First, a review of last week’s forecast:

- EUR/USD. Recall that 40% of experts and graphical analysis on H4 expected the pair would transition into a lateral trend in the 1.1885-1.2070 range. At the same time, a number of oscillators on D1 signaled it was overbought, which indicated a possible fall at the beginning of the week. This is what happened. By the evening of Wednesday, 13 September, it had reached this lower border; on Thursday, it made an attempt to break through it. However, the bears' forces were already running out, and in just an hour the pair returned to the set limits, completing the week near 1.1960: the level of the central line of the side channel;

- 30% of experts, 100% of trend indicators, graphical analysis on D1 and 80% of oscillators voted for the growth of GBP/USD last week. 1.3440 was named as the bulls’ goal. However, on Thursday, 14 September, following the publication of the Bank of England's quarterly report and the speech of monetary policy committee member Gertjan Vlieghe in favor of raising the base rate at the next meeting of the Bank of England’s MPC, the pound received an additional upwards push. Having risen by 450 points, it reached the level of 1.3600;

- USD/JPY. Whilst the British pound showed impressive growth relative to the dollar, the Japanese yen demonstrated a fall that was equally impressive. Positive trends emerging in the Japanese economy contributed to the growth of its stock market, but simultaneously pressured the yen. The reduction in the volume of QE (quantitative easing) by the US Federal Reserve and the flow of investment from reliable but not profitable assets to less reliable but more profitable ones also played against the Japanese currency, causing it to lose more than 350 points against the dollar during the week;

- Only 10% of experts, 20% of oscillators and graphical analysis on D1 sided with the bulls, having calculated that USD/CHF had reached its bottom and would now grow to 0.9620. The pair did indeed immediately go up and reached the height of 0.9700 exceeding expectations. After that, it rolled back 100 points and finished in a strong support / resistance zone at 0.9600.

As for the forecast for the coming week, summarizing the opinions of analysts from a number of banks and brokerages, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. After the slowing of the uptrend last week, the experts appear to be disorientated: 40% of them stand for the growth of the pair, 40% for its fall and 20% envisage a sideways trend. Indicators do not bring clarity to the forecast either, demonstrating a similar dispersion in their readings. Graphical analysis on both H4 and D1 is the only forecaster which unreservedly points northwards. Resistance levels are at 1.1985, 1.2075 and 1.2165, whilst supports levels are at 1.1915 and 1.1825.

Dollar pair trends may be influenced to a certain extent by the rate decisions and forecasts made by the US Federal Reserve on Wednesday, 20 September; - As for the future of GBP/USD, most experts (65%), supported by graphical analysis and 40% of oscillators, expect a correction of the pair down to the level of 1.3500. In the event of a break through this level, the next supports would be 1.3440 and 1.3385.

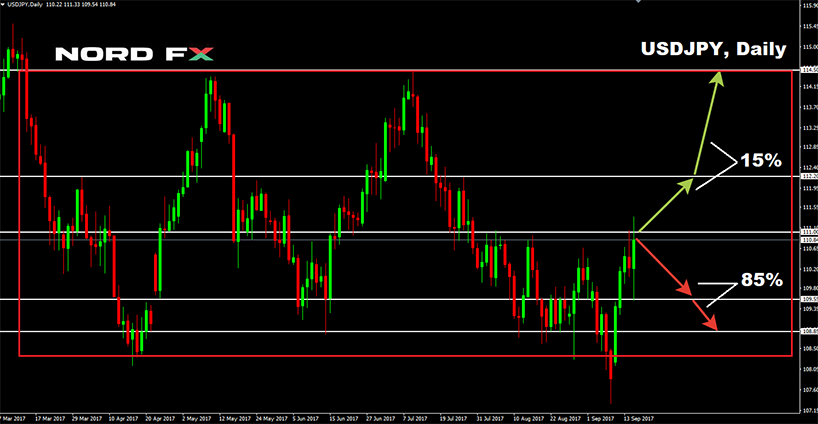

An alternative point of view, represented by 35% of analysts, 100% of trend indicators and 60% of oscillators, implies a continuation of the uptrend to 1.3665, after which the pair will ascend yet another 100 points higher. The bulls’ final medium-term target is at the level of 1.4000; - USD/JPY. The forecast for this pair is a lateral trend in which the bears have a slight advantage—at least 85% of analysts voted for this scenario. The support levels are 109.55 and 108.85; the resistances levels are 111.00 and 111.30.

A minority of experts (only 15%) and the majority (about 90%) of indicators side with the bulls. They believe that the pair has returned to the borders of the medium-term side channel. In this case, the short-term goal of the pair is to secure itself in the central zone of 111.00-112.20, whilst the medium-term goal is to reach the upper boundary of the 114.50 channel.

And, of course, we must not forget a Bank of Japan press conference is scheduled for Thursday, 21 September, where a rate decision is expected;

- "South and only southwards" was the forecast for USD/CHF last week. It also remains the forecast for this week. 75% of analysts and the same number of indicators on H4 vote for the scenario in which the pair will again rush to the support at 0.9415.

Meanwhile, 10% of experts and the indicators on D1 vote for a lateral trend.

The pair’s growth is supported by 15% of analysts and graphical analysis on H4. In their opinion, the pair should grow first to 0.9765, and then to 0.9845.

Roman Butko, NordFX

戻る 戻る