Forex trading in Kenya has rapidly transformed from a niche activity into a mainstream financial opportunity, attracting thousands of individuals eager to explore global markets. With the rise of mobile money platforms, widespread internet access, and growing financial literacy, Kenya has become one of Africa’s most active hubs for retail forex trading. For many, this market represents more than just currency exchange—it is a gateway to new income possibilities, financial independence, and a deeper connection to the global economy.

Table of Contents

What is forex trading in Kenya?

How does Forex trading work in Kenya?

The rise of forex trading in Kenya

Is Forex trading legal in Kenya?

What defines the best forex brokers in Kenya

Economic impact of forex trading in Kenya

The role of mobile technology on forex trading in Kenya

Tips for new forex traders in Kenya

Forex trading sessions and time zones in Kenya

How much money do you need to start trading Forex in Kenya?

How to open a Forex trading account in Kenya with NordFX

How to make money through Forex in Kenya

How to manage trading Forex in Kenya as a beginner

Tips, risks, and best practices for new traders

The future of forex trading in Kenya

Key Takeaways

- Forex trading involves exchanging one currency for another to benefit from fluctuations in exchange rates.

- In Kenya, increasing internet access, mobile penetration, and interest in alternative income are driving growth in Forex trading.

- The best brokers offer transparent fees, good customer support, secure deposit/withdrawal options, leverage appropriate to your risk tolerance, and reliable platforms.

- Mobile technology has lowered entry barriers: smartphones, apps, mobile payments help more people access Forex.

- Understanding trading sessions, time zones, and market overlaps is essential for timing trades.

- Start with small amounts, use demo accounts, manage risk, avoid over-leverage, maintain discipline.

🔗 What

What is forex trading in Kenya?

Forex (foreign exchange, FX) trading is buying one currency while selling another simultaneously, with the aim of making profit from changes in exchange rates. In Kenya, forex trading means that Kenyan traders participate in the global FX markets, trading major, minor, exotic currency pairs (e.g. USD/KES, EUR/USD, GBP/USD, etc.), through brokers (local or international).

Kenyan traders can do this from their homes, using a computer or a mobile device, via Internet, as long as they have a broker that accepts Kenyan users, and provides mechanisms to deposit, withdraw, and meet regulatory requirements.

Forex trading is speculative in nature: profits come when your forecast of currency movements is correct; losses happen when your forecast is incorrect. It is high risk, potentially high reward.

🔗 work

How does Forex trading work in Kenya?

Forex trading in Kenya operates just like it does globally, but with unique local factors such as mobile payments and regulatory oversight shaping the experience. At its core, it involves buying one currency while selling another, aiming to profit from exchange rate movements. Kenyan traders participate through brokers, using platforms like MT4 or MT5, with opportunities enhanced by high internet penetration and easy access to global markets.

Currency pairs and markets

Currency pairs form the foundation of forex trading, as every transaction involves simultaneously buying one currency and selling another. Each pair is quoted with two currencies: the first is called the base currency, and the second is the quote currency. The price displayed represents how much of the quote currency is required to purchase one unit of the base currency.

For example, if you trade EUR/USD, the euro is the base currency and the US dollar is the quote currency. If the pair is quoted at 1.10, this means that 1 euro is worth 1.10 US dollars. If you believe the euro will appreciate against the dollar, you buy the pair; if you expect it to depreciate, you sell.

There are three broad categories of currency pairs:

- Major pairs: these include the most traded currencies in the world, such as EUR/USD, GBP/USD, and USD/JPY. They are highly liquid, with tight spreads and heavy participation from global institutions.

- Minor pairs: these involve widely traded currencies but exclude the US dollar, for example EUR/GBP or AUD/JPY. They usually have less liquidity than majors but can offer strong opportunities.

- Exotic pairs: these combine a major currency with one from a smaller or emerging economy, such as GBP/TRY or USD/ZAR. They often feature higher volatility and wider spreads, making them riskier for inexperienced traders.

The choice of pairs to trade depends on a trader’s strategy, market knowledge, and appetite for risk. Majors are usually recommended for beginners because of their stability and predictability, while minors and exotics can provide sharper moves for those comfortable with higher risk and broader spreads. Understanding how these pairs function is essential, as every profit or loss in forex trading is derived from changes in their relative values.

Brokers and platforms

Brokers and platforms are the gateway for Kenyan traders to access the global forex market. They provide the necessary infrastructure through trading platforms such as MetaTrader 4, MetaTrader 5, or WebTrader. These platforms allow traders to analyze price movements, place trades, and manage risk with various built-in tools. Depending on their needs, traders can choose between international brokers that operate globally or local and regional brokers.

Beyond basic access, brokers deliver essential services that make trading possible. They provide live price feeds, ensure smooth order execution, and offer features like customizable charts, stop-loss and take-profit orders, and varying levels of leverage. Brokers also set margin requirements, define account types, and sometimes offer additional resources like educational materials or customer support to help traders develop their skills.

Leverage, margin, and risk

Leverage is a big component in Forex: it allows you to open positions much larger than your capital. For example, with 1:100 leverage, you can trade $1,000 position with $10 of your money. But this magnifies both gains and losses.

Margin is the required amount to keep positions open. If your losses become too big, the broker may close positions (margin call / stop-out).

Costs: spreads, commissions, swaps

- Spread is the difference between buy and sell price. Tighter spreads are usually better.

- Commissions may be charged per trade, especially in ECN or zero-spread type accounts.

- Swaps or rollover fees: if you hold a position overnight, you may pay or receive swap. Some brokers offer “swap-free” or Islamic accounts for traders who cannot accept swaps.

Order types and execution

Order types and execution are critical concepts every forex trader in Kenya must understand before entering the market. Different order types allow traders to control when and how they buy or sell a currency pair, making it possible to tailor trading strategies to individual goals. A market order, for instance, executes immediately at the current available price, while a limit order triggers only when the market reaches a more favorable price level. Stop orders, on the other hand, are designed to activate once the market moves beyond a specific threshold, often used to catch breakouts or protect against sudden reversals.

Risk management is closely tied to stop-loss and take-profit orders. A stop-loss order automatically closes a position when losses reach a predetermined level, ensuring traders do not lose more than they can afford. A take-profit order does the opposite, closing a trade once a desired profit level has been achieved. By combining these tools, traders can build discipline into their trading, reduce emotional decision-making, and protect their capital against unexpected market moves.

Execution methods vary depending on the broker’s setup. Instant execution offers speed and certainty by filling orders at the requested price, but it can sometimes result in re-quotes if the market moves too quickly. Market execution, more common with ECN or STP brokers, fills orders at the best available price in the market, which may differ slightly from the price a trader sees on screen. Both methods have advantages: instant execution provides greater control, while market execution offers access to deeper liquidity and faster order flow. Kenyan traders should carefully evaluate which execution type suits their style and risk tolerance when selecting a broker.

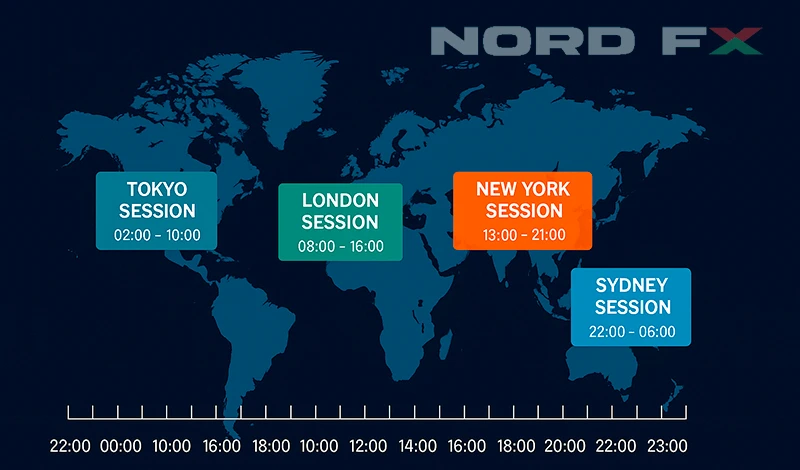

Timing and liquidity

Timing and liquidity play a vital role in determining the quality of trading opportunities in the forex market. Since the market is decentralized and operates around the clock from Monday to Friday, traders in Kenya can access it at virtually any time. However, not all hours are equally active. Liquidity, which refers to how easily a currency pair can be bought or sold without causing significant price changes, fluctuates throughout the day. Periods of higher liquidity generally mean tighter spreads and faster execution, creating favorable conditions for traders. On the other hand, during quiet hours, spreads may widen, and price movements can become less predictable, making it more challenging to enter or exit trades efficiently.

The busiest and often most profitable times to trade are during session overlaps, such as when the London and New York markets are both open. These periods witness high trading volume, sharp price movements, and plenty of opportunities for both short-term and long-term strategies. For Kenyan traders, aligning their schedules with these active hours can make a big difference in profitability. Meanwhile, trading during low-liquidity periods, like late evenings or before major sessions open, can expose traders to slippage or unexpected volatility caused by even small market orders. Understanding when liquidity peaks and how it impacts spreads and volatility allows traders to plan more effectively, maximize opportunities, and manage risks with greater precision.

🔗 rise

The rise of forex trading in Kenya

The rise of forex trading in Kenya has been shaped by several important factors. Widespread internet penetration, both in urban and rural areas, has made access to global markets easier than ever before. The rapid adoption of smartphones has further boosted this trend, allowing traders to use mobile apps for real-time market participation. Increased awareness and education, supported by online courses, social media discussions, and webinars, have introduced many people to the basics of forex. At the same time, high unemployment and underemployment have encouraged individuals to seek new income streams, whether active or passive. The availability of brokers who accept Kenyan clients has also made participation far more convenient.

Recent trends highlight how trading habits in Kenya are evolving. Social trading is becoming more popular, with less experienced traders choosing to copy the strategies of professionals. Many people are starting with demo accounts to learn before committing real funds, while others are experimenting with smaller investments and micro-trading to reduce risk exposure. There is also a noticeable interest in major currency pairs, though some traders are exploring exotic pairs involving African currencies despite their higher risk. Together, these developments reflect a dynamic and growing trading culture that is reshaping Kenya’s financial landscape.

🔗 legal

Is Forex trading legal in Kenya?

Forex trading is legal in Kenya, and traders are free to choose between brokers licensed by the Capital Markets Authority (CMA) and reputable international brokers. While the CMA regulates local firms to enhance consumer protection, Kenyan residents are not restricted from opening accounts with international brokers, provided those brokers accept clients from Kenya. Many traders opt for global companies because they often offer a wider range of platforms, lower minimum deposits, and additional features, while still complying with international regulatory standards.

🔗 defines

What defines the best forex brokers in Kenya

When choosing a broker in Kenya, you should evaluate:

Feature | Why it matters |

Regulation / licensing status | For safety, legal protection, recourse in case of disputes |

Trading platforms offered | Ease of use, reliability, tools for analysis |

Leverage and margin terms | Higher leverage means higher risk; should match your experience |

Spread, commission, swap / rollover costs | These directly reduce your profit |

Deposit & withdrawal methods | Ease and cost of moving money in and out |

Minimum deposit | If you're starting, low minimum deposit helps reduce risk |

Customer support and education resources | Guidance, learning, handling issues matter a lot |

Account types (e.g. swap-free, micro, standard, ECN) | Let you pick what suits your style and constraints |

Transparency of fee structure & trading rules | Hidden fees or unclear rules are red flags |

Example: What NordFX offers

- NordFX has a Client Agreement with clear terms & conditions, includes attachments on trading regulations, swap-free option accounts, etc.

- Minimum deposit options from ~ USD 10 in some account types; spreads from very low (0 pips on zero-type accounts) in favorable conditions.

- A variety of deposit/withdrawal methods including bank cards, online payment systems, crypto, etc.

🔗 impact

Economic impact of forex trading in Kenya

Positive contributions

- Provides opportunities for income generation, especially among youth.

- Contributes to financial deepening: more people engaging in financial markets, learning about macroeconomics, exchange rates.

- Brings in foreign exchange when traders deposit or move funds internationally (if brokers accept international clients).

- Boosts tech and fintech sectors: payment solutions, mobile platforms, educational services for trading.

Risks and potential negative effects

- Losses among novice traders can lead to personal financial hardship.

- Possible fraud or scams, especially from unlicensed brokers, which can hurt trust in broader financial markets.

- Volatility in currencies (e.g. KES) adds risk; also macroeconomic shocks can affect people trading with borrowed money.

- Capital outflows: when profitable trading means moving money out of local bank system relatively quickly.

Data & scale

While exact numbers are not public, market observers estimate increasing volume, number of registered traders, and large amounts of remittances / exchanges involving Forex. The growth of brokers licensed in Kenya or targeting Kenyan clients indicates growing economic footprint.

🔗 mobile

The role of mobile technology on forex trading in Kenya

Mobile technology has had a profound influence on forex trading in Kenya by making the market more accessible than ever before. Since most Kenyans connect to the internet through mobile devices rather than fixed broadband, trading apps designed for smartphones and tablets have opened the door to participation from virtually anywhere. Platforms such as MetaTrader and broker-specific applications are mobile-friendly, ensuring traders can monitor charts, place orders, and manage risk on the go.

Another major development has been the integration of mobile money services, especially M-Pesa. For many traders, depositing and withdrawing through mobile networks is far more convenient than traditional bank transfers, and several brokers now support these methods directly. In addition, mobile technology has expanded access to trading education and tools. Social media channels, messaging apps like WhatsApp and Telegram, and YouTube content provide learning resources, while charting tools and trading signals are increasingly optimized for mobile use.

Despite these advantages, challenges remain. Connectivity issues, particularly in rural areas, can result in delays, slippage, or failed trades. The cost of mobile data also adds up when streaming charts or using resource-heavy trading platforms. Finally, the smaller screen size and lower processing power of some devices can limit analysis and multitasking, meaning traders may find it harder to perform in-depth studies compared to using desktops. Even so, mobile technology continues to lower barriers and fuel the rapid growth of forex trading across Kenya.

🔗 Tips

Tips for new forex traders in Kenya

- Begin with educational resources: online courses, YouTube tutorials.

- Use a demo account to practise without risking real money.

- Only trade with money you can afford to lose.

- Understand risk management: stop-loss, take-profit, position sizing.

- Avoid over-leverage until experienced.

- Keep a trading journal: record trades, reasons, outcomes.

- Be aware of macroeconomic news (interest rates, inflation, central bank announcements) as these affect currency values.

- Choose a broker with good support and clear policies.

🔗 sessions

Forex trading sessions and time zones in Kenya

Session | Approximate Kenyan Time | Characteristics |

Asian / Tokyo / Sydney overlap | ~03:00 – 09:00 | Lower volatility than London/New York overlap, but still usable for some pairs especially Asian and commodity-related ones. |

London session (European) | ~11:00 – 19:00 | Major activity, many macroeconomic releases, high liquidity. |

New York overlap | ~16:00 – 20:00 | Peak volume, volatility; many trades happen here. |

Quiet periods | Overnight local time (Kenya) outside overlap sessions | Lower volatility, wider spreads, risk of illiquidity. |

Kenya is in East Africa Time (EAT) UTC+3. Traders should align their schedule with global sessions to optimize trading – entering during overlaps can give better liquidity and tighter spreads.

🔗 start

How much money do you need to start trading Forex in Kenya?

Minimum required capital

The amount of money needed to begin Forex trading in Kenya depends heavily on the broker, account type, and the trader’s risk tolerance. Key points include:

Scenario | Typical Minimum Deposit (USD equivalent) | Notes |

International / low-cost brokers | $5 to $50 | Some brokers allow these small amounts to open “micro” or “mini” accounts. However, trading costs (spread, commission) may swallow small profits, and low capital limits how many trades you can place. |

Mid-level brokers / more features | $50 to $200 | Gives more room to absorb losses, try different trading strategies, and use better account types. |

Zero-spread or ECN-style accounts | $100 to $200+ | Zero-spread accounts often come with commissions; traders using these usually have more capital so that costs don’t eat profit. |

Safe starting capital for consistent results | $200 to $500+ | Especially for traders intending to trade seriously and make income, not just experiment. Allows risk management, diversification. |

Using demo accounts

Before investing real money, using a demo account is crucial. It allows you to:

- Test strategies without financial risk.

- Learn platform tools.

- Practice risk management.

- Understand how markets move (and how you react emotionally).

Many brokers including NordFX provide demo accounts.

🔗 open

How to open a Forex trading account in Kenya with NordFX

NordFX is a broker that offers many options, and it supports mobile payment methods including for Kenya. Here’s a step-by-step outline for opening an account with them from Kenya, plus relevant features.

Step-by-step: opening the account

1. Visit NordFX website

Go to nordfx.com and locate “Open Account” or “Open Demo Account.”

2. Fill in registration form

Provide name, email, phone number, country of residence.

Choose account type (e.g. MT4 Pro, MT4 Zero, MT5 Pro, MT5 Zero) depending on how much capital, spread/leverage you'd want.

Accept client/user agreements, privacy policy.

3. Verify account

Complete KYC/AML verification: upload ID, proof of address. Once verification is accepted, you’ll be able to deposit funds.

4. Deposit funds

Use any of the supported deposit methods.

5. Install trading platform and choose account type

Download and install MT4 or MT5 on your device, then select whether to use a “Pro” or “Zero” account depending on spreads, commissions, and instrument access.

6. Start trading

After deposit, you can open your first trade.

NordFX account types & features for Kenyan traders

Here are key features of NordFX offerings:

Account Type | Minimum Deposit | Spread / Commission | Instruments | Leverage / Other Perks |

MT4 Pro | USD 10 | Spreads from ~10 pips; no commission | FX Currencies, metals, cryptos, etc. | Up to high leverage (1:1000) in some account types; negative-balance protection; segregation of funds. |

MT4 Zero | ~USD 100 | Zero spread (0.0 pips) but commission per trade | Same instrument variety; access to ECN/interbank liquidity. | Higher starting capital required. |

MT5 Pro | USD 50 | Spread from ~10 pips; few commissions | More modern meta-platform, more tools, more instrument options. | Similar leverage; sometimes better analytics. |

MT5 Zero | USD 200 | Very tight spreads / zero spread; commission-based | Best for frequent traders, high volume, more professional usage. |

🔗 make money

How to make money through Forex in Kenya

Making money in Forex is possible, but it involves skill, discipline, risk control, and strategy. Below are methods, strategies, and realistic expectations.

Trading strategies

- Trend following: Identify and follow market trends; use indicators like moving averages, MACD, RSI.

- Range trading: When market is not trending, identify support/resistance zones.

- Breakout strategies: Trade when price breaks significant levels (resistance, support) with momentum.

- Scalping: Many small trades, small profit per trade; needs very low spreads and execution speed.

- Swing trading: Medium-term holding of positions (hours to days).

Fundamental analysis

- Monitor macroeconomic data: interest rates (CBK, FED, ECB etc.), inflation, trade balances, employment reports. In Kenya, watch CBK announcements, foreign reserve levels, inflation, currency controls.

- Monitor global events: global economic slowdowns, commodity price changes, geopolitical risk, US dollar strength etc.

Risk and money management

- Use stop-loss and take-profit orders to limit potential loss.

- Only risk a small percentage of account on single trade (commonly 1-2%).

- Consider leverage carefully: high leverage can amplify losses.

- Diversify trading pairs; don’t put all capital in one instrument.

Realistic expectations

- It is unlikely to start with very large profits immediately; many new traders lose more than they gain at first.

- Consistency matters more than occasional large gains.

- Learn from losses; keep trading journal of trades, decisions, outcomes.

🔗 manage

How to manage trading Forex in Kenya as a beginner

Managing forex trading as a beginner in Kenya requires laying a strong foundation before committing real money to the markets. The first step is education: traders should take time to learn the basic terminology, how charts and indicators work, and the essentials of risk management. Online courses, books, videos, and webinars are readily available and provide valuable guidance. Alongside theory, it is important to practise using a demo account, which allows new traders to build confidence, test strategies, and gain experience without risking their savings.

Psychology plays a big role in trading success. Fear, greed, and overconfidence often lead to impulsive decisions that undermine even the best strategies. Beginners should plan their trades in advance and avoid chasing losses, sticking closely to a clear trading plan. Keeping accurate records is also crucial. A trading journal that documents setups, reasons for entering or exiting, and outcomes helps traders identify what works and what does not. Reviewing past trades regularly provides insights that lead to steady improvement over time.

Managing costs and preserving capital is another important responsibility. Overtrading should be avoided, as placing too many trades only increases spreads, commissions, and swap charges. Traders must also be aware of overnight swap or rollover fees if they hold positions for longer periods. Maintaining enough margin to cushion against volatility reduces the risk of stop-outs during sudden market moves. Finally, choosing the right broker makes a significant difference. A reliable broker should offer fast execution with minimal slippage, transparent pricing and fees, accessible local deposit and withdrawal options, and responsive customer support to assist when challenges arise.

🔗 Tips

Tips, risks, and best practices for new traders

Key tips

- Always test your strategy on demo before going live.

- Start with small trades / lot sizes.

- Use leverage conservatively.

- Stay updated on news and macroeconomic events affecting currencies.

Common risks

Risk Type | Description |

Market risk | Prices move against your position; potentially large losses if positions aren’t managed. |

Leverage risk | High leverage multiplies both gains and losses. |

Broker risk | Unreliable or unlicensed brokers might manipulate pricing, delays, or fail to honor withdrawals. |

Operational risk | Internet downtime, device problems, slippage. |

Emotional / psychological risk | Making impulsive trades, overconfidence, missing exit signals. |

Regulatory / legal risk | Changes in regulations, currency controls, tax rules. |

🔗 forex trading

The future of forex trading in Kenya

The future of forex trading in Kenya is expected to be shaped strongly by technology. Mobile applications with more user-friendly designs, faster execution speeds, and stronger security will continue to drive accessibility, making it easier for traders to participate wherever they are. Artificial intelligence and machine learning tools are likely to become more common, helping traders generate signals and make more informed decisions. At the same time, blockchain-based solutions and elements of decentralized finance could gradually be integrated, offering greater transparency and efficiency in payments and transactions.

On the regulatory side, stricter oversight by the Capital Markets Authority is expected to strengthen consumer protection and enforce fair trading practices. Collaboration with international regulators may also increase, ensuring that scams or unlicensed brokers targeting Kenyan traders can be addressed more effectively across borders. This shift will build more trust in the industry and create a safer environment for retail participants.

Forex trading in Kenya will also continue to benefit from broader inclusion and democratization. As more people gain internet access, and as costs for data and platforms become lower, trading will be available to a wider segment of the population. Social trading and copy trading are already gaining traction, allowing beginners to follow the strategies of more experienced traders. Finally, the macroeconomic environment will remain a decisive factor. Fluctuations in the Kenyan shilling, movements in inflation and interest rates, and changes in the global economy such as shifts in the strength of the US dollar or commodity prices will continue to influence both major and exotic pairs. This means that while technology and regulation will make trading more accessible and safer, external economic forces will keep shaping the opportunities and risks Kenyan traders face.

🔗 FAQ

FAQ

Below are frequently asked questions by Kenyan forex traders, with answers.

What is the minimum deposit I need with NordFX in Kenya?

Depending on the account type, NordFX allows a minimum deposit as low as USD 10 for some accounts (e.g. MT4 Pro). More premium or zero-spread accounts may require USD 100 or more.

What leverage should I use as a beginner?

Beginners are advised to use low leverage, perhaps 1:10, 1:20 or similar, depending on comfort. High leverage like 1:100, 1:500 or even 1:1000 (available with some brokers) increases both potential gain and risk — use with care. NordFX offers leverage up to about 1:1000 in certain account types.

How much profit can one expect?

Profit depends on many variables: capital, risk management, strategy, discipline, market conditions. Many beginners may break even or incur losses in early months. With experience, consistent modest returns are realistic; but large profits are rare and come with higher risk.

Where can I learn more?

- Broker education sections (e.g. NordFX Learning Center)

- Free online courses, YouTube tutorials

- Local forums, trading groups, but always verify credibility

العودة العودة