Short answer

When you click Buy or Sell, your order is sent from the trading platform to the broker, then routed to liquidity providers and executed at the best available market price. This process usually takes milliseconds, but the final execution price depends on real-time market conditions.

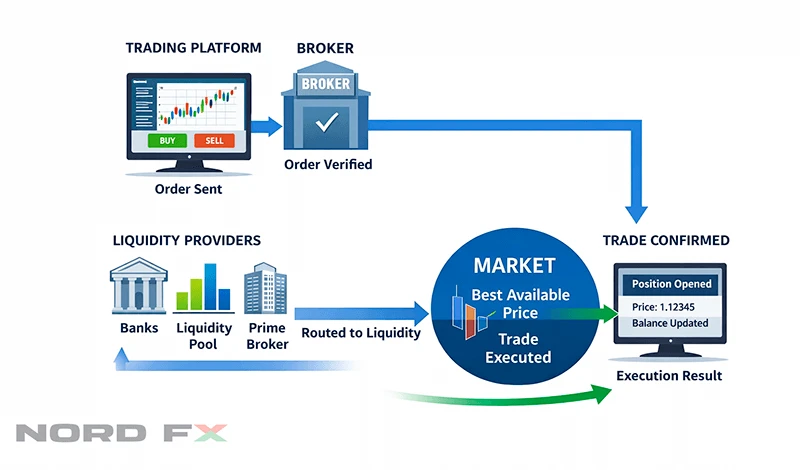

This video shows how a trade moves from the trading platform to the broker’s server, then to liquidity providers and is executed at real market prices.

Trade execution explained step by step

1. You place an order in the trading platform

When you click Buy or Sell, the trading platform sends an order request, not an instant trade.

This request includes:

- the instrument (for example, EUR/USD),

- order type (Buy or Sell),

- trade volume,

- execution type,

- optional parameters such as Stop Loss or Take Profit.

At this stage, no position exists yet. You are only sending a request to trade.

2. The broker receives and validates the order

The broker’s system checks several key conditions:

- whether you have enough free margin,

- whether the market is open,

- whether the order parameters are valid.

If all conditions are met, the order is approved and passed to the next stage.

If not, the order is rejected before execution.

3. The order is routed to liquidity

Once validated, the order is sent to liquidity providers — banks, prime brokers, or liquidity pools that provide bid and ask prices.

Important to understand:

- prices can change every millisecond,

- the order is executed based on available liquidity, not a fixed quote shown earlier.

4. The trade is executed at market price

The order is matched at the best available price at the moment of execution.

This means:

- the execution price may differ slightly from the price you clicked,

- this difference is normal for market execution,

- price movement, spread, and liquidity depth affect the final result.

5. The execution result is sent back to the platform

After execution:

- the position appears in your terminal,

- balance, equity, and margin values are updated,

- the trade officially exists.

Only at this point is the order fully completed.

This diagram visually shows how an order travels from the trading platform through the broker to the market and back as an executed trade.

Why the execution price may differ from what you clicked

This usually happens because:

- the market moves between click and execution,

- spread changes in volatile or low-liquidity conditions,

- available liquidity at the requested price is limited.

This is not an error — it is how real market execution works.

Why this matters for traders

Understanding the execution process helps traders:

- correctly interpret slippage,

- understand Stop Loss and Take Profit behavior,

- avoid false assumptions about “wrong prices,”

- trade with realistic expectations.

Most execution-related questions start with not knowing how this process works.

What’s next

Now that the execution process is clear, the next key concepts to understand are:

ආපසු යන්න ආපසු යන්න