First, a review of last week’s events:

- EUR/USD. We noted in the previous forecast that only a clear breakdown of the channel 1.1700-1.1910 in one direction or another can give a clear idea of the dominant trend in conditions of subsiding activity. It is in this range that the pair has been moving for four weeks. But the breakdown never happened: after all it is August, holidays, and no extra events capable of stirring up markets, have not yet happened. The situation shows that investors are ready to buy back even very small drawdowns and close positions with very moderate profits. As a result, the breakthrough to 1.1965 did not bring success to the bulls, and the pair returned to the sidelines1.1700-1.1910, having finished the week not far from its central line, in the 1.1795 zone;

- GBP/USD. The British currency has also moved into a side trend, where it has stayed for the third week in a row. The main difference in the last five-day period was some dominance of bullish sentiment, caused rather by a general weakening of the dollar rather than a strengthening of the pound. And if the 1.3075 horizon could be viewed as Pivot Point in the first half of August, it has now turned into a level of support. Pushing off from it, the bulls raised the GBP/USD pair twice to aеру height of 1.3265, and twice it returned to the indicated support, near which, at the level of 1.3090, it put the final point;

- USD/JPY. The 106.00-108.10 zone is the range in which the pair has been trading 75% of the time over the past 20 weeks. And all the experts were sure that it would stay within these limits last week, moreover, that it would rise to its upper limit. However, the expected strengthening of the dollar did not happen, and those oscillators that warned against opening long positions, giving signals of overbought, turned out to be right. As a result, the pair, having broken through support 106.00, groped the local bottom of 100 points lower. Then, after the rebound, it could not overcome the level of 106.00, which has now become resistance, and completed the trading session at 105.80;

- cryptocurrencies. Bitcoin has gone from $4,000 to $12,000 over the past five months. Many experts believe that the main reason is the huge dollar mass that the US Federal Reserve has thrown into the market to overcome the crisis caused by the COVID-19 pandemic. By diversifying their portfolios, investors invested some of this money in real gold and digital gold, which have shown steady growth in recent months. Another part went where it was intended, to the stock market. But if bitcoin showed an increase of 200%, the gold rose in price by a little more than 30%, and the S&P500 index barely crossed the 50% mark.

In the United States, according to the financial analytical portal TradingView, the main cryptocurrency has surpassed the shares of leading American companies in popularity, losing only to Tesla Elon Musk. Boeing took the third place in views.

The data from another survey conducted by a well-known analyst under the nickname Plan B is Interesting as well, it was attended by 22.6 thousand Twitter users. When asked “At what price will you get rid of bitcoin if it does not rise sharply in the next few years?” 5.8% of respondents named the price below $1000, about the same amount - the range of $1000- $3000. 16.2% of those surveyed would have sold the coins at around $6,000. The remaining 72% of the survey participants said that they would continue to hold bitcoin even if its price approached zero.

In the meantime, the quotes of the leading cryptocurrency are very far from the "zero" level. Bitcoin is swinging on the scales against the dollar - when the USD (DXY) index goes down, BTC goes up, and vice versa. As most of our experts assumed, when at the beginning of last week, the DXY dropped from 93.1 to 92.16, the BTC/USD pair jumped upward, broke through the resistance of $12,000 and reached the height of $12.470. The dollar then returned to levels above 93, and bitcoin dipped to a new, fairly strong, support level, $11,600.

The total capitalization of the crypto market changed slightly over the week, falling from $370 billion to $366 billion. The Bitcoin Fear & Greed Index is in the last quarter of the scale for the fourth week and has even grown slightly — from 78 to 81 points. This suggests that the decline in the pair from $ 12,470 to $ 11,600 did not satisfy the market and it remains overbought.

And a few words about altcoins. Lately, a lot of attention - and rightly so - has been paid to ethereum. The Block analyst Larry Cermak believes that while the trend continues, ethereum could become the most sought-after asset in the corporate environment. “The commission revenues of Monero, Bitcoin Cash and BSV miners remain negligible. I think that there will be two big players in this game soon, bitcoin and ethereum. In his opinion, the difference in their indicators will become so obvious soon that the altcoin will be officially recognized as the leader.

However, at the moment it was not ETH which was the most profitable acquisition on the market, but yearn. finance (YFI). It was this coin that showed twenty-fold growth in a month and outstripped even bitcoin in value, reaching the height of $15,400. By the way, the YFI developers decided to follow the path of the leading cryptocurrency, limiting its circulation to only 30,000 coins, which led to such a jump in value. It is not at all a fact that the YFI price will hold at this level or go further up. It is possible that we will soon witness its equally rapid downfall. The aforementioned fact only suggests that, in addition to coins from the TOP-10, instruments have appeared, appear and will still appear on the crypto market that can bring hundreds and thousands of percent of profit due to short-term speculation.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

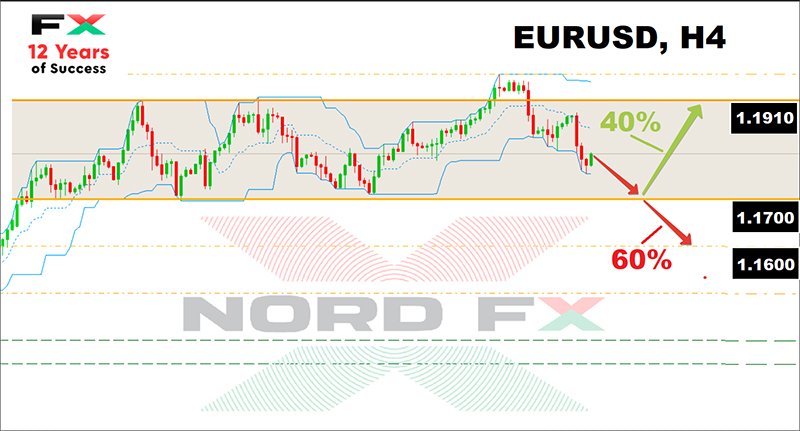

- EUR/USD. The number of initial claims for unemployment benefits again exceeded 1 million in the United States last week. The statistics on manufacturing activity in New York and Philadelphia were also quite sad. Against this backdrop, the bulls made an attempt to renew multi-month highs and raise the pair above 1.2000. The attempt ended in failure, the pair returned to the limits of the channel 1.1700-1.1910, and the main benchmark for the market still remains the prospects of another, autumn round of the pandemic COVID-19.

At first glance, the better epidemiological situation in Europe should convince investors that the eurozone economy will recover faster than the US economy. But the situation is getting worse every day. In Germany, the rate of infected with COVID-19 exceeded the highs in May, in France, the number of cases increased by 50% in a week, jumping over 1,500, in Spain, about 4,800 cases of infections are recorded daily, which, in terms of 1 million people, is only 25% less than in the USA. So, it is quite possible that quarantine measures in the EU will be tightened again, causing another blow to the economy, and the ECB will be forced to expand its quantitative easing (QE) program. This, in turn, will push the EUR/USD pair down.

On the other hand, the dollar, apart from doubts about the pace of recovery of the US economy, continues to be pressured by the growth of money supply from the Fed, the growth of national debt, the decline in government bond yields, tug-of-war in the confrontation with China, and uncertainty about the upcoming presidential election. As a result, the USD (DXY) index, which shows the ratio of the dollar to 6 major currencies, fell from the highs of mid-March (104 points) to the lows of May 2018 around 92-93 points.

Today, the preferences of most analysts are still on the side of the dollar. 60% of them believe that the EUR/USD pair is able to break the support of 1.1700 and fall at least another 100 points lower. According to the remaining 40%, the pair will still remain within the trading range of 1.1700-1.1910, with which the graphical analysis on D1 agrees.

The indicators on H4, working out the trend of the second half of the last week, are naturally colored red. But on D1 there is a complete color confusion, which confirms the forecast of sideways movement.

And now positive information for those who, in the medium term, are betting on the victory of the euro over the dollar. If you look at the options market, it does not exclude the growth of the EUR/USD pair to the levels of 1.2200-1.2500. However, it is necessary to keep in mind that COVID-19 will surely put everything in its place this autumn. And one of the decisive factors here may be the emergence of a vaccine against this scourge and the speed and scale of vaccination in different countries.

- GBP/USD. “As the euro, so the pound” — this is how the forecast for the GBP/USD pair sounds for the third week in a row. As with EUR/USD, 60% of experts vote for the turn of the pair down. They are supported by 75% of oscillators, 80% of indicators and graphical analysis on H4. The closest strong support is at 1.3000. In case of its breakout, the bears will try to move the pair to echelon 1.2665-1.2765.

But on D1 there is still a slight advantage for the “green” ones among the indicators. In addition, signals about the pair being oversold are also signaled by 25% oscillators on H4. According to 40% of analysts, two side channels can be drawn for the pair. The first, narrow one - 1.3075-1.3185, and the second, wider in case of increased volatility - 1.3000-1.3265. The goal of bulls to update the 2019 high of 1.3515 is hardly achievable in the coming days; - USD/JPY. 50% of experts believe that the pair will again try to test the strength of the support in the 105.00 zone and reach the low of July 31, 104.18. This scenario is supported by 60% of oscillators and 100% of trend indicators on D1. The rest of the indicators on both timeframes are colored neutral gray. 15% of analysts have also taken a neutral position. As for the remaining 35% of experts, they predict the pair will return to the trading range 106.00-108.10;

- cryptocurrencies. The news feed, as usual, is full of optimistic crypto-guru statements.

Anthony Pompliano, CEO of Morgan Creek Investment Company: “I think bitcoin will surpass gold in capitalization by 2029. Then most of the financial institutions will stop being afraid of cryptocurrency and start investing large amounts in it. The dollar and other currencies this year have shown weakness in the face of geopolitical fluctuations and even pandemics. Bitcoin has not only resisted, but also increased its potential”, Pompliano said.

Jason Williams, co-founder of venture capital firm Morgan Creek Digital, is confident that legendary investor and adversary of cryptocurrencies Warren Buffett will eventually see bitcoin in the investment portfolio of his holding company Berkshire Hathaway. And it can happen even without his knowledge. 'These are young managers and analysts who are pushing gold trading and BTC trading. He won't even know when it happens," Williams explained.

Bitcoin price will reach $100,000 next summer, to be exact, on August 16, 2021. This forecast was published by an analyst under the pseudonym Bit Harrington, based on the popular Stock-to-Flow (S2F) model used in the gold market. He added that the value seems too high to him for such a period but noted that bitcoin has always gone against bearish sentiment.

Analyst and entrepreneur Mark Van Der Chase explained why this forecast could well come true. “A lot of people think it's impossible,” he wrote, “but I've seen 1,000% growth in less than a year at least twice in BTC history (in 2013 and 2017). S2F holds up pretty well after the halving. If the fear of lost profits resumes, anything is possible. "

- The head of Galaxy Digital holding Mike Novogratz has once again stated that the value of bitcoin should increase to at least 20 thousand dollars by the end of this year. And the analyst Plan B, who was the first to apply S2F to bitcoin, presented a chart according to which this cryptocurrency may, for the first time since 2017, reach the level of $ 14,000 in the next week or two.

It is interesting that, despite such optimistic statements, most experts look at the prospects for BTC quite calmly. They do not exclude that bitcoin, as an alternative to fiat currencies, will receive a new growth impetus during the second wave of the pandemic. If, of course, it happens this fall. But so far 70% of analysts expect that in the first half of autumn the BTC/USD pair will move along the Pivot Point of $11,000 with one-time emissions up to $9,500 to the south and to $13,000 to the north. And only 30% of experts believe that in the coming weeks the pair will be able to steadily gain a foothold above $12,000.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Повернутися Повернутися