Trading in financial markets involves constant decision-making under uncertainty. Prices move quickly, data flows continuously, and traders must manage risk at every step. A trading tool helps traders structure this process by providing calculations, data, and visual insights that support analysis and execution.

This article explains what a trading tool is, the main kinds of trading tools available, and how they are used in real trading situations. It is written for beginner to intermediate traders who want to understand how tools fit into a disciplined trading approach.

A trading tool is any software feature, calculator, or analytical aid that helps traders analyze markets, plan trades, and manage risk. Trading tools do not predict outcomes, but they help traders make more informed and consistent decisions by turning raw market data into usable information.

Types of Trading Tools:

- Market analysis tools

- Technical analysis tools

- Risk and money management tools

- Trading calculators

- Volatility measurement tools

- Currency strength and heat map tools

- Trade planning tools

- Market awareness tools

- Economic and news tools

- Platform-based trading tools

Key points:

- A trading tool supports analysis, risk management, or execution.

- Trading tools range from simple calculators to complex market visualizations.

- Tools are aids, not substitutes for strategy or discipline.

- Proper use of trading tools can improve consistency and control.

What a the trading tool?

A trading tool is a practical resource used to assist traders in analyzing markets, calculating trade parameters, and managing risk before and during a trade. It can be built into a trading platform, available on a broker’s website, or offered as standalone software.

Trading tools typically focus on one or more of the following tasks:

- Measuring risk and position size

- Visualizing price behavior or market strength

- Converting raw price data into actionable metrics

- Planning entries, exits, and trade management

For example, instead of guessing how much to trade, a trader can use a lot size calculator to align position size with account balance and stop-loss distance. Instead of estimating volatility by eye, a trader can use a volatility tool to compare currency pairs objectively. These tools are designed to reduce avoidable mistakes, not to eliminate risk.

Kinds of trading tools

Trading tools can be grouped by function rather than by complexity. Some tools are purely mathematical, while others provide visual or comparative market data. Understanding these categories helps traders choose the right tool for each stage of a trade.

Analysis tools

These tools help traders understand market conditions. Examples include heat maps, volatility indicators, and technical analysis calculators.

Risk and money management tools

These tools focus on position sizing, leverage, and potential profit or loss. Trading calculators fall mainly into this category.

Market awareness tools

These tools provide context about broader market conditions, such as economic calendars and currency converters.

Each type of trading tool plays a different role, and experienced traders often combine several tools rather than relying on just one.

Trading Calculator:

A trading calculator is a category of trading tool designed to perform specific numerical calculations related to a trade. Instead of manual calculations, traders input values such as account size, stop-loss distance, or leverage, and the calculator produces accurate results instantly.

Trading calculators are especially useful for beginners, as they reduce calculation errors and encourage consistent risk management.

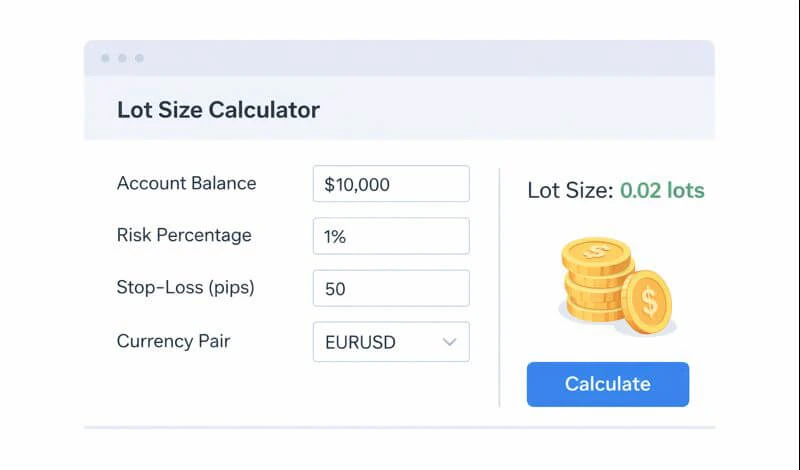

Lot size calculator

A lot size calculator helps traders determine how large a position they should open based on their risk parameters.

It answers a simple but critical question: how many lots can I trade if I only want to risk a specific amount of my account?

How it works

The trader typically inputs:

Account balance

Risk percentage per trade

Stop-loss distance in pips

The calculator then outputs the appropriate lot size. For example, with a 10,000 account and a 1 percent risk limit, the calculator ensures that the loss at the stop-loss level does not exceed 100.

This tool is fundamental to risk management and is often explained in broker resources such as risk management guide.

Pip Calculator

A pip calculator determines the monetary value of a single pip for a given trade size and currency pair.

Why pip value matters

Different currency pairs and lot sizes produce different pip values. A pip calculator helps traders:

Understand how price movement translates into profit or loss

Compare risk across different instruments

Set stop-loss and take-profit levels realistically

For example, a 20-pip stop-loss on EURUSD does not carry the same risk as a 20-pip stop-loss on GBPJPY. The pip calculator clarifies this difference before the trade is placed.

Leverage Calculator

A leverage calculator shows how much margin is required to open a specific position size given the selected leverage ratio.

Practical use

Traders use this tool to:

Check whether they have sufficient free margin

Avoid overleveraging the account

Understand how leverage magnifies exposure

For instance, opening a 1-lot position with 1:100 leverage requires far less margin than with 1:20 leverage. The calculator makes this relationship clear and helps traders plan responsibly. Related explanations can often be found in broker education sections such as leverage and margin guide.

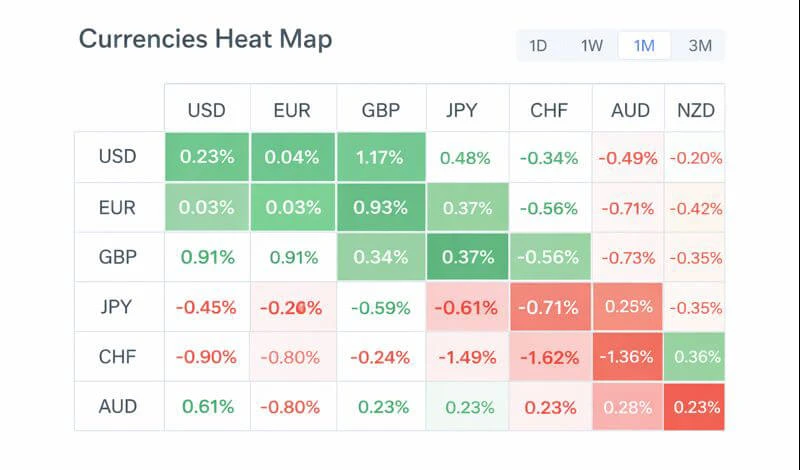

Currencies Heat Map

A currencies heat map visually displays the relative strength or weakness of currencies against each other over a selected time frame.

How traders use it

A heat map allows traders to:

Identify strong currencies to buy

Identify weak currencies to sell

Avoid trading pairs with mixed signals

For example, if the heat map shows strong USD performance and weak JPY performance, a trader may focus on USDJPY setups rather than scanning the entire market manually.

Currency Volatility

Currency volatility tools measure how much a currency pair typically moves within a given time period.

Why volatility matters

Volatility affects:

Stop-loss placement

Position sizing

High-volatility pairs may offer larger price swings but also higher risk. Low-volatility pairs may require tighter targets and longer holding periods. A volatility tool helps traders align their strategy with market behavior instead of guessing.

Additional Trading Tools

Beyond calculators and market visualizations, several additional trading tools help traders manage timing, conversions, and technical levels more efficiently.

Economic Calendar

An economic calendar lists upcoming economic events, such as interest rate decisions, inflation reports, and employment data.

Practical application

Traders use economic calendars to:

Avoid entering trades before high-impact news

Adjust stop-loss levels during volatile periods

Plan news-based trading strategies

For example, a trader holding a EURUSD position may reduce exposure ahead of a major European Central Bank announcement. Educational explanations of macro events are often linked from pages like forex fundamentals guide.

Currency Converter

A currency converter calculates the value of one currency in terms of another at current exchange rates.

Use cases

This trading tool is useful for:

Understanding account balance in base currency

Calculating profit or loss in local currency

Managing multi-currency accounts

Although simple, it removes confusion when trading instruments denominated in unfamiliar currencies.

Fibonacci Calculator

A Fibonacci calculator automatically plots retracement and extension levels based on a selected price move.

Why traders use Fibonacci tools

Fibonacci levels are commonly used to:

Identify potential pullback zones

Set profit targets

Align entries with technical structure

The calculator ensures accurate level placement, especially for traders still learning manual charting techniques.

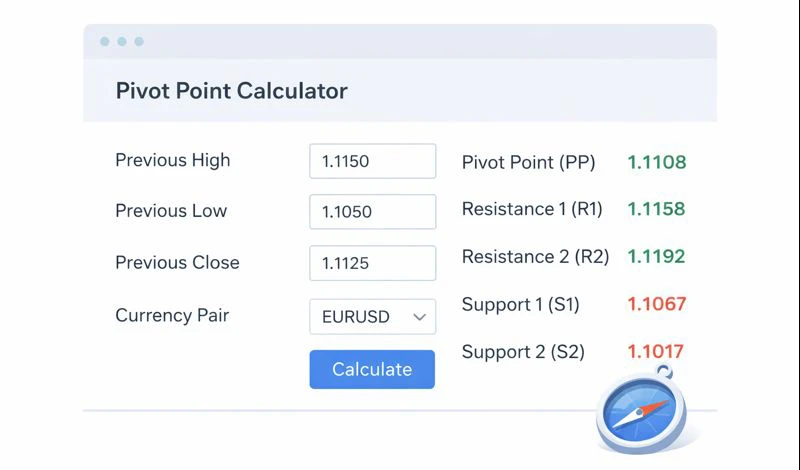

Pivot Point Calculator

A pivot point calculator generates potential support and resistance levels based on previous price data.

Practical benefits

Pivot points help traders:

Identify intraday turning points

Plan range-bound strategies

Combine static levels with dynamic indicators

This trading tool is especially popular among day traders and scalpers who rely on structured price levels.

How to use trading tools in trading (real examples)

Trading tools are most effective when used together within a clear process. Below are simplified examples showing how traders apply multiple tools in real situations.

Example 1: Risk-based position sizing

A trader with a 5,000 account wants to risk 2 percent on a EURUSD trade with a 30-pip stop-loss. Using a lot size calculator, the trader determines the correct position size so the maximum loss equals 100. A pip calculator confirms the pip value before execution.

Example 2: Volatility-adjusted stop-loss

A trader checks currency volatility and sees that GBPJPY has a much higher average daily range than EURCHF. The trader sets a wider stop-loss for GBPJPY and reduces position size accordingly, instead of using a fixed stop for all pairs.

Example 3: News-aware trade planning

Before opening a USD-based trade, a trader checks the economic calendar and notices a high-impact US inflation release scheduled in two hours. The trader delays entry or reduces exposure to avoid unpredictable price spikes.

These examples show that a trading tool supports decisions but does not replace strategy or judgment.

Advantages of Trading Tools

Trading tools offer several practical benefits when used correctly:

- Reduce calculation errors and guesswork

- Encourage consistent risk management

- Save time during trade planning

- Improve market awareness and preparation

- Help beginners follow structured processes

When integrated into a trading plan, tools help traders focus on execution rather than mental arithmetic.

Disadvantages of Trading Tools

Despite their benefits, trading tools also have limitations:

- Overreliance can weaken analytical skills

- Tools may oversimplify complex market behavior

- Incorrect inputs lead to misleading outputs

- Too many tools can cause analysis paralysis

Trading tools should be treated as aids, not authorities. Traders remain responsible for decisions and risk.

FAQ

What is the most important trading tool for beginners?

For beginners, a lot size calculator is often the most important trading tool. It directly supports risk management and helps prevent oversized positions. Without proper position sizing, even a good strategy can fail due to poor risk control.

Are trading tools free to use?

Many trading tools are free and provided by brokers or trading platforms. Some advanced tools or analytics services may require payment. Beginners usually have access to sufficient free tools for effective trading.

Can trading tools guarantee profitable trades?

No trading tool can guarantee profits. Tools provide information and calculations, but market outcomes remain uncertain. Profitability depends on strategy, discipline, and risk management, not tools alone.

Should I use many trading tools at once?

Using too many trading tools can be counterproductive. It is better to choose a small set of tools that support your strategy and understand them well. Simplicity often leads to clearer decisions.

Are trading tools suitable for all markets?

Most trading tools can be used across forex, CFDs, and other markets, but their parameters may differ. For example, pip calculators apply mainly to forex, while volatility tools can be used more broadly.

How often should I rely on trading tools?

Trading tools are best used during trade planning and review, not constantly during live price fluctuations. Using them at structured points in your process helps maintain discipline and clarity.

Do professional traders use trading tools?

Yes, professional traders use trading tools extensively. They often rely on calculators, market data tools, and calendars to support structured decision-making. Experience changes how tools are used, not whether they are used.