First, a review of last week’s events:

- EUR/USD. The key day last week was Thursday, June 10. There were two important events on the day: the European Central Bank meeting and the release of US consumer market data. Now let's talk about everything in order.

The ECB raised its forecasts for Eurozone GDP from 4.0% to 4.6% for 2021 and from 4.1% to 4.7% for 2022. Inflation is expected to rise by 1.9% this year and 1.5% next year (the previous forecast was 1.5% and 1.2% respectively). At the same time, the pace of economic recovery has not particularly impressed Ms. Lagarde, especially as it is lagging seriously behind the US. The ECB chief also considers the jump in inflation a temporary phenomenon. While prices may continue to rise in 2021 Q3 and Q4, they should go down as the “temporary factors disappear.” So, the overall inflation rate in the Eurozone, she believes, will remain below target “throughout the forecast horizon.”

As a result, the result of the ECB meeting was... no result. Despite the debate, the Bank's Governing Board has not made any decisions regarding the winding down of QE, leaving the current stimulus measures in place. The interest rate on the euro was also unchanged, at 0%. But it was because of such passivity that Ms. Lagarde succeeded in achieving what she wanted: keeping the euro from rising.

And now about the second event on Thursday - the publication of data on the US consumer market (CPI). It was just that, according to the reaction of the market, it resembled the moment when the regulator announced new interest rates. The CPI figures turned out to be much higher than forecasted, showing the fastest rise in consumer prices in the United States in more than 12 years.

Such a rise in inflation could scare investors, however, exactly the opposite happened: the S&P500 index updated another high, reaching 4250 (against 4244 exactly a month ago), and the yield on 10-year Treasuries fell to a 3-month low.

As for the EUR/USD pair, this is where the bears won. Their logic was as follows: the ECB postponed the decision to roll back QE in Europe, but in the US, a jump in inflation could push the Fed to take some real steps in this direction. And some goals are likely to be identified at the next meeting of the regulator next Wednesday, June 16. This expectation of tightening monetary policy has driven the dollar higher. Additional strength for the bears was given by the growth of the Consumer Confidence Index of the University of Michigan in the USA, which was published on June 11. As a result, the dollar won back about 100 points from the euro, and the EUR/USD pair finished just below the lower border of the four-week side channel 1.2125-1.2265, at around 1.2108; - GBP/USD. The statistics from the USA pushing the pair down was mentioned above. As for the UK's performance, it's not all that simple. Data released on Thursday June 10 supported the pound, showing a sharp rise in the Manufacturing PMI, which indicated a strengthening of industrial production and trade in the UK. However, another package of macro-statistics, published the next day, aroused caution among investors.

The center of the British economic recovery has shifted from manufacturing and the housing market to the service sector. Here, thanks to vaccinations and the easing of quarantine measures, activity has increased and even exceeded forecasts. But the figures were not so rosy in other sectors of the economy.

Construction volumes declined by 2%, while industrial production for April fell 1.3%. When compared to the same period in 2020, it added 27.5% during that time. It would seem that the growth is evident. But, according to a number of experts, there is nothing much to be happy about. If we compare the absolute values, they are 3% lower than the levels of February 2020 and 6.5% below the local peak in March 2019. And this speaks of the stagnation of the sector, which, apparently, was provoked not only by the COVID-19 pandemic, but also by Brexit.

These multidirectional statistics resulted in the GBP/USD pair failing to reach beyond the 1.4075-1.4220 side channel, along which it was drifting for the fourth week, and put the last point at 1.4115; - USD/JPY. Having started the five-day period at 109.50, the pair completed it at 109.70. At the same time, it was below these levels almost all the time, bouncing over and over again from the support in the area of 109.18-109.30. However, thanks to strong statistics from the US, the pair managed to climb to the height of 109.85 at the end of the week. But even taking into account this spurt, the weekly fluctuation range of 45 points looks more than modest;

- cryptocurrencies. The crypto market is calm. Bitcoin has been consolidating around $36,000-37,000 for the third week in a row. An attempt by the bears on to turn quotes downward June 8 ended in failure: the lowest point they managed to reach was $31.065. Having stayed there for only a few minutes, the BTC/USD pair turned around, climbed to $38.325, and then went back to the consolidation area.

Elon Musk is back in the news of the week, which could somehow influence the market sentiment. The owner of Tesla and SpaceX received a video allegedly from the Anonymous hacker group. It states that his tweets regarding cryptocurrency ruined the lives of ordinary working people, and their dreams were shattered by Musk's public tantrums.

The man in the video, in the group's familiar Guy Fawkes mask, changed his voice and called the billionaire a Bond villain who pretends to be a visionary, but in fact is a narcissistic rich man desperately in need of attention. The video indicates that Musk abandoned bitcoin only because he feared Tesla would lose subsidies from the state. And the hackers called Musk's recent initiative to create a Council of Bitcoin Miners an attempt to take control of the industry.

The video, which has already garnered about 2 million views, ends with a challenge: “You consider yourself the smartest, but this time you will play against an equal opponent. We are Anonymous! We are legion! Wait for us".

Another newsmaker, analytical software provider MicroStrategy Inc. announced a $400 million convertible bond offering maturing in 2028. The company will use the funds raised from the placement to buy bitcoins.

According to Bitcoin Treasuries, MicroStrategy currently owns 92,079 BTC worth more than $3.37 billion.. And if you study the history of its crypto assets’ replenishment, it becomes obvious that the company is moving towards averaging its position in the market. And this happens due to borrowed funds.

Averaging is considered a rather risky investment method. For those who don't know, we'll explain in a simple example. Averaging is when you buy 3 BTC: the first one for $5,000, then you buy the second one for $20,000, and the third one for $35,000. The average price of 1 coin in this case will be equal to $20,000 ($ 60,000/3). And if quotes fall below this level, you will be at a loss. This is why some experts believe MicroStrategy has embarked on a "journey on thin ice."

At the time of writing the forecast, the BTC/USD pair is in the $37,000 zone. The Crypto Fear & Greed Index, as well as the coin itself, demonstrates "consolidation": it was equal to 21 points on May 28, 27 on June 04, and again 21 points on June 11, which corresponds to the average Fear indicator.

Among the 10,332 existing cryptocurrencies, bitcoin, despite its decline in its share in the total crypto market capitalization, still leads by a huge margin. Its dominance index is 44.03% at the moment. The capitalization of the entire digital currency market fell from $1.663 trillion to $1.585 trillion over the week.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. As mentioned above, the Governing Council of the ECB has not made any decision regarding the winding down of the quantitative (QE) program. But the Fed can discuss this issue at its meeting on Wednesday, June 16, and, as a result, publish a "road map". If not publish a detailed road map, then at least indicate its certain stages. And if this happens, we can expect a rapid rise in the dollar and a decline in the EUR/USD pair to the level of 1.2000. The next support is 1.1945, then the zone 1.1880-1.1900.

If the Fed gets off with general phrases that the rise in inflation and the current improvement in the US labor market are not at all a reason for tightening economic policy again, then the pair may return to the upper border of the 1.2125-1.2265 channel. The next target for the bulls is the growth of the pair to this year's high of 1.2350.

So, all the market's attention is now focused on this event. And analysts avoid any predictions until it's over. Graphical analysis is in disarray as well. Among the trend indicators, 55% are colored red on D1, and 100% on H4. The picture is slightly different among oscillators. Here, 60% of them are looking down on both time frames, 20% have taken a neutral position, and the remaining 20% are signaling that the pair is oversold.

In addition to the Fed meeting and comments on June 16, other events of the week include the release of statistics on the German consumer market and on retail sales in the United States. Both numbers will be released on Tuesday June 15; - GBP/USD. The Bank of England now faces a difficult choice of which way to go further: to support economic growth by continuing fiscal stimulus programs, or to start fighting inflation and prices that have already exceeded pre-Covid levels.

If you look at the ECB and the Fed, they have preferred the first option so far, postponing the second one for later. The renewed trend towards the stagnation of the UK manufacturing sector indicates that the Bank of England should follow the example of its colleagues. Especially since the country's coronavirus curve has moved up sharply again, and there is increasing discussion about moving the full abolition of the quarantine restrictions scheduled for June 21.

If this happens, the pound will be under strong pressure. However, there will be June 16 before June 21, when the Fed meeting will take place - the key event of the week for almost all dollar pairs. As in the case of EUR/USD, expert opinions are now almost impossible to be brought to any common denominator. Graphical analysis also indicates the continuation of the pair's sideways movement in the coming days within the range of 1.4075-1.4220. Oscillators on both timeframes give multidirectional signals, although the red ones have a slight advantage here. The trend indicators on D1 are split evenly: 50% pointing north, 50% pointing south. And it is only among the trend indicators on H4 that there is an overwhelming majority: 85% of them are colored red.

The targets of the bears: 1.4075, 1.4000, then the low in the 1.3900-1.3925 zone. The bulls' targets: 1.4185-1.4225 and 1.4250, having reached which, they will then try to break through the resistance of 1.4300 and refresh the 2018 highs.

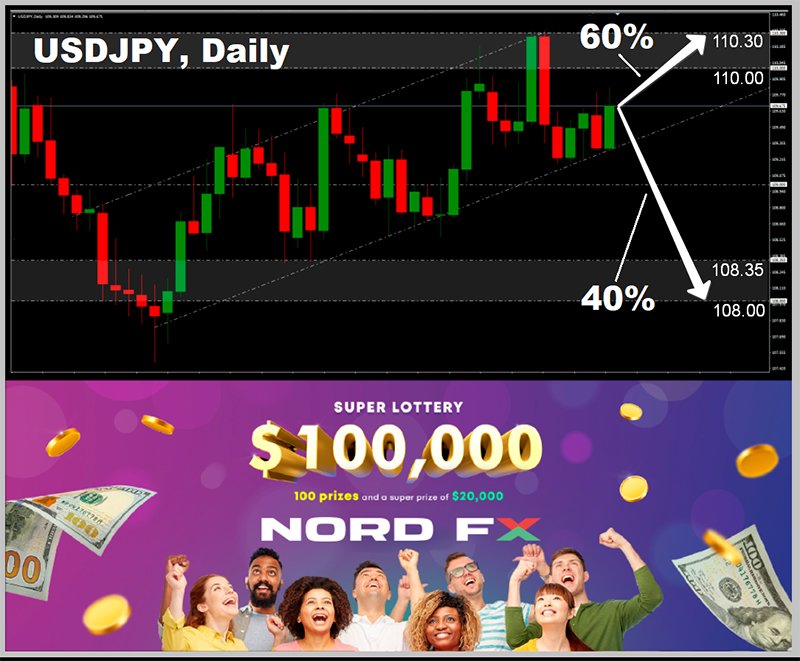

Among the important events of the coming week: the release of UK labour market statistics and Bank of England Governor Andrew Bailey's speech on Tuesday June 15, as well as data on the country's consumer market on Wednesday June 16; - USD/JPY. Giving a weekly forecast, the majority of experts (60%) vote for the strengthening of the dollar and the growth of the pair to the zone of 110.00-110.30. Graphical analysis and 65% of oscillators on H4, as well as 100% of trend indicators on H4 and D1 agree with them.

The remaining 40% of analysts, along with graphical analysis on D1, expect the pair to decline to support at 108.00-108.35. The next strong support is at 107.50.

When switching to the monthly forecast, the picture changes in a mirror-like manner: here it is already 60% that side with the bears. 40% remain on the side of the bulls, with only half of them believing that the pair will be able to rise above 111.00 and renew the March 31 high.

As for the events of the next week, one could note the decision of the Bank of Japan on the interest rate and the subsequent press conference. However, the likelihood that the bank's monetary policy will undergo changes that could seriously affect market sentiment is close to zero;

- cryptocurrencies. Goldman Sachs experts have downgraded bitcoin's rating from gold to copper. According to them, it is still difficult to put the main coin on a par with gold, since it does not have such a powerful support as this precious metal. Commodities expert Jeff Curry explained that the volatility of the main coin is very similar in nature to the price swings of copper in the global market.

Previously, a similar point of view was voiced by JPMorgan experts. According to them, the main cryptocurrency is a cyclical commodity, and therefore cannot compete with precious metals or fiat. Investment companies are well aware of this, which is why they have portfolios that only consist of a few percent of bitcoin and other digital assets.

The opposite point of view to bankers was expressed by the CEO of the crypto exchange Gemini and bitcoin billionaire Tyler Winklevoss. He believes that bitcoin is still in its early stages of development. “Bitcoin is Gold 2.0,” Winklevoss said, “and its market cap should be over $10 trillion, just like gold. It is currently at the level of $1 trillion, that is, growth may be at least 10 times more. "

In his opinion, even a rate of about $35,000 is an excellent opportunity to enter a long-term investment. With a capitalization of $10 trillion, 1 BTC will be worth $500,000, and this may happen within the current decade, or maybe within the next 5 years.

“We will hodl to at least $500,000, and even then, we will not have to sell the asset, because it can be lent, used as collateral, etc.,” the billionaire added. And then he flew into space in his fantasies, claiming that bitcoin could be used for transactions between planets in the future: “Bitcoin is a project that continues to evolve and can achieve much more. It could become the global reserve digital currency of the world or even several planets when we get to Mars."

The forecast (or rather, its absence) by another billionaire, the founder of Avenue Capital Management Mark Lasry, seems to be much more mundane. According to him, the cryptocurrency market has already formed, and nothing threatens it, and the rapid growth of bitcoin in 2021 has exceeded his expectations. That being said, “to be honest, I don't know where bitcoin is heading,” Larsy admitted. "I can justify why it will rise to $100,000, but I can also justify why it will fall to $20,000."

And it is difficult to argue with him about this. At least in the current situation, any movement of digital gold can be justified. Suffice it to recall two authoritative predictions:

: of the American company Fundstrat analysts, according to which, despite the fall in May, the bitcoin rate may return to the $50,000 mark in the near future,

- and of the JPMorgan financial holding strategist Nikolaos Panigirtzoglou, who is confident that the fundamentally justified value of bitcoin is in the range of $24,000- $36,000.

***

And in conclusion, our traditional, albeit irregular, section of crypto life hacks. True, it applies not only to cryptocurrencies, but also to fiat this week. We are talking about the opportunity to top up your budget with a fairly round amount by taking part in the lottery held by the NordFX broker. There are a total of 100 prizes to be won for a total of $100,000. And the first draft will take place in two weeks, on July 1, so you may well have time to become a participant. All the details are available on the NordFX website.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Повернутися Повернутися