First, a review of last week’s events:

- EUR/USD. On Thursday, November 07, the US markets updated historical highs after reports of the US and China willingness to remove duties as new parts of the Trade Treaty are being signed. Speculators have turned their backs on traditional safe havens such as bonds, yen and gold. The European currency has also become cheaper against the dollar: investors expect the US macroeconomic indicators to improve after the US-China trade war ends. And although it is still a long way to signing a full-fledged agreement, analysts believe that Donald Trump will no longer make any sudden moves ahead of the upcoming US presidential election.

Last week 40% of experts, supported by graphical analysis, voted for the reduction of the Euro. 10% of the oscillators pointed that the European currency was overbought, which is a strong signal for the trend to change. In the case of a breakdown of the lower border of the side channel 1.1075-1.1175, the bearish scenario provided for a decrease of the pair to support in the 1.1000 zone. This was what happened in reality: by the end of the week session, the pair was at 1.1016, and the final chord was set at 1.1020; - GBP/USD. As expected, the Bank of England left the interest rate unchanged at 0.75%. But what analysts did not expect was that two of the nine members of the monetary policy Committee would vote to cut the rate to 0.50%. These two votes were enough for the pound to lose more than 70 points.

In general, as expected, the pound followed in the wake of the Euro. And if the EUR/USD pair lost about 150 points in five days, the British currency fell by 170 points, ending the week at 1.2780; - USD/JPY. As mentioned above, the progress in the US-China talks reflected on the attractiveness of the yen as a safe-haven currency. As a result, the fall of the Japanese currency against the dollar at the maximum on Thursday 07 November amounted to 130 points. The pair met the end of the five-day period at the level of 109.22;

- cryptocurrencies. As for the news background, so strongly affecting the quotes of digital currencies, the past week was not particularly outstanding. Therefore, Bitcoin quietly moved along the consolidation line in the corridor $9,100-9,500 until Friday. However, November 08 brought disappointment to investors and traders who opened long positions. The reference cryptocurrency went down sharply and, having lost 6% of its value in a few hours, found a local bottom at the level of $8,680.

It is difficult to say unequivocally what was the reason for such a fall. Fans of technical analysis refer to the narrowing triangle on the 4-hour BTC/USD chart. The reason could be the news about another – the seventh this year – hacking of a cryptocurrency exchange. This time, hackers withdrew funds in 23 digital assets totaling about $500 thousand from the Vietnamese exchange VinDAX.

Speaking of digital assets. The past week is interesting because a number of top altcoins did not follow in the wake of the main cryptocurrency but demonstrated independent dynamics. Unlike Bitcoin, which went to the south, Ethereum (ETH/USD) completed the seven-day period in the same place where it began, and Litecoin (LTC/USD) put up by 5%.

Ripple was different. It should be noted that, despite the efforts of the management of Ripple, the clouds over this token continue to thicken. It "shrunk" by 90% in 2018-2019. The last week was no exception. The week volatility of the XRP/USD pair was about 14%, and it fell to the level of 0.2710 on Friday 07 November.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. In the coming week, we are expecting a lot of significant economic events. Among them the speech of the head of the Federal Reserve Jerome Powell in the US Congress in the middle of the week should be noted. Also, the formation of local trends may be influenced by inflation data in the United States on Wednesday 13 November, the Eurozone GDP estimate on Thursday 14 November, and data on retail sales in the United States on Friday 15 November.

The rate of inflation in the United States should be seen with a special attention, because if inflation for October is much lower than the forecast, the Fed may decide on the fourth this year's interest rate cut next month.

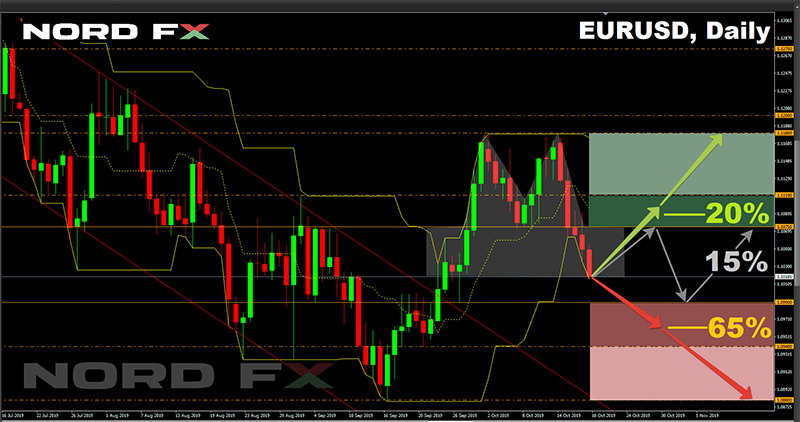

And, of course, the market will listen carefully to the news about the progress of the US-China trade war. There are many chances that the optimism associated with the decision of the parties to phase out customs tariffs will continue this week. Investors are also expecting some positive news from US President Trump's meeting with Chinese President XI Jinping in December. That is why 65% of experts voted for the further strengthening of the dollar and the decline of the Euro to the zone 1.0940-1.0990. The further target is the minimum of October 01, 1.0880.

Graphical analysis and indicators show a rare unanimity with analysts: 90% of oscillators and 100% of indicators are colored red.

Only 20% of experts and 10% of oscillators expect the pair to grow, signaling it is oversold. The nearest resistance zone is 1.1075, then 1.1110 and 1.1180.

And finally, the remaining 15% of analysts talk about a sideways trend. Over the past four weeks, the pair has formed a double-headed top, and experts expect it to stay at its base for some time, moving in the range of 1.0990-1.1075;

- GBP/USD. The UK economy is experiencing constant difficulties because of the uncertainty due to Brexit. There was a decline in the construction industry by 1.3% in the 2nd quarter of this year and a drop in industrial production, caused, among other things, by the closure of several automobile plants. For this reason, data on UK GDP in the 3rd quarter, which will be known on Monday 11 November, can cause serious jumps in the British currency. According to the forecast, GDP growth could reach +0.3% against -0.2% in the previous quarter, which will push the pair up.

The main driver of the GBP/USD pair will remain the dollar. As in the case of the Euro, 65% of experts, graphical analysis on D1 and the vast majority of indicators are waiting for its strengthening and the fall of the pound. Supports are at 1.2700, 1.2650 and 1.2550 levels.

As for the remaining 35% of analysts, they believe that after reaching the lower limit of the three-week side channel 1.2770-1.3000, the pair will turn around and go north. 15% of oscillators on H4 and D1 agree with this as well, giving signals that the pair is oversold; - USD/JPY. The situation with the Japanese currency is similar to the Euro and the pound. It is also under pressure from improving macroeconomic indicators of the United States and China after the signing of the "Peace Treaty".

On Thursday, November 14, data on Japan's GDP growth in the 3rd quarter will be released. Analysts are already predicting a slowdown in the Japanese economy. So the Japanese yen will have another reason to weaken in the short term, with which 65% of experts agree. The nearest resistance level is 109.50, then 110.00 and 110.70.

Only 10% of analysts have voted for the strengthening of the yen and the decline of the pair, and 25% believe that the pair will move sideways along the Pivot Point 109.00; - cryptocurrencies. The Bitcoin Crypto Fear & Greed Index deviated from the average value and moved closer to the fear zone by the end of the week. According to the classical interpretation, this position is a reason to think about opening long positions. However, investors have recently become much more cautious and expect all sorts of traps from sharp price spikes.

60% of experts remain pessimistic as well. So, according to Bloomberg analysts, the first cryptocurrency has a chance to fall to the level of $8,000 before the end of the year. The growth of the BTC/USD pair, as already mentioned, will be hampered by sales due to fears of "burning". However, despite this, 40% of experts believe that bitcoin will still be able to meet the onset of 2020 in the $10,500-11,000 zone.

For those who do not want to be nervous, daily watching the schedule of quotations, here is a piece of advice from the Director of the American bitcoin exchanger BitInstant Charlie Shrem. In his opinion, "the best way to invest in bitcoin is to hide 5 to 10 BTC in a cold wallet, and in such a way that you yourself can not access them for 20 years." "I do believe," he said, " that in 20 years 5-10 Bitcoins will be the money that will change your life for the better. Bitcoin will survive even a nuclear disaster, while banks and paper money will literally burn."

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back