First, a review of last week’s events:

- EUR/USD. The dollar is slowly weakening, the pair moved above Pivot Point 1.1240 last week, but is still within the five-week channel 1.1170-1.1350. As expected by 25% of experts, the bulls made an attempt to reach the level of 1.1400, but their attack choked quickly, and, turning at the height of 1.1370, the pair went down again, ending the five-day period in the 1.1300 zone.

The pressure on the American currency is explained by the improvement in the economic situation in a number of countries, including the EU. Enterprises have started working there, demand is recovering, buyers are returning to stores, unlike the United States, where even Fed officials doubt the ability of the economy to recover quickly. Thus, FOMC members Rosengren and Barkin noted that, having fulfilled the old orders, the industry has so far not received new ones. And this could lead to further printing of dollars and an increase in the quantitative easing (QE) program.

All this comes amid a new wave of the COVID-19 pandemic. On Wednesday, July 08, a new peak of infections was reached in the United States, 60 thousand people. The number of deaths doubled compared with average levels, reaching 1000 per day, which is a significant reason for the growth of pessimism among market participants.

The euro, on the contrary, feels better, thanks to the improvement of the epidemiological situation and the competent monetary and fiscal policy of the EU. Support for Europe is also provided by the rapidly strengthening yuan and, paradoxically, the US president Donald Trump. More precisely, his falling ratings, because of which he is now not up to the trade wars with China. And if Democrat Joe Biden becomes the new president, then Washington’s policy towards Beijing may change dramatically, which will lead to further growth of the Chinese and, as a consequence, European economies; - GBP/USD. In the last issue of the forecast, we wondered whether the growth of the pound was considered a temporary correction or a serious turnaround in the trend. The vast majority of indicators, along with graphical analysis, predicted a further rise for the pair. A total of 50% of experts also spoke in favor of its northward movement, with 30% pointing to a resistance of 1.2680 as a limiter. And they were right: the week's high was recorded at 1.2670, followed by a slight bounce down and a finish at 1.2625.

The steady growth of the pound was facilitated by the widespread weakening of the dollar (the reasons are indicated above), as well as moderate optimism caused by the negotiations on the terms of the UK's exit from the EU; - USD/JPY. Tokyo, like a number of US states, has also recorded a record rise in coronavirus cases. However, so far this is not very worrying for investors, especially since the data on actual orders for machine tools and equipment that became known this week turned out to be higher than forecast, which indicates some recovery in the Japanese economy.

Against the backdrop of a general weakening of the dollar, the yen was able to strengthen its position a bit: starting the week from 107.50, the pair sank to the horizon of 106.65 by Friday evening. The final chord of the week was set at 106.90; - cryptocurrencies. If a few months ago, the main topic of discussion was the question of whether Bitcoin can be considered a safe haven asset, now the topic of correlation of the main cryptocurrency with the stock market is constantly being discussed. For example, the Skew portal calculated that the correlation between bitcoin and the S&P500 index has now reached a historical high and currently its coefficient is approximately 66%. According to portal analysts, this means that Bitcoin has failed to become the antithesis of traditional finance and is moving in the same harness with them. Some even called bitcoin a "stock market startup."

There is a certain logic to this, since the main source of financing for both markets, both the stock and crypto, have been central banks in recent months, and, first of all, the US Federal Reserve, which pours the economy with a huge amount of cheap money.

But if you look at the graphs, a completely different picture emerges. Since the May halving of the BTC, the S&P500 index has risen by about 9%, the Nasdaq 100 - by 19%, but bitcoin, having failed to gain a foothold above $10,000, has gone down and now is consolidated in the $9,000-9,500 zone. So where's the correlation?

Unlike the stock market, bitcoin does not look like the most attractive asset at the moment, despite the entreaties of all kinds of crypto gurus. The main cryptocurrency continues to consume a huge amount of energy, and at its current price, it loses its supporters even among miners, whose revenue, according to Coindesk estimates, fell by 26% in June.

The cryptocurrency market capitalization has grown slightly over the past week, reaching $269 billion, and has only returned to where it was already on June 22 and 24. The Crypto Fear & Greed Index of Bitcoin has not changed at all for the week: its arrow is still at 41.

Such sluggishness of the main cryptocurrency plays into the hands of altcoins, especially since it has become much easier to buy them than a year or two ago. And if on May 15 the share of Bitcoin in the crypto market was 69.81%, now it has dropped to 62.79%. That is, in less than two months, the drop was 7.02% in absolute terms and 10% in relative terms.

Unlike BTC, many altcoins show impressive growth in July, and this can't help but attract investor attention. So, for example, the growth of Ethereum (ETH/USD) at the high of July 07 was about 10%, Ripple (XRP/USD) - 20%, Cardano - 34%. The record holders were Dogecoin, which added 79% after the viral video in TikTok and VeChain with 101%.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. If earlier the main reference point for investors was US stock indices, now everything has changed. At the beginning of July, the ball is ruled not at all by the American S&P500, but by the Chinese Shanghai Composite. And if before the US economy grew much faster than the European economy, fueled by trade wars with China, things have now turned 180 degrees. Now the Fed no longer has the ability to raise the interest rate, making the dollar more attractive compared to rival currencies. A black cloud over the US economyis the prospect of massive non-repayment of loans, which are the main driver of its growth.

The dollar index has already returned to the area of June lows, losing 1.4% since early July, and this trend threatens to become long-term. According to some experts, the American currency may lose up to 20% of its value within a few years, losing most of what has been won since 2014.

The average forecast of the 11 largest US banks indicates the EUR/USD pair at 1.1500 by the end of 2020. The only one to favor the strengthening of the dollar and lower the pair towards 1.0500 was investment bank Merrill Lynch. The reason for this forecast was the expectation of an expansion of the ECB's quantitative easing program by €400-600 billion.

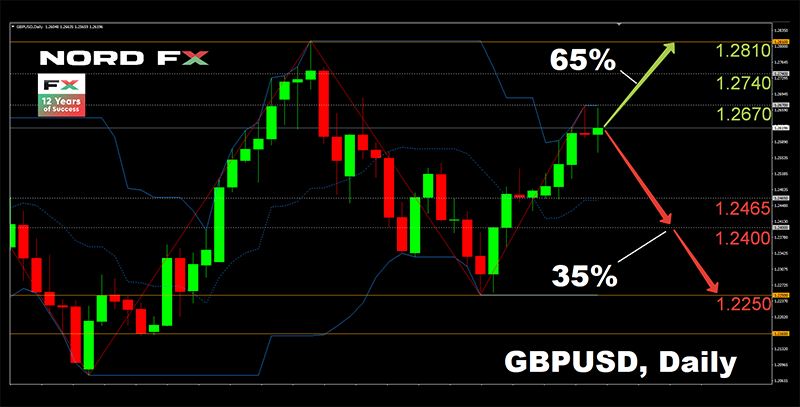

If we talk about the forecast for the coming days, according to the Bloomberg Probability Calculator, based on the readings of the options market, the EUR/USD pair has a better chance to rise above 1.1500 than to fall below 1.1200. 80% of oscillators and 95% of trend indicators on D1 are also colored green. The remaining 15% of the oscillators give signals that the pair is overbought. - GBP/USD. This week we expect: Monday, July 13, a statement by the head of the Bank of England, Andrew Bailey, Tuesday - data on GDP, Wednesday - on the consumer market, and Thursday - on the UK labor market. Particular attention should be paid to Tuesday 14 July: according to preliminary forecasts, GDP growth in May may be 5% compared with a drop of 20.4% a month earlier. And if the forecast proves correct, it could serve to further strengthen the British currency.

Its growth is expected by 65% of experts, supported by 80% of oscillators and 90% of trend indicators on H4, as well as 85% of oscillators and 95% of trend indicators on D1. The main goal is the high of June 10, 1.2810, resistance is located at levels 1.2670 and 1.2740.

The opposite point of view is shared by 35% of analysts and the remaining oscillators, painted red on H4 and located in the overbought zone on D1.

It should be noted that when switching from a weekly forecast to a monthly one, the number of bear supporters among experts increases to 60%. The goal is to return the pair to the 1.2250-1.2400 zone;

- USD/JPY. Except for a single release on June 2-05, the pair has been moving in the lateral corridor 106.00-108.10 for 13 weeks, and, according to experts, is not going to leave its limits yet. At the same time, 70% of analysts vote for further strengthening of the yen and reduction of the pair to the lower border of the corridor, supported by graphical analysis on H4, and 30% are for its growth to the upper border. Among the oscillators on both H4 and D1, 80% are colored red, 95% among trend indicators.

In terms of important economic developments, the Bank of Japan will decide on the interest rate on Wednesday, July 15, followed by a press conference of its management. However, surprises are most likely not worth waiting for, and the rate will remain negative at the level of -0.1%; - cryptocurrencies. The gurus of this market, as usual, compete in predictions regarding the rise of Bitcoin. So, a team of researchers from the Bloomberg Agency published a report, according to which the BTC/USD pair is expected to grow to $12,000 in the near future. Recall that among Bloomberg analysts, Mike McGlone is an ardent supporter of the largest cryptocurrency. He said back in June that a BTC jerk was imminent, with the result by the end of the year being to overcome the psychological milestone of $20,000.

- Anthoni Trenchev, Managing Partner of Nexo Credit Platform, gave an even more optimistic forecast. In his opinion, the value of bitcoin may exceed $50,000 in a few months. During an interview at the Block Down conference, Anthoni Trenchev said that the Nexo platform is growing tens of percent every month, new customers are constantly registering, both retail and institutional investors. And it is the increased participation of institutionals that can be the driver of growth. I admit, this is a bold statement, but fundamental factors and a change in attitude towards cryptocurrency make it real,” he concluded.

The fact that the attitude is changing is indisputable. According to the survey conducted by The Tokenist in 17 countries, 45% of respondents would prefer to have cryptocurrency instead of stocks, real estate and gold, and among millennials their share is 92%.

And now the results of another survey conducted on Twitter by popular cryptanalyst under the nickname PlanB with the aim of finding out what price BTC will be by the end of 2021. Of the nearly 27,000 surveyed, the majority (53%) were inclined to a high of $55,000. Nearly 30% of respondents named the $100,000 mark. And 17% do not exclude the option in which BTC will approach $ 300,000.

As for forecasts for the next week, the vast majority of analysts still consider the level of $9,000 as Pivot Point for the pair BTC/USD, citing the lower limit of fluctuations as $8,800, the upper - $9,700. And only 10 per cent believe the pair could drop to the $8,400 zone.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back