First, a review of last week’s forecast:

- EUR/USD. The forecast for this pair turned out to be almost 100% correct. Recall that we spoke of a slight increase to 1.1725-1.1750 (and the pair actually climbed to 1.1720), as well as its possible drop and another attempt to test the level of 1.1500 (on Thursday the pair dropped to the horizon 1.1525). In the end, while maintaining the balance between bulls and bears, it returned to the Pivot Point zone for the last one and a half months and completed the five-day period at the level of 1.1680;

- GBP/USD. Thanks to the votes from the Bank of England, a positive mood prevailed in the analysts' camp last week - 65% of them expected a pair to rise above 1.3350. However, those 35% of experts who believed that all hawkish statements of the regulator were nothing more than an attempt to support the rate of the British pound, which had lost more than 1,000 points since April, turned out to be right. According to their forecasts, the pair was to fall into the zone of 1.3000-1.3100. That's exactly what happened: the local bottom was found exactly in the middle of the zone, after which the GBP/USD returned to 1.3200;

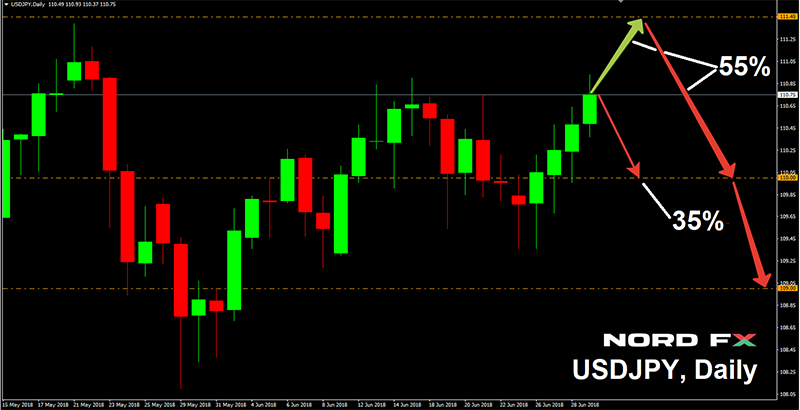

- USD/JPY. Once again, the oscillators turned out to be right - 15% of them pointed it was oversold, and that was enough for the pair to go up. At the same time, it stayed within the rather narrow monthly lateral channel 109.20-110.90, which confirmed the consolidation of the pair in the 110.10 zone;

- Cryptocurrencies. The forecast for BTC/USD said that if the pair confidently passes support in the $5,900-6,100 zone, with a high probability, after a while it will be seen near the horizon $4,300. And it was on June 28, that the bears decidedly went for a breakthrough. It seemed that the collapse was imminent, but when it reached $5,790, the pair first froze, and then jerked up on June 30, reaching a height of $6,525. As a result, over a day, bitcoin has grown by more than 10%, the reason for which was the mysterious large-scale purchase of BTC by an unknown investor, which occurred after the CME futures closed.

Many altcoins went into the growth. following bitcoin. The highest growth was demonstrated by Bitcoin Cash + 13% and Litecoin + 11%. The average growth of the top twenty cryptos was 7-10%.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- Last week, the short-term growth of the EUR/USD was caused by the results of the EU summit and the agreement on migration issues reached. However, in the near future it is hardly possible to have a release of new economic data, which would push the pair EUR/USD further up. The publication of the data on the labor market in the United States (NFP) on Friday July 07 is of particular interest, but the information on the possible tightening of the Fed's monetary policy may be on the other side of the scale. As a result, according to 35% of experts, the pair will be able to stay in the side corridor 1.1500-1.1725.

At the same time, it is possible that it will still be able to break the upper boundary of this channel and rise to zone 1.1725-1.1825. This version is supported by 20% of analysts and graphical analysis on H4.

The remaining 45% of experts, together with graphical analysis on D1 and 15% of oscillators signaling that the pair is overbought, believe that it will once again test the level of 1.1500, and in case of its breakdown it will drop by 100-150 points lower; - A similar picture is drawn by graphical analysis for the GBP/USD as well: on H4, a rise to the level of 1.3300-1.3335, and a fall into the zone 1.2900-1.3100 on D1. 15% of the oscillators also agree with the latter scenario.

As for the experts' opinion, they are divided almost equally: 35% support the growth of the pair, 35% are for its fall and 30% favor the sideways trend.

We can assume from all of the above, that the pair will continue to move east along the horizon 1.3200, fluctuating in the range 1.3050-1.3325.

If we talk about a medium-term forecast, 65% of analysts have supported the growth of the pair to 1.3450-1.3615 zone, and only 35% have voted for its fall below the level of 1.3000. In the event that the head of the Bank of England, Mark Carney, directly or indirectly confirms the "hawkish" statements of his colleague Andy Haldane in his speech on Thursday, July 05, the pair's jump may be expected as early as this week; - USD/JPY. Despite the fact that it is already 10% of oscillators on H4 and D1 that give signals that the pair is overbought, most experts (55%) still expect the pair to grow at least to the 111.45 horizon. And it is only after that, in their opinion, it can return to the support of 110.00. This development is supported by graphical analysis on D1, it warns that, if this level is broken through, the pair can very quickly drop another 100 points lower;

- Cryptocurrencies. Seeing the latest jerk up of the bitcoin, the crypto world wondered: what was this? The long-awaited turn of the trend and the fulfillment of John McAfee's prophecy that bitcoin will cost $1 million per coin by 2020? Or just another trap? And, maybe, the IMF's Kenneth Rogoff was right, when he said that by the end of the year the rate of this forefather of virtual currencies will fall to some miserable $100?

Perhaps the answer to this question remains to be seen soon. For now, as the ancient Greek sage Skelef said, everyone sees what he wants. Analysts who are optimists say that if bitcoin confidently overcomes the level of $ 6,700, it will be a strong enough positive signal for the trend to change. As for the pessimists, we see the last breath of a dying coin. And if the pair BTC/USD is fixed below the horizon of $5,900, it is highly likely that after a while it will be possible to be seen about $4,300, and then even lower.

Roman Butko, NordFX

戻る 戻る