Forex trading example scenarios provide valuable insights into how traders navigate the dynamic currency market to maximize profits and manage risks. Whether you're a beginner or an experienced trader, understanding real-life forex trading examples can help you grasp the fundamentals, refine your strategies, and make informed decisions. This article dives into detailed examples, strategies, and tips to illustrate how the forex market operates, empowering you to approach trading with confidence and clarity.

Table of Contents

Key Components of Forex Trading

Pros and Cons of Forex Trading

Factors Influencing Forex Markets

Getting Started with Forex Trading

Role of the U.S. Dollar in Forex

Forex Trading Examples

Now, let’s delve into real examples to demonstrate how Forex trading works in practice. Forex trading is all about buying one currency while simultaneously selling another, aiming to profit from fluctuations in their exchange rates. These fluctuations are influenced by a variety of factors, including economic data, geopolitical events, and market sentiment. By examining detailed, real-life forex trading examples, you'll gain a clear understanding of the strategies, calculations, and decision-making processes that drive success in this fast-paced market. Whether you're learning to manage risk or exploring profit opportunities, these examples will provide a practical foundation for navigating the world of forex trading.

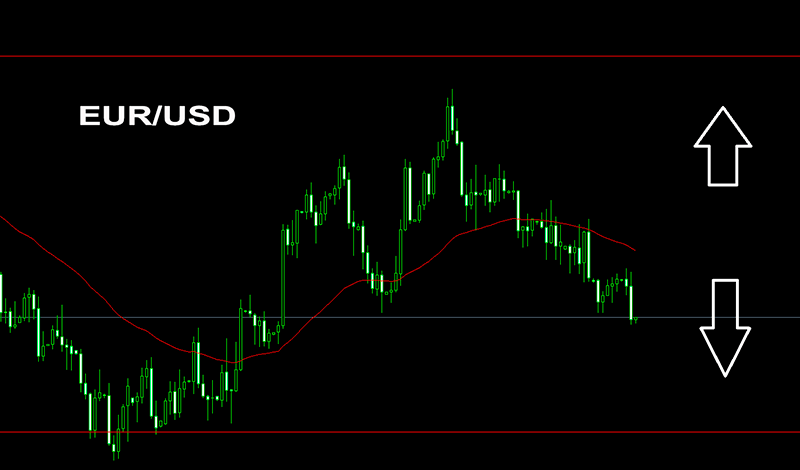

1. Short Trade: Selling EUR/USD

- Current Price: EUR/USD is trading at 1.0467/1.0468.

- Trade Action: Sell €100,000 at 1.0467 (bid price).

- Leverage: 1:1000

- Required Margin: $100 (€100,000 × 1.0467 ÷ 1000).

Outcome A: Price Decrease

- New Price: EUR/USD falls to 1.0400/1.0401.

- Closing Action: Buy €100,000 at 1.0401 (ask price).

- Profit Calculation:

- Initial Sale: €100,000 × 1.0467 = $104,670.

- Repurchase Cost: €100,000 × 1.0401 = $104,010.

- Profit: $104,670 - $104,010 = $660.

Outcome B: Price Increase

- New Price: EUR/USD rises to 1.0500/1.0501.

- Closing Action: Buy €100,000 at 1.0501 (ask price).

- Loss Calculation:

- Initial Sale: €100,000 × 1.0467 = $104,670.

- Repurchase Cost: €100,000 × 1.0501 = $105,010.

- Loss: $104,670 - $105,010 = -$340.

2. Long Trade: Buying GBP/USD

- Current Price: GBP/USD is trading at 1.2536/1.2537.

- Trade Action: Buy £100,000 at 1.2537 (ask price).

- Leverage: 1:1000

- Required Margin: $125.37 (£100,000 × 1.2537 ÷ 1000).

Outcome A: Price Increase

- New Price: GBP/USD rises to 1.2600/1.2601.

- Closing Action: Sell £100,000 at 1.2600 (bid price).

- Profit Calculation:

- Initial Purchase: £100,000 × 1.2537 = $125,370.

- Sale Value: £100,000 × 1.2600 = $126,000.

- Profit: $126,000 - $125,370 = $630.

Outcome B: Price Decrease

- New Price: GBP/USD falls to 1.2500/1.2501.

- Closing Action: Sell £100,000 at 1.2500 (bid price).

- Loss Calculation:

- Initial Purchase: £100,000 × 1.2537 = $125,370.

- Sale Value: £100,000 × 1.2500 = $125,000.

- Loss: $125,370 - $125,000 = -$370.

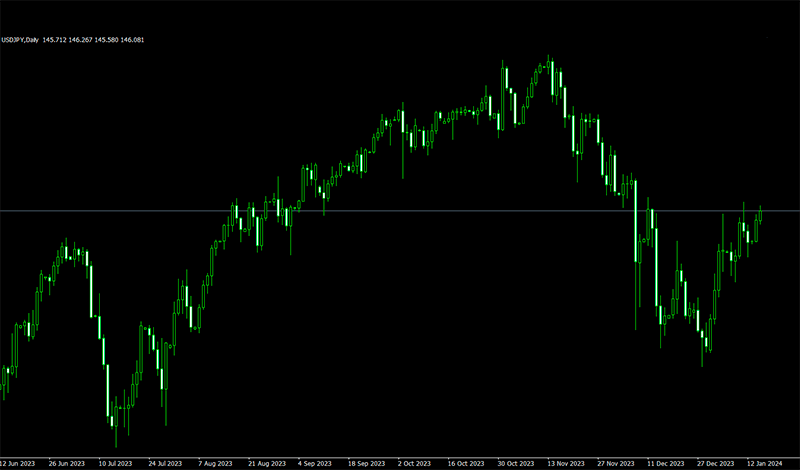

3. Short Trade: Selling USD/JPY

- Current Price: USD/JPY is trading at 153.31/153.35.

- Trade Action: Sell $100,000 at 153.31 (bid price).

- Leverage: 1:1000

- Required Margin: $100 ($100,000 ÷ 1000).

Outcome A: Price Decrease

- New Price: USD/JPY falls to 152.50/152.54.

- Closing Action: Buy $100,000 at 152.54 (ask price).

- Profit Calculation:

- Initial Sale: $100,000 × 153.31 = ¥15,331,000.

- Repurchase Cost: $100,000 × 152.54 = ¥15,254,000.

- Profit in USD: ¥77,000 ÷ 152.54 = $504.8.

Outcome B: Price Increase

- New Price: USD/JPY rises to 154.00/154.04.

- Closing Action: Buy $100,000 at 154.04 (ask price).

- Loss Calculation:

- Initial Sale: $100,000 × 153.31 = ¥15,331,000.

- Repurchase Cost: $100,000 × 154.04 = ¥15,404,000.

- Loss in USD: ¥73,000 ÷ 154.04 = -$473.8.

4. Long Trade: Buying AUD/USD

- Current Price: AUD/USD is trading at 0.6489/0.6490.

- Trade Action: Buy A$100,000 at 0.6490 (ask price).

- Leverage: 1:1000

- Required Margin: $64.90 (A$100,000 × 0.6490 ÷ 1000).

Outcome A: Price Increase

- New Price: AUD/USD rises to 0.6550/0.6551.

- Closing Action: Sell A$100,000 at 0.6550 (bid price).

- Profit Calculation:

- Initial Purchase: A$100,000 × 0.6490 = $64,900.

- Sale Value: A$100,000 × 0.6550 = $65,500.

- Profit: $65,500 - $64,900 = $600.

Outcome B: Price Decrease

- New Price: AUD/USD falls to 0.6450/0.6451.

- Closing Action: Sell A$100,000 at 0.6450 (bid price).

- Loss Calculation:

- Initial Purchase: A$100,000 × 0.6490 = $64,900.

- Sale Value: A$100,000 × 0.6450 = $64,500.

- Loss: $64,900 - $64,500 = -$400.

Please note that prices are current at the time of writing this article.

Understanding Forex Trading

Forex trading, or foreign exchange trading, is the process of buying and selling currencies to profit from changes in their exchange rates. It operates on a decentralized global network that connects traders, financial institutions, and brokers across different continents. Unlike traditional financial markets such as stock exchanges, the forex market does not have a centralized physical location. Instead, it relies on electronic trading platforms and networks to facilitate transactions. This structure not only enhances accessibility but also ensures a seamless trading experience for participants worldwide.

One of the key advantages of the forex market is its round-the-clock operation during weekdays. The market is open 24 hours a day, thanks to the overlapping time zones of major financial hubs like London, New York, Tokyo, and Sydney. This continuous cycle allows traders from different parts of the world to engage in trading activities at their convenience. For example, when the New York session is winding down, the Tokyo session is gearing up, ensuring that the market remains active and liquid throughout the day. This global connectivity also makes forex trading responsive to international economic events and news, giving traders the opportunity to react promptly to market developments.

The decentralized and dynamic nature of the forex market offers unique opportunities but also requires a deep understanding of its mechanics. Currency values are influenced by a variety of factors, including economic indicators, central bank policies, and geopolitical events. For this reason, forex trading is as much about staying informed as it is about executing trades. Whether you're a retail trader or an institutional investor, the forex market provides a platform to capitalize on global financial trends, making it one of the most versatile and exciting markets in the world.

Key Components of Forex Trading

To succeed in forex trading, understanding its fundamental components is essential. The forex market operates on a foundation of key elements, including currency pairs, pips, leverage, and margin. These components define how trades are executed, profits are calculated, and risks are managed. Each plays a critical role in shaping trading strategies, enabling traders to navigate the complexities of the market effectively. Whether you're buying or selling currencies, mastering these core concepts is crucial for making informed decisions and maximizing potential returns.

Currency Pairs

In forex trading, currencies are always traded in pairs, as the value of one currency is measured relative to another. Each currency pair consists of a base currency and a quote currency. The base currency is the first currency listed in the pair, and the quote currency is the second. The price of a currency pair represents how much of the quote currency is needed to purchase one unit of the base currency. For instance, in the EUR/USD pair, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. If the EUR/USD pair is trading at 1.2000, it means that one euro costs 1.20 U.S. dollars.

Forex traders can buy or sell currency pairs based on their expectation of how the exchange rate will change. For example, if a trader expects the euro to strengthen against the dollar, they might buy the EUR/USD pair. Conversely, if they expect the euro to weaken, they could sell the pair.

| Currency Pair | Description |

| EUR/USD | Euro vs. U.S. Dollar |

| GBP/JPY | British Pound vs. Japanese Yen |

| AUD/CAD | Australian Dollar vs. Canadian Dollar |

Major Currency Pairs

The most traded currency pairs in the forex market are known as major pairs. These pairs always include the U.S. dollar (USD) as either the base or quote currency, and they represent the most liquid and actively traded markets. Major pairs are popular among traders because of their tight spreads, high liquidity, and consistent price movements. Examples of major pairs include:

- EUR/USD (Euro vs. U.S. Dollar)

- GBP/USD (British Pound vs. U.S. Dollar)

- USD/JPY (U.S. Dollar vs. Japanese Yen)

- USD/CHF (U.S. Dollar vs. Swiss Franc)

Minor Currency Pairs

Minor pairs, also known as cross-currency pairs, do not include the U.S. dollar. These pairs involve major currencies like the euro (EUR), British pound (GBP), or Japanese yen (JPY) trading against each other. Although they are less liquid than major pairs, minor pairs still offer trading opportunities, especially for traders focusing on specific regional economies. Examples of minor pairs include:

- EUR/GBP (Euro vs. British Pound)

- AUD/JPY (Australian Dollar vs. Japanese Yen)

- GBP/CAD (British Pound vs. Canadian Dollar)

Exotic Currency Pairs

Exotic pairs consist of one major currency paired with a currency from a developing or smaller economy. These pairs typically have wider spreads and lower liquidity, making them more volatile and riskier to trade. However, they can present significant opportunities for traders willing to manage the associated risks. Examples of exotic pairs include:

- USD/TRY (U.S. Dollar vs. Turkish Lira)

- EUR/SEK (Euro vs. Swedish Krona)

- GBP/ZAR (British Pound vs. South African Rand)

Pips and Lots

A pip (percentage in point) is the smallest price move in a currency pair exchange rate. For most currency pairs, a pip is 0.0001. Trading is conducted in lots:

- Standard Lot: 100,000 units of the base currency.

- Mini Lot: 10,000 units.

- Micro Lot: 1,000 units.

Understanding pips and lot sizes is essential for calculating potential profits and losses.

Leverage and Margin

Leverage allows traders to control a large position with a relatively small amount of capital. For example, a leverage ratio of 100:1 means that for every $1 in your account, you can control $100 in the market. While leverage can amplify profits, it also increases the potential for losses.

Margin is the amount of money required to open a leveraged position. It's a fraction of the trade size and acts as a security deposit to cover potential losses.

Pros and Cons of Forex Trading

Pros

- High Liquidity: The forex market is one of the most liquid markets in the world, making it easy to enter and exit positions.

- Flexibility: With operations running 24 hours during weekdays, traders can trade at any time, regardless of their location.

- Low Costs: Forex brokers typically earn through spreads rather than high commissions, making trading cost-efficient.

- Leverage: Traders can control larger positions with smaller amounts of capital, increasing potential returns.

- Global Access: The forex market offers a wide variety of currency pairs, enabling traders to diversify their portfolios and capitalize on international opportunities.

Cons

- High Risk: The use of leverage can amplify losses, sometimes exceeding the initial investment.

- Complexity: Understanding currency movements requires knowledge of global economics, monetary policies, and geopolitical factors.

- Speculative Nature: Many traders rely on short-term strategies, which can lead to overtrading or excessive risk-taking.

- No Central Regulation: The decentralized nature of forex markets can lead to inconsistent fees and broker practices.

Types of Forex Transactions

Spot Transactions

Spot transactions are the most straightforward forex trades, involving the immediate exchange of currencies at current market rates. These trades typically settle within two business days.

| Feature | Description |

| Settlement Time | Typically two business days |

| Common Participants | Individual traders and small businesses |

| Flexibility | Allows for quick trades in real-time conditions |

Forward Transactions

Forward contracts involve agreements to exchange currencies at a set rate on a future date. These contracts are customized to meet the needs of the buyer and seller, making them suitable for businesses looking to hedge against currency fluctuations.

| Feature | Description |

| Settlement Time | On a pre-agreed future date |

| Common Participants | Corporations and financial institutions |

| Purpose | Hedging against exchange rate fluctuations |

Forex Futures

Forex futures are standardized contracts traded on exchanges, obligating the buyer to purchase or sell a specific amount of currency at a set rate on a future date.

| Feature | Description |

| Exchange Traded | Yes |

| Standardized Terms | Yes |

| Common Use | Hedging and speculative trading |

Factors Influencing Forex Markets

The forex market is highly dynamic and influenced by a variety of factors that impact currency values. Understanding these factors is crucial for traders to anticipate market movements and make informed decisions. Key drivers include economic indicators, central bank policies, geopolitical events, and market sentiment. Each of these elements can cause significant fluctuations in currency pairs, presenting opportunities and risks for traders.

Economic Indicators

Economic indicators are among the most critical factors affecting forex markets. These indicators provide insights into the health of an economy and often dictate the monetary policies of central banks, which in turn influence currency values. Common economic indicators include:

- Gross Domestic Product (GDP): A growing GDP indicates a healthy economy, which can lead to an appreciation of the country’s currency.

- Employment Figures: Metrics such as unemployment rates and non-farm payroll data signal economic strength or weakness. For instance, a drop in unemployment often boosts confidence in the currency.

- Inflation Rates: Moderate inflation is a sign of a stable economy, but high inflation can weaken a currency as it erodes purchasing power.

- Retail Sales and Industrial Production: These indicators reveal consumer activity and manufacturing performance, both of which impact currency values.

Example: The U.S. dollar often strengthens when non-farm payroll data reports higher-than-expected job growth. This signals a robust labor market, increasing the likelihood of the Federal Reserve tightening monetary policy, which supports the dollar.

| Economic Indicator | Impact on Currency | Example |

| GDP Growth | Indicates economic strength, boosting currency value | A rise in U.K. GDP may strengthen GBP |

| Non-Farm Payrolls (NFP) | Reflects labor market health, influencing USD | Higher-than-expected NFP data strengthens USD |

| Inflation Rates | Moderate inflation supports the currency | High inflation in Japan could weaken the yen (JPY) |

| Retail Sales | Higher sales indicate stronger economic activity | Increased U.S. retail sales may strengthen the USD |

Economic indicators often work together, creating a complex interplay that shapes the forex market. For example, high employment figures might signal economic growth, but if accompanied by rising inflation, it could lead to uncertainty about future monetary policy. Traders must analyze these indicators in context and consider their broader implications on currency movements.

Interest Rates

Central banks set interest rates to influence economic activity. Higher interest rates typically attract foreign capital, boosting demand for a country's currency.

| Central Bank | Currency | Current Policy Example |

| U.S. Federal Reserve | U.S. Dollar (USD) | Tightening |

| ECB | Euro (EUR) | Easing |

Geopolitical Events

Geopolitical events play a significant role in shaping forex market dynamics, often creating volatility and uncertainty. Events such as political elections, trade negotiations, wars, or diplomatic tensions can lead to rapid and sometimes unpredictable shifts in currency values. For instance, a country facing political instability may see its currency weaken as investors lose confidence and move their capital to safer assets. Conversely, positive developments, such as the resolution of a trade dispute or the signing of a beneficial treaty, can strengthen a country’s currency by boosting market optimism and economic prospects. These events highlight how closely tied the forex market is to the political and diplomatic landscape.

For traders, staying informed about geopolitical developments is crucial. Even rumors or speculations about potential events can cause significant market reactions, making timing and adaptability key aspects of successful trading. For example, during elections, currencies may experience heightened volatility as markets react to potential policy changes depending on which candidate is favored to win. Similarly, trade negotiations between major economies, such as the U.S. and China, can impact global currency pairs like USD/CNY or USD/JPY. By closely monitoring geopolitical news and understanding its implications, traders can better anticipate market movements and adapt their strategies to capitalize on opportunities or mitigate risks.

Getting Started with Forex Trading

Embarking on your forex trading journey can be both thrilling and challenging. As one of the largest and most liquid financial markets globally, forex trading offers vast opportunities to profit from currency fluctuations. However, success in this market demands more than enthusiasm—it requires a strong foundation of knowledge, a disciplined approach, and effective tools. With currencies influenced by a wide range of factors like economic indicators, geopolitical events, and market sentiment, understanding the fundamentals is crucial for making informed trading decisions.

For beginners, starting with the basics—such as understanding currency pairs, leverage, and market mechanisms—is essential. Building a comprehensive trading plan, choosing a reliable trading platform, and employing sound risk management strategies can significantly enhance your chances of long-term success. Meanwhile, experienced traders can refine their strategies and adapt to evolving market conditions. Whether your goal is to trade part-time or establish a full-time career, approaching forex trading with a structured and informed mindset is key to navigating its complexities and capitalizing on its opportunities. In this section, we'll break down the critical steps to help you start trading confidently and effectively.

Building a Trading Plan

A well-structured trading plan is the cornerstone of successful forex trading. It should include:

- Risk Tolerance: Define the maximum percentage of your capital you're willing to risk on a single trade.

- Trading Goals: Specify short-term and long-term profit objectives.

- Entry and Exit Criteria: Determine the conditions under which you'll enter or exit a trade.

Choosing a Trading Platform

Selecting the right trading platform is crucial for executing trades effectively. Key features to consider include:

- User-Friendly Interface: Ensure the platform is easy to navigate.

- Analytical Tools: Look for platforms offering charting tools and technical indicators.

- Customer Support: Reliable customer service is essential, especially for new traders.

Example Platform: MetaTrader 4 (MT4)

A popular choice among forex traders, MT4 provides robust analytical tools and automated trading capabilities.

Risk Management

Effective risk management is essential to sustain long-term profitability. Strategies include:

- Position Sizing: Adjust trade size based on your risk tolerance.

- Stop-Loss Orders : Limit potential losses by setting predefined exit points.

- Diversification: Trade multiple currency pairs to spread risk.

Real-World Forex Trading Example

A trader observes a slowdown in the Eurozone economy and expects the European Central Bank to ease monetary policy. Predicting a decline in the euro, the trader sells €100,000 at 1.15 against the U.S. dollar.

- Initial Sale: €100,000 × 1.1500 = $115,000

- Repurchase: €100,000 × 1.1000 = $110,000

- Profit: $115,000 - $110,000 = $5,000

This example illustrates the importance of market analysis and timing in forex trading.

Role of the U.S. Dollar in Forex

The U.S. dollar (USD) holds a dominant position in the forex market, making it one of the most influential currencies in the global economy. As the world's primary reserve currency, the USD serves as a benchmark for international trade, finance, and economic stability. It is involved in over 80% of all forex transactions, underscoring its importance in the daily operations of the market. This widespread use is not only a reflection of the size and strength of the U.S. economy but also of the trust that global investors place in its stability and resilience.

One of the key reasons the U.S. dollar plays such a pivotal role is its use in pricing and trading global commodities like oil, gold , and natural gas. Known as the "petrodollar," this arrangement ensures that most countries require USD to facilitate trade in essential resources, driving consistent demand for the currency. Additionally, during times of economic uncertainty or geopolitical tension, the dollar often acts as a safe haven, attracting investors looking to protect their capital from volatility in other markets. The stability of the U.S. economy, supported by its diverse industries and robust financial systems, further enhances the attractiveness of the dollar as a reliable currency.

| Currency | Role |

| U.S. Dollar (USD) | Global benchmark and reserve |

The USD's central role also gives the U.S. Federal Reserve an outsized influence on global monetary policy. Decisions made by the Fed, such as changes in interest rates or quantitative easing measures, ripple through global markets, affecting the value of currencies worldwide. For traders, the U.S. dollar's unique position means that any economic, political, or policy changes in the United States can significantly impact trading strategies and opportunities across a wide range of currency pairs. Understanding the dynamics of the USD is therefore essential for anyone participating in the forex market.

The Basics of Forex Trading

Forex trading revolves around the simultaneous exchange of one currency for another, creating opportunities to profit from fluctuations in exchange rates. Every trade in the forex market occurs within a currency pair, such as EUR/USD, where the value of one currency (the base currency) is measured against another (the quote currency). Traders speculate on whether the base currency will strengthen or weaken relative to the quote currency. For example, if a trader believes the euro will appreciate against the U.S. dollar, they may buy EUR/USD. Conversely, if they anticipate the euro will weaken, they might sell the pair.

This dual-currency structure makes forex trading unique compared to other financial markets. Instead of buying a single asset, like a stock, traders are always exchanging one currency for another. The market's global nature means it operates 24 hours a day during the week, allowing traders to react to economic data, geopolitical events, and market sentiment in real time. Mastering the key mechanics of forex trading is essential to navigate this dynamic market effectively.

- Pip (Percentage in Point): A pip represents the smallest price movement in a currency pair. For most major pairs, one pip equals 0.0001, or one ten-thousandth of a unit. Pips are critical for measuring changes in currency values and calculating profits or losses in trades. For example, if EUR/USD moves from 1.1000 to 1.1005, the pair has increased by five pips.

- Spread: The spread is the difference between the bid price (what traders are willing to pay) and the ask price (what sellers are willing to accept). This gap represents the cost of trading and is how brokers earn revenue. Tight spreads indicate high liquidity, while wider spreads often occur in less liquid markets or during periods of high volatility.

- Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. For instance, with 1:100 leverage, a trader can control a $100,000 position with just $1,000 in their account. While leverage amplifies potential returns, it also increases the risk of significant losses, making effective risk management crucial.

Understanding these terms is foundational for anyone entering the forex market. They help traders assess potential opportunities, calculate risks, and execute trades with confidence. As the market operates at a rapid pace, having a strong grasp of these concepts ensures that traders can adapt to its movements and make informed decisions.

Major Currency Codes

Each currency is identified by a unique three-letter code, simplifying trading and transactions.

| Currency | Code | Country |

| U.S. Dollar | USD | United States |

| Euro | EUR | Eurozone |

| Japanese Yen | JPY | Japan |

| British Pound | GBP | United Kingdom |

| Swiss Franc | CHF | Switzerland |

How Big Is the Forex Market?

The forex market is unparalleled in size and scope, making it the largest and most liquid financial market in the world. With a staggering daily trading volume exceeding $7 trillion, it dwarfs other financial markets like the stock and commodities markets. This immense scale reflects the global nature of forex trading, involving millions of participants ranging from central banks, commercial banks, and multinational corporations to individual retail traders. The market's size and activity are a testament to the critical role currencies play in facilitating international trade, investment, and economic stability.

One of the defining features of the forex market is its unparalleled liquidity. Liquidity refers to how easily assets can be bought or sold without causing significant price changes. In the forex market, the high volume of daily transactions ensures that traders can execute even large trades almost instantaneously, with minimal price impact. This liquidity is especially beneficial for retail traders, as it keeps transaction costs low and enables quick responses to market changes. Whether trading major currency pairs like EUR/USD or exotic pairs, participants can capitalize on opportunities across the globe.

| Metric | Figure |

| Daily Trading Volume | Over $7 trillion |

| Active Traders | Millions worldwide |

The sheer size of the forex market also means it operates as a 24-hour global network, accommodating traders in every time zone. Its continuous operation during the week allows participants to react instantly to economic news, geopolitical events, or market sentiment shifts. This accessibility, combined with its scale and liquidity, makes the forex market a unique and dynamic environment for traders of all levels, from beginners to institutional investors.

How Does the Forex Market Differ from Other Markets?

The forex market stands out from other financial markets like stocks or commodities due to its unique structure and operational features. One of its most distinctive traits is its decentralized nature. Unlike stock markets, which are tied to centralized exchanges such as the New York Stock Exchange (NYSE) or NASDAQ, the forex market operates through a global electronic network of banks, brokers, and individual traders. This lack of a centralized exchange enables forex trading to run continuously, 24 hours a day, five days a week. As a result, traders can react instantly to global news, economic data, and geopolitical events as they unfold, without being constrained by market opening or closing times.

Another key difference lies in the market's unparalleled liquidity. The forex market's daily trading volume of over $7 trillion ensures that trades can be executed quickly and with minimal price fluctuations, even for large orders. This high liquidity reduces transaction costs, as spreads between bid and ask prices tend to be narrower compared to less liquid markets like stocks or commodities. By contrast, liquidity in stock markets can vary widely depending on the specific stock being traded, with smaller or less popular stocks often facing higher spreads and reduced trading volumes.

| Aspect | Forex Market | Stock Market |

| Hours of Operation | 24/5 | Limited to trading hours |

| Centralized Exchange | No | Yes |

| Liquidity | High | Varies |

Additionally, the forex market offers a higher degree of flexibility in trading strategies compared to other markets. Traders in forex can profit from both rising and falling markets, as buying and selling currency pairs are fundamental to its operations. In contrast, short-selling in stock markets often involves borrowing shares, which can incur additional costs and is subject to stricter regulations. These differences make the forex market a more accessible and flexible option for traders looking for diverse opportunities across a wide range of assets and time zones.

Is Forex Trading for Beginners?

Forex trading is accessible to beginners, but success requires a strong foundation of knowledge and disciplined risk management. Unlike some financial markets that may have higher barriers to entry, the forex market offers tools and resources specifically designed to help new traders get started. Many brokers provide demo accounts, which allow beginners to practice trading in a risk-free environment. These accounts simulate real market conditions, enabling new traders to familiarize themselves with currency pairs, market movements, and trading platforms without the fear of losing money.

In addition to demo accounts, most brokers offer comprehensive educational resources tailored for beginners. These may include video tutorials, webinars, eBooks, and articles covering the basics of forex trading, such as understanding currency pairs, leverage, and pips. Some platforms even provide interactive tools like trading simulators or real-time market analysis to help beginners develop practical skills. By utilizing these resources, new traders can build a strong foundation and gradually gain the confidence needed to enter live trading.

Moreover, forex trading offers flexibility, which appeals to beginners. With a 24-hour market and a wide range of trading strategies, new traders can start small and trade at their convenience. Micro and mini accounts, which require lower capital investment, allow beginners to participate without significant financial risk. However, it’s essential for new traders to prioritize risk management, as leverage and market volatility can amplify losses just as quickly as profits. By starting with proper education and a cautious approach, forex trading can be a rewarding endeavor for those new to financial markets.

How Much Do You Need to Start Trading Forex?

The amount of capital needed to start trading forex depends on the broker, account type, and individual trading strategy. Some brokers set higher minimum deposit requirements, while others cater to beginners by allowing traders to start with minimal funds. For instance, with NordFX, you can begin your trading journey with as little as $10, making forex accessible to almost anyone interested in the market. This low barrier to entry enables new traders to gain hands-on experience without committing substantial financial resources upfront.

While it is possible to start with a small amount, such as $10 or $100, having more capital can significantly improve your trading experience and risk management. A larger starting balance allows you to manage trades more effectively by avoiding over-leveraging and maintaining a reasonable margin buffer. For example, with a modest balance, even small price fluctuations can lead to margin calls, especially when using high leverage. By starting with a larger amount, traders can sustain minor losses and keep their positions open longer, increasing the chance of recovering from unfavorable market movements.

Additionally, the starting capital you choose should align with your trading goals and risk tolerance. While a small deposit is ideal for testing strategies or getting accustomed to a platform, traders aiming for consistent profits may find it more practical to invest more upfront. Many brokers offer flexible account types, such as micro or mini accounts, allowing traders to scale their investments gradually as they gain experience and confidence. Regardless of the initial amount, it’s crucial to approach forex trading with a well-thought-out plan and sound risk management to maximize your potential for success.

What Moves Forex Markets?

The forex market is highly dynamic, influenced by a range of factors that drive currency values up or down. Understanding these factors is essential for traders seeking to anticipate market movements and capitalize on trading opportunities. Key influences include economic indicators, interest rates, and geopolitical events, all of which can cause significant fluctuations in currency pairs.

- Economic Indicators: Reports such as GDP growth, employment data, and inflation figures play a critical role in shaping forex markets. For instance, strong GDP growth or positive employment data in a country can lead to an appreciation of its currency, as these metrics indicate a robust and expanding economy. On the other hand, high inflation might weaken a currency, as it erodes purchasing power and may signal economic instability. Staying updated on these indicators allows traders to predict potential market shifts.

- Interest Rates: Central bank policies, particularly changes in interest rates, are a major driver of forex markets. Higher interest rates typically attract foreign investment, increasing demand for the country’s currency and boosting its value. Conversely, lower interest rates may discourage investment and weaken the currency. For example, a decision by the Federal Reserve to raise rates can strengthen the U.S. dollar, impacting pairs like USD/EUR or USD/JPY.

- Geopolitical Events: Elections, trade disputes, and conflicts can create significant market volatility. Political uncertainty often causes currencies to weaken as investors seek safer assets, while positive developments such as trade agreements can strengthen a currency by boosting economic confidence. For instance, news of a major trade deal between two countries might lead to an increase in the value of their currencies.

To navigate these market-moving events effectively, traders should rely on trusted resources for real-time updates and analysis. Websites like Forex Factory provide a comprehensive calendar of economic events and key market news, enabling traders to stay informed and adjust their strategies accordingly. Being proactive and informed is crucial for managing risks and capitalizing on opportunities in the fast-paced world of forex trading.

Key Takeaways

- Understanding Forex Trading Example Basics: Forex trading involves buying one currency while simultaneously selling another within pairs like EUR/USD. Real-world forex trading examples illustrate how traders capitalize on exchange rate fluctuations.

- Key Market Drivers in Forex Trading Examples: Economic indicators, interest rates, and geopolitical events are critical factors that influence currency values. By analyzing these, traders can anticipate market movements and adapt strategies effectively.

- Risk Management in Forex Trading Examples: Leverage, while offering the potential for higher profits, also increases risks. Proper risk management, including stop-loss orders and position sizing, is essential to avoid significant losses.

- Currency Pair Types in Forex Trading Examples: Forex trading examples include major pairs (e.g., EUR/USD), minor pairs (e.g., EUR/GBP), and exotic pairs (e.g., USD/TRY). Each category offers unique opportunities and risk profiles based on liquidity and volatility.

- Educational Resources for Forex Trading Examples: Beginners can explore forex trading examples through demo accounts and learning tools provided by brokers to build skills and confidence before trading live.

- Global Accessibility of Forex Trading Examples: The forex market operates 24/5, allowing traders to engage in currency trading examples at any time, benefiting from high liquidity and continuous market activity.