Markit index of business activity in the service sector did not help the pound, which is not surprising given the serious concern of the markets with Brexit problems. However, summing up the week, it is necessary to take into account the growth of the pair from June 22 to 24, one of the reasons of which was the tapering by the Fed of swap lines central banks, opened to maintain liquidity back in March. Given this growth, the final result of the week is close to zero: starting from 1.2350, the pair finished at 1.2335, with a minimum margin of 15 points in favor of the dollar;

- USD/JPY. Most analysts (60%), with almost full support for the indicators, expected this pair to decline to the horizon of 106.00, and this forecast turned out to be 100% correct: the pair reached the local bottom at 106.05 on Tuesday June 23. After that, it turned around and rose to the height of 107.45, which was followed by a correction and a final chord at 107.20, also with a slight advantage of 35 points in favor of the dollar;

- cryptocurrencies. Experts from the cybersecurity company ClearSky calculated that a group of hackers called CryptoCore (also known as Leery Turtle) have stolen more than $200 million over the past couple of years, attacking crypto exchanges and cracking crypto wallets. It should be noted that security is actually a weak point of many cryptocurrency exchanges, which cannot be said about the NordFX brokerage company. Over more than 10 years of its work, its experts have gained vast experience in repelling hacker attacks, which, coupled with the most modern technological support, allows us to talk about the maximum protection of customer funds. There hasn't been a single hack at NordFX since 2008, and this applies to customer accounts in both USD and BTC and ETH.

In addition to crime news, the Deutsche Bank brought us troubling news. Its experts, predicting the future of cryptocurrencies, voiced, among others, one completely apocalyptic scenario. According to them, electronics on the planet will at some point be seriously affected by outbreaks in the Sun, causing bitcoin to simply disappear as, unlike fiat money, it cannot to be used without additional appliances and energy consumption.

Meanwhile, oblivious to solar activity, the main cryptocurrency continues to move in the range of $9,000-10,000 for the sixth week in a row. Another attempt to break through the sign $ 10,000 resistance ended in failure on Monday June 22, after which the initiative passed into the hands of the bears, who dropped quotes to the lower border of the channel.

According to some analysts, the reason for this fall is the early expiration of $1 billion in bitcoin options. Fears of the second wave of the COVID-19 pandemic, which are putting more and more pressure on the market, cannot be ruled out either. In the eyes of many investors, bitcoin was, is, and will still for a long time remain the riskiest asset they will get rid of in the first place. While investors wait for clearer signals from traditional markets, the crypto market has metered, reminding a cocked trigger. But it is not clear which way the bullet will go.

Despite taking off to $276 billion on June 24, the crypto market's total capitalization was virtually unchanged in seven days: $263 billion on June 26 versus $266 billion a week ago. The same applies to the Crypto Fear and Greed Index which is at 40 (39 seven days earlier).

As for the main altcoins, in general, fluctuations in their quotes duplicate the movements of the main cryptocurrency. However, if the volatility of the BTC/USD pair in June was about 13%, litecoin and ripple show a greater tendency to fall: LTC/USD - 18%, XRP/USD - 17%. Ethereum (ETH/USD), on the contrary, was more stable, and the width of its side channel did not exceed 13% of the June 02 high.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. The closer the November U.S. election, the higher the activity of President Trump and his entourage. The White House is considering imposing duties on goods from the EU and the UK worth more than $3bn, and 20 major Chinese companies have been blacklisted by the Pentagon on suspicion of links to the PRC military. On the other hand, in Europe, everything is going downhill. ECB officials predict a further slowdown in economic growth and weak consumer demand. According to ECB board member Yves Mersch, “the prospects for Eurozone economic recovery are shrouded in uncertainty” and, as a result, long-term scenarios may prove too optimistic. All this, coupled with a decrease in risk appetites due to the second wave of COVID-19, should lead to further growth in the dollar. Such sentiments are particularly visible in monthly and medium-term forecasts.

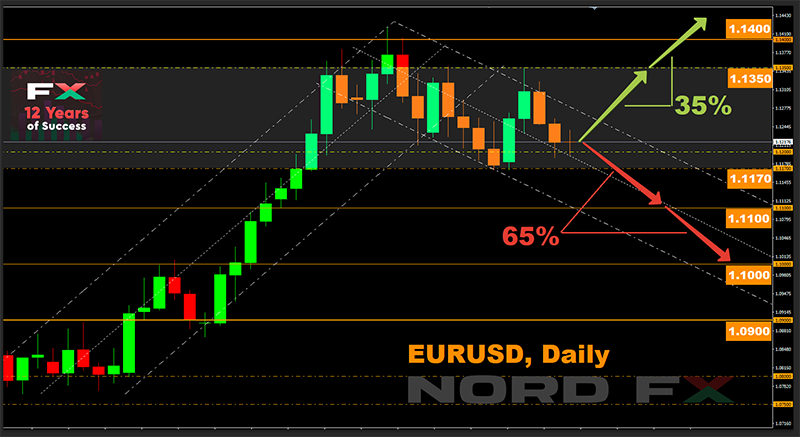

Thus, as for the behavior of the pair in the coming week, the opinions of analysts were divided almost equally: 30% voted for the growth of the pair, 40% - for its fall and 30% - for the side trend. At the same time, the main levels of support and resistance are the boundaries of the channel that it has moved the last two weeks - 1.1170 and 1.1350.

When moving to the forecast for July, the number of supporters of the dollar increases to 65%. In their opinion, the pair will first drop to 1.1100, then to 1.1000, and will grope the local bottom another 100 points lower. And here we must take into account that very often such forecasts are implemented within the first two weeks of the month.

The goals of the bulls are 1.1350, followed by the 09 June high at 1.1425 and finally the height of 1.1500.

Among the events that should be paid attention in the coming week are data on the consumer market in Germany and the EU, which will be published on Monday, June 29 and Tuesday, June 30, respectively. The statements of US Treasury Secretary Stephen Mnuchin and Fed Chairman Jerome Powell, scheduled for June 30, are also of undoubted interest to the markets. As for the second half of the week, we are expecting a whole series of data on business activity and labour market in Germany and the US, including such an important indicator as NFP - the number of new jobs created outside the US agricultural sector;

- GBP/USD. Next week, with regard to the British pound, important news risks await us: negotiations with the EU on the transition period in the framework of Brexit will resume. In their expectation, the experts' votes are distributed almost the same as in the case of EUR/USD: 35% vote for the pair's growth, 35% – for its fall, and 30% – for a sideways trend.

Technical analysis gives a slightly different picture. Almost 100% of the trend indicators on both H4 and D1 are painted red. Red also dominates among the oscillators, however 15% of them give signals about the pair being oversold, which may indicate a trend reversal up. The pair's northward reversal and return to the June 10 high at 1.2810 is also indicated by graphical analysis. Support levels are 1.2245, 1.2160 and 1.2070, resistance - 1.2470, 1.2545 and 1.2650; - USD/JPY. If 75% on the H4 trend indicators point to the north, as much look to the south on D1. Green also dominates among the oscillators on H4, but on D1 there is a complete mess of green, red and neutral gray colors.

Most of the analysts are bearish: 65% of them believe that with a full-scale decline in interest in risky assets, investors will again want to withdraw their capital to such a safe haven like the yen. As a result, the pair will test the 106.00 level again. The nearest support is in the 106.75 zone.

35% of experts vote for the strengthening of the dollar and the growth of the pair, expecting its rise to the 108.00 zone. The nearest resistance is located in zone 107.45-107.60; - cryptocurrencies. Downward trends in the crypto market are once again correlated with the dynamics of stock exchanges. And according to a number of experts, the sell-off of risk assets caused by the expectation of the second wave of coronavirus will negatively affect cryptocurrencies as well. Although, as usual, there are optimists. For example, Dan Tapeiro, co-founder of Gold Bullion International, believes that some of the anti-crisis $4.6 trillion that the US Federal Reserve has distributed over the past 3 months in the form of assistance can be used to buy bitcoin.

Since the BTC halving on May 11, despite all expectations, it has not been able to overcome the $10,000 bar. This suggests that the famous trader and analyst Tone vays was right when he said that "for bitcoin to rise, people must start to hate it." It is possible that this is what big speculators are trying to achieve – having pinched the pair in the range of $9,000-10,000, they are waiting for small investors, who have not seen the take-off, to start mass sales of bitcoin, which will allow the "whales" to buy coins with a significant discount and fully take over the market. And then.

..Then they will send the main crypto asset to new, space heights. For example, experts at Weiss Ratings, an analytical company from the USA, believe that the main cryptocurrency will rise in price to $ 180,000. In terms of security, mobility and utility, Bitcoin is much better than gold, and if it takes at least a third of gold's share, it will trade at about 20 times higher than current levels, they believe.

Mike Novogratz, head of the Galaxy Digital crypto trading bank, is also waiting for a new bitcoin rally. In an interview with CoinDesk, the billionaire admitted that he was in a hurry trying to attract institutionalists to the digital asset market three years ago. However, now, in his opinion, an excellent moment has come for a new attempt: "It took longer than expected, but intuition tells me that in the period from 6 to 24 months we will have great [institutional] progress".

The influence of institutional investors in this case is beyond doubt. According to Chainalysis estimates, only 3.5 million BTC coins are used for trading now. (The rest of the 18.6 million are either frozen as long-term investments or lost altogether). And here 85% of these 3.5 million belong to “whales”, which shape market trends on their own.

Now about the forecast for the coming week. From the technical analysis side, important support in the form of a 50-day moving average passes through the $9,000 level. And if the pair breaks this level, we can expect it in the zone of $ 8,500-8,800. This development is expected by 30% of analysts. Another 25% believe the 6-week side trend will last further, keeping the pair in the $9,000-10,000 range. And the remaining 45% of experts do not lose hope of seeing bitcoin above the psychological level of $10,000.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Повернутися Повернутися