First, a review of last week’s events:

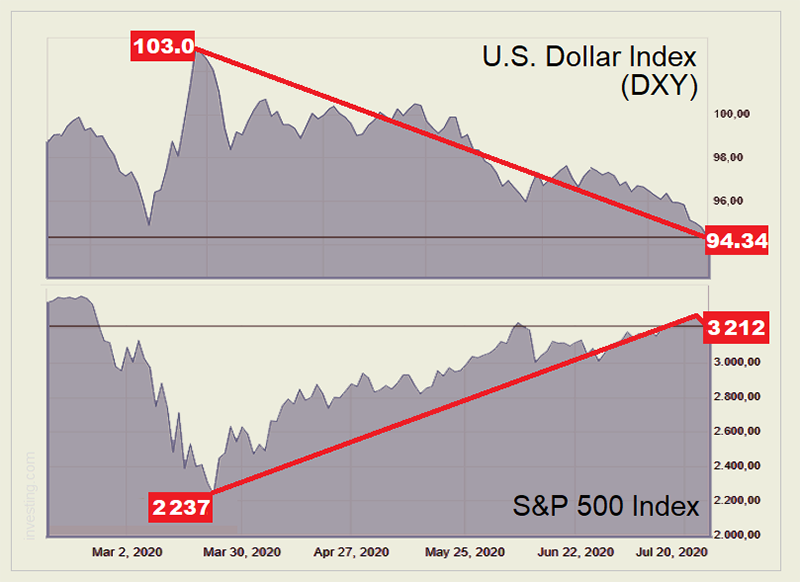

- EUR/USD. The USA does not bring good news to the markets. Escalating tensions between Beijing and Washington, rising jobless claims, and the ongoing COVID-19 offensive frighten investors, raising doubts about the imminent recovery of the American economy. The Nasdaq and S&P500 indexes turned red at the end of the week. However, their decline is not yet large enough to return investor interest to the dollar - the USD (DXY) index continues to fall and has already reached 94.4, which is even below the low of March 09, 2020.

In his speech on Thursday, July 23, the head of the Treasury Department, Steven Mnuchin drew attention to the weakening of the dollar and noted that the USA intends to protect its stability. However, the same Mnuchin said in the same speech that in addition to the fourth package of economic stimuli worth $ 1 trillion, which is currently being discussed in Congress, a fifth one may also be required. And this, coupled with cheap liquidity from the Fed and the possible emergence of a vaccine against the coronavirus, means that stock markets can turn north again, and the dollar can continue to move further south.

In the future, additional pressure on the US currency can be exerted by the issue of bonds worth €750 billion, which the European Commission plans to carry out. The lion's share of China's gold and foreign exchange reserves is denominated in dollars now. That is just over $3 trillion. And if Beijing, offended by the United States and PresidentTrump, decides to transfer some of them into Eurobonds, this will cause another dollar collapse, which has already yielded 465 points to the euro in July alone. Of these, 215 points were made over the past week.

This development was expected by 80% of analysts, supported by 75% of oscillators and 95% of trend indicators. And this forecast turned out to be correct, except that the EUR/USD pair did not just break through the 1.1500 resistance, but reached the 1.1650 high, where it ended the five-day session; - GBP/USD. The vast majority of experts (70%) expect that market interest in the dollar will continue to weaken, and this will help the GBP/USD pair to continue its northward movement, which began on June 30. The main target was the June 10 high of 1.2810, and this target was practically reached: the pair rose to the height of 1.2803 on the evening of Friday July 24. This was followed by a slight rebound and a finish at 1.2790;

- USD/JPY. Apart from a single blowout on June 02-05, the pair has not left the 106.00-108.10 side corridor for 15 weeks. Moreover, this channel has narrowed even more in the last week, to just 75 points. In such conditions, the opinions of experts were divided equally: 50% for the growth of the pair, 50% for its fall. But 85% of the oscillators and 100% of the trend indicators on D1 pointed to the south and were right. The first attempt to break through the 106.65 support on Tuesday July 21 ended in failure. But the bears did not stop there, and the pair went for a new breakthrough on Thursday July 23, this time successful. It reached a local bottom at 105.65 by Friday evening, and the final chord of the week sounded in the 106.00 zone four hours later;

- cryptocurrencies. The past week did not bring anything extraordinary to the crypto market. There was both good news and bad news. Let us start with the crime.

Cisco Talos specialists discovered a botnet that infected about 5,000 computers for hidden mining of Monero. And this is good. However, it was not possible to identify the hacker, tentatively from Eastern Europe. And that's bad. And in China, hackers stole 10,000 bitcoin mining devices from one of Bitmain's farms, which is bad for Bitmain and probably good for the hackers.

As for more global news, we note the decision of the world giant Mastercard to open access to its payment system for cryptocurrency companies. The first Issuer of crypto cards will be the British startup Wirex, whose cards will allow you to store and spend both fiat and digital currencies, as well as convert one asset to another.

The names of lobbyists who prevent the US government from completely banning bitcoin have become known. They were named by the head of Grayscale Investments, Barry Silbert. “In terms of our relationship with Washington, we as an industry are experiencing the best period ever. Two groups - the Blockchain Association and the Coin Center - are bringing the benefits of this technology and asset class to policymakers. The catastrophic legal risk that could have existed earlier is now over,” he said addressing his investors.

And although the situation in the US has improved for bitcoin, it is still very far from ideal. According to experts from Fidelity and BitOoda, the US is gradually losing the mining market due to various legal restrictions. The US segment now accounts for only 14%, while China controls about 50% of the world's capacity. And according to expert Max Keyser, the hashrate of bitcoin may become a factor of serious confrontation between the United States, on the one hand, and Iran and Venezuela on the other in the near future, as they gradually take the American “piece of that pie”.

As for the behavior of the main cryptocurrency, the forecast that most experts had given last week also proved 100% correct. Recall that 55% of analysts supported the rise of the BTC/USD pair to the $9,400-9,700 zone. This is exactly what happened - starting from the $9,150 mark, it was striving up all seven days, which is most likely caused by the general weakening of the dollar. On Thursday, July 23, the pair peaked at $9.675, showing an increase of 5.7%, followed by a rebound, and it fell into the $9,500 zone.

It should be noted that bitcoin cannot overcome the resistance of $9,700 for 6 weeks in a row, although the Crypto Fear & Greed Index has grown to the mark of 53 (41 weeks ago). The total capitalization of the crypto market grew by $15 billion (to $ 286 billion). However, only half of this increase comes from BTC, the other 50 percent belongs to altcoins and stablecoins.

The only cryptocurrency with a daily trading volume of over a billion dollars was the stablecoin Tether (USDT), showing a daily turnover of $1.5 billion. The next stablecoin, USD Coin (USDC), shows only $32 million. For comparison, the real daily turnover of BTC, according to the provider Messari, is now about $430 million. Note that the market capitalization of Tether again exceeded $10 billion (for bitcoin, it is now equal to $175 billion).

Among the TOP-10 digital coins, Ethereum still demonstrates the maximum growth. It grew 210% heavier in 4 months and almost reached the pre-crisis highs of February 2020. The ETH/USD pair grew by about 20% just over the last seven days.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. So, the fourth and fifth economic stimulus packages, liquidity from the Fed and the COVID-19 vaccine can seriously support the US stock markets. However, according to experts of Moody's Analytics, if the decision to stimulate the American economy is stuck in Congress for a long time, the risks of a double recession will seriously increase. In addition, until the pandemic recedes, unemployment will continue to be in two-digit numbers. Those factors could push the Nasdaq and S&P500 further down, which would return investor interest in the dollar as a protective asset.

It is clear that 100% of the trend indicators on both H4 and D1 are colored green at the end of the trading session, on July 24. Among the oscillators, there are fewer of them - 75%, while the remaining 25% signal that the EUR/USD pair is overbought. 45% of experts expect at least a downward correction, another 35% vote for the transition to a sideways trend, and 20% for further growth of the pair. Support levels are 1.1500 and 1.1380, resistance levels are 1.1740 and 1.1815.

As for the graphical analysis, it draws a rebound on H4 from the resistance at 1.1650 and a decline to the horizon at 1.1565. On D1, naturally, the oscillation span is greater: first, a fall to 1.1500, and then an increase to 1.1740.

Of the important macroeconomic events next week, they are expecting: July 27 - the publication of data on the US consumer market, July 29 - the Fed's decision on the lending rate and a press conference of its management (according to forecasts, the rate will remain unchanged at 0.25%), the data on the GDP of Germany and the United States will be released on July 30, and the week and month will end on July 31 with the publication of the data on the consumer market and GDP of the Eurozone, as well as on retail sales in Germany. Note that, according to forecasts, the fall in GDP (Q2) in the United States may reach -35%, which is 7 times more than the previous value (-5%);

- GBP/USD. “Both the euro and the pound” - this is what the forecast for the GBP/USD pair looks like this week. Just like in the case of EUR/USD, 45% of experts vote for a downward reversal of the pair, 35% for a sideways trend, and 20% for further growth of the pair. Indicators have a similar picture: 100% of trend indicators and 75% of oscillators look up, and the remaining 25% give signals that the pair is overbought.

It should be borne in mind here that on July 24, the pair almost reached the high of June 10, 1.2810, thus completing a seven-week V-shaped cycle. Therefore, the probability of a downward correction is now quite high. The target for the bears may be a return to the 1.2480-1.2670 zone, the nearest support is at 1.2715. If the pair, having broken through the resistance of 1.2810, nevertheless goes further upward, its targets will be the levels 1.3020, 1.3070 and 1.3200; - USD/JPY. As mentioned above, this pair has not left the side corridor 106.00-108.10 for 15 weeks. However, on Friday, July 24, it broke through its lower border and dropped to 105.65. True, then it turned around and finished the last five days in the area of 106.00. So, what was it: a false breakthrough, a move to a new echelon or a serious trend sweep? We'll find out soon enough. In the meantime, the forecast for the Japanese yen looks like this: 60% of experts vote for the strengthening of the dollar and the return of the pair within the trading range of 106.00-108.10. The targets are 106.65, 107.50 and, of course, 108.10. The remaining 40% believe that investor interest in the yen, as a protective asset, will still outweigh interest in the dollar, and the pair will go further down. Supports are 105.65 and 105.00.

As for indicators, their readings are largely like those of their “colleagues” on the euro and the pound, of course, in a mirror reflection. Colored red: on H4 - 85% of oscillators and 90% of trend indicators, on D1 - 70% of oscillators and 95% of trend indicators, and 15% of oscillators on H4 and 30% on D1 signal that the pair is oversold; - cryptocurrencies. Some experts talk a lot about bitcoin being linked to the stock market. In their opinion, the change in stock indexes pulls the change in bitcoin quotes. Though, probably, it is not like this It is just that both stocks and cryptocurrencies are, in the eyes of institutional investors, independent risk assets that are pushed up by fear for the fate of the dollar. At the same time, the crypto market, if compared with the traditional one, is quite small, and any moves by large speculators can cause serious excitement on it, and sometimes a real storm.

In the meantime, expert opinions are as follows. 45% of them believe that the BTC/USD pair will continue to move sideways and will not go beyond the $9,000-9,700 corridor. 45% do not rule out attempts by bitcoin to break into the $9,800-10,000 zone, and only 10% expect it to fall below $9,000. At the same time, 65% are confident that the main cryptocurrency will still be able to gain a foothold in the area of the landmark $10,000 mark within two to three months.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back