First, a review of last week’s events:

- EUR/USD. According to Reuters sources, the rate close to 1.2000 currently suits both sides, the US Federal Reserve and the ECB. Looking at the chart, one could clarify: not 1.2000, but 1.1850. After all, it is along this horizon the pair has been moving for seven weeks. But, in fact, the difference of 150 points has no fundamental significance here.

It would seem that the "dovish" rhetoric that sounded at the end of the Fed meeting on Wednesday, September 16, should have reduced the attractiveness of the American currency. Moreover, the regulator announced its readiness to keep low interest rates until 2023. However, nothing of the kind happened. The reason is that no less “dovish” statements are constantly being heard from the ECB side.

On the contrary, the dollar tried to go up against the background of the fall in the stock market, but this attempt failed as well. Investors believe in the prospects of the euro and begin to actively open long positions as soon as the pair approaches the lower border of the 1.5-month channel 1.1700-1.2010. As a result, the pair returned to its equilibrium state by the end of the week and finished at 1.1845; - GBP/USD. The pound has been growing throughout the past week. And this despite the problems with the UK labor market, the worsening situation with COVID-19 and the still unsettled situation with Brexit. The initial vote in Parliament on the scandalous bill, the adoption of which will sharply increase the likelihood of a "hard" Brexit, did not add clarity to the order of parting with the EU.

Taking into account the above, the Bank of England at its meeting on September 17 did not begin to adjust the monetary policy, but decided, having taken a wait and see attitude, to leave everything as it is for the time being.

And despite all this, the pound managed to win back from the dollar more than 200 points and reach the iconic level of 1.3000 by midweek. This was followed by a rebound downward, and the pair completed the five-day period at 1.2921; - USD/JPY. Like other regulators, the Bank of Japan decided to leave the interest rate unchanged. This decision was not a surprise to anyone. Markets associate much higher expectations with the departure of Prime Minister Shinzo Abe. Although his successor, Yushihide Suga, has vowed to continue his policy, certain changes will not take long.

Most experts last week voted in favour of the strengthening of the Japanese yen and the pair decrease to the level of 105.10 and then 100 points lower. And this prediction turned out to be 100% correct: the pair found the local bottom at 104.25, and placed the final chord in the 104.55 zone; - cryptocurrencies. Last week, we talked about a new indicator for assessing BTC investor sentiment, which was presented by the analytical resource CryptoQuant. At the $10,000 level, bitcoin is "experiencing strong demand from buyers," according to the instrument. The majority (60%) of experts agreed with the possibility of a rebound of the BTC/USD pair from this support and its moderate growth to the $10,700-11,200 zone, and they were right: having fixed the weekly low at $10,200, the pair reached a strong medium-term level of $11,100 by midweek, around which it has been revolving for eight weeks.

The increase in bitcoin transactions was more than 75% in August, according to The Block news agency. This fact may indicate a return to the industry of small miners who dropped out due to halving in May. Now they have the opportunity to start earning again thanks to the growth in the value of the main coin. And this is a good factor for the main cryptocurrency. Moreover, not only the number of transactions increased significantly, but their volume, which amounted to more than $191 billion. In July, the same figure was around $85 billion.

On the other hand, according to Glassnode analysis, almost 10% of the reward to miners is spent on transactions to place BTC coins on centralized exchanges, which is why this cryptocurrency is facing strong pressure from sellers when trying to rise above $11,100.

The Bitcoin Fear and Greed Index has risen slightly and is almost in the middle of the scale at 49 (41 weeks ago). The total cryptocurrency market capitalization has also grown in seven days, rising from $334 billion to $355 billion.

And one more interesting observation of The Block, now about Ethereum. While in August, compared to July, the income of bitcoin manners increased by 23%, the income of the miners of ethereum almost doubled - by 98%. According to some analysts, this may be due to the growing interest in this altcoin from large investors.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. As for the technical analysis, it is clear that after a month and a half of the pair's movement in the 1700-1.2010 corridor and the finish at its center at 1.1845, neither trend indicators nor oscillators can give any intelligible signals. Graphical analysis on D1 also draws the continuation of the sideways trend. However, given the fact that the pair finished the last week near the 1.1900 resistance and that 15% of oscillators indicate it is overbought, we can expect its correction to the south. Most experts agree with this (75%). However, only global economic policy will be able to give a confident command for the EUR/USD pair to break through the boundaries of the specified channel in one direction or another.

There are plenty of arguments about the euro strengthening. We have already written that Bloomberg's outperforming indicators indicate further growth of EUR/USD. The reason lies in the faster recovery of the Old-World economy compared to the United States. The diversification of gold and foreign exchange reserves by the central banks of leading countries is also developing in favour of the European currency. And then there is China, the main export partner of the Eurozone, despite the COVID-19 pandemic, showed GDP growth in the second quarter.

And, finally, one cannot ignore the intention of the Federal Reserve to reduce the price of the dollar, and the unwillingness of the head of the ECB, Christine Lagarde, to start a currency war with her overseas colleagues because of this.

We will be listening to Fed Chief Jerome Powell's speeches for most of the coming week. It will start right on Monday September 21st, followed by a speech in Congress on Wednesday and Thursday. And on September 24, he will be accompanied by US Treasury Secretary Stephen Mnuchin. Will they say something fundamentally new or repeat just what Powell talked about on September 16? Most likely the second. But their speeches will surely be able to cause an increase in volatility; - GBP/USD. The situation with the indicator readings here resembles the discord in the British Parliament during the Brexit vote. The only ones that give more or less clear signals are the oscillators on D1 - 75% of them are coloured red. But here the remaining 25% is already signaling that the pair is oversold. There is no consensus among the experts either, their opinions were equally divided: a third - for the growth of the pair, a third - for its fall, and a third turned their eyes to the east.

The graphic analysis was not clear either. Unlike most oscillators on D1, it indicates that the pair will first rise to 1.3000, and in case of a breakout, the next target will be 1.3185. The ultimate goal of the bulls is to retest the September 01 high at 1.3480. Support levels are 1.2760, 1.2650, 1.2500.

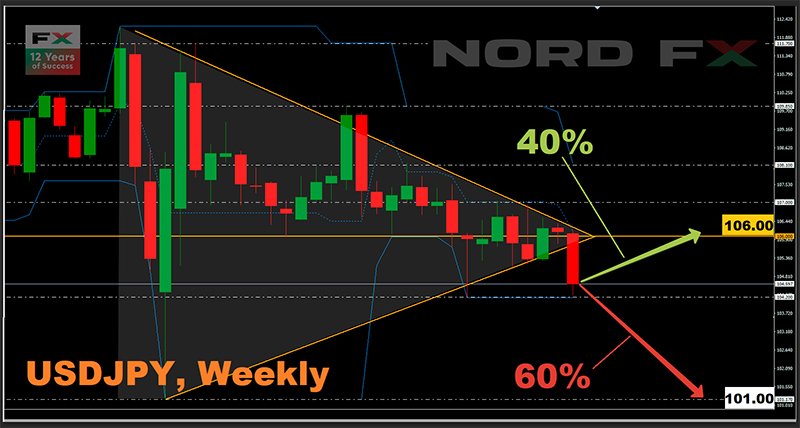

Moving from technical to fundamental analysis, it is necessary to recall the details of the last meeting of the Bank of England. Despite the absence of any decisions, the regulator's management did not hide that discussed the possibility of introducing negative rates as early as this November. And if such a decision is made, it can send the pound into a deep knockout. In the meantime, investors hope to be able to gain greater clarity on this issue from Bank of England Governor Andrew Bailey's speech on Tuesday 22 September; - USD/JPY. Although the Bank of Japan has raised its assessment of the state of the economy, the government has no intention of altering the volume of the stimulus program. Therefore, in this case, investors are more guided by the “dovish” statements of the Fed. Undoubtedly, the fall of US stock markets also plays a role. As a result, just like a week ago, the majority of experts (60%) side with the bears, who expect the pair to continue downtrend and further strengthen the Japanese currency. At the same time, they do not exclude that it can reach first the low of 09 March 101.17, and then the psychologically important level of 100.00 in the coming weeks. The closest support is located in the 104.20 zone.

The remaining 40% of analysts, supported by graphical analysis on D1, expect that the pair will not be able to break through the 104.20 level and will rebound upward and return to the 105.80-106.30 zone. 15% of the oscillators on H4 and D1, signaling that the pair is oversold, agree with this scenario. It should be noted here that with the transition to the mid-term forecast, the number of supporters of the growth of the pair increases to 70%;

- cryptocurrencies. According to Dan Tapiero, co-founder of investment company DTAP Capital, the market has developed conditions for long-term strengthening of bitcoin. There are several macroeconomic factors that will drive increased demand for cryptocurrency. The main culprit is the US Fed, which is pouring money into the economy, thereby devaluing it.

“We are on the verge of economic turmoil; the situation will be similar to the crisis of the late 1980s. The value of American assets will fall by about half, which will cause a massive transition of capital from state securities to gold and bitcoin,” Tapiero said, stressing that during the last two and a half years we have seen consolidation of BTC and that now, most likely, we are waiting for an explosive growth in the value of the largest cryptocurrency. Investors just need to be patient.

Well-known writer and investor Robert Kiyosaki, who also considers bitcoin to be one of the best long-term investments, agrees with Tapiero. True, he warns that the invention of a valid coronavirus vaccine could lead to a collapse in the price of bitcoin and gold, which Kiyosaki sees as safe haven assets. But it is at this point that investors will have a great opportunity to acquire these assets.

The opposite point of view was expressed by analysts from Weiss Crypto Ratings, who believe that the Bitcoin downtrend that took over the market in the early days of September is not strong enough to drive the coin value below $10,000 in the near future. (For Ethereum, Weiss Crypto Ratings consider the $350 level to be strong support.)

Interesting results were also shown by recent trading on the Deribit crypto derivatives exchange. Their participants actively bet on bitcoin options with the expectation that the price will rise to $32-36 thousand by the end of the year. According to the company, December contracts with a settlement price of $36,000 are in the lead, 752 of which were counted. They are followed by 462 contracts with a strike price of $32,000. December contracts, priced at $28,000, attracted relatively small volumes.

Such trading results are difficult to explain, given that, in general, market participants estimate the chance of Bitcoin's rise to at least $20,000 by the end of December as very low. The estimated probability of exceeding $20,000 is 5%, and $ 28,000 is only 2%. Most experts (65%) believe that the BTC/USD pair will meet 2021 in the $9,000-10,000 range, 10% believe that it will continue to move along $11,000, and only 25% expect to see it above $12,000.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back