A Forex trading journal is an indispensable tool for traders aiming to enhance their performance and achieve consistent profitability. By meticulously documenting each trade, traders can gain valuable insights into their strategies, decision-making processes, and emotional responses. This comprehensive guide delves into the significance of maintaining a Forex trading journal, its essential components, creation methods, and best practices to maximize its benefits.

Table of Contents

What Is a Forex Trading Journal?

Why Is a Forex Trading Journal Important?

What Should a Trading Journal Include?

How to Create a Forex Trading Journal

Examples of Effective Forex Trading Journals

Best Practices for Maintaining a Forex Trading Journal

Tools and Software for Forex Trading Journals

Key Takeaways

- A Forex trading journal systematically records all trading activities, providing insights into performance and areas for improvement.

- Essential components include trade specifics, market conditions, emotional states, and performance metrics.

- Utilizing tools like spreadsheets or dedicated software can streamline the journaling process.

- Regular review and adherence to best practices enhance the effectiveness of a trading journal.

What Is a Forex Trading Journal?

A Forex trading journal is a structured and comprehensive log where traders meticulously document their trading activities. It includes key details such as the time and date of trades, entry and stop-loss, position sizes, chosen instruments, and the rationale for executing each trade. This detailed record serves as a personal trading ledger, helping traders maintain clarity and organization in their trading practices.

More than just a log, a Forex trading journal acts as a powerful analytical tool. By consistently reviewing past trades, traders can uncover patterns in their decision-making processes and trading behaviors. This reflection enables them to pinpoint areas of strength, such as effective strategies or market conditions they excel in, as well as identify weaknesses that may need improvement, like emotional trading or inconsistent risk management.

A well-maintained journal is also invaluable for fostering discipline and long-term growth. It encourages traders to evaluate their performance objectively, refine their strategies, and develop a data-driven approach to trading. Whether a trader is a beginner or an experienced professional, the habit of maintaining a Forex trading journal is a critical component of achieving consistency and success in the market.

Why Is a Forex Trading Journal Important?

A Forex trading journal is more than just a log of trades; it is a powerful tool that can significantly enhance a trader's journey toward consistent profitability. By maintaining a detailed record of trading activities, traders unlock the ability to reflect on their actions, evaluate their strategies, and continuously improve. This process of self-assessment helps traders build a foundation for long-term success in the highly dynamic Forex market.

One of the foremost advantages of a trading journal is its role in performance analysis. It allows traders to revisit their past trades and critically evaluate the decisions that led to profits or losses. This reflective practice sheds light on which strategies worked well under specific market conditions and which failed, enabling traders to make data-informed adjustments to their methods. Over time, this continuous refinement enhances both efficiency and effectiveness in trading.

Beyond strategy, a trading journal fosters emotional intelligence by helping traders document and analyze their feelings during different phases of a trade. This practice reveals emotional triggers, such as anxiety, overconfidence, or fear, that might lead to impulsive or irrational decisions. By identifying these patterns, traders can take proactive steps to manage their emotions, ensuring that their actions remain aligned with their trading plan rather than being swayed by temporary sentiments.

Additionally, journaling enforces discipline and consistency, two critical pillars of successful trading. By maintaining a routine of recording trades and analyzing them, traders reinforce the importance of following a structured approach. This habit reduces the likelihood of deviating from established plans, promoting adherence to proven strategies even in the face of market volatility. Consistency in journaling mirrors consistency in trading, which is vital for achieving long-term results.

Risk management is another area where a trading journal proves indispensable. Reviewing historical trades helps traders gauge their risk tolerance and understand the implications of their decisions. By analyzing key metrics like the risk-to-reward ratio, win rate, and maximum drawdown, traders gain deeper insights into their exposure and can adjust their risk management techniques accordingly. This focus on risk helps protect capital while pursuing steady growth.

As NordFX highlights, a trading journal offers traders the unique ability to identify recurring patterns and trends in their performance. This ability to uncover hidden insights enables traders to make meaningful improvements over time, transforming their trading habits and overall approach to the market.

What Should a Trading Journal Include?

An effective trading journal should encompass the following elements:

Trade Details

- Entry and Exit Points: The exact prices at which positions are opened and closed.

- Position Size: The volume of the trade.

- Stop-Loss and Take-Profit Levels: Pre-determined levels to manage risk and secure profits.

- Trade Direction: Indication of whether the trade is a buy or sell.

Market Conditions

- Market Trend: The overall direction of the market during the trade.

- Economic Indicators: Relevant news or data releases that could impact the market.

- Technical Indicators: Indicators used to justify the trade, such as moving averages or RSI.

Emotional State

- Pre-Trade Emotions: Feelings before entering the trade, such as confidence or anxiety.

- Post-Trade Emotions: Emotions after exiting the trade, like satisfaction or regret.

Performance Metrics

- Profit or Loss: The financial outcome of the trade.

- Risk-to-Reward Ratio: Comparison of potential risk to potential reward.

- Win Rate: Percentage of profitable trades over a period.

Incorporating these components provides a holistic view of trading activities, facilitating comprehensive analysis and improvement.

How to Create a Forex Trading Journal

Establishing a trading journal can be approached through various methods:

Using Spreadsheets

Spreadsheets offer flexibility and customization for journaling:

- Excel or Google Sheets: Create a structured template to log trade details, market conditions, and performance metrics.

- Formulas and Charts: Utilize formulas to calculate metrics like profit/loss and risk-to-reward ratios; implement charts for visual analysis.

For guidance on creating a Forex trading journal in Excel, refer to this resource.

Dedicated Software

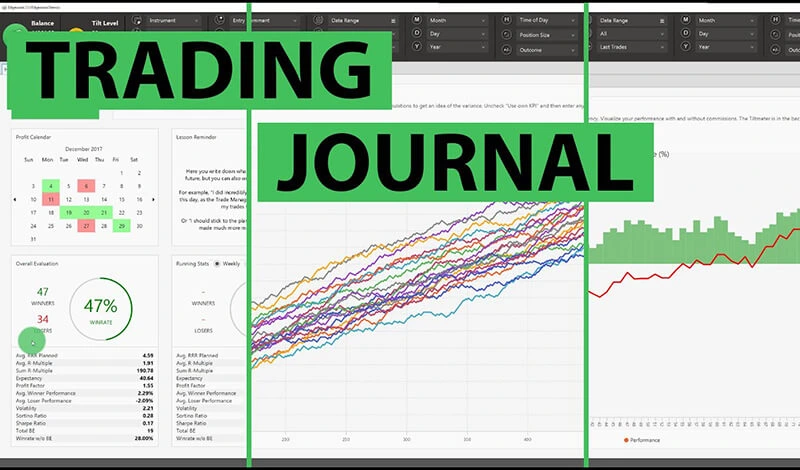

Specialized trading journal software can enhance the journaling process:

- Features: Automated data import, advanced analytics, and performance tracking.

- Examples: Platforms like Forex Smart Tools and TradingDiary Pro offer comprehensive journaling solutions.

Selecting the appropriate method depends on individual preferences and trading requirements.

Examples of Effective Forex Trading Journals

Examining well-structured Forex trading journals provides valuable inspiration and guidance for creating your own. These journals demonstrate how meticulous record-keeping can enhance trading performance, offering insights into the types of formats and approaches that work best for different trading styles.

One effective example is template-based journals, which utilize pre-designed formats with essential fields for trade logging and analysis. These templates often include sections for recording trade details such as entry and exit points, position size, and market conditions, along with areas for performance metrics like profit and loss or risk-reward ratios. They are ideal for beginners, as they provide a structured framework that ensures no critical information is overlooked. Many traders find these templates easy to use and customizable, making them an excellent starting point.

On the other hand, customized journals offer a more personalized approach. These are often built from scratch to align with a trader’s unique strategies, goals, and preferences. For example, a day trader might emphasize fields for tracking intraday patterns and emotional responses, while a swing trader might prioritize data on long-term trends and macroeconomic influences. Custom journals allow traders to focus on the aspects most relevant to their success, enabling deeper insights and a more targeted evaluation of their performance.

Some of the most effective trading journals also incorporate visual elements such as charts and graphs to analyze trends over time. For instance, a trader might include a chart tracking their monthly win rate or a graph illustrating their cumulative profits. These visual aids make it easier to identify patterns and pinpoint areas for improvement, turning raw data into actionable insights.

Whether using a pre-designed template or a fully customized journal, the key to effectiveness lies in consistency and attention to detail. A well-maintained journal not only records trades but also reflects the trader's mindset, strategies, and progress, ultimately serving as a roadmap for continuous improvement.

Table: Key Components of an Effective Forex Trading Journal

| Component | Description |

| Trade Details | Entry/exit points, position size, stop-loss/take-profit levels, trade direction. |

| Market Conditions | Market trends, economic indicators, technical analysis used. |

| Emotional State | Feelings before, during, and after the trade. |

| Performance Metrics | Profit/loss, win rate, risk-reward ratio, maximum drawdown. |

Best Practices for Maintaining a Forex Trading Journal

A Forex trading journal is a powerful tool, but its effectiveness depends on how well it is maintained. By following best practices, traders can ensure their journal serves as an invaluable resource for improving performance and achieving long-term success.

Be Consistent:

Consistency is the cornerstone of an effective trading journal. Ensure you update your journal immediately after each trade while the details are fresh in your mind. Delayed entries can lead to forgotten details or inaccurate records, reducing the journal’s reliability as a reflection of your trading activity. Make it a habit to include every trade, even small ones, to get a comprehensive picture of your trading patterns.

Review Regularly:

Setting aside time to analyze your trading journal on a weekly or monthly basis is essential. Regular reviews allow you to identify patterns, such as which strategies yield the most consistent profits and which market conditions tend to lead to losses. Reviewing also helps you track progress toward goals and refine strategies based on data-driven insights. This reflection is crucial for maintaining accountability and continuous improvement.

Set Clear Goals:

A trading journal becomes even more effective when tied to specific objectives. Use it to define and monitor short-term and long-term goals, such as improving your risk-reward ratio, increasing your win rate, or mastering a new trading strategy. Clearly documented goals make it easier to measure progress and stay focused on achieving tangible milestones.

Focus on Quality Over Quantity:

While it’s important to document every trade, prioritize detail over volume. Comprehensive entries that include trade specifics, market context, and emotional states provide more value than superficial records. This approach ensures you have enough information to extract meaningful insights during reviews. For example, instead of simply noting a trade as a “win” or “loss,” detail the factors contributing to the outcome.

Leverage Visual Data:

Incorporating visual tools like graphs and charts can make your journal more informative and easier to analyze. For instance, a bar graph of monthly profits or a pie chart of winning versus losing trades can quickly highlight trends that might take longer to spot in raw data. Visual data helps you see the bigger picture and identify areas that require attention, such as periods of underperformance or strategies that consistently perform well.

Keep It Organized:

Structure your journal in a way that makes it easy to navigate. Use sections or tabs to separate different types of information, such as trade details, emotional notes, and performance metrics. A well-organized journal ensures you can quickly find relevant data during reviews and minimizes the risk of overlooking important insights.

Integrate Emotional Analysis:

Forex trading involves not just strategy but also emotional management. Record your emotional state before, during, and after each trade to uncover patterns, such as overconfidence leading to unnecessary risks or anxiety causing hesitation. Recognizing and addressing these patterns can help you make more rational decisions in the future.

By adhering to these best practices, your Forex trading journal will become a vital tool for self-assessment and growth. It will help you track progress, refine strategies, and maintain the discipline needed for consistent success in the Forex market.

Tools and Software for Forex Trading Journals

While spreadsheets offer flexibility, several tools and software are specifically designed for Forex trading journals:

Table: Comparison of Popular Forex Trading Journal Tools

| Tool | Key Features | Price |

| TradingDiary Pro | Automated data import, performance analytics | Paid (Free trial available) |

| Edgewonk | Trade tagging, psychological feedback | Paid |

| MyFXBook | Community-based insights, automated data sync | Free/Paid |

MyFXBook is a widely recognized online platform designed to enhance the trading experience for Forex traders by providing advanced analytics, performance tracking, and social networking features. It allows traders to connect their trading accounts for real-time monitoring, enabling them to analyze their performance through detailed metrics such as win rates, risk-to-reward ratios, and drawdowns. MyFXBook also offers tools like automated trade verification, economic calendars, and trading signals to support decision-making. Additionally, its social networking aspect allows traders to share strategies, discuss market insights, and benchmark their results against peers, fostering a collaborative and educational trading environment. With its user-friendly interface and comprehensive features, MyFXBook is an invaluable resource for traders seeking to improve their skills and gain deeper insights into their trading performance.

Common Mistakes to Avoid

While maintaining a Forex trading journal is an invaluable practice, many traders encounter challenges that undermine its effectiveness. Recognizing and addressing these common mistakes can help ensure that your journal remains a useful tool for improving your trading performance.

Incomplete Entries:

One of the most frequent mistakes is neglecting to record critical details for each trade. Entries that lack key information, such as the reasoning behind the trade, emotional states, or the market conditions at the time, fail to provide a complete picture. This omission makes it harder to analyze trades effectively and learn from past experiences. Ensuring that every entry includes comprehensive details will enhance the value of your journal as a learning and diagnostic tool.

Inconsistent Updates:

Skipping journal entries or delaying updates is another common issue. When trades are not recorded promptly, important details can be forgotten, leading to incomplete or inaccurate records. This inconsistency diminishes the journal’s reliability and limits its usefulness for identifying patterns or evaluating strategies. To avoid this, make journaling a non-negotiable part of your trading routine, updating it immediately after each trade.

Ignoring Data Analysis:

Some traders view journaling as a mere task of logging trades without taking the time to analyze the collected data. While documentation is essential, the true value of a trading plan lies in reviewing and interpreting the information it contains. Neglecting this step means missing out on opportunities to identify strengths, weaknesses, and recurring patterns. Regularly schedule time to review your journal, extract insights, and apply them to refine your trading strategies.

Overcomplication:

Including excessive details or creating an overly complex structure can make a trading journal difficult to maintain. While it’s important to capture relevant information, overloading your journal with unnecessary data can make it cumbersome and time-consuming to update. Focus on including only the most impactful details, such as trade specifics, emotional notes, and performance metrics, to strike a balance between thoroughness and simplicity.

Neglecting Goals:

A trading journal without clear objectives is like a map without a destination. Failing to set and monitor progress toward specific goals, such as improving a particular strategy or reducing losses, undermines the journal’s purpose. Use your journal not only to document trades but also to track your progress in achieving defined milestones. This approach adds direction to your trading activities and provides motivation to improve.

Lack of Emotional Insights:

Trading is as much about managing emotions as it is about strategy, yet many traders overlook the importance of documenting their emotional states. By skipping this step, traders miss the chance to identify how emotions like fear or greed influence their decisions. Including emotional reflections in your journal helps you become more aware of psychological factors, enabling you to make more rational and disciplined trading choices.

Focusing Solely on Losses or Wins:

Some traders only journal losing trades, seeking to understand what went wrong, or only focus on wins to celebrate their success. Both approaches are incomplete. Every trade—profitable or not—offers insights into strategy effectiveness, market conditions, and emotional responses. Ensure that you document all trades to create a balanced and accurate record for analysis.

By avoiding these common mistakes, you can ensure your trading journal remains an effective tool for growth and improvement. A well-maintained journal provides the insights and discipline needed to navigate the complexities of Forex trading with confidence and precision.

Frequently Asked Questions

What is the best format for a Forex trading journal?

The best format depends on personal preference. Spreadsheets are flexible and customizable, while dedicated software provides automation and advanced analytics.

How often should I review my Forex trading journal?

Ideally, you should review your journal weekly to assess short-term performance and monthly for long-term patterns and trends.

Can a Forex trading journal help reduce emotional trading?

Yes, documenting emotional states helps identify triggers for impulsive decisions, allowing you to address these patterns.

What tools can automate my Forex trading journal?

Tools like MyFXBook and TradingDiary Pro can automate data import and provide detailed performance analytics.

How do I analyze my Forex trading journal effectively?

Focus on key metrics such as win rate, risk-reward ratio, and maximum drawdown. Look for patterns in successful and unsuccessful trades to refine your strategy.

Throughout this article, we’ve linked useful resources for further exploration. Here are some internal links to explore:

For a detailed step-by-step guide, watch this helpful YouTube video.

This guide is designed to help traders of all levels understand the value of a Forex trading journal and use it to its fullest potential.

Go Back Go Back