First, a review of last week’s events:

- EUR/USD. The question that we tried to resolve last week was whether this pair will continue its fall or return again to channel 1.1700-1.2010. Experts couldn't give any clear answer then. Their votes were divided as follows: 30% favored the fall of the pair, 30% favored its rise and 40% took a neutral position. As a result, the pair surely did not continue to fall, but it is also difficult to call its movement returning to the channel: having reached the local high at 1.1700 on Thursday, October 01, the pair turned around and completed the five-day period at 1.1715.

Investors were not particularly impressed by the fact that the Democrats in the US House of Representatives passed legislation on a new package of economic stimulus worth $2.2 trillion, especially since it was previously about $3 trillion-plus. The US labour market data didn't have much impact on anything either. ADP's September Private Sector Employment Report showed an increase to 749K, up from 481K a month ago and a 650K forecast. The number of new jobs created outside the agricultural sector (NFP), on the contrary, turned out to be less than both the August and forecast values: 661K in September, 1489K in August against the forecast for September 850K.

Investors were much more impressed by the news of the infection of US President Trump and the first lady with coronavirus. When this information appeared, the US dollar and the Japanese yen went up, but then the question arose, how serious this disease is and how it could affect the economic situation in the United States and in the world. And before at least some clarity appeared, the market paused, and the EUR/USD pair moved to a sideways movement in a narrow range of $ 1.1685-1.1770, within which, as already mentioned, it came to the end of the weekly trading session; - GBP/USD. Against the background of Brexit uncertainty, the pair returned to the range where it was already trading on September 15-21 - 1.2805-1.3000, thus confirming the forecast given last week by 35% of analysts, graphical analysis and 15% of oscillators that signaled the pair was oversold. After a jerk up by 230 points, the strength of the bulls dried up, they could not break through the resistance of 1.3000, and the pair completed the five-day period in the area of 1.2935;

- USD/JPY. The last week cannot be called remarkable for the Japanese currency. Until Friday, the pair moved in a very narrow channel 105.30-105.75, and it was only on the news of the positive test for coronavirus by Donald and Melania Trump that the pair jumped down, reaching 104.95. This movement showed that, in such a critical situation, investors are likely to intuitively prefer yen, considering it a safer protective asset than the dollar. Although, a 70-point drop in the dollar could hardly be considered a major loss. Moreover, later the situation stabilized, the pair went up, and its final chord sounded at the level of 105.35;

- cryptocurrencies. We started our previous analytical review of the digital market with the phrase: "Another attempt by bitcoin to gain a foothold above the $11,000 mark ended in another failure." the same can be said about the outgoing week. Having bumped their heads against the ceiling of $10,940-10,970, the bulls gave up and the BTC/USD pair rolled back to the $10,400-10,500 zone, which fully confirmed the forecast, which was voted for by the majority of experts (65%). As for the Crypto Fear & Greed Index, it has dropped slightly over the past seven days, from 46 to 41, and is still in the neutral zone.

According to analyst portal Messari, this is the first time that daily bitcoin candles close above $10,000 for 63 consecutive days. The previous longest series was 62 days and was registered from December 1, 2017 to January 31, 2018, when bitcoin reached an all-time high near $20,000, having risen in price by 100% in two weeks. At the same time, the cryptocurrency was held above $11,000 for 50 days, and above $12,000 for 41 days.

According to the experts of the WhaleMap analytical service, bitcoin is now prevented from falling below $10,000 by large investors who begin to replenish their reserves as soon as the value of BTC approaches this level. It is for this reason that at the week high, the total capitalization of the crypto market, despite the drop in quotations, grew to $350 billion. However, on October 01-02, another sale of coins dropped it to $330 billion once again.

The dynamics of the cryptocurrency market is increasingly dependent on the mood in the traditional markets and is subject to changes in the risk appetite of investors. The latter in turn depend on the situation with the coronavirus and the reaction of regulators to it.

According to experts of Galaxy Digital Capital Management, bitcoin is beginning to be perceived by institutional players as an inflation hedge, that is, as a kind of “insurance” in case the US dollar loses the status of the world reserve currency. Comparing the capitalization of gold (more than 12 trillion dollars) and bitcoins (about 200 billion dollars), analysts of this company conclude that “the situation will level out towards the main cryptocurrency, into which there will be an outflow of investments from the precious metal, which may raise its value 60 times in the future.

If you look at the results of the first 9 months of 2020, it becomes obvious that the COVID-19 pandemic has already benefited bitcoin. Even despite the panic of late February - early March, the coin has risen in price by about 40% (gold - by 25%). If we take March 13 as the starting point, then during this period the main cryptocurrency has grown 2.75 times (gold - 1.3 times).

This situation also contributed to the growth of cryptocurrency fans. A study by the Cambridge Center for Alternative Finance says about 100 million people already own bitcoin and other coins in the world. In 2018, there were about 35 million of them, that is, three times less. The lion's share of BTC and other coin holders live in North America and Europe, followed by Latin America and the Asia-Pacific region. As of the end of the third quarter of 2020, up to 191 million addresses were registered on cryptocurrency exchanges.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. 65% of analysts supported by graphical analysis on H4 expect that the dollar will be able to strengthen its position somewhat in the coming days, and the pair will once again test support of 1.1600. This is opposed, respectively, by 35% of experts and graphical analysis on D1, according to which the EUR/USD pair, having returned to the 1.1700-1.2010 range, will continue to move towards its central part and will consolidate in the 1.1800-1.1900 range in the second half of the week.

Oscillators and trend indicators do not give any signals that are more or less suitable for forecasting. Particularly important macro statistics are not expected these days either. Interest may be caused by the speeches of the head of the US Federal Reserve Jerome Powell on Tuesday October 6 and his European counterpart Christine Lagarde on Wednesday October 7. The minutes of the US Fed Open Market Committee meeting will be published on the same day.

However, the main intrigue of the week will undoubtedly remain the health of the Trump presidential couple. If the old enough president of the United States quickly returns to full-time work, it will become a good trump card in his election race. Thus, he will be able to show that he assessed the degree of danger of coronavirus correctly and took adequate measures to combat the pandemic in the United States. If the symptoms of the disease turn out to be severe, this will not only force Trump to curtail the election campaign, but, showing the seriousness of the threat, will turn many doubting voters against him; - GBP/USD. Due to the growth of the pair last week, the overwhelming majority of indicators (85%) are colored green. But will this trend continue in the future?

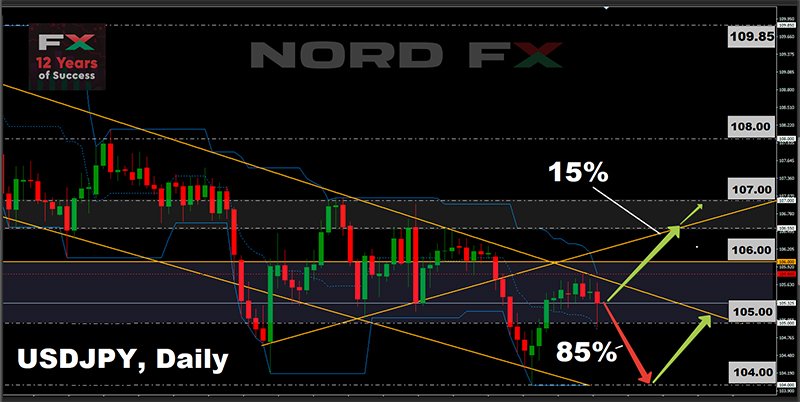

It is clearly not worth looking for the answer to this question in the readings of the indicators. As of Friday evening October 02, when this forecast is being written, Brexit news remains more than contradictory. British Prime Minister Boris Johnson is due to meet European Commission President Ursula von der Leyen on Saturday 03 October. How this meeting will end is anyone's guess so far. And then another factor of uncertainty arrived in time - the infection of Donald and Melania Trump with the COVID-19 virus. That is why the analysts' opinions are distributed as follows: 40% support the growth of the pair, 40% are for its fall and 20% have taken a neutral position. The nearest target of the bears is 1.2675, followed by support in the 1.2500 zone. The bulls' task is to break through the resistance at 1.3000 and return the pair to the echelon 1.3000-1.3200; - USD/JPY. Graphic analysis both on H4 and D1 shows the pair's decline to the lowest of the past week in the 105.00 zone, and then another 100 points lower, where it already visited on July 31 and September 21. Resistance in this case will be the level of 105.80.

After completing this trip to the south, according to the graphical analysis on D1, the pair should return to the zone 105.00-106.00, and go further north by the end of October, to 107.00.

The bearish sentiment is also supported by 85% of the experts, as well as about 70% of the indicators. Analysts' forecasts are largely influenced by the situation with the coronavirus pandemic in the United States, which has now directly affected the Trump couple. And that's just a month before this country's presidential election. However, this situation can change very quickly, and then the scenario will be realized, for which only 15% of experts have now voted, according to which the pair will go up and quickly reach the zone 106.55-107.00;

- cryptocurrencies. The number of bitcoins mined exceeded 18.5 million units. Just under 12% of the total issue or less than 2.5 million coins remain available for production, most of which could be mined in the next four years and the last coin in 2140.

Recall that according to the algorithm established by the creator of bitcoin Satoshi Nakamoto, the total amount of coins is 21 million, and halving occurs every four years - the reward for miners is halved. The main task of halving is to control the issue of cryptocurrency and its inflation.

Bitcoin miners expect a repeat of the rally of the main coin of three years ago. Many market representatives are confident that there are all conditions for the cryptocurrency market to move into a stage of active growth now. It is about snatching the main coin to $20,000.

The head of the Crypto Quant trading platform, Ki Yong Joo, noted that signals for a return of bullish sentiment to the market began to appear in mid summer, but strong external factors opposed the rise in the value of the coin then. “There is no denying that mining pools are having a major impact on the cryptocurrency market. It is worth remembering the consequences of the halving this May, when the hashrate of the main coin dropped for a while. Growth in such conditions became impossible, so investors and holders of the asset moved to wait-and-see tactics. The situation is completely different now. Miner Position Index (MPI) continues to strengthen. They try to mine as many blocks as possible for maximum rewards. The hashrate of bitcoin is also stable at high rates," Joo said.

Bloomberg Intelligence chief commodities strategist Mike McGlone expects growth as well. He believes that the first cryptocurrency should be valued at $15,000. He came to such conclusions based on the dynamics of growth in the number of active addresses since 2017. At the same time, he estimates the likelihood of alternative scenarios as low.

As for the current forecast, almost everything is the same here: the lower bar of the trading range for the BTC/USD pair is $9,500, the main support is $10,000, the main resistance is $11,000. At the same time, the probability of the next attack of bulls to this height, according to experts, is close to 70%, and the probability of consolidation above this level is twice lower.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back