First, a review of last week’s forecast:

- EUR/USD. Recall that experts appeared to be completely bewildered when giving last week’s forecast: 40% of them voted for the growth of the pair, 40% for its fall and 20% for a sideways trend. The indicators did not clarify the situation either, showing a very similar dispersion in their readings. Graphical analysis was alone in pointing unambiguously to the north, where the pair indeed went, having reached 1.2033 on Wednesday 20 September.

The main event of the day was an atypical meeting of the US Federal Reserve, which confirmed the expediency of another increase in the interest rate in 2017 followed by three increases in 2018. In addition, the Fed, finally, decided to start reducing its balance. All this led to a sharp increase in the dollar, and the EUR/USD suddenly fell 170 points, stopping at 1.1860. After that, the bulls vigorously won back the losses, and the pair finished the week practically at the same place where it started: near 1.1950, having performed the predicted scenarios of all three groups of experts; - As for the future of GBP/USD, most experts (65%), supported by graphical analysis and 40% of oscillators, expected a correction of the pair down to the level of 1.3500. 1.3665 was named the main resistance. This forecast can be considered almost 100% fulfilled, since, adjusting for a standard backlash, the pair remained in this channel.

At the beginning of the week, it dropped to 1.3463. Then, on the back of data on UK retail sales, it began to grow. It then reacted to the Fed meeting, and eventually returned to 1.3500; - Naturally, USD/JPY could not ignore the news from the US either. In the first half of the week, the forecast for this pair - a sideways trend, for which 85% of analysts voted - was brought to life with an accuracy of 1 point: having started the week at 111.09, it encountered the Fed speech on Wednesday, 20 September at the same position. After that, the yen began to fall and completed the five-day period in the central zone of the mid-term side channel, where it has been moving for more than six months, at 112.00;

- USD/CHF. Only 15% of analysts and graphical analysis on H4 took the side of the bulls, considering that the pair should grow to the level of 0.9765. But their few voices unexpectedly received active support from the hawks of the Fed, thanks to which the pair almost reached that goal, rising to the height of 0.9746. As for the end of the workweek, it found it in the region of a strong support/resistance level of 0.9700.

As for the forecast for the upcoming week, at the time of writing the results of the federal elections in Germany are not yet known.

The impact these elections may have on the movement of the major currency pairs requires no explanation. Meanwhile, summarizing the opinions of analysts from a number of banks and brokerages, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

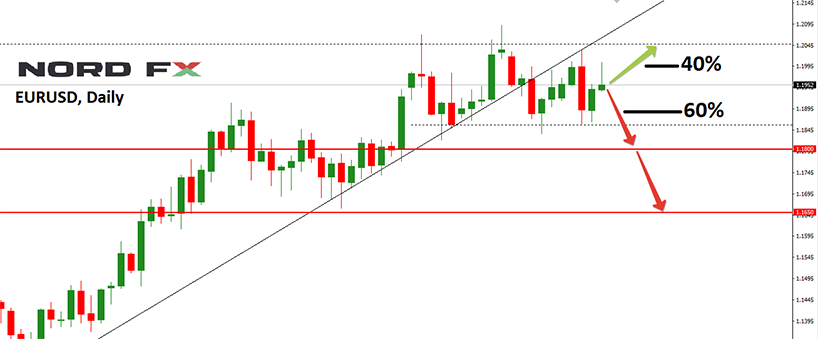

- EUR/USD. Thanks to the Fed decision on a fourfold increase in the interest rate in 2017-18, most experts (60%) have sided with the bears, expecting the dollar to initially rise and then fall. However, the range of fluctuations indicated by analysts is within the limits of 1.1800-1.2100, which allows us to speak about the continuation of the lateral trend that began in the last week of August.

As for graphical analysis, for the next two or three weeks it predicts a fall of the pair to 1.1650. But this can only be said if the elections in Germany do not bring unexpected surprises to the market;

- As for the future of GBP/USD, it is clear that most of the indicators on D1 are looking northward. As for their colleagues on H4, the vector is directed horizontally eastwards. Graphical analysis expects the continuation of the lateral trend in the 1.3460-1.3660 range as well. Experts' opinions for the next week are as follows: 35% side with the bulls, 45% side with the bears, and 20% give a neutral forecast. If we move to the medium-term analysis, we now see that 80% of experts vote for the growth of the dollar and the fall of the pound. The support levels are 1.3460, 1.3160 and 1.2850. The resistance levels are 1.3660, 1.3835 and 1.4000.

- USD/JPY. 85% of analysts, supported by one third of oscillators on D1, expect the pair to fall to 110.70, after which the uptrend may continue. The targets are 112.65, 113.50 and 114.50. Support is at the levels 111.10, 110.70, 109.85 and 109.40;

- 80% of indicators and graphical analysis on D1 predict the growth of USD/CHF to 0.9770 and, in the event of its breakthrough, 50 points higher to the level of 0.9820. The final target is the height of 0.9900. However, only 20% of experts agree with this point of view. The remaining 80% expect, instead, a fall of the pair and its movement in the 0.9585-0.9770 range. This scenario is supported by 25% of oscillators who signal this pair is overbought. If the pair breaks through the lower border of the channel, the next support would be at 0.9525.

Roman Butko, NordFX

Go Back Go Back