A double bottom is one of the classic chart patterns used to spot a possible end to a downtrend. It appears in forex, stocks, indices, and crypto, and can offer clear entry, stop-loss, and take-profit levels. Understanding this pattern helps traders plan structured and disciplined trades instead of guessing reversals.

A double bottom pattern is a bullish reversal formation that appears after a downtrend. Price makes a low, bounces, then returns to a similar low, forming two “bottoms” around the same level. When price breaks above the interim high (the neckline) with enough momentum, traders see it as confirmation that sellers are losing control and a trend reversal may be starting.

Key points:

- A double bottom signals a potential shift from a downtrend to an uptrend.

- The neckline breakout is the main confirmation level.

- Volume, momentum indicators, and support/resistance help filter good patterns from weak ones.

- It works on any liquid market and timeframe, but higher timeframes tend to be more reliable.

- Risk management is crucial because failed double bottoms can turn into strong downward continuations.

What Is a Double Bottom

A double bottom is a chart pattern that forms after a decline in price and suggests that the market may be ready to move higher. It is made of two distinct lows that occur near the same price level, separated by a moderate rally in between. Visually, it looks like the letter “W” on the chart.

The first low shows where buyers initially step in to stop the downtrend. After a small recovery, sellers test that level again, creating the second low. If buyers defend the level a second time, it signals that support is strong and supply around that price is drying up.

The high point between the two lows is called the neckline. Traders usually wait for price to break above this neckline to confirm that the double bottom pattern is complete. Without a neckline breakout, the market may still be in a downtrend and the two lows could be part of a continuation move rather than a true reversal.

Understanding Double Bottoms

To understand double bottoms properly, it helps to break them into phases and think about what traders are doing at each stage.

Phases of a Double Bottom

1. Downtrend phase

The pattern always begins with a clear downtrend: lower highs and lower lows. This shows that sellers are in control and sentiment is bearish.

2. First bottom

Price reaches a low where buying interest appears. Some traders start taking profits on short positions, and bargain hunters begin to buy. This creates a temporary support zone.

3. Neckline formation

After the first bounce, price rallies to a swing high. This high forms the neckline and often aligns with previous minor support or resistance levels.

4. Second bottom

Sellers push the price down again, retesting the earlier low. If the second low holds at roughly the same area, it suggests that buyers are defending that level, and selling pressure is not strong enough to break it significantly.

5. Breakout and confirmation

When price moves back up and breaks through the neckline, the market confirms that buyers have taken over. Many traders see this as a signal to enter long positions.

Market Psychology Behind Double Bottoms

The double bottom expresses a shift in market psychology. Initially, traders believe the downtrend will continue. But when price tests the same support level twice and fails to break it, confidence in the downtrend weakens. Short sellers may close positions, and new buyers gain conviction that a reversal is possible, fueling the breakout above the neckline.

Importance of Double Bottom

The double bottom is important for traders because it provides a structured way to trade potential reversals, instead of randomly buying dips.

First, it offers clear levels: support at the double lows and resistance at the neckline. This makes it easier to define invalidation (stop-loss placement) and potential profit targets. Traders can calculate the distance between the bottoms and the neckline and project it upward after the breakout as one possible target.

Second, the pattern appears across many markets and timeframes, which makes it a flexible tool. Swing traders might find double bottoms on 4-hour or daily charts, while intraday traders look for them on 5-minute or 15-minute charts.

Finally, the double bottom helps traders align with the new trend early, if the reversal is successful. Instead of waiting until the uptrend is obvious, the pattern lets traders join when the shift from selling pressure to buying pressure is just starting to show on the chart. Of course, this advantage comes with risk if the pattern fails, which is why confirmation and risk management are essential.

Double Bottom Breakout Strategy

A double bottom breakout strategy focuses on trading the move that follows the break above the neckline. The goal is to catch the start of a potential uptrend with defined risk.

Step-by-step Double Bottom Breakout Strategy

1. Identify a prior downtrend

Make sure price has been making clear lower highs and lower lows before the pattern forms. A double bottom in a sideways market is less meaningful.

2. Mark the two lows

The two bottoms should be near the same price level, but they do not need to be exactly equal. Small differences are normal. Look for some distance in time between the two lows; if they are too close, the pattern may just be noise.

3. Draw the neckline

Connect or mark the swing high between the two lows. This horizontal (or slightly sloping) line is your neckline and potential breakout level.

4. Wait for a breakout

A conservative trader waits until a candle closes above the neckline, not just touches it. Some traders also want to see above-average volume or strong momentum on the breakout.

5. Choose your entry

Breakout entry: Enter as soon as the price breaks and closes above the neckline.

Retest entry: Wait for price to break the neckline, then retest it as support before entering.

6. Set stop-loss

Common stop placements:

Below the neckline (more aggressive, tighter risk).

Below the second bottom (more conservative, wider risk but safer).

7. Set take-profit

A common target is the height of the pattern: distance from the bottoms to the neckline, projected upward from the breakout. More advanced traders may use multiple targets, scaling out as price moves in their favor.

This structured approach keeps the trade logical and rule-based, rather than emotional.

Confirmation Tools for a Double Bottom Chart Pattern

Although some traders enter as soon as the neckline breaks, many prefer to confirm the double bottom with additional tools. Confirmation reduces the number of trades but can improve the quality of signals.

Volume as Confirmation

Volume is often watched during double bottoms:

- During the decline, volume may be heavier as selling pressure dominates.

- At the first bottom, volume might spike as early buyers step in.

- On the second bottom, lower volume can indicate that sellers are losing strength.

- A strong increase in volume during the neckline breakout is a positive sign that the move has support from many participants.

Momentum Indicators

Momentum indicators can help confirm that selling pressure is fading and buying pressure is rising.

Common tools include:

- RSI (Relative Strength Index): A double bottom forming with RSI divergence (price makes similar lows while RSI makes higher lows) may signal weakening bearish momentum.

- MACD: A bullish crossover of MACD lines or a move from negative toward positive territory around the pattern supports the reversal idea.

Moving Averages

Moving averages can act as dynamic support or resistance and can help confirm the trend shift. For example, price breaking above a widely-watched moving average (like the 50-period or 200-period) after forming a double bottom can strengthen the bullish signal.

Support/Resistance and Higher Timeframes

Confirmation is stronger when the double bottom coincides with a major support level from a higher timeframe. Checking higher timeframes (such as daily or weekly charts) helps avoid trading small patterns that form against a larger-trend direction.

Double Top and How it Is Traded

A double top is the bearish counterpart of the double bottom. Instead of appearing after a downtrend, it forms after an uptrend and signals a potential reversal to the downside.

The structure is the mirror image: price makes a high, pulls back, and then retests a similar high. The line drawn through the low between the two highs becomes the neckline. If price breaks below this neckline, traders interpret it as a sign that buyers are losing control and sellers are gaining strength.

Trading a double top is similar to trading a double bottom, but in reverse:

- Entry is usually on the break below the neckline.

- The stop-loss can be placed above the second high or above the neckline.

- The target is often the height of the pattern (distance from the highs to the neckline), projected downward.

For traders, understanding double tops alongside double bottoms is helpful, because markets move both up and down. Being able to trade both bullish and bearish reversals allows for more balanced strategies, especially in leveraged markets like forex and CFDs.

Is a Double Bottom Bullish or Bearish

A double bottom is considered a bullish reversal pattern. It appears after a decline and suggests that sellers are no longer able to push the price much lower, while buyers are becoming stronger.

However, the pattern is not bullish until it is confirmed. Before the neckline is broken, the price action could still be part of a downtrend or a temporary consolidation. Traders generally treat the pattern as fully bullish only after a clear breakout above the neckline, ideally supported by rising volume or strong momentum.

How to Identify a Double Bottom

Identifying a double bottom correctly is essential for using it in trading. A random pair of lows does not automatically qualify as a pattern.

Checklist for Identifying a Double Bottom

Use this checklist when scanning charts:

- Prior downtrend:

- There should be a clear series of lower highs and lower lows before the pattern appears.

- Two similar lows:

- The two bottoms should be at roughly the same price level. A small difference (for example, up to 1–3% in many markets) is usually acceptable.

- Time separation:

- The two lows should be separated by a meaningful number of candles or bars. If they form immediately one after another, it may just be noise.

- Neckline:

- The high between the two lows should be obvious and form a resistance level. This is your neckline, the main confirmation point.

- Breakout:

- The pattern is complete only when price breaks and closes above the neckline.

Visual Clues

On most charts, a double bottom looks like a clear “W”. The first leg down, first bottom, bounce to the neckline, second leg down, second bottom, and then a rally through the neckline should be visible without needing to force the pattern. If you have to bend the rules or ignore obvious highs and lows to fit the pattern, it is probably not a clean double bottom.

Double Bottom vs Double Top

Double bottoms and double tops are closely related patterns, but they signal opposite directions. Understanding their differences helps traders decide whether to look for long or short opportunities.

Here is a simple comparison:

Feature | Double Bottom | Double Top |

Trend context | Forms after a downtrend | Forms after an uptrend |

Market bias | Bullish reversal | Bearish reversal |

Shape | “W” shape | “M” shape |

Key level | Neckline above the bottoms | Neckline below the tops |

Typical trade direction | Long (buy) | Short (sell) |

Stop-loss area | Below second bottom or neckline | Above second top or neckline |

Both patterns rely on the idea of price failing twice at a similar level: in a double bottom, price fails twice to break support; in a double top, it fails twice to break resistance. The logic and trading methods are similar, but the direction of the trade is opposite.

Advantages of a Double Bottom

Double bottoms have several advantages that make them popular among traders.

- Clear structure

- The pattern is visually simple to recognise once you know what to look for. This helps traders build rule-based strategies.

- Defined levels

- Support and resistance levels are easy to identify: the double lows and the neckline. This simplifies placing stops and targets.

- Good risk-to-reward potential

- When traded correctly, the distance between entry, stop-loss, and target can offer attractive risk-to-reward ratios, especially if entering near the neckline with a stop below the second bottom.

- Works across markets and timeframes

- Whether you trade forex, crypto, indices, or commodities, you can find double bottoms on intraday and higher timeframes. The pattern does not depend on a specific asset.

These advantages make the double bottom a useful tool, especially for traders who prefer visual and price-based setups.

Disadvantages of a Double Bottom

Despite its strengths, the double bottom pattern has limitations and should not be used blindly.

- False breakouts

- Price may briefly break above the neckline and then fall back, trapping breakout traders in losing positions. This is known as a fakeout.

- Subjectivity

- Not all traders agree on what qualifies as a perfect double bottom. Differences in interpretation can lead to inconsistent results.

- Lagging nature

- By the time the pattern is fully confirmed, a portion of the move off the bottom may already have happened. Traders enter after some recovery is already in place.

- Not always a reversal

- Sometimes a double bottom forms during a larger downtrend but fails to reverse it, causing traders to buy into a temporary bounce rather than a new uptrend.

These disadvantages underline the need for confirmation tools, proper position sizing, and a clear exit plan.

How Is Trading Done During a Double Bottom

Trading during a double bottom can be done at different stages: during the formation or after confirmation. Each approach has different risk and reward characteristics.

Trading During Formation

Aggressive traders sometimes enter after the second bottom forms, even before the neckline is broken. Their logic is that the support level has already proven strong twice, and entering early offers a better price and a tighter stop-loss.

In this case, a typical setup might be:

- Entry near the second bottom when price starts to bounce.

- Stop-loss slightly below the second low.

- Initial take-profit near the neckline, with a possible extension if the neckline breaks.

Trading After Confirmation

More conservative traders wait for confirmation: a break and close above the neckline. They accept a higher entry price in exchange for a higher probability that the downtrend is actually reversing.

In practice:

- Entry on or just after the breakout candle above the neckline.

- Stop-loss below the neckline or below the second bottom, depending on risk tolerance.

- Targets based on the pattern height or nearby resistance levels.

Both methods can be valid. The choice depends on the trader’s risk tolerance, experience, and overall strategy.

Trading Strategies During a Double Bottom

There are several ways to build trading strategies around a double bottom. Here are three common approaches.

1. Classic Breakout Strategy

This is the most straightforward:

- Wait for the double bottom to form and the neckline to be clearly established.

- Enter long when price breaks and closes above the neckline.

- Place a stop-loss below the second bottom.

- Set a take-profit equal to the pattern height (distance from the bottoms to the neckline), projected upward.

This strategy aims to ride the first major upside move after the reversal.

2. Breakout and Retest Strategy

Some traders prefer a retest of the neckline for extra confirmation:

- Wait for the neckline breakout.

- Do not enter immediately; instead, watch for price to pull back to the neckline.

- If the neckline holds as support and bullish candles appear, enter long.

- Stop-loss usually goes below the neckline or slightly below the retest low.

- Targets can again be based on pattern height or nearby resistance zones.

This strategy reduces the risk of chasing an overextended breakout but may miss trades that do not retest.

3. Multi-timeframe Strategy

Here, traders combine a higher timeframe pattern with a lower timeframe entry:

- Identify a clean double bottom on a higher timeframe (for example, 4-hour or daily).

- When the higher timeframe price reaches the neckline or second bottom area, drop to a lower timeframe (15-minute, 1-hour) to look for precise entries using candlestick patterns or indicators.

- Use the higher timeframe structure for overall direction and targets, and the lower timeframe for fine-tuned entries and stops.

This strategy aims for better precision and improved risk-to-reward, but requires experience and more chart monitoring.

Example

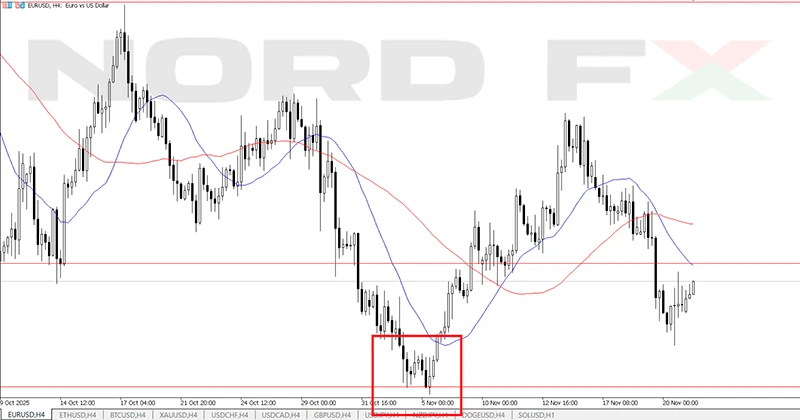

Let’s walk through a simplified example of a double bottom trade on a currency pair.

Assume a pair has been in a downtrend, falling from 1.2000 to 1.1500. At 1.1500, price finds support and bounces to 1.1650. This creates the first bottom at 1.1500 and a potential neckline at 1.1650.

After the bounce, sellers push the price back down toward 1.1500. It reaches 1.1510 and then starts to rise again. The two lows at 1.1500 and 1.1510 form the double bottom area, and 1.1650 acts as the neckline.

A conservative trader waits for the price to close above 1.1650. Once a strong bullish candle closes at 1.1670, they enter long around 1.1670. The stop-loss is placed below the second bottom at 1.1480, allowing some room below support in case of volatility.

The height of the pattern is 1.1650 − 1.1500 = 0.0150 (150 pips). The trader projects this above the neckline: 1.1650 + 0.0150 = 1.1800 as a reasonable target. If price reaches 1.1800, the trade yields about 130 pips of profit for roughly 190 pips of risk, which may be refined by tightening the stop or scaling out partial profits along the way.

This is only one simplified example, but it shows how the double bottom pattern gives clear entry, stop, and target ideas.

FAQs

How reliable is the double bottom pattern?

The double bottom is considered one of the more reliable reversal patterns, especially on higher timeframes and in liquid markets. However, it is not a guarantee of a trend change. Its reliability increases when combined with confirmation tools like volume, momentum indicators, and strong support zones. Risk management and proper position sizing are still essential, because failures do occur.

Does the double bottom pattern work in forex and crypto?

Yes, the double bottom pattern appears in forex, crypto, commodities, indices, and stocks. It is based on crowd behaviour and support/resistance, which are present in all liquid markets. In forex and crypto, where leverage is common, traders must be extra cautious with risk. Volatility can create fakeouts above the neckline, so confirmation and stops are critical.

What timeframe is best for trading a double bottom?

There is no single “best” timeframe; it depends on your trading style. Swing traders often prefer 4-hour or daily charts, where patterns tend to be more reliable and less noisy. Intraday traders may use 5-minute, 15-minute, or 1-hour charts to find more frequent opportunities. Generally, higher timeframes produce fewer but higher-quality double bottoms.

Where should I place my stop-loss in a double bottom trade?

Two common stop-loss placements are below the second bottom or just below the neckline. Placing the stop below the second bottom is more conservative, giving the trade more room to breathe. A stop below the neckline is tighter and allows a better risk-to-reward ratio but increases the chance of being stopped out by normal volatility. Your choice depends on your risk tolerance and strategy.

Can I trade a double bottom without indicators?

Yes, many traders use double bottoms as pure price action setups, relying only on support, resistance, and candlestick patterns. Indicators like RSI or MACD can help confirm the signal, but they are not required. If you trade without indicators, it becomes even more important to pick clean, obvious patterns and manage risk carefully.

How often do double bottoms fail?

There is no fixed failure rate, and it varies by market, timeframe, and how strictly you define the pattern. Failures often happen when the larger trend is very strong or when traders rush into weak patterns that do not meet the basic criteria. Using a checklist, combining confirmation tools, and keeping your risk per trade small can help reduce the impact of losing trades.

Is the double bottom pattern suitable for beginners?

The double bottom can be suitable for beginners because it is relatively easy to recognise and offers clear levels for entries, stops, and targets. However, beginners should practise on a demo account first and focus on building a rule-based plan instead of trading every “W” they see. Combining the pattern with basic risk management and simple confirmation tools makes it more beginner-friendly.

戻る 戻る